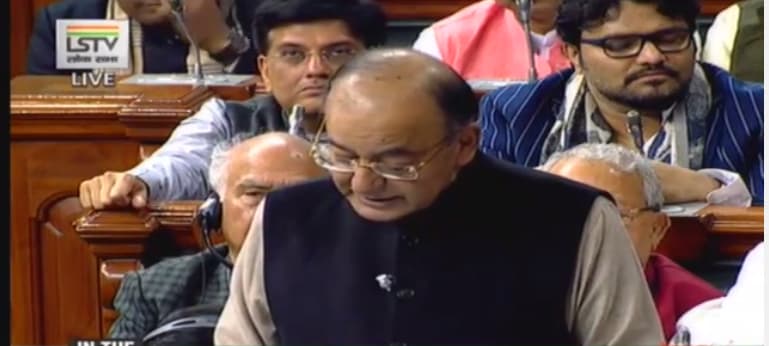

After last minute questions on whether the Union Budget 2017-18 will be presented on account of demise of a sitting Member of Parliament, the much-awaited budget was presented today by Finance Minister Arun Jaitley. The budget was especially important, given that it was the first one following the demonetisation move by Prime Minister Narendra Modi on November 8, 2016 which tendered INR 500 and INR 1000 notes invalid.

With the GDP and the economy reeling from the temporary effects of demonetisation, it was expected that the budget in all likelihood will be replete with measures to soften the blow as well as be populist in nature. The eyes of the Indian Startup ecosystem were equally on the Union Budget given that it came against the backdrop of two major domestic policy developments in the past year — the House agreement on implementing the GST (Goods and Services Tax) and then the demonetisation drive.

Presenting a soft and one of the least volatile budgets, in his speech, the FM stated that “demonetisation to create a new normal for a bigger, cleaner GDP; slowdown, if any, will be only transient. The effects of demonetisation will not spill over into the next year.”

He hinted that surplus liquidity in the banking system created by demonetisation will lower borrowing cost and increase access to credit. He also added that demonetisation data mining will widen tax net and lead to increase of tax revenue.

Here’s a quick look at the measures announced by the government to boost a digital economy.

Measures To Boost Digital Economy

- For senior citizens, Aadhaar-based smart health cards will be issued.

- A Digi Gaon initiative to provide telemedicine and education.

- Service charge on e-tickets booked through IRCTC will be withdrawn.

- Targeting INR 2,500 Cr digital payments in the coming year.

- The Government will launch two new schemes for BHIM app signups – a cash back scheme and referral scheme.

- Plans to launch 20 lakh Aadhar POS by 2017 end.

- Aadhar Pay to be launched – a merchant-enabled version which will enable payment for those without debit cards, mobile phones.

- E-pension distribution for services.

- Banks have targeted to introduce additional 10 lakh point-of-sale terminals by March 17, 2017.

- Duty exempted on various POS machines and IRIS readers to encourage digital payments.

- To promote cash less transaction, cash transactions have been capped. No transaction above INR 3 lakh will be permitted in cash.

- Allocation of INR 10,000 Cr for Bharat Net project for providing high-speed broadband in FY18.

- A proposal to receive all government receipts beyond a certain threshold through e-modes under consideration.

- The announcement of creation of a Computer Emergency Response Team (CERT) to tackle cyber security threats in the financial sector.

- Payment regulatory board to be set up in RBI to regulate electronic payments, replacing the Board for Regulation and Supervision in Payments and Settlements System.

Stating that the burden of taxes is falling on a few with too many people not paying taxes, FM Jaitley has proposed certain tax relief measures for both individuals and MSMEs. Here’s a quick look at the measures announced by the government as far as startups are concerned.

Measures Impacting Startups And Tax

- For startups, profit-linked deductions for startups have been changed. Startups to pay tax on profits for three out of seven years has been increased from the earlier limit of three out of five years.

- Carry forward losses allowed for startups, with the limit of 51% promoter holding relaxed, provided the promoter still holds a stake in the company.

- In order to make MSMEs more viable, taxes for companies with revenues of INR50 Cr to be reduced by 5% to 25%.

- Minimum alternate Tax (MAT) can be carried forward for 15 years by companies as against 10 years allowed earlier.

- The Foreign Investment Promotion Board has been abolished. Further liberalisation in the FDI policy will be taken in the next few days.

Ad-lite browsing experience

Ad-lite browsing experience