In 2020, healthtech sector recorded 77 deals raising $455 Mn in funding in contrast to $512 Mn funding in 62 deals in 2019

In 2021, the healthtech segment expects to see some big announcements in terms of mergers and acquisitions, as well as funding for the growth-stage startups

Read to find out which startups have made it to our healthtech Startup Watchlist 2021

Startup Watchlist 2021

The Inc42’s annual series, Startup Watchlist brings together the list of top growth stage startups to watch out for in 2021 across various industries.

This article is part of the fifth edition of Inc42’s Startup Watchlist series, an annual series in which we list the top growth-stage startups to watch out every year from some of the most trending industries in the Indian startup ecosystem. Explore all the stories from the ‘Startup Watchlist’ 2021 series here.

You can view our early-stage discovery watchlist here.

India spends just 3.6% of GDP on healthcare – a figure much lower than other countries like the US (16.9%), Germany (11.25%), China (5%), and Russia, (5.3%). This leaves a lot of scope for the private sector to invest in healthtech startups to make healthcare affordable in the country. Unfortunately, the pandemic that should have been the trigger point for investors to make their bets by investing more in healthtech firms, had an opposite effect.

In 2020, the healthtech segment saw a decline of 11% in the overall funding, even though the deal count increased by 24% in comparison to 2019. The healthtech sector recorded 77 deals raising $455 Mn in funding in contrast to $512 Mn funding in 62 deals in 2019, according to Inc42 Plus Annual Indian Tech Startup Report 2020.

On the positive side, the year 2020 attracted big corporates to invest in healthtech startups. While Tata group’s talks with 1mg are yet to take a final shape, the acquisition of Netmeds by Reliance was the highlight of the year. The latter acquired 60% equity in Netmeds and 100% equity in its subsidiaries for around $85 Mn. Other startups that raised funding in 2020 include Curefit, 1mg, IVF Access, Healthpix, Phable among others.

While Curefit raised $110 Mn in Series D funding led by Temasek Holdings, 1mg raised around $28 Mn in debt funding from existing investors as well as by offering preferential shares to Gates Foundation. Another Bengaluru-based startup Healthpix raised around $6 Mn in Series B round led by JSW ventures.

Other positives of 2020 include the government’s decision to roll out the National Digital Health Mission and Telemedicine guidelines which helped healthtech startups to come up with online accessibility of quality treatment for both Covid and non-Covid health issues, to far flung areas. The Insurance Regulatory and Development Authority too issued a notification advising the insurers to allow telemedicine be covered under health insurance programmes. The telemedicine facility could help Indians save about $10 Bn by 2025.

From Inc42’s Healthtech startup watchlist 2020, Bengaluru-based mfine raised $5.41 Mn in Series B funding led by Caretech Pte, 5C Network. Another Bengaluru-based healthtech startup raised $1.2 Mn in Pre-Series A funding led by Unitus Ventures.

According to Inc42 Plus, India’s healthtech market is estimated to reach $21 Bn in 2025 on the back of telemedicine and preventive healthcare growth. Further, the report revealed that preventive healthcare in the country is expected to reach market size of $170 Bn by 2025, primarily driven by fitness and wellness apps and diagnostics solutions.

As part of the Inc42’s annual series of Startup Watchlist, here are the top 6 healthtech startups that made it to the fifth edition of Startup Watchlist 2021.

Editor’s Note: The startups listed below are in alphabetical order, and do not represent the ranking of the companies in any manner.

