Online grocery delivery startups are working with state governments to make it easier for their delivery partners to work on the ground

Meanwhile, an array of new players including Zomato, Domino's, Paytm Mall, Perpule, Shopclues have entered the grocery delivery space

Can they replicate the model that established players such as BigBasket, Grofers took many years to create?

Covid19 Tech Impact

Latest updates & innovations, in-depth resources, live webinars and guides to help businesses navigate through the impact of the COVID19 pandemic on India's economy.

As the pandemic confines all of us to our homes, there are only a few industries that are expected to thrive, one of which is grocery delivery, at least as far as the Indian market is concerned.

The online food and grocery retail currently accounts for just 0.2% of the overall retail market and according to pre-coronavirus estimates, and it was expected to touch $10.5 Bn, or 1.2% of the overall retail market by 2023. The numbers in grocery retail, however, may see a spike as predicted by many VC firms and industry leaders.

The important reason being higher trust in home-cooked meals. On a lighter note, an evident fact that can be supported with the increasing number of online searches for food recipes. The fear of delivery personnel transmitting the disease is high today and may stay for a while.

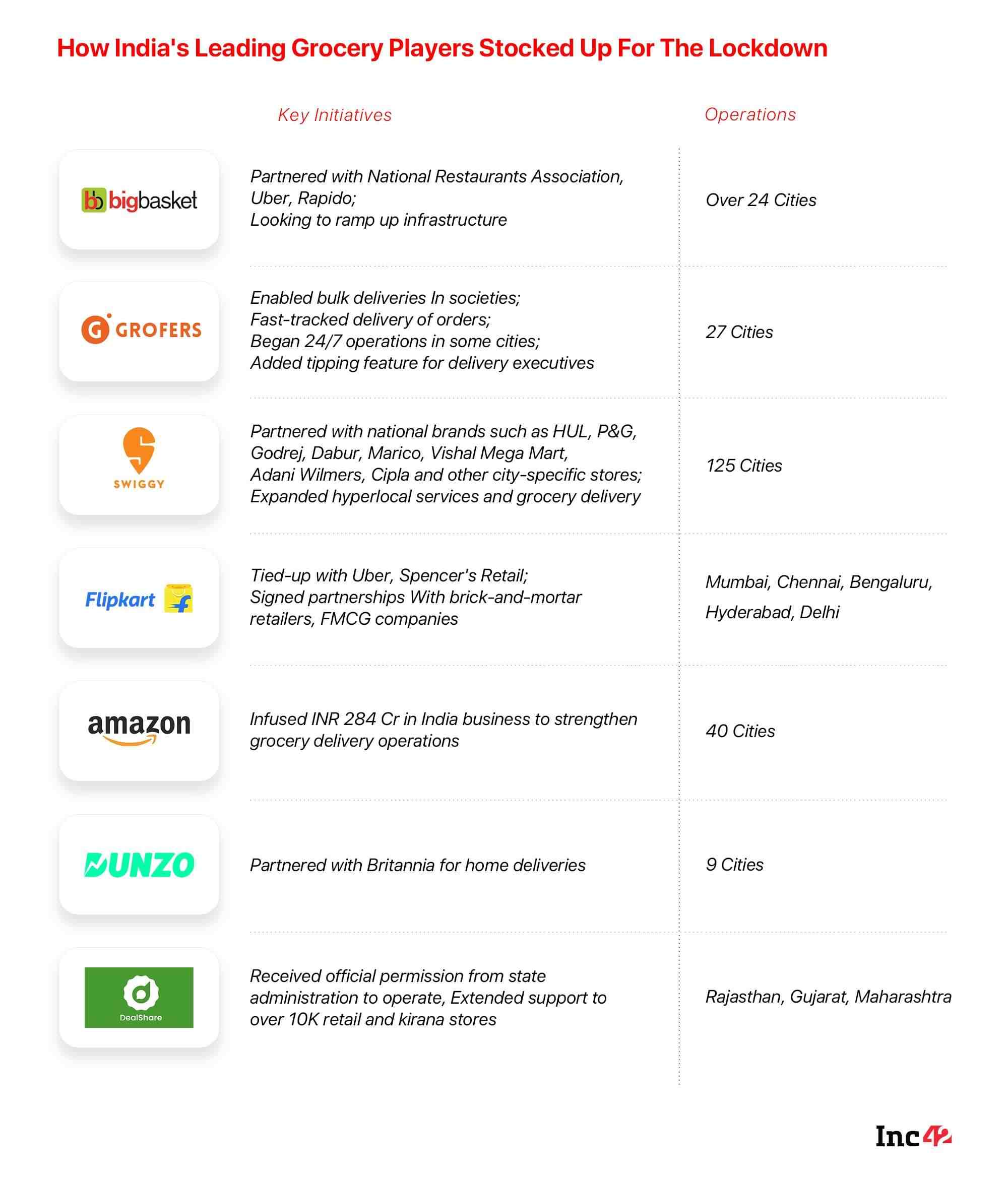

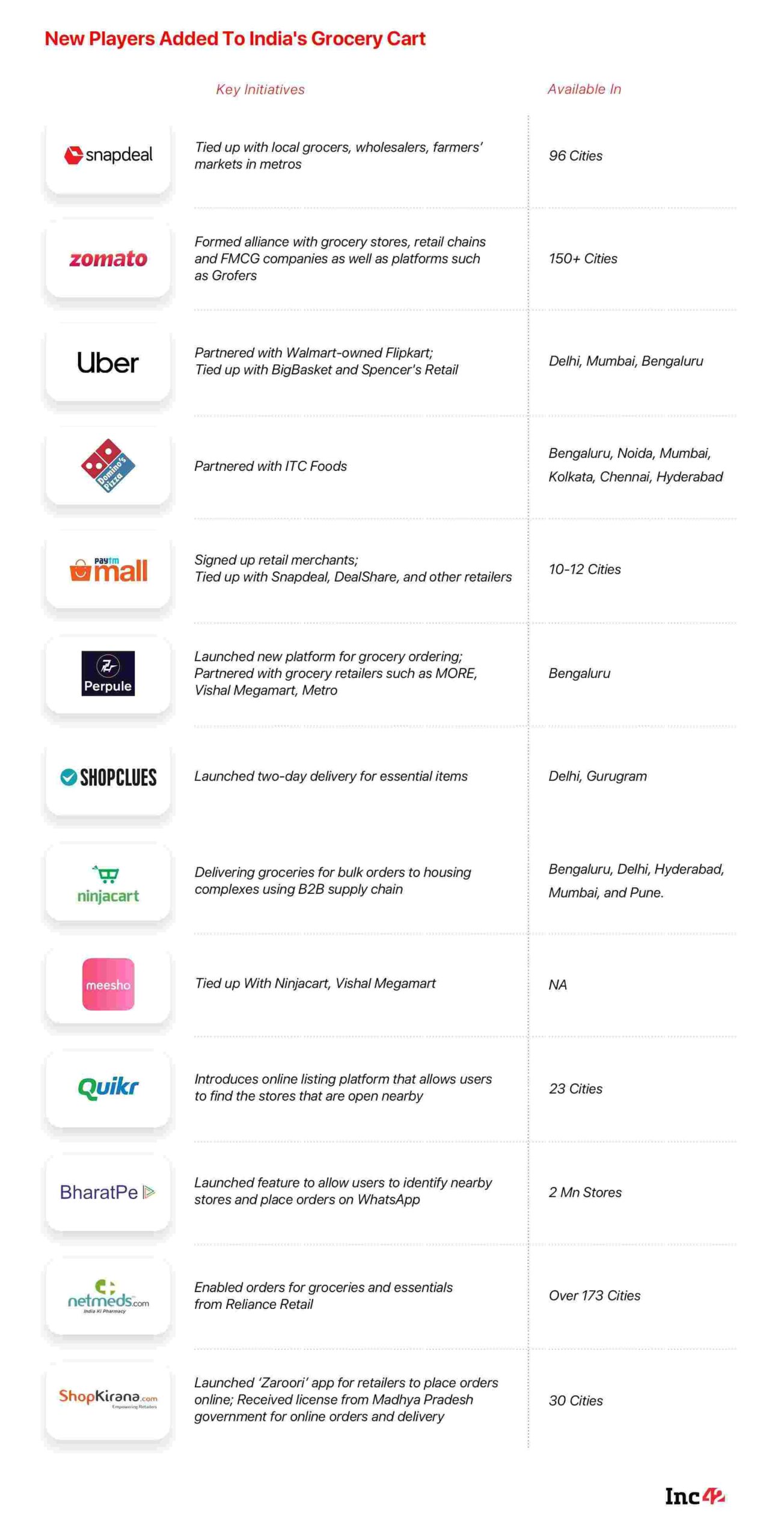

With supermarkets shut and kirana stores not able to deliver and keep up with the demand, the grocery delivery platforms are being looked at as the saviours. This has led to an array of new players joining the sector. Snapdeal, Zomato, Uber, Dominos, Paytm Mall, Perpule, Shopclues and few others have entered the grocery delivery space.

