![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2021/04/Feature-3.jpg)

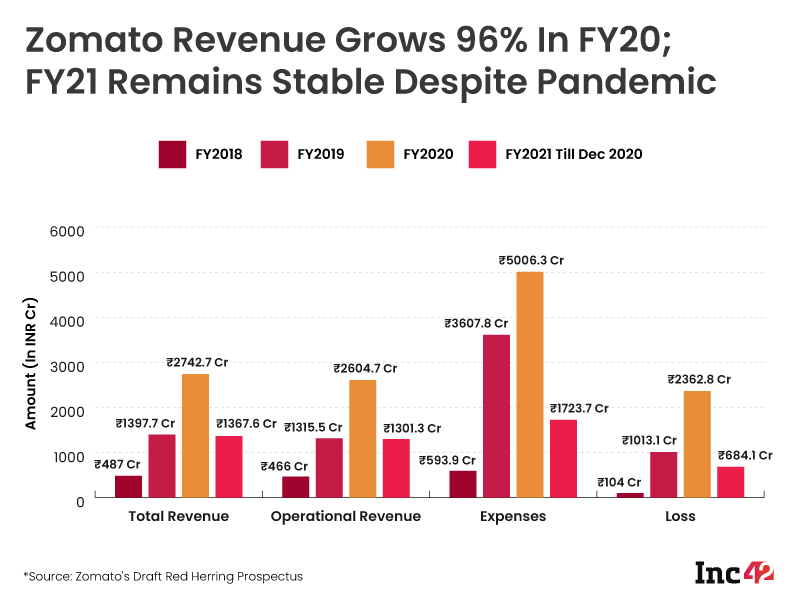

Zomato clocked INR 1,367 Cr in revenue in the first three quarters of FY21 but posted a loss of INR 684 Cr

The company’s average order value increased by 32% to cross INR 400 post Covid-induced lockdowns in several cities