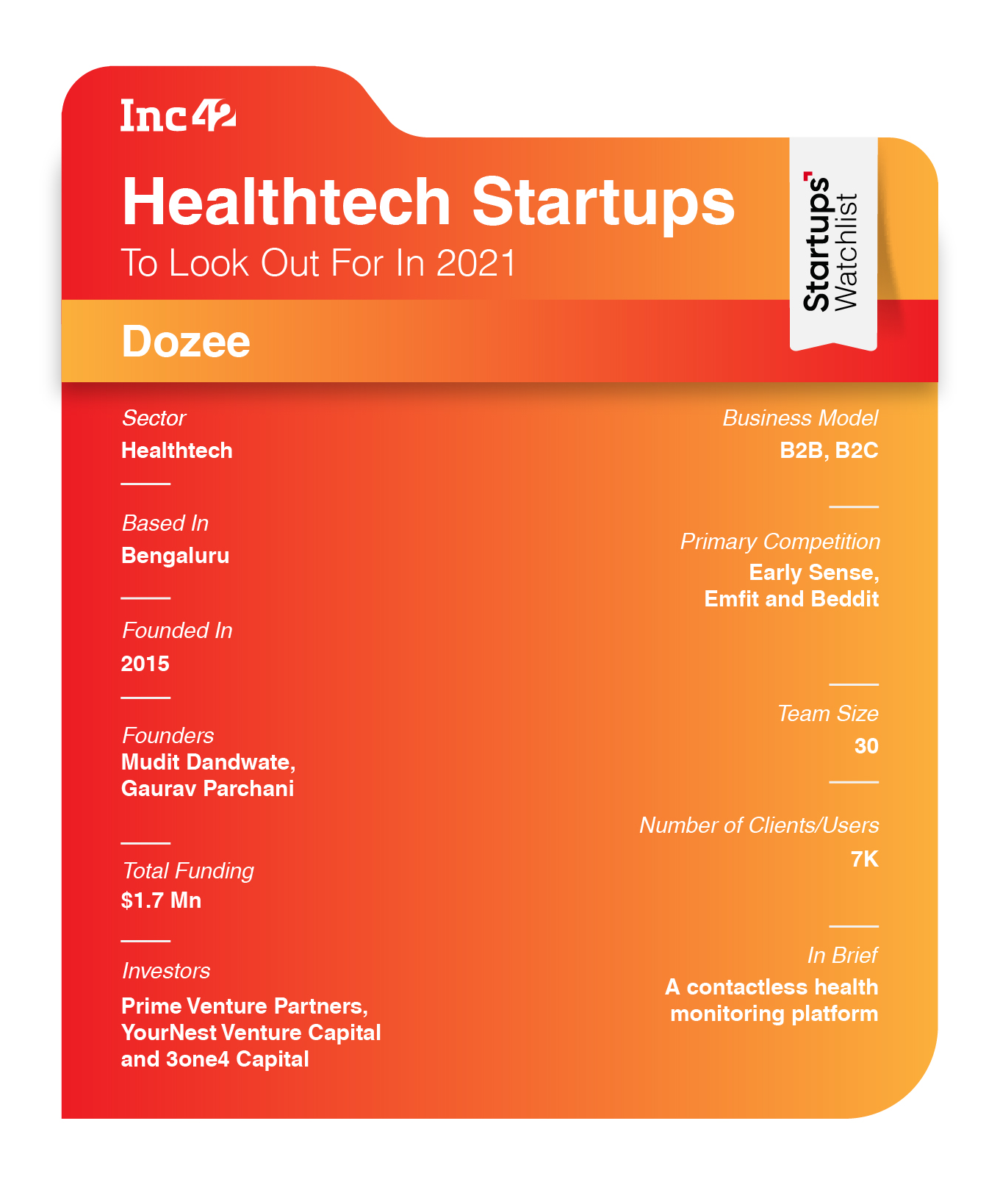

Dozee: Dodging The Covid-19 Challenges

In India, only 1 lakh beds get monitored continuously out of 19 lakh beds which are dependent on human intervention. This leaves loopholes in the care of critically ill patients, who need constant monitoring of their vitals. Bengaluru-based Dozee aims to bridge this gap. The company offers remote patient care through its health tracking products both at hospitals and homes. Dozee has come up with a subscription-based model for remote healthcare at home which includes doctors’ consultations.

Hospitals are using Dozee to continuously monitor a patient’s cardiac and respiratory cycles, and notify the care team of any abnormalities that may be detected before it becomes critical. The AI powered early prediction algorithms can help in saving lives in 70+ cases, predicting early cases of heart failure, tuberculosis, pneumonia etc. During Covid, the company improved its tracking solutions in accordance with the varying needs.