However, can they replicate the model that leading players such as Bengaluru-based BigBasket, Gurugram-based Grofers that took many years to create and ecommerce players such as Flipkart and Amazon are still struggling to strengthen? The more immediate question would be, can they handle the current increase in demand when others are still struggling?

New Players Join The Bandwagon

Zomato has tied up with government authorities, grocery stores, retail chains and FMCG companies to provide essentials to the users. It claims to collect directly from stores and to deliver groceries across more than 150 cities and 50 lakh households as of now.

Swiggy has recently expanded the delivery of groceries and household essentials to over 125 cities by partnering with several brands such as ITC, HUL, P&G, Godrej, Dabur, Marico, Adani Wilmers, Cipla and large format retailers. The service is being enabled through neighbourhood stores and distribution centres of large brands. Through the ‘Grocery’ category in the app, consumers can directly view available stores in their locality, add items to their cart for payment and opt for ‘No-contact’ delivery on prepaid orders. The company also said that it has revamped its offering ‘Swiggy Go’ by launching a hyperlocal delivery service ‘Genie’ in over 15 cities.

The switch is not just limited to Indian foodtech unicorns, but even digital payments platform BharatPe and social ecommerce portal Meesho. Both have joined the grocery delivery space to increase the reach of retailers selling essential products and ensure a continuous supply chain. BharatPe, which has a network of 2 Mn neighbourhood groceries, dairy and pharma stores will be able to connect them with potential customers, it claims.

Uber has also announced a new last-mile delivery service and is partnering with BigBasket as its first client to collectively address the growing needs of consumers to access everyday essentials. The platform has deployed a mix of UberGo, UberXL and UberMOTO and is sharing its technology and the network of delivery partners to support BigBasket in delivering essential supplies.

B2B supply chain players Jumbotail and Shopkirana have also joined in. While ShopKirana has started supplying to apartment complexes and homes through the stores, Jumbotail through its J24 stores, launched last year as an extension to its offering, has started supplying to apartment complexes as well. “We are able to turn an empty room into a fully functional J24 Modern Convenience Retail store powered by our Goldeneye Retail Operating System within 24-48 hours,” a Jumbotail spokesperson said.

Limetray has launched a new tech-enabled platform that will allow kirana stores to accept online orders. This will allow the startup to directly accept online orders and payments from consumers, without relying on third-party players. Quikr, on the other hand, has come up with an online listing platform that allows users to find the stores that are open nearby.

Snapdeal has tied up with local grocers and wholesalers to make fast intra-city deliveries. It is also tying up with local Kisan Mandis in metro cities so that staples like pulses, salt, sugar, cooking oil and other packaged food items. Online pharmacy Netmeds has also enabled ordering groceries and essentials from Reliance Retail on its platform.

Addressing Manpower Shortage And Supply Chain Disruption

The delivery startups have been working with various state and district governments to make it easier for delivery partners to work on the ground. This was a major challenge in the initial days of the lockdown. Stocks in transit were stuck on the road and in warehouses across the country.

Despite the government classifying grocery delivery as essential service, trucks carrying supplies and delivery executives in many parts of the country were stopped. This disrupted the entire supply chain from warehousing and logistics to vendors and delivery partners.

The situation is improving, claim the companies. They have reportedly asked the government to expedite the process of obtaining licenses to allow them to stock food and pharmaceutical supplies to improve the availability of such essentials for consumers.

“While there are a few short-term challenges in the on-ground implementation of rules across certain states, we have seen the situation continuously improve over the last three weeks. To ensure continuity of our service which is deemed as essential, we have been working with local governments to remain operational while bolstering our offerings to cater to the needs of the citizens,” a spokesperson for Swiggy said,

Another huge constraint is the shortage of staff across the country. Many delivery and warehouse executives have migrated back to their villages and some of them are too scared to work. And, the companies are also working on resolving the same.

According to Grofers, currently, its warehouses are operational with 60% staff and in order to meet the massive surge in demand, the company is working on hiring an additional 2000 temporary warehouse and delivery staff across the country. The company is also collaborating with other platforms to get their staff and delivery fleet on board. It hopes to solve all emergency and quick requirements of the customers first.

“Shortage of manpower is the primary concern, and we are working hard to solve this. Our HR and regional teams are working at full tilt to ensure we’re recruiting more people as well as retaining our current employees. We are also trying to work with cab aggregators, restaurant associations and other organizations to see if we can get some of their employees onboarded,” said BigBasket earlier.

The Bengaluru-based grocery delivery platform has also received INR 379.87 Cr ($49.9 Mn) in debt from existing investor Alibaba. According to the ministry of corporate affairs filings by BigBasket’s B2B arm Supermarket Grocery Supplies, accessed by Inc42, the company has issued fresh debentures to Alibaba.com Singapore Ecommerce Private Limited.

Delivery services from various brands have been playing an important role in either keeping the businesses running or enabling them to function better. “Several ecommerce and online delivery companies are doubling down on delivery of grocery and essential items to provide relief to customers across different towns and cities amidst the lockdown,” added Swiggy.

However, the morale of delivery teams is also low as the fear and also misinformation on the disease is high. Rajneesh Kumar, chief corporate affairs officer at Flipkart, told Inc42, “We are working towards building and strengthening the confidence of delivery teams and supply chain executives and are hopeful that more executives will resume work soon in this national fight against Covid-19. This includes providing them medical and life insurance, pay, and benefits in case they are quarantined or diagnosed with Covid-19.”

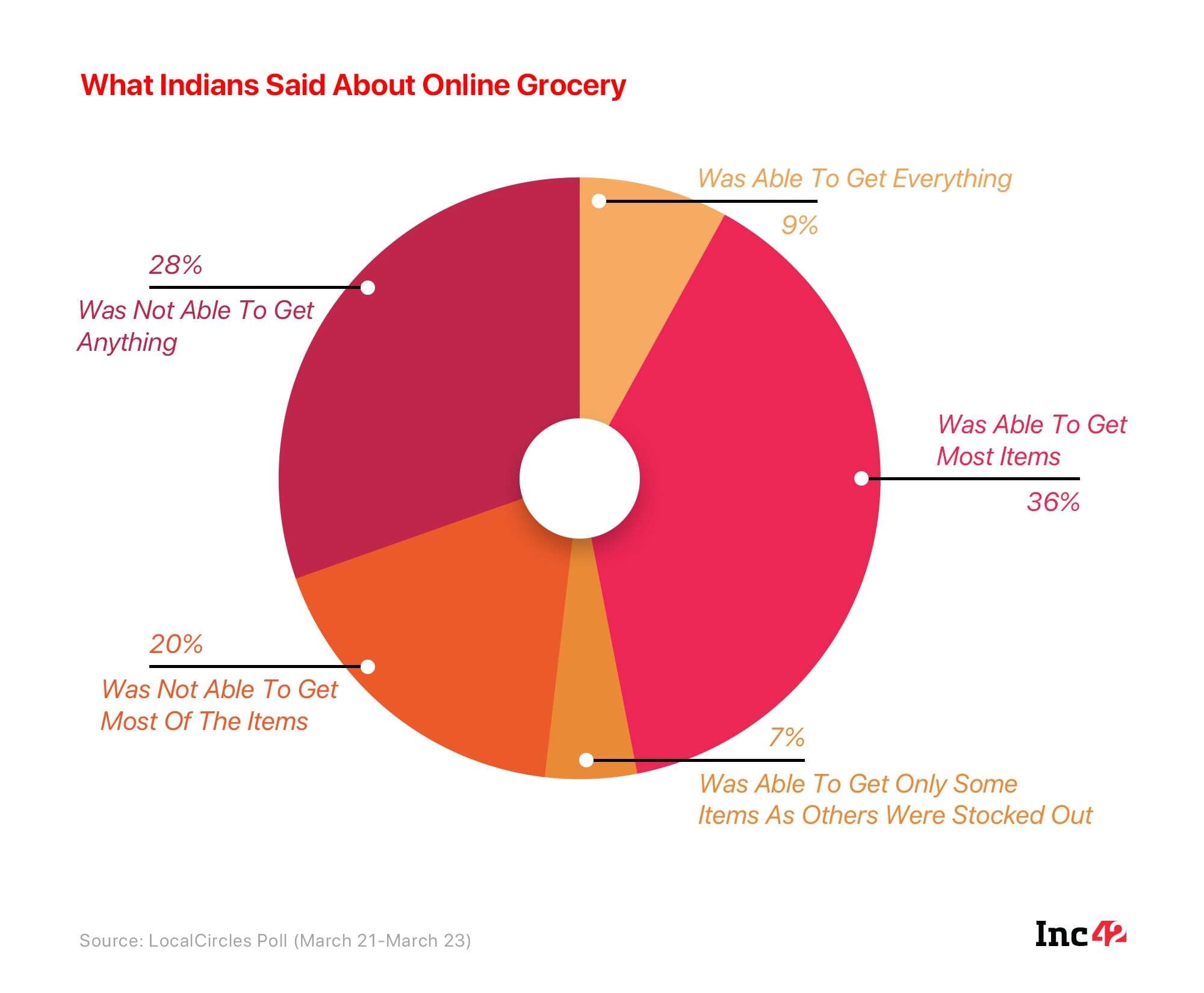

For new entrants, ensuring supply is expected to be a bigger challenge. Especially since the mom and pop stores have been traditionally more inclined to choosing walk-in customers. According to a poll conducted by LocalCircles at the end of March, many consumers said that deliveries from ecommerce grocery apps like Grofers, BigBasket, Amazon, Flipkart etc. were not reaching them.

While the situation may have improved now, the online marketplaces especially new players may have to quickly come up with strategies to instill or restore the confidence in customers.

Can New Players Keep It Going?

Another important question is, are the new entrants planning to scale up the operations in future and how sustainable their new business model is.

“Grocery delivery has always been on our long term radar since it fits into our vision of ‘better food for more people’. Given the current need of our customers, we quickly sprung into action to serve,” Mohit Sardana, COO, food delivery, Zomato told Inc42.

Zomato claims to have all the factors in place to sustain the new business model. “Our delivery network in the country is only second to India Post. On-demand delivery of essentials will allow us to utilize the non-peak hours between lunch and dinner of our delivery fleet to drive better efficiencies. We need to make sure that we make sustainable investments in this part of our business so that customers continue to prefer transacting with Zomato in a post COVID environment,” Sardana added.

Whereas players such as B2B grocery delivery platform Ninjacart, which has partnered with societies and apartment communities to directly deliver groceries there, say that it is surely not a business strategy. Speaking to Inc42 earlier, Ninjacart’s director of business strategy, Ben Mathew said that the company will use the same supply chain it has created for its B2B operations to deliver vegetables and fruits to societies as well. However, it doesn’t view this as a business opportunity, but rather about fulfilling the essential needs of those living in a lockdown.

“We will also sell our products definitely at lower prices than the market,” Mathew said.

For Swiggy, the grocery and essentials category has been a part of its long-term strategy of delivering hyperlocal convenience. “By extending our hyperlocal delivery offerings, we’re unlocking a new dimension of convenience and safety for our consumers as well as earnings for our delivery partners,” said Swiggy.

The pandemic is expected to bring in an ecommerce boom across the world. However, will small players survive, considering ecommerce giants such as Flipkart, Amazon are still strengthening their position in a phased manner? Reliance also introduced JioMart albeit only in Mumbai and was looking to scale across the country soon.

Or as the cofounder and CEO Hari Menon had said, the grocery delivery sector will see great growth in the next few years with Amazon and Flipkart bringing in their user bases to the sector and the competition will be healthy for the sector as it will replicate the growth of ecommerce in the Indian market. Well, this was last year and maybe with the rising demand and changing consumer behaviour, a strong strategy that can deal with an increasing influx of orders will usher in a new era for grocery delivery.

With inputs from Kritti Bhalla

![[The Outline By Inc42 Plus] Do Tech Workers Want Offices To Reopen?](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2021/05/Outline_65_Feature1360X1020-490x367.jpg)

![[The Outline By Inc42 Plus] What is Holding Back India’s Healthtech?](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2021/05/Outline_64_FeatureImage_Final-03-490x367.jpg)

Ad-lite browsing experience

Ad-lite browsing experience