Jio has single-handedly opened a front against OneWeb, SpaceX Starlink and Amazon Kuiper, seeking auction-based approach to satcom spectrum allocation

SpaceX’s Starlink fears a redux of 2021 when it was forced to abandon its India dream after government termed its local operations illegal

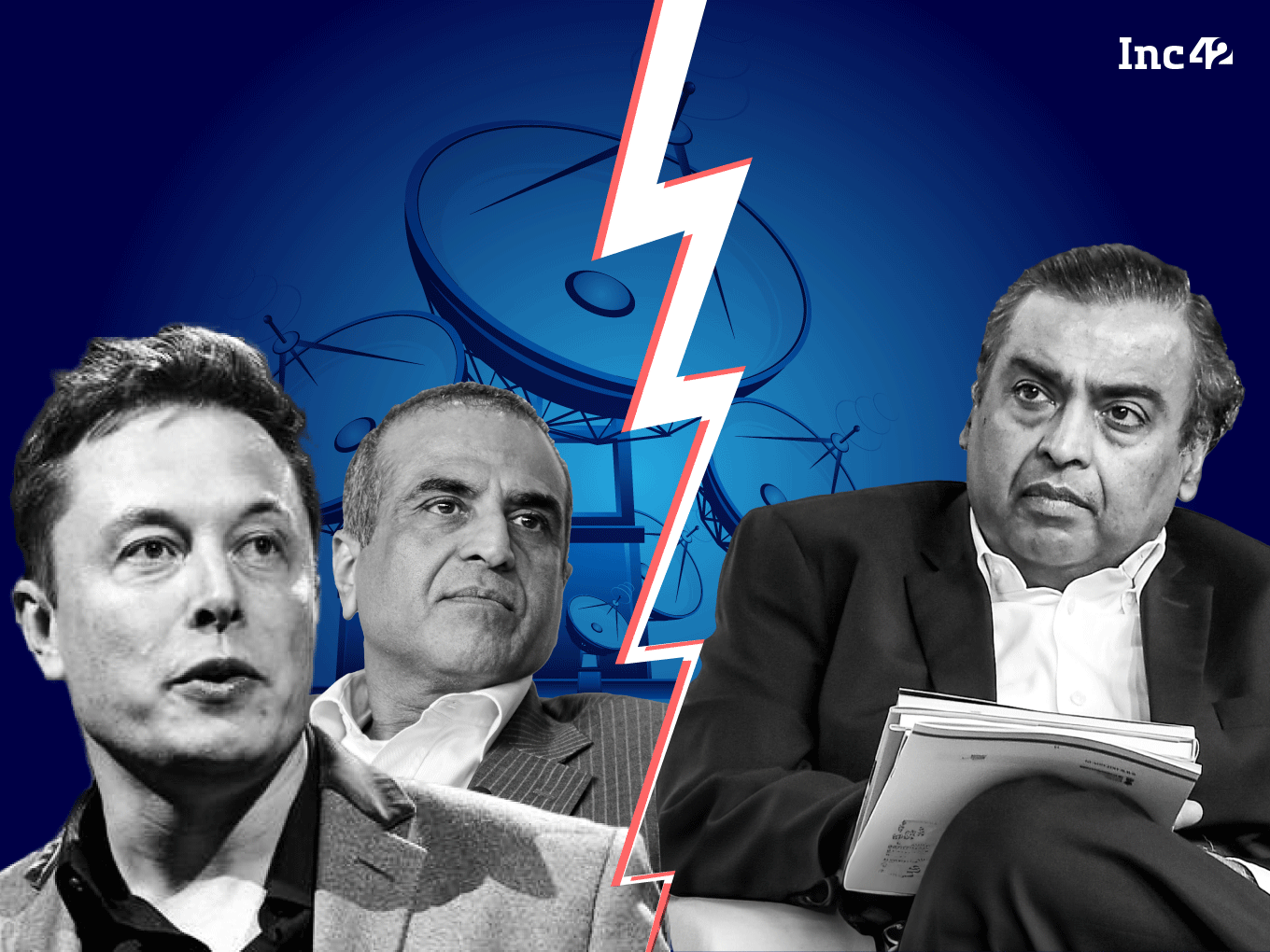

While the previous dogfight over cheap internet ended up being a race to the bottom, the satcom space now seems all set for a mega tug-of-war between some of the richest men in the world

In 1995, the Supreme Court, in a landmark judgement, ruled that airwaves were a public property. The move ushered in a new age, which opened up spectrum allocation for broadcasters and eventually telecom operators.

Three decades on, a protracted battle between tech billionaires has spurred a similar debate. This time, satellite communication (satcom) is at the centre of it.

The issue pertains to spectrum allocation for satellite broadband services and has pitted India’s biggest conglomerate Reliance Industries against the likes of Bharti Global and UK government-backed OneWeb, Elon Musk-backed Starlink, and Amazon’s Kuiper.

To put things in perspective, the government claims that satcom will play a key role in delivering internet services to 1.2 Bn Indians by 2025-26.

However, the bone of contention seems to be how the Centre intends to distribute satellite broadband spectrum to applicants. Players such as OneWeb, Starlink and Amazon are lobbying the government to follow the global trend and opt for administrative assignment, meaning the Centre should simply assign licence to players.

Taking on the coterie appears to be Reliance Jio, which has put its weight behind auctioning spectrum. Besides, another telecom operator Vodafone-Idea has also pitched for an auction-based approach.

The fracas came to the fore earlier this month after the Telecom Regulatory Authority of India (TRAI) released all comments received in response to a consultation paper floated on spectrum assignment for space-based communication. Of the 64 submissions made to TRAI, nearly 73%, or 47, backed a non-auction route for the spectrum allocation.

Jio: The Odd One Out

In its submission before the telecom body, Jio pitched ‘free and fair auctions’ as the ‘most’ transparent method for maximising public good and serving the greatest number of people via spectrum auction.

The telecom operator also claimed that the auction process would allow service providers to determine their preferred technology (terrestrial or satellite) as against spectrum assignment by the Centre.

Amid all this, reports also surfaced that Jio would continue ‘nudging’ the union government to go for an auction and not give in to the demands of foreign players.

The telco also fears that satcom players could simply deploy the spectrum for internet calls and messaging, dealing a major blow to its operations in many far-flung areas. Adding to the problem seems to be concerns around heavy capex and 5G spectrum acquisition costs, which could go down the drain if satcom spectrum is allocated without auction.

The Reliance Industries-owned telco also cited a 2012 Supreme Court judgement to pitch its case for the auction of natural resources such as satcom spectrum.

Curiously, Bharti Group has been batting against auction, as it has always touted its services as focussed on B2B enterprises and not the general populace. On the other hand, Starlink has always brandished its offerings as targeting users in far-flung areas where high-speed internet services are still not prevalent.

In addition, Starlink is also reportedly lobbying the government to simply assign licence to interested players, claiming that satcom spectrum is a natural resource that ought to be shared by companies. In its submission to TRAI, the Elon Musk-backed company said that the an auction would impose geographical restrictions and raise costs.

Amazon, too, is batting for auction-free spectrum allocation and has termed any attempts at resorting to bidding as ‘artificially’ limiting competition to only a few players.

“Auctioning spectrum used for satellite services in the higher frequency bands would block other potential users and artificially limit competition to only a few players. Auctions can also result in higher prices for customers, as winning bidders pass through their spectrum acquisition on costs,” as per Amazon’s Kuiper.

By steering the debate towards an auction, Jio wants to strengthen its play and prevent the space from becoming over-crowded and competitive.

Price Wars In The Offing?

Currently, only two companies have satcom licences — Bharti Group-backed OneWeb and Jio Satellite Communications, which it operates in a joint venture with Luxembourg-based SES.

With Starlink’s entry, the space could see the emergence of a three-cornered fight, which could further intensify the competition in the niche segment. Satellite communication service is largely suited for remote areas and entails a one-time installation cost.

A recent report, quoting industry experts, said that the tariffs for satcom services could largely hover in the range of INR 8,000 to INR 10,000 per month. At such levels, the service is expected to be unattractive for rural and remote areas, where purchasing power is lower. Besides, telcos such as Bharti Airtel and Jio already offer broadband services, with speeds in the range of 100-200 Mbps, at sub-INR 500 rates.

Experts believe that with too many players foraying into the space, the satcom industry could also see a price war, similar to what the country saw in 2016 when Jio entered the telecommunications arena.

Starlink: Once Bitten, Twice Shy?

While TRAI is still ironing out policy matters pertaining to the satcom space, Starlink likely fears a redux of 2021 when it was forced to abandon its India dreams, when local players were just taking baby steps.

In June 2021, the Digital Communications Commission (DCC) approved TRAI’s recommendations that sought to allow very-small-aperture terminal (VSAT) operators to offer satellite-based cellular backhaul connectivity to telcos.

Just a month later in August, the Department of Telecommunications issued a letter of intent (LoI) in favour of OneWeb to offer satcom services.

As the homegrown satcom space began walking out of its infancy, other players joined the fray, even global ones. In September 2021, Elon Musk-backed satcom operator Starlink set its India plans into motion and even hired former Paypal executive Sanjay Bhargava as country director.

Over the next few months, it registered Starlink Satellite Communications as a fully owned subsidiary in India. Right afterwards, everything spiralled out of control as the government flagged a previous announcement made by SpaceX offering a beta version of Starlink on pre-order in India for a fully refundable deposit of $99.

By November 2021, the upcoming service ceased as the government issued a notice saying that the company was not authorised to offer satellite-based internet services in the country. Back then, Starlink claimed it had received 5,000 pre-booking orders and was forced to refund the deposit it had collected from Indian citizens. Even Bhargava resigned from the company.

The Way Ahead

Two years on, the tide seems to have turned. After being at loggerheads with the Indian government for years now, Elon Musk met Prime Minister Narendra Modi during the latter’s state visit to the US.

Musk heaped praises on PM Modi after the meeting. However, what caught the attention was the Tesla chