SUMMARY

The global economy is in a state of flux with major influences from the rising interest rates, the recent collapse of the Silicon Valley Bank, and other macroeconomic uncertainties

The historical returns data of US venture capital shows that 2023 will be very similar to 2009, opening a very lucrative opportunity for startup investors

Tumbling valuations and top investors pulling back from investments is contributing to the Indian startup opportunity for emerging investors

You know how roller coaster rides can be – thrilling, unexpected, and intense. That’s pretty much the state of the global economy right now. With everything going on, from the unpredictable stock market, climbing interest rates, the sudden fall of Silicon Valley Bank, and other macroeconomic events, it’s enough to make any investor dizzy.

However, the most astute investors see beyond the haze of volatility, uncertainty, and fear. For them, there are no bull and bear markets, only lucrative opportunities, regardless of the economic environment.

And today, we want to introduce you to one such golden opportunity – the chance to be a part of the burgeoning Indian startup ecosystem as an investor.

Why now, you ask?

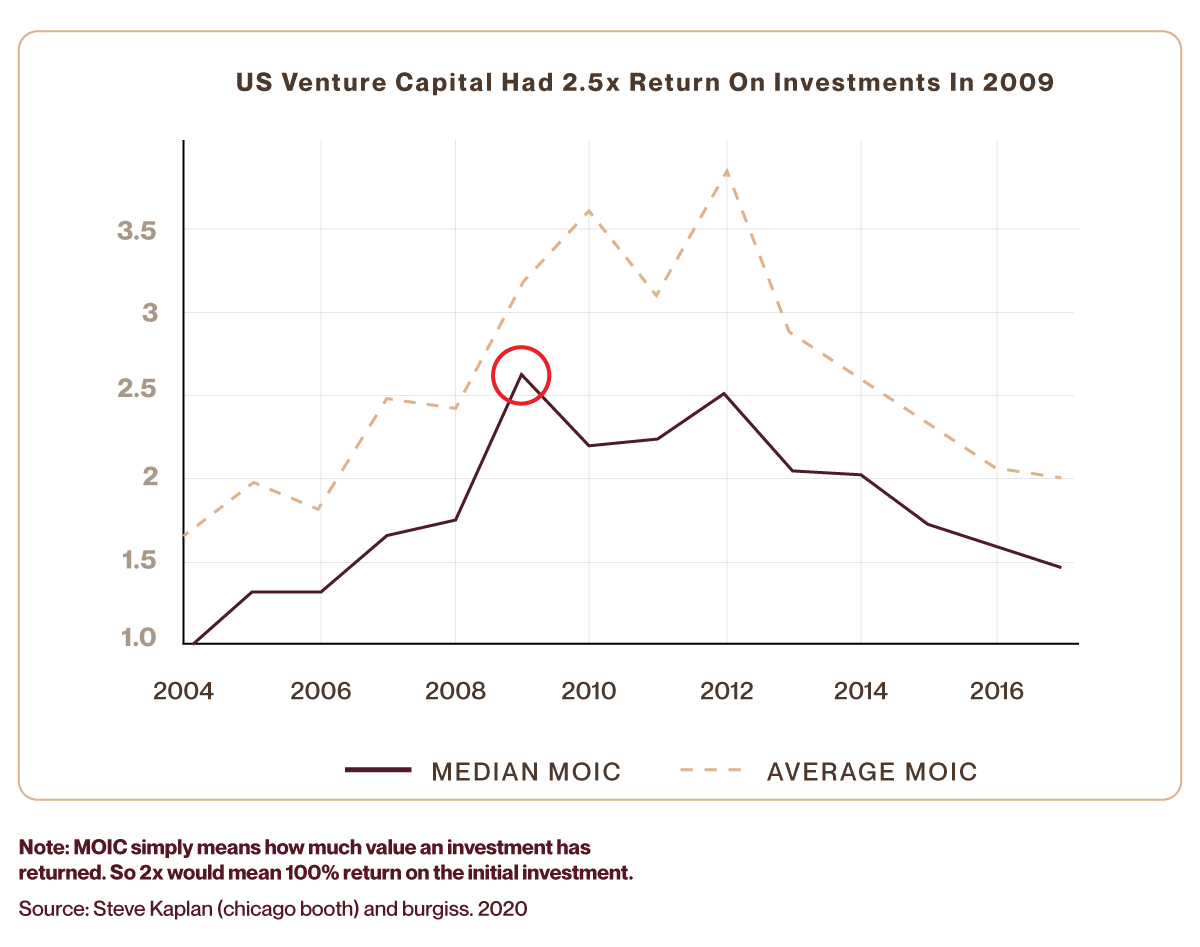

Let’s look at the historical returns data of the US Venture Capital around 2008. When the markets collapsed, an interesting pattern emerged…

The median Multiples On Invested Capital (MOIC) shot up in 2009, right after the recession year and never touched the same level thereafter.