Cofounder and CEO Mudit Dandawate said, “We integrated certain essential components, such as pulse oximeter to our device and adopted our software layer especially for hospitals. This was followed by setting up operations in hospitals to ensure technology adoption even in government hospitals in tier 2 and tier 3 cities of India. We have also integrated our services with leading telemedicine companies and hospitals to provide continuous monitoring of critically ill patients, especially of covid-19 patients at home.”

Dozee is being used by 4500+ users at home. The company is also working with 25+ hospitals and powering 1900+ Covid-19 beds. “We have so far monitored 7000+ covid-19 patients in hospitals, leading to 30+ patients getting timely transfer to ICUs. Due to the rise in demand, the company surpassed the last financial year’s sales in just one quarter this year.”

Among hospitals who have installed Dozee are Indira Gandhi Government Medical College & Hospital, Government Medical College in Nagpur, Victoria Hospital and ESIC Hospital in Bengaluru.

Claiming to have recorded 5X growth in sales of its remote health monitoring devices during the pandemic in hospitals. Currently, Dozee has installed 3K+ devices in hospital beds and is monitoring 4K+ users at home.

Medikabazaar: India’s B2B Bazaar For Healthtech Equipment And Devices

Medikabazaar is an online B2B platform for medical supplies offering high-end medical equipment. Catering to medical establishments across the country, the company has partnered with over 13,000 suppliers and caters to 70,000+ medical establishments, 1.5 lakhs Independent practitioners, and has a catalogue of >500,000 SKUs.

During Covid times, the company launched private labelled products like MedScan, MedSmart, KN95 Masks, and PPE Kits to support the fraternity with high-quality products at affordable prices.

On the company’s revenue model, founder Vivek Tiwari said, “The revenue mechanics are quite simple. We follow the mark up pricing approach and the margins are determined on the basis of various factors like logistics cost, demand and supply gap, volume vs niche category, competition intensity etc.”

The company has consistently narrowed its losses in the last 8 quarters and now claims to be in the EBIDTA positive zone. According to Tofler, the company’s revenue has grown from INR 2.1 Cr in 2016 to INR 55 Cr in 2019. The financial numbers for 2020 are not available yet.

In the last 10 months, the company claims to have doubled its revenue and the customer base, and has added over 150 employees. This year, Medikabazaar expects to gain more traction for its AI-ML powered SaaS product VIZI and one stop procurement solution offering VPO.

Meddo: Bridging India’s Outpatient Services’ Demand-Supply Gap

Working as a connected care delivery platform, Meddo offers tele-consultancy services as well as other outpatient services in the ambulatory care segment. In partnership with clinics, the company offers one stop solution to the patients for their primary and secondary care needs.

The company, thus, caters to both — doctors as well as patients. With a team of 350 plus doctors, 200 clinics across Delhi NCR, Meddo has served over 6 lakh customers so far.

The company earns its margins through supply chain disintermediation across multitude of services. The company claims that its revenue has grown by 2.5x in 2020 in comparison to 2019.

On profitability, cofounder and CEO Saurabh Kochhar said, “More than 70% of our clinics are profitable, with others being well on their way to profitability. With further improvements in our supply chain, we should be able to hit profitability in the clinics even faster.”

The company has planned to launch more products as well as penetrate 3-4 cities, this year.

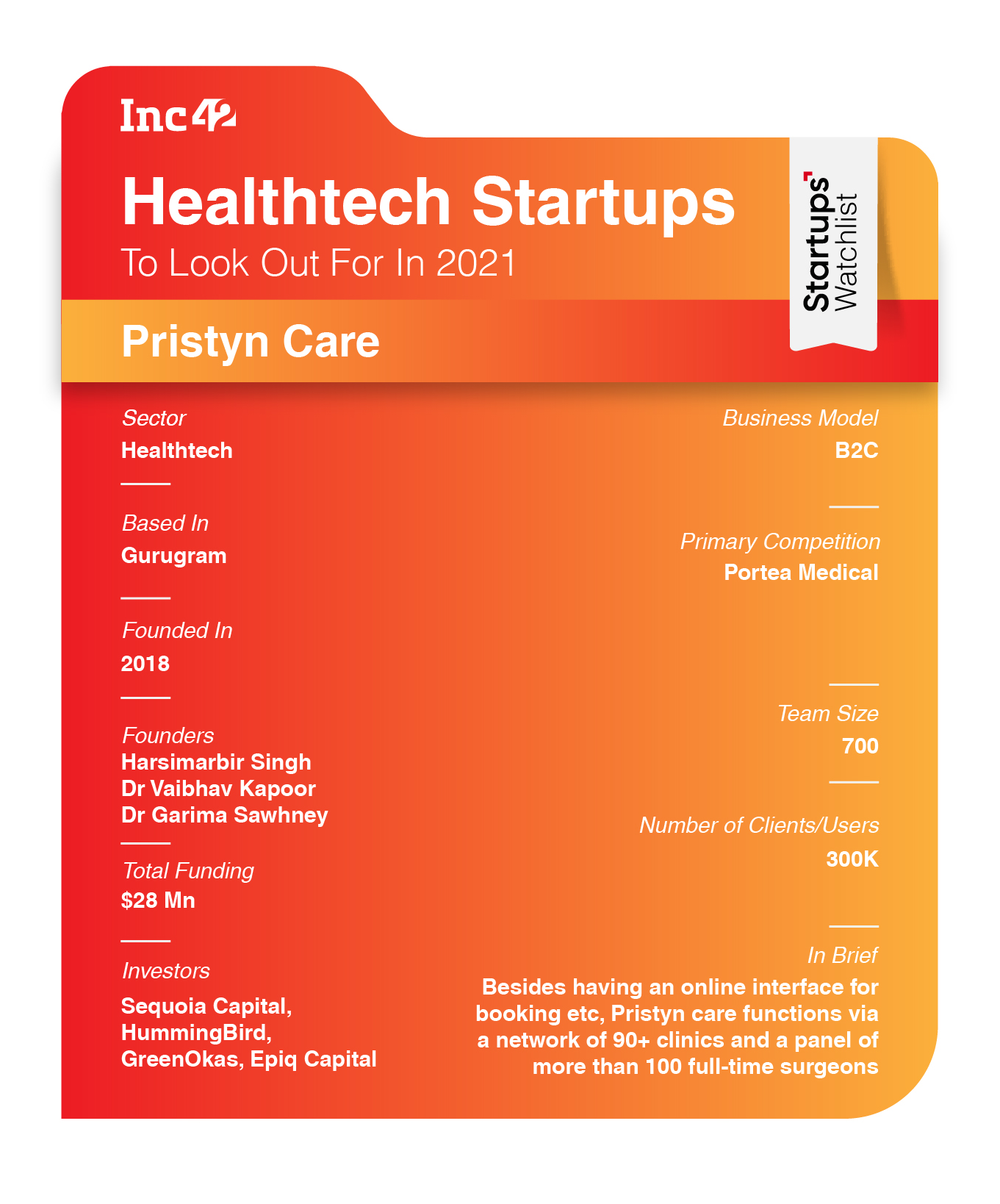

Pristyn Care: Digitising India’s Surgeries

Having set up over 90 clinics and a panel of over 100 full-time doctors, Pristyn Care offers surgeries in eight categories which include general surgery, vascular, urology, gynaecology, ENT, head and neck, plastic and cosmetic.

Amid pandemic, the company introduced on call/video consultations with super specialist surgeons for patients across the country. The company also provides digital scheduling of surgeries and paperless hospital admissions in order to minimise the hospital visits for patients. Pristyn Care is also providing RT-PCR COVID-19 Testing across 22+ cities through 50+ partner diagnostic labs.

Within a span of two years, the company has registered a remarkable growth. In terms of numbers, from a team of 3 founders to a team of 750+ employees, 2 surgeons to 100+ Super Specialist Surgeons, from being present only in Delhi NCR to now being present in 22+ cities, from offering 1 speciality to offering 10 specialities, the company has come a long way.

On 2021 plans, cofounder Harsimarbir Singh said, “We will go deeper in existing cities by adding new categories and adding disease lines to existing categories. We will also expand our presence by adding operations in more cities in India. Towards the end of the coming year we are also evaluating expanding to geographies outside India.”

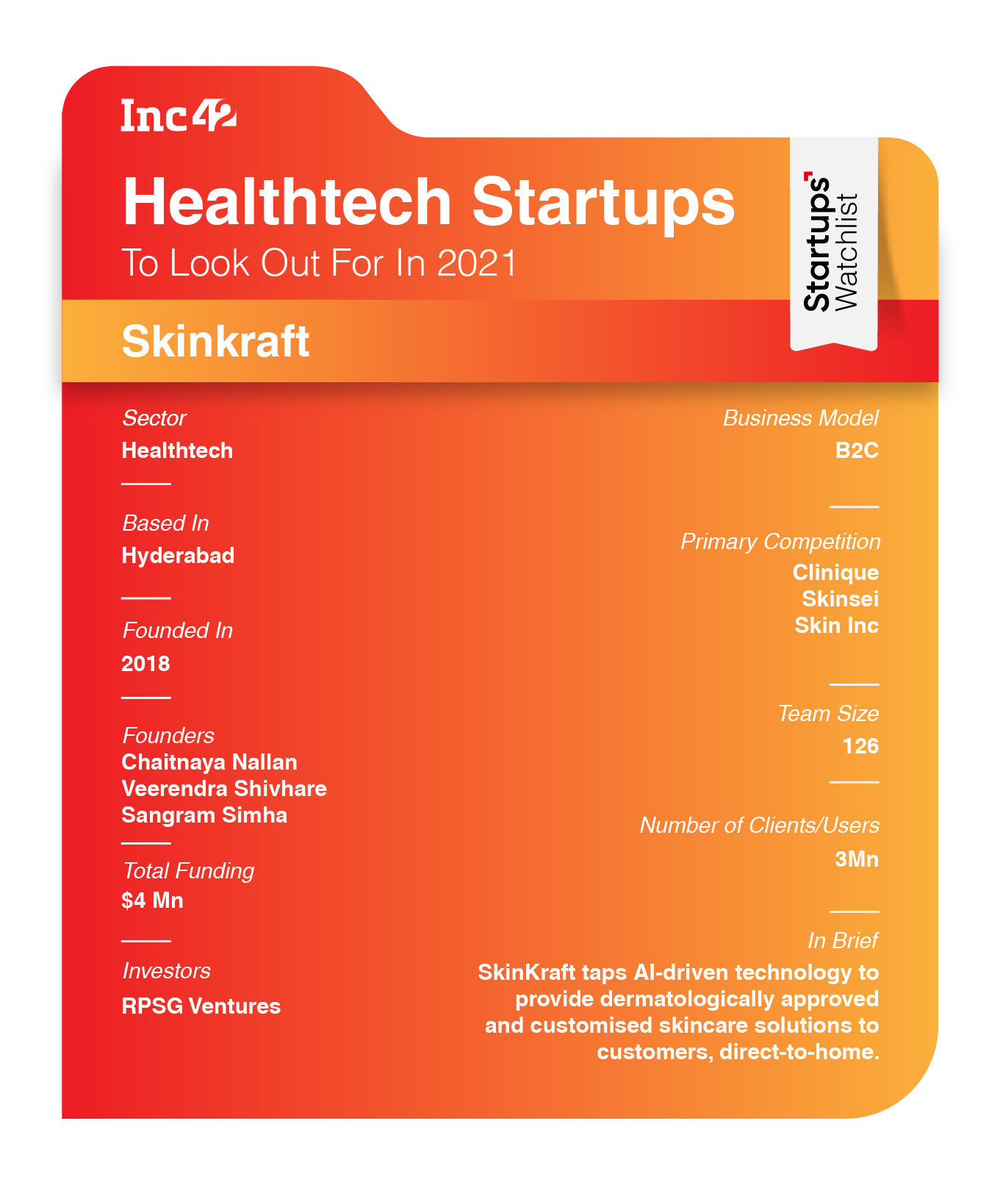

SkinKraft: Customising Skin Care Solutions

SkinKraft taps artificial intelligence (AI)-driven technology to provide dermatologically approved and customised skincare solutions to customers. The company’s key product ‘SkinID’ – helps in customising individual kits and curating unique experiences for each user. Targeting online shoppers and working professionals between the age group of 18-45 years old, the SkinID model currently uses 21 features to evaluate the user’s three-step routine via an in-depth skin analysis.

Conceptualised in 2017, SkinKraft started retailing online in mid-2018. Every new customer has to answer 30-odd questions, to help feed the data about their skin type, acne type, and other critical information. Post this, based on the result or skin ID, the platform suggests three products to its customers: one cleanser, one barrier repair (or moisturiser) and an active, aimed at solving skin problems such as acne or blemishes.

The products are currently exclusively sold via its website SkinKraft.com. Most of SkinKraft customers belong to the Tier 1 cities like Delhi, Mumbai, Bangalore, Chennai and Hyderabad.

“We grew from selling zero to 30K Regimens per month, i.e 90K units per month at an annual run rate of 36Cr in a short span of 9 months,” said cofounder Sangram Simha, who claims to have improved the accuracy rate of its product SkinID from 54% in 2018 to 82% in 2020.

With over six lakh paying users, the company has served over 3 Mn consumers so far. Claiming to be profitable, SkinKraft’s average monthly revenue is INR 8 Cr and its ARR stands at INR 100 Cr.

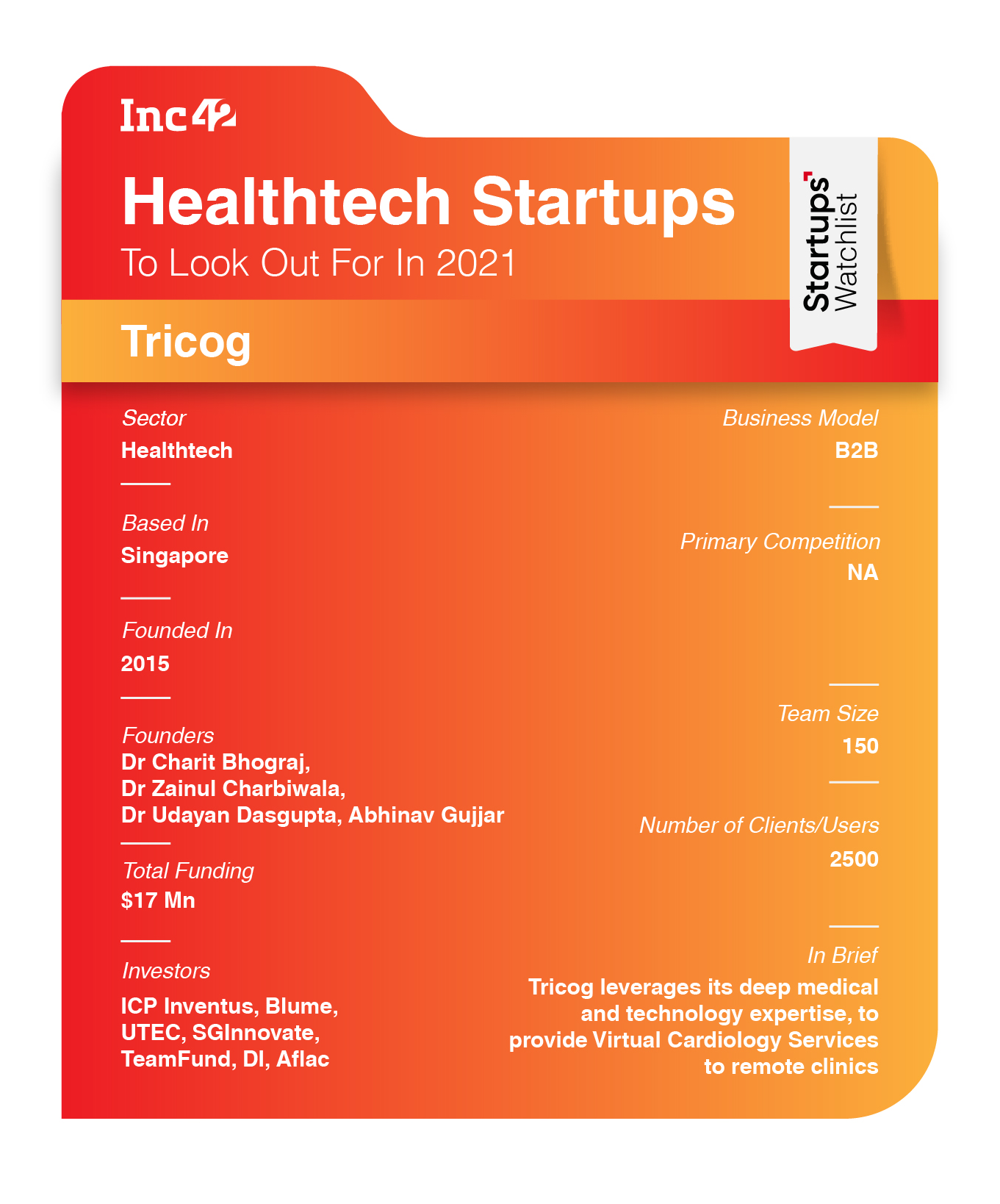

Tricog: Saving Lives Of Critical Heart Attack Patients

Poor care quality leads to more deaths than insufficient access to healthcare –1.6 million Indians died due to poor quality of care in 2016, nearly twice as many as due to non-utilisation of healthcare services. In order to bridge this gap, Tricog, a predictive healthtech analytics company has come up with a SaaS model offering 24 x 7 ECG reporting by a team of in-house specialists equipped with advanced AI tools. The solution also comprises a preconfigured 12 Channel ECG machine, Tricog Communicator providing 2G/3G/Wifi access for cloud, and SIM card with data connectivity Service.

The treating doctor/medical center gets ECG report with all the details of interpretation on a mobile app, email, and SMS. The mobile app also provides advanced features of STEMI protocol management, care coordination and advanced features of tracking and monitoring each case’s outcome.

Catering to government-owned primary and tertiary care centres, private tertiary care hospitals, nursing homes, diagnostics centres, etc.Tricog offers a monthly subscription model based on the scope of the offered solution, and the volume of diagnostic tests (ECGs) offered in the package.

Tricog’s operating revenue has grown from INR 1 Cr in 2017 to INR 15.5 Cr in 2019, according to Tofler. On the company’s growth plans, cofounder Dr Zainul Charbiwala said that despite all the challenges the year 2020 posed, the company has managed to expand its presence across 6 countries (Southeast Asia, Africa), while serving customers in more than 12 countries, and crossed the mark of more than 4 Mn ECGs diagnosis in 2020. This led to a 1.5x YoY growth in comparison to the previous year.

The company claims to be EBITDA positive across geographies including India.

However, “We want to continue investing in new geographies and R&D. We are trying to have a balanced mix of growth and profitability, though we are well aware of the fact that growth comes at a cost, especially in SaaS businesses. We have set ourselves on the path to profitability by carefully planning our costs and are confident that with a focus on innovation and emerging global markets, profitability can be achieved in the next few years,” said Charbiwala.

The company plans to launch new product lines like InstaEcho for quick and accurate echocardiogram diagnosis and a digital platform for the diagnosis and management of cardiac patients.

Editor’s Note: The startups were selected on the basis of editorial discretion, keeping in mind various factors such as revenue growth, profitability, funding stage, pivot and growth of the companies in the preceding year among other factors, and have been weighted thoroughly on the basis of the performance of the companies, and some of the information was also gathered from public and private sources.

Ad-lite browsing experience

Ad-lite browsing experience