After earning a reputation as a unicorn maker in 2021, Tiger Global has had to deal with fires at many of these startups in the past few months

One of the clearest indicators of a startup funding boom in India is the volume of investments by Tiger Global. And the roar of the mighty US hedge fund has quietened in the past 12-14 months.

After a whirlwind 2021 where Tiger backed several new unicorns (more on this), the talk these days is about how its India investments have not provided the returns expected. While the troubles of Sequoia-backed companies have come to the fore in the past year, the truth is that even Tiger’s portfolio has had its share of problems. And in the past year it has changed its investment strategy as it hunts for its next Flipkart.

With partner Scott Shleifer’s comments on India not being the home of big returns, perhaps a closer look is warranted at Tiger Global’s India fortunes. Before that a look at other top stories of the week:

- #Budget4Startups? The Union Budget 2023 brought up several questions on the effectiveness of startup-friendly policies, despite a clear focus on emerging sectors such as climate tech, deeptech and 5G

- Paytm’s Comeback: Paytm’s net losses fell 50% to INR 392 Cr in Q3 FY23 compared to last year while revenue from operations surged 41% Here are the other highlights from the fintech giant’s Q3 results

Tiger Global’s Unicorn Machine

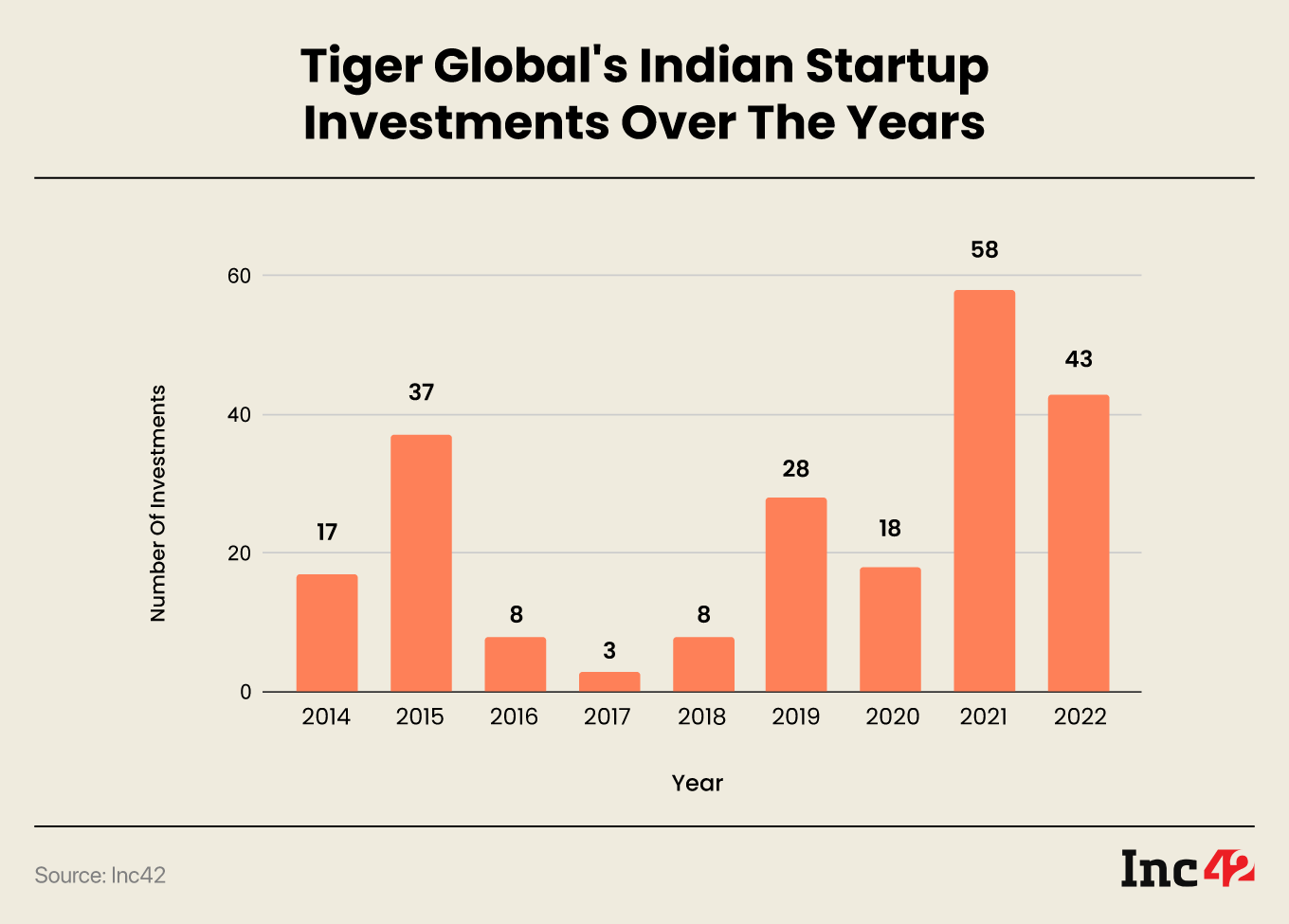

The US crossover fund entered India in 2007, but only went on a major investment spree from 2014 onwards, when it backed the likes of Flipkart, Zomato, Ola, Policybazaar and others.