MOIC simply means how much value an investment has returned. So 2x would mean 100% return on the initial investment.

Now that history is repeating itself in 2023, the startup investment returns will see a similar trajectory in the coming years. But only the investors who are investing in startups today will have the opportunity to replicate these results.

Let’s peel the layers and uncover three reasons why the financial year 2023-24 could be your golden ticket to big wins with Indian startups.

Lower Valuations: The Silver Lining In The Market Correction

The ongoing market correction has led to valuation markdowns for several Indian unicorns. High-profile names like BYJU’S, Swiggy, Ola, Meesho and OYO have already seen multiple markdowns. And even though these markdowns are on investors’ books, they have a ripple effect on valuations across all stages.

For instance, a startup that was valued at $10 Mn last year could now be valued at $7.5 Mn. Therefore, an investor purchasing $1 Mn worth of equity in the company would now own 13.33% of the company, up from 10% before the correction.

It’s not about lower prices but getting access to the right deals at lower prices.

This wisdom underscores the importance of identifying the right deals at lower prices, not just randomly grabbing low-cost investments.

Increased Deal Availability: A Result Of Geopolitical & Financial Turmoil

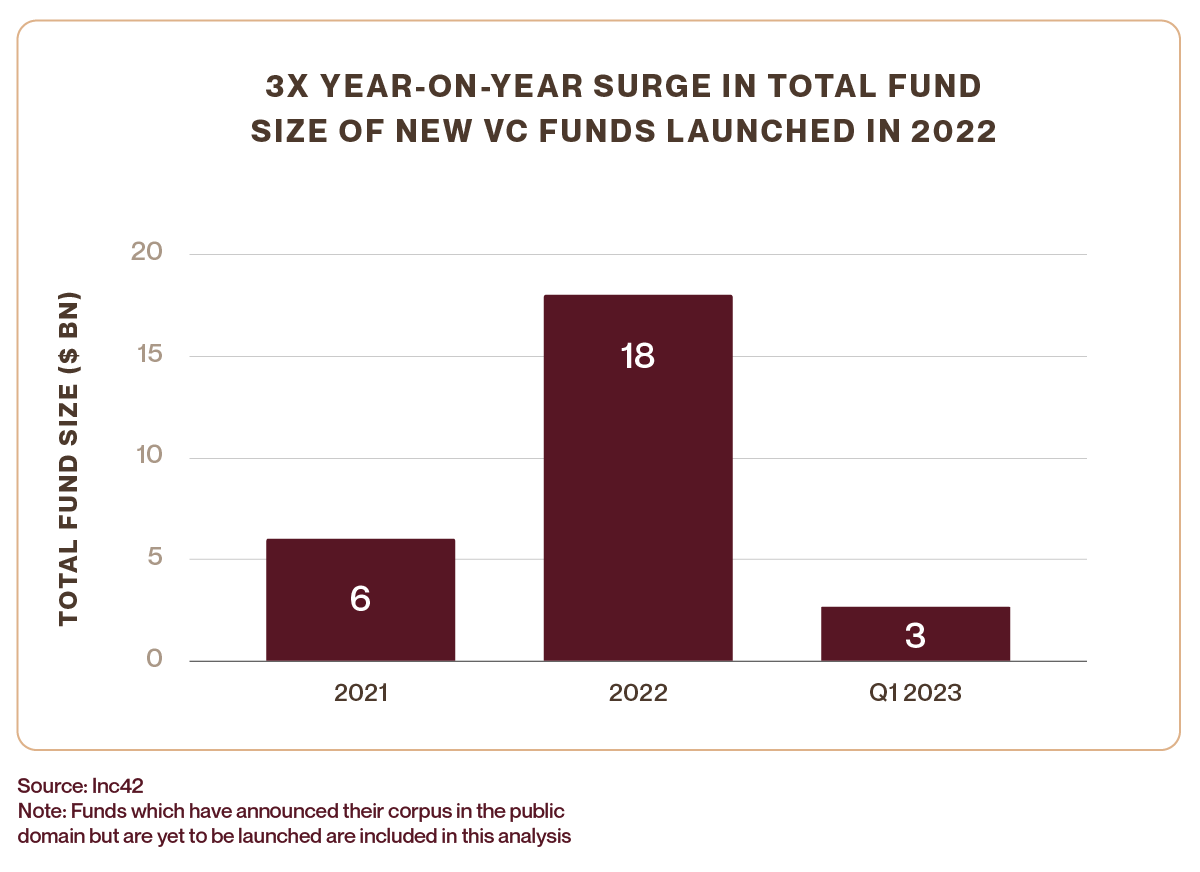

Despite the funding winter, CY 2022 was a blockbuster year for Indian venture capital. 126 new funds worth $18 Bn were launched in CY 2022 followed by $3 Bn in Q1 2023.

The macroeconomic uncertainties triggered many top investors to pull back from the market. It is estimated that $16 Bn+ capital is still sitting in VC coffers forming the dry powder, waiting to be unleashed.

When top investors pull back, it opens up opportunities for emerging investors because innovation doesn’t stop in an economic slowdown and entrepreneurs continue creating remarkable products.

