Zomato had reported a loss of INR 250.8 Cr in Q2 FY23 and INR 67.2 Cr in Q3 FY22

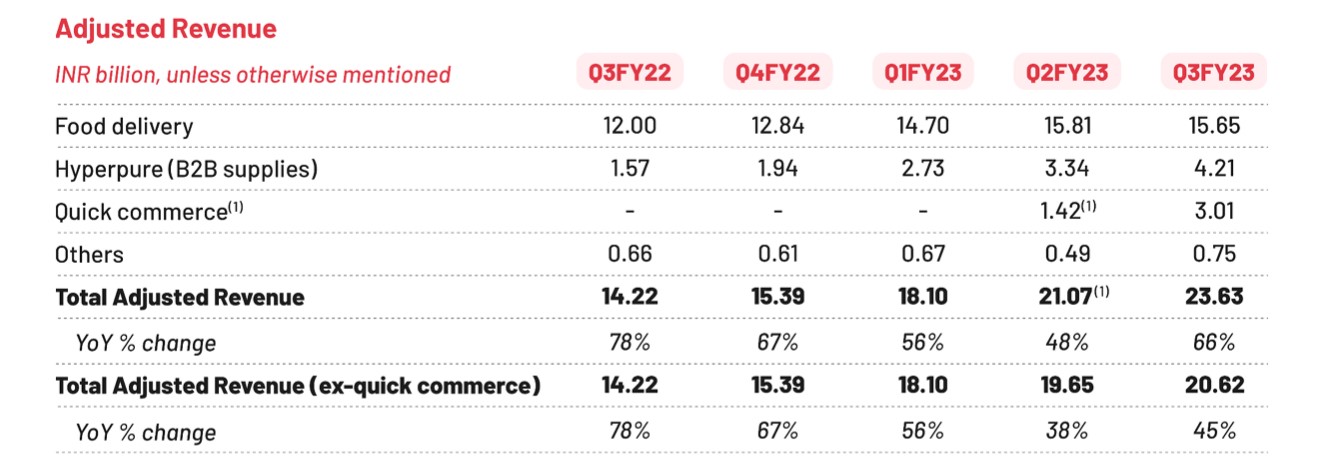

Zomato’s adjusted revenue for its food delivery business declined to INR 1,565 Cr in the December quarter of FY23 from INR 1,581 Cr in September quarter

Zomato’s B2B Hyperpure business generated adjusted revenue of INR 421 Cr in Q3 FY23 as against INR 334 Cr in Q2 FY23

Foodtech major Zomato’s consolidated net loss widened on a year-on-year (YoY) as well as quarter-on-quarter (QoQ) basis to INR 346.6 Cr in the December quarter of the financial year 2022-23 as degrowth in food delivery business hurt the company.

While Zomato had reported a loss of INR 250.8 Cr in the preceding Q2 FY23 quarter, its loss stood at INR 67.2 Cr in the year-ago quarter.

However, the numbers are not comparable as the financial statements of December 2021 didn’t include the performance of Blinkit, which was acquired by the company in August last year. Besides, the preceding September quarter consolidated Blinkit’s numbers for only 50 days.

Zomato said that its adjusted EBITDA loss (ex-quick commerce business Blinkit) stood at INR 38 Cr in Q3 FY23 compared to INR 272 Cr in the corresponding quarter last year. Even after consolidating quick commerce, Zomato’s adjusted EBITDA loss reduced to INR 265 Cr during the quarter under review.

Meanwhile, operating revenue stood at INR 1,948.2 Cr in Q3 FY23 as against INR 1,112 Cr in the year-ago period and INR 1,661.3 Cr in September quarter.

Zomato’s adjusted revenue for its food delivery business declined to INR 1,565 Cr in the December quarter of FY23 from INR 1,581 Cr in the preceding quarter. Average monthly transaction customers also declined QoQ to 17.4 Mn from 17.5 Mn.

On a YoY basis, Zomato’s total adjusted revenue grew 66% to INR 2,363 Cr in Q3.

On the other hand, Blinkit’s business contributed INR 301 Cr to adjusted revenue.

Zomato’s B2B Hyperpure business generated adjusted revenue of INR 421 Cr in Q3 FY23 as against INR 334 Cr in Q2 FY23.

“We believe that the long term opportunity remains large and exciting. We think that the current slowdown is a result of a few temporary factors – a) macro slowdown for the mid-market segment, b) boom in dining out for the premium-end, and c) boom in travel at the premium-end,” said Deepinder Goyal, MD and CEO of Zomato, on the slowdown in the food delivery business.

“We continue to stay focused on our long-term growth vectors without worrying too much about near-term growth pressures,” Goyal added.

Due to the slowdown in the food delivery business, gross order value (GOV) of the segment grew only 0.7% QoQ in an otherwise seasonally strong quarter, the foodtech giant said in its statement. However, the startup said that its average order volume (AOV) grew but didn’t disclose the number. On a YoY basis, GOV grew 21% driven by order volume growth of 14% along with 6% growth in AOV.

Zomato’s total expenses surged 51% to INR 2,485.3 Cr in the December quarter of FY23 from INR 1,642.6 in Q3 FY22. Sequentially, it rose almost 19% from INR 2,091.3 Cr reported in Q2 FY23.

Zomato spent the highest amount on delivery and related charges, which grew over 19% YoY to INR 654.9 Cr in Q3 FY23.

Meanwhile, helped by headcount reduction steps, Zomato was able to control its employee benefit expenses. It spent INR 395 Cr on employee benefits during the quarter, an increase of only 3% from Q2. On a YoY basis, it declined 4% from INR 411.5 Cr reported in the corresponding quarter last year.

In November 2022 there were reports of laying off around 4% of its workforce. Amid the company’s restructuring efforts, top executives of the company including cofounder Mohit Gupta, Rahul Ganjoo, who was the head of new initiatives, and Gunjan Patidar, who was the cofounder and CTO at Zomato, also exited the company.

Addressing the issue of exits of senior executives, Goyal said, “…sometimes, for some people, the distance between their form (their mindset and skillset) and the company’s context becomes such that it is necessary to take a break from each other.”

Besides, he also said that Zomato currently doesn’t need to fill the positions of CTO and head of food delivery.

Speaking on the relaunch of Zomato Gold membership in January and its impact on the company’s profitability target, the company said that the short-term negative impact of Zomato Gold (due to free delivery benefit) will be offset by improvements in other revenue and fixed and variable cost drivers. It is also looking to make the Zomato Gold program profitable by itself.

Meanwhile, Zomato remains confident of reaching adjusted EBITDA break-even (ex-quick commerce) by Q2 FY24. It also hinted at the possibility of achieving this target in Q4 FY23 and said that ex-Blinkit, Zomato’s business has already turned EBITDA positive in January.

Zomato shares ended today’s session marginally higher at INR 54.4 on the BSE.

Ad-lite browsing experience

Ad-lite browsing experience