But soon after the hyperlocal bubble burst in 2016, Tiger slowed down its dealmaking in India. Even though it had a significant share of the unicorn club till before the pandemic, it was in 2021 that Tiger became known as a unicorn maker.

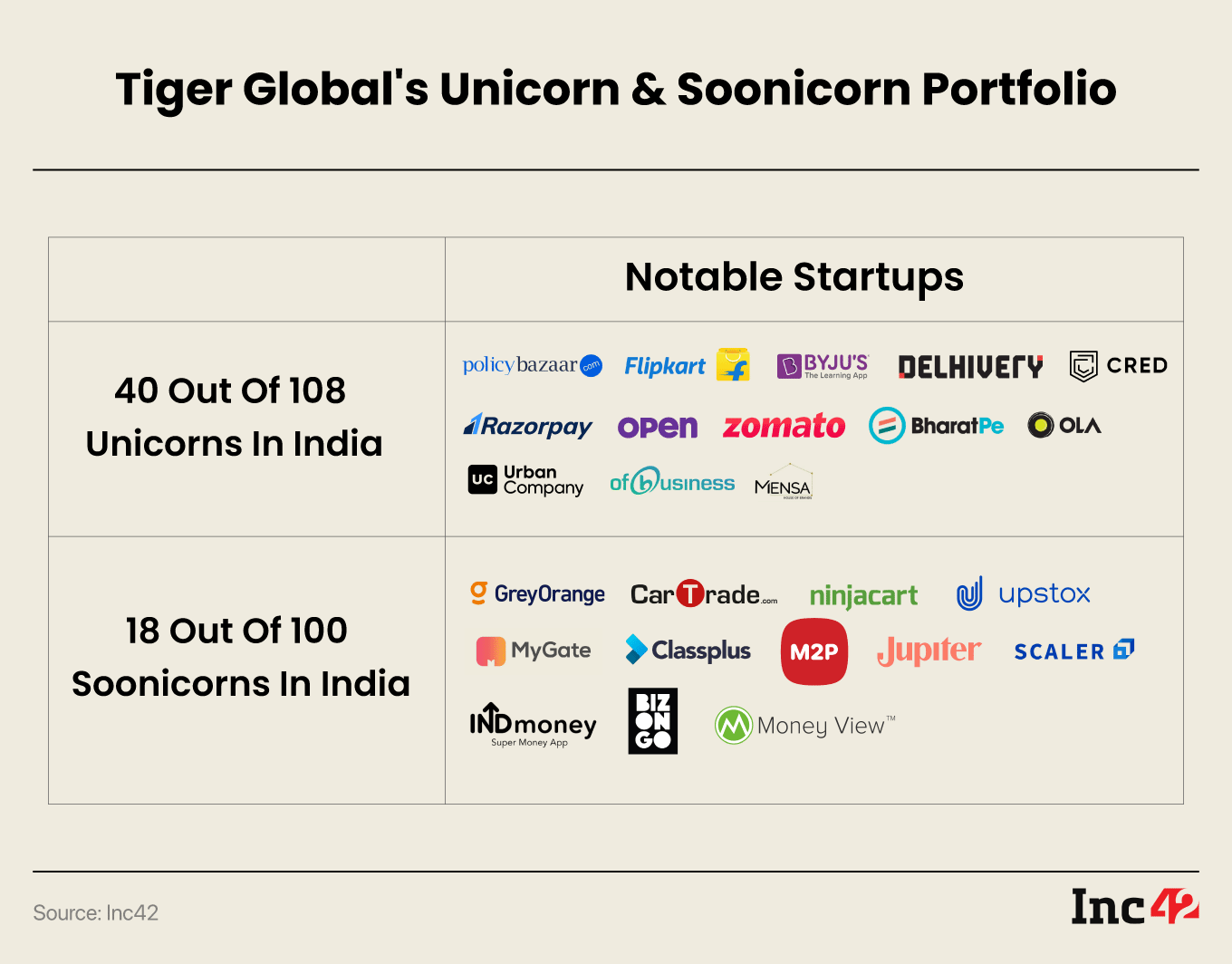

Its participation in funding rounds for CRED, ShareChat, Urban Company, BharatPe, Infra.Market, the VC made the biggest splash. Overall, it has invested in 40 out of India’s 108 unicorns and 18 out of the 100 soonicorns in India.

Come 2021, Tiger was a significant backer of the unicorn parade, which saw 42 new unicorns. Tiger’s India portfolio today includes 124 unique startups since 2014 as per Inc42 data, and the firm is said to have invested over $6.5 Bn in the market since its entry.

But while its portfolio includes some of the biggest startups in India, there is also plenty of trouble in the likes of BharatPe, Ola, PharmEasy, ShareChat, Infra.Market, GoMechanic and others, who have come under the spotlight for controversies such as corporate governance issues, fraud, slowdown in business leading to uncertain futures for many.

Besides this, other unicorns in Tiger’s portfolio such as BYJU’s, Unacademy, Vedantu, Urban Company or CRED are far from the profitability mark and have turned to layoffs to get there.

India Portfolio Loses Sheen

While BharatPe’s troubles are well documented, the likes of PharmEasy and ShareChat have had a rough go of it recently. Further, Infra.Market’s offices were raided by tax authorities in connection with an alleged INR 1,500 Cr tax evasion probe. After rising to unicorn status rapidly, these companies are facing tough, existential questions.

PharmEasy’s debt-heavy operations are in need of a booster shot and the company put off its IPO after floating a DRHP in 2021. This despite the acquisition of the profitable Thyrocare, the company is struggling to grow at the same clip as it did in the pandemic years amid stiff competition from Tata 1mg, Apollo Pharmacy and Reliance’s NetMeds. PharmEasy might even have to sell Thyrocare, which is unable to support the loss-making core epharmacy operations.

ShareChat’s founders Bhanu Pratap Singh and Farid Ahsan have stepped down from their active roles. This was on the heels of ShareChat’s parent firm Mohalla Tech laying off 20% (500) of its workforce in early 2023, and another 100 layoffs in December 2022, as Inc42 reported.

Further, Tiger-backed GoMechanic has also been hit with allegations of fraud and misreporting revenue growth. The founders admitted to the board of directors about reporting fake numbers, which has resulted in talks about a distress sale of the company.

Among its unicorn portfolio, only SaaS company HighRadius, B2B commerce and trade player OfBusiness, its sister company, fintech startup Oxyzo, and crypto exchange CoinSwitch are profitable, while the rest are still looking to get out of the red.

This includes listed companies such as Zomato, PolicyBazaar, Delhivery and Freshworks. Tiger sold a 3.57% stake in Policybazaar a year after its listing in November last year, but it’s Flipkart that could show the biggest upside.

Waiting For Another Flipkart

Despite selling part of its equity in Flipkart to Walmart, Tiger has a 4% stake. Reports in January suggested that Tiger Global is looking to sell its stake to the US retail giant for roughly $1.5 Bn, which would value Flipkart at around $30 Bn, $7Bn lower than its previous funding round.

Tiger had already earned $2 Bn through a partial stake sale during Walmart’s Flipkart acquisition in 2018. But that was a one-off. “As a result, returns on capital for investors like us have been below average … way below. Our returns in India, our IRR, is something like 20% gross since inception. That compares to mid-30s in the U.S. on the private side, and low-50s in China. But that’s the past,” Schleifer was quoted as saying this week.

Despite the relatively below average returns from India, the fund has a positive long-term view due to macroeconomic tailwinds such as growing internet adoption and rising GDP per capita.

Will Tiger Roar In 2023?

But the question is what will happen in 2023? Will Tiger continue to go after the value deals in the Indian ecosystem at the early stage and smaller growth and bridge stage rounds?

Indeed, in terms of new deals in the past year, Tiger has changed its stripes and gone after startups at a much early stage, and even backed those with business models in transitions such as Jar. It also invested in Shopflo in a seed round, the first of its kind in the fund’s history in India, and primarily participated in smaller Series A/B deals in the range of $10 Mn – $20 Mn.

This is not the usual Tiger, known for its big ticket size and high valuations. At least not the same Tiger Global that was seen in 2021. The VC fund participated in just seven mega deals in 2022 compared to 26 deals in 2021.

Last year, it was reported that Tiger Global is planning a $6 Bn venture fund to invest ‘largely in enterprise themes and in India’ and ‘in a lower-valuation environment’. Whether this means looking to grab large stakes for less capital is unclear.

If Tiger is indeed looking at increasing its investment volume in India in the next few months, it could be a great signal to the investor ecosystem at large. Given the funding crunch, this strategy might work in some cases, since investors have the leverage. But it also means investing in a lot more companies in the hope of breaking even from a market that has not historically been great for Tiger Global.

? Unveiling The FAST42 2023 List

Inc42 partnered with Shiprocket for the second edition of FAST42, an initiative to recognise the fastest-growing D2C brands in India. More than 140 interviews were conducted and dozens of business pitches were heard before finalising the 42 fastest-growing D2C brands in the country.

View The List HereSunday Roundup: Startup Funding; Tech Stocks & More

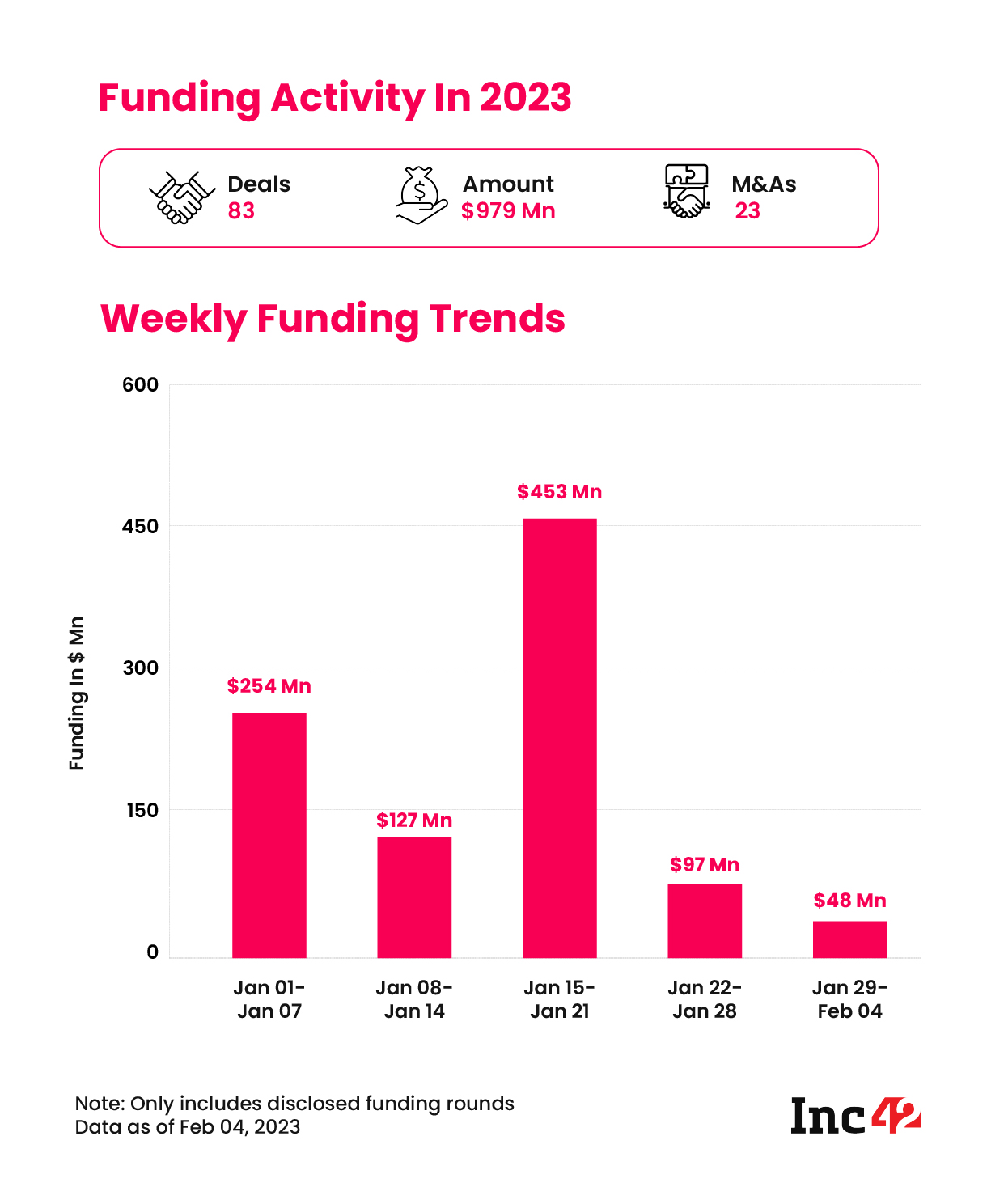

Weekly Funding Hits New Low: With just $48 Mn raised across 12 deals, this past week saw the lowest weekly tally of funding in the past three years. For context, this figure is less than half of the $97 Mn raised in the week before.

Angel Tax Relief: After fears of a reintroduced Angel Tax, DPIIT secretary Anurag Jain clarified that recognised startups in India would continue to enjoy exemption from the tax

Stocks Rebound: Among listed cos, MapmyIndia reported a near 2X growth in profits in Q3, while BSE-listed Fino Payments Bank also improved its profitability in the December quarter

Binance Hits Back: Crypto giant Binance has terminated wallet services for Indian crypto exchange WazirX amid the ownership standoff between the two companies

Ad-lite browsing experience

Ad-lite browsing experience