This landscape translates to better deals and lower valuations for emerging investors.

Building Relationships With Founders: An Investment In Itself

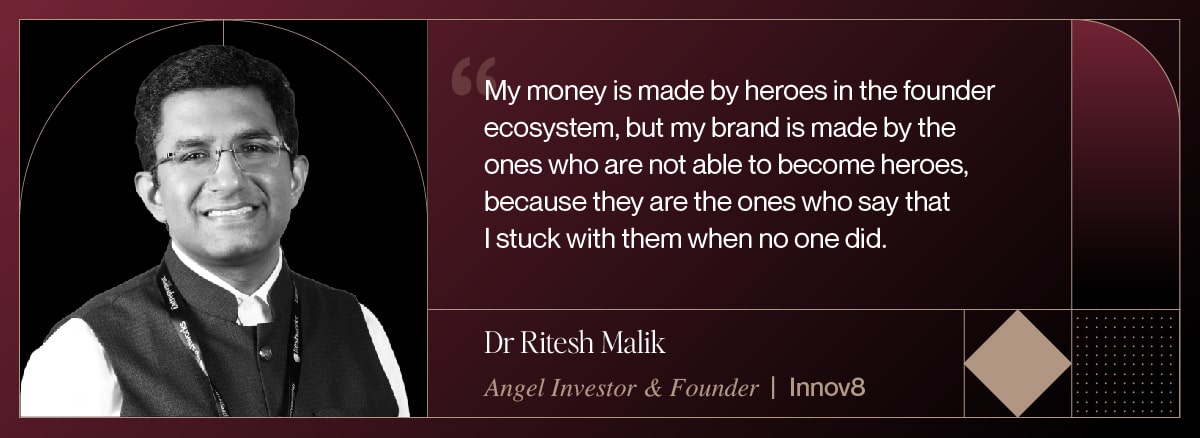

During tough economic times, building relationships with founders can offer great returns.

Humans remember and respect others who help them in their tough times. When the market is down, founders are more likely to meet with investors and discuss their business challenges.

Consider this – India’s top 200 startups spent $25 Bn to earn $19 Bn in FY22.

Clearly, the most prominent goal of Indian startups today is to chase profitability. And the best cheat code to excel in startup investing is to help founders succeed.

Investors helping founders accrue so much good karma that it opens a stream of referrals that brings in the type of deals that an investor won’t find in any other angel syndicate or platform.

Unlocking A New Avenue Of Insights, Deal Flow & Collaboration At MoneyX

If you’re ready to avail this golden chance of investing in Indian startups, you can start by attending MoneyX – India’s largest Angel & VC conclave, to be hosted on 20 July 2023 at The Leela Ambience, Delhi-NCR.

MoneyX is an invite-only conclave set to shape India’s entrepreneurial destiny by unlocking the domestic capital of the country. This conference will provide a platform to foster collaboration with 350+ leading LPs, GPs, Angels, Family Offices, and Institutional Investors.

Learn the key investment insights of India’s top 1% investors through 20+ sessions across 2 stages. In addition to enlightening panel discussions and presentations, attendees will experience MoneyX’s AI-powered matchmaking system, designed to facilitate connections and build relationships among emerging and seasoned investors.

Step into the future of startup investments with MoneyX. Book your pass today!

Explore MoneyX