In May, Invesco internally marked down Swiggy’s valuation, while Neuberger Berman trimmed the valuation of two of its portfolio startups Pine Labs and PharmEasy

The median valuation-to-revenue multiple for the top 10 Indian unicorns stood at 23X in FY22, compared to 21X reported by their US-based peers

Rising interest rates place a premium on current profitability as opposed to future profitability, which has led to high cash burn stocks to lose favour, said Siddarth Pai

At the height of the capital-addled frenzy in 2021, valuations were easily obtained. Investors poured a record $42 Bn into Indian startups, causing valuations for most consumer-facing platforms to skyrocket.

Further, the pandemic boom pushed the valuations of many of these startups to the sky, even as foundational metrics such as profits were missing behind the scenes.

As 2022 arrived, the Indian startup ecosystem received a rude wake-up call as geopolitical tensions and macroeconomic pressures suddenly brought home the point of fewer funding options and a renewed focus on profitability. But, the highlights appeared blurry to many startup founders, triggering the valuation markdown trend in the second half of 2022.

Pop Goes The Valuation Bubble!

It was at this point in time that many investors started marking down the valuations of their big-ticket portfolio startups, and, seemingly, OYO emerged as its first casualty.

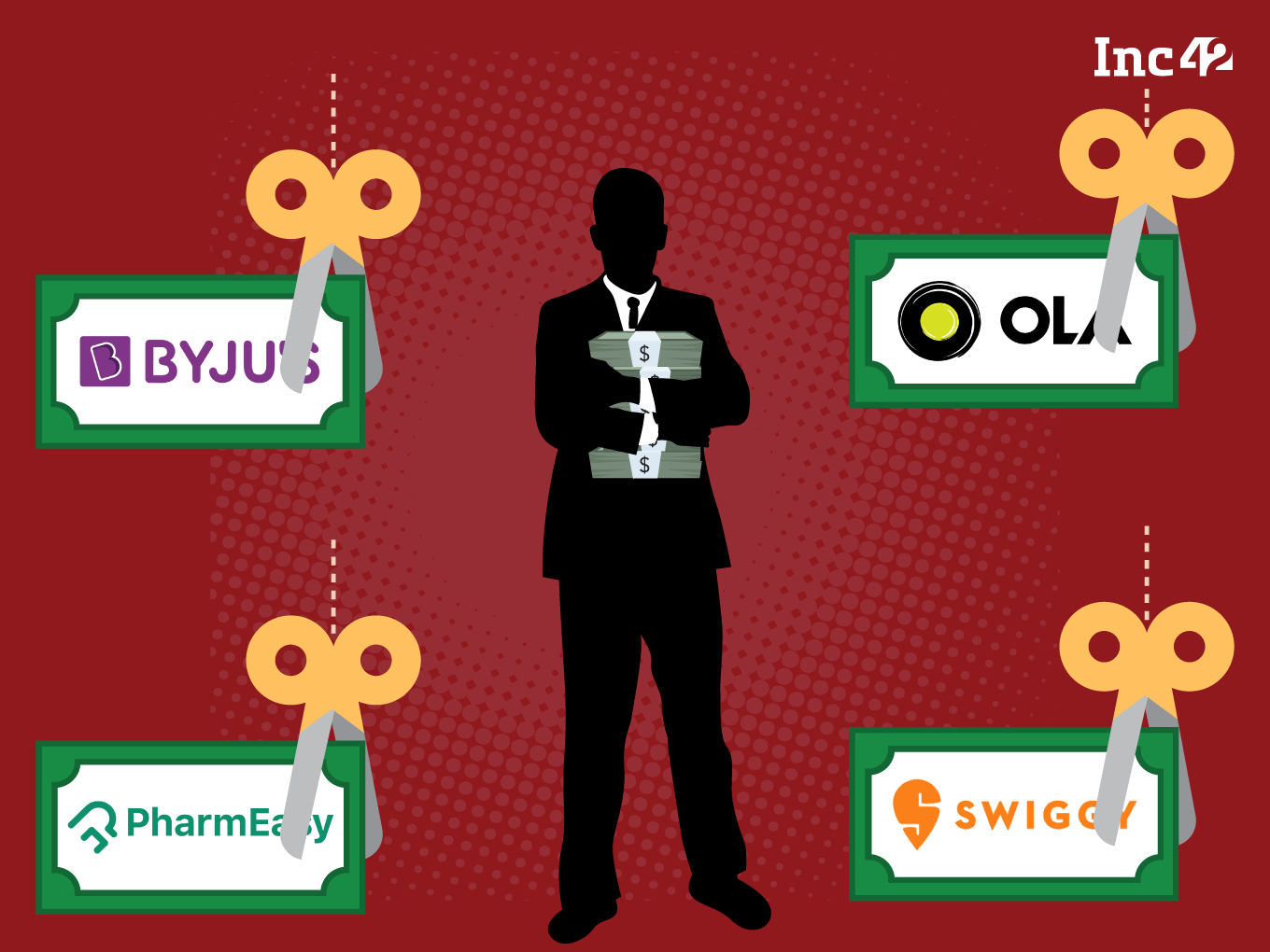

Global tech investor SoftBank, in September 2022, slashed the valuation of the hospitality major in its book by as much as 20%. Hot on the heels of this markdown, Prosus internally marked down the valuation of India’s most valued startup, BYJU’S, by a whopping 73% in November.

After a brief lull, the trend picked up again in 2023, and the first month of 2023 saw Invesco downgrading the valuation of Swiggy to $8 Bn, just a year after it led the $10.7 Bn funding round of the foodtech giant.

The lightning struck BYJU’S again in April as its minority investor, BlackRock, slashed its valuation by nearly half to $11.5 Bn, down from $22 Bn.

In May 2023, Invesco revisited its strategy on Swiggy and gave the foodtech major another haircut that left it with a valuation of $5.5 Bn.

In quick succession, US-based investment firm Vanguard Group cut the valuation of ride-hailing startup Ola on its book by 35% to $4.8 Bn.

Recently US-based investor Neuberger Berman has trimmed the valuation of two of its big-ticket portfolio startups Pine Labs and epharmacy PharmEasy by 38% and 21%, respectively.

Counting Recurring Aberrations

When looked closely, a pattern seems to emerge in the aforementioned markdowns. Whether Swiggy, BYJU’S or PharmEasy, these consumer-facing startups reached their valuation peak during the Covid outbreak, cashing in on the pandemic boom. As investors lined up in droves, these startups even hinted at plans for a public listing.

But as normalcy returned in 2022 and pandemic growth fizzled out, these startups were caught unawares. The investor focus suddenly turned to profitability and less cash burn, but losses continued to pile up for these players. BYJU’S, which is yet to file FY22 financials, recorded a loss of INR 45,88 Cr, up 19.8X YoY, in FY21, while Swiggy raked up a net loss of INR 3,628.9 Cr in FY22, up 2X YoY.

PharmEasy also posted a record loss of INR 4,043 Cr in FY22, up from a loss of INR 1,552 Cr in FY21.

Meanwhile, these startups deferred their IPO plans as negative market sentiment loomed heavily over their fortunes and the return to normalcy wreaked havoc on their digital offerings.

With the exception of BYJU’S, funding winter seems to have dried up some of the funding options for these players even as they undertook extreme cost-cutting operations across the board, from layoffs to shutting verticals.

The trio (Swiggy, BYJU’S and PharmEasy) has also been dogged by a tightening regulatory noose, which has also dampened some investor confidence in them. While Swiggy is the face of an antitrust probe, BYJU’S has seen raids over FEMA violations. PharmEasy, which operates in the digital pharmacy segment, is also witnessing the dagger of a ban hanging over its fate.

As sanity returned to the investor ecosystem, the focus now seems to be more on sustainable growth, revenue and profits. With startups now facing a valuation correction, at least, on the side of investors, these consumer-facing startups could now see themselves in a soup as VC and PE firms seek more accountability.

Flagging Flawed Growth Metrics

In the recent past, critics have flagged the sky-high valuations of Indian unicorns, along with their mounting losses. Of the 74 unicorns deep-dived by Inc42, 55 reported a cumulative operating loss of $5.9 Bn in FY22.

At the centre of questionable yardsticks for valuation are metrics such as innovation, category building, and gross merchandise value (GMV), which normally do not convert into hard cash.

Then, there are metrics such as valuation-to-revenue multiples, which for most Indian startups are through the roof and have been flagged by experts time and again. Data perused by Inc42 shows that the median valuation-to-revenue multiple for the top 10 Indian unicorns stood at 23X in FY22 versus 21X reported by their US-based peers.

The oft-quoted wisdom of burning capital to sustain growth, prior to achieving profitability, also seems to have exacerbated the issue of ballooning valuations. The pursuit of scale, building innovative products, and rapid expansion leads to massive cash outflows, derailing any plans for startups to focus on unit-positive economics.

The high valuations have also been attributed to a mismatch between reality and revenue projections, which could present a rather big picture of the total addressable market (TAM) than what could be achieved.

“Rising interest rates place a premium on current profitability as opposed to future profitability. This is causing growth stocks with high cash burn to lose favour, while cash flow-generating companies fare better. The basic Discounted Cash flow formula attests to this premise,” 3one4 Capital cofounder and co-chair of the regulatory affairs committee of the Indian Venture and Alternate Capital Association Siddarth Pai told Inc42.

“The second reason is the lack of fundraisers due to reduced burn. In the absence of profits and external validations of valuations via funding, accounting standards & prudence demand a markdown of valuation. Risk & valuation frameworks of investors play an active role here,” he added.

An angel investor and the cofounder of investment firm WeFounderCircle Gaurav VK Singhvi attributes the markdowns to larger uncertainty in the markets. He told Inc42 that the downgrades were largely the result of a negative market environment turning out to be a stronger force than startups’ investor pull.

He expects the valuation markdown saga to continue for at least the next six months, adding that it could also percolate to the lower levels and impact lower-rung startups as well in the near future.

As the drama around valuation markdowns unravels, BYJU’S, despite witnessing an ED raid post markdowns, is all set to raise $1 Bn in funding, turning the construct of internal valuation cuts on its head.

Speaking with Inc42, Pai said that it was important to differentiate markdowns in accounting from markdowns due to capital raises, citing the subjective nature of the former.

Chiming in, Singhvi believes that different investors take different positions, adding that a fund, built on public money would have to make provisions to ensure it is able to give maximum returns to its shareholders.

“The situation is totally different for an individual investor, while it is completely different for a family office or a fund. It all depends on the patience of the capital and the tenure of the capital, and accordingly, an investor may see merit in marking down a company on its book,” Singhvi added.

However, SoftBank’s CEO Masayoshi Son had sounded somewhat of an alarm bell about the valuation cuts back in August last year. He had warned that the ongoing funding winter could drag longer for unicorn founders unwilling to take a valuation cut to raise funds.

While Son has stuck to his tone and words, it remains to be seen whether Indian unicorns stay stubborn to their valuations or willingly accept corrections.

Ad-lite browsing experience

Ad-lite browsing experience