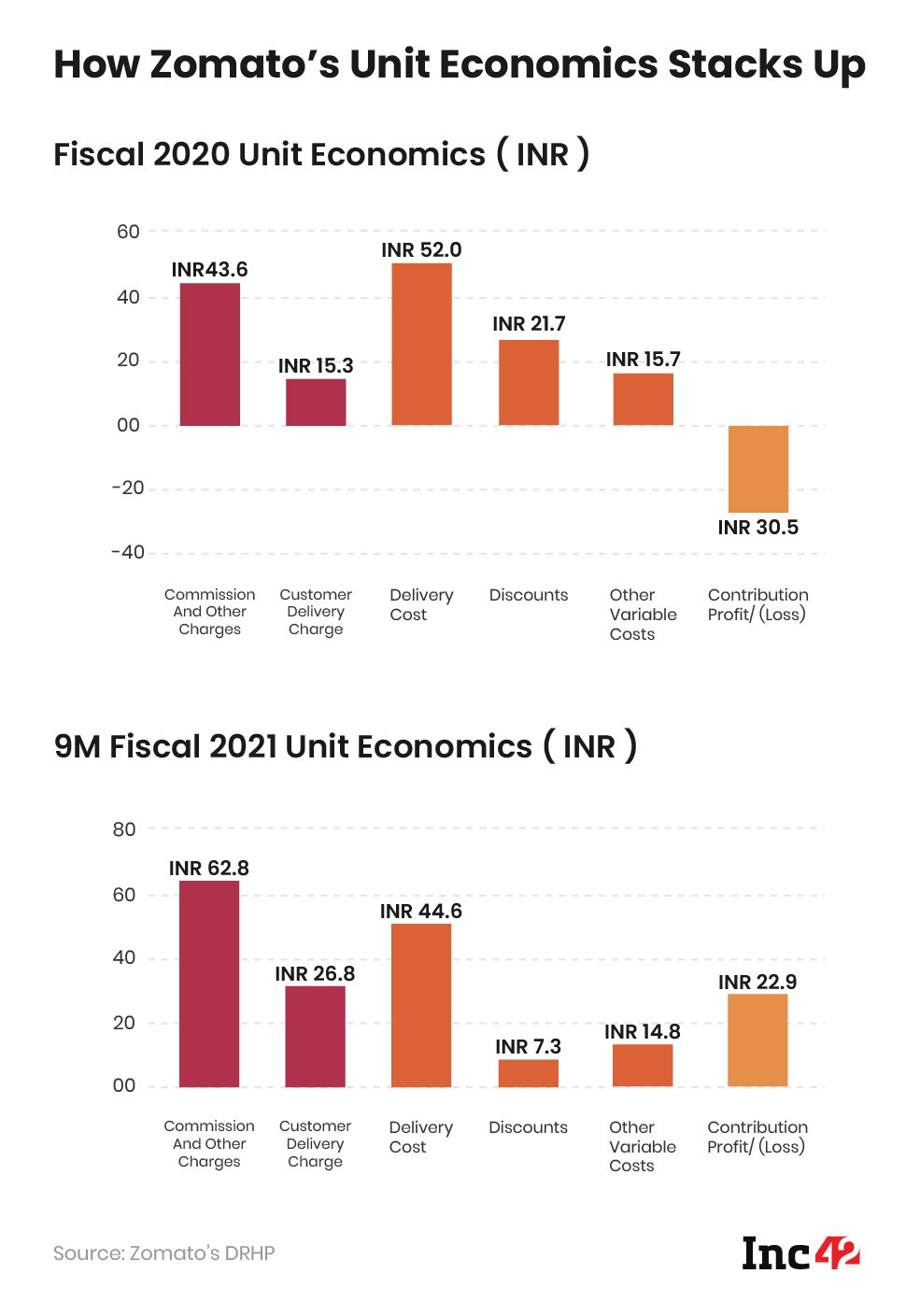

Zomato achieved positive unit economics with a contribution margin of INR 22.9 per order on average till Q3 of FY21

What The Financials

Inc42 unveils and deciphers all the important financial metrics of Indian startups across industries. Find out revenues, unit economics, profit & loss and all the important financial metrics to judge how the startup will perform in the coming years.

Despite a year plagued by Covid-induced lockdown and layoffs, Zomato clocked INR 1,367 Cr in revenue in the first three quarters of FY2020-21 (between Apr 1 and Dec 31, 2020). The foodtech startup spent about INR 1,724 Cr during this period, leading to a loss of INR 684 Cr.

The details mentioned above were revealed in Zomato’s much-awaited draft red herring prospectus (DRHP), filed today (Apr 28) for an INR 8,250 Cr ($1.1 Bn) initial public offering (IPO) this year.

The company’s operational revenue totalled INR 1,301 Cr in the three quarters as its average order value increased by 7%, from INR 378 in Q1 to INR 408 in Q3. The food aggregator also saw a spike in its gross order value (GOV) or gross merchandise value (GMV), which also grew by 7%, from INR 2,785 Cr in Q3 of FY20 to INR 2,981 Cr in Q3 of FY21. It was an all-time high quarterly GOV for Zomato.

“In the first quarter of Fiscal 2021, we saw a significant impact on our business, and our food delivery business in India hit its lowest in terms of GOV in a quarter in two financial years. However, since then, our food delivery business in India has recovered strongly, with GOV growth of 91.6% and 42.3% in the second and third quarters of fiscal 2021, respectively, over the immediately preceding quarters,” the DRHP stated.

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics](https://inc42.com/wp-content/uploads/2021/04/ZomatoAOVShareholding_Article-1.jpg)

Zomato’s overall revenue in FY21, between April 2020 and March 2021, is bound to increase as the company witnessed more stability in the last quarter due to a fall in Covid cases. But the same cannot be said for the first quarter of FY22 (April 1-June 30, 2021) as India is currently facing the second wave of Covid-19 and reporting over 243 cases a minute.

Zomato, in its latest filings, also highlighted that its revenue increased by a whopping 96%, from INR 1,398 Cr in FY19 to INR 2,743 Cr in FY20. This growth also reflected in its operational revenue that nearly doubled from INR 1,315 Cr in FY19 to INR 2,605 Cr in FY20. Its average order value has grown by INR 22, from INR 264.6 in Q1 FY20 to INR 286.9 in Q4 FY20.

The company’s expenses grew by 39%, from INR 3,608 Cr to INR 5,006 Cr, in the same period. The rise in expenses increased the company’s losses by 133% or 2.3x to INR 2,363 Cr from the previously reported INR 1,013 Cr. The company reported a revenue of INR 487 Cr and expenses of INR 594 Cr in FY18, leading to a loss of INR 104 Cr.

Zomato Boasts Positive Unit Economics

One good sign for the company is its improved unit economics. Zomato achieved positive unit economics with a contribution margin of INR 22.9 per order on average till Q3 of FY21. It was a massive improvement from the negative INR 30.5 margin logged in FY20 (between March 2019 and March 2020). It means Zomato is actually making money per order on an average instead of burning cash to fulfil deliveries.

One of the key reasons behind this improved unit economics is the steep decrease in the company’s outsourced support cost, the amount paid as availability fee to delivery partners. The company spent INR 2,093 Cr in this department in FY20, which was slashed by almost 6x to INR 363.3 Cr till Q3 of FY21. “Our cost-effectiveness depends on our ability to continue reducing delivery costs on a per-order basis,” Zomato said in the DRHP filing. As of Dec 2020, the company had more than 1.61 Lakh delivery partners registered on its platform.

Zomato also noted an increase in commissions from restaurants and ad revenue by INR 20, from INR 43.6 in FY20 to INR 62.8 till Q3 in FY21. Delivery fees paid by customers also increased from INR 15.3 to INR 26.8 in the same time frame, and delivery cost, or the money paid to a delivery executive, came down from INR 52 in FY20 to INR 44.6. The company also reduced discounts from INR 21.7 to INR 14.8.

Zomato Cuts Advertising Costs To Survive The Covid Storm

Zomato’s expenses in the first three quarters of FY21 were 3x lower than its spending till Q3 FY21, thanks to a major reduction in the outsourced support and advertising costs. The food aggregator spent INR 307 Cr as advertising and promotional expenses, which was 77% less than INR 1,338 Cr spent in this area in FY20. The company spent INR 1,236 Cr as advertising cost in FY19.

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics](https://inc42.com/wp-content/uploads/2021/04/WTF-Zomato-2-1.jpg) The food aggregator business also reported a 31% decline in its employee benefits expenses as it paid INR 404 Cr in salaries in the first three quarters of FY21 compared to INR 645 Cr. Overall, Zomato spent INR 798.8 in FY20 and INR 549 Cr till Q3 of FY21 under this head. However, these costs may balance out when compared with overall FY21 expenses.

The food aggregator business also reported a 31% decline in its employee benefits expenses as it paid INR 404 Cr in salaries in the first three quarters of FY21 compared to INR 645 Cr. Overall, Zomato spent INR 798.8 in FY20 and INR 549 Cr till Q3 of FY21 under this head. However, these costs may balance out when compared with overall FY21 expenses.

In FY19, Zomato spent INR 1,330 as outsourced support cost and INR 601 Cr as employee benefits expenses.

However, the Covid-induced lockdowns impacted Zomato’s restaurant network in the first nine months of FY21. Zomato revealed it had about 94K active food delivery restaurants on its platform in March 2019 (FY19), which rose to 1.43 Lakh in March 2020 (FY20). But the number of active restaurants on the platform came down to 1.32 Lakh by Dec 2020 (Q3 FY21). The MTU also saw a similar trend as it increased from 5.6 Mn to 10.7 Mn in FY20 but dipped to 5.8 Mn in FY21.

But the customer side of the business stayed strong as Zomato’s premium subscription service Zomato Pro recorded 1.4 Mn members in India as of Dec 31, 2020.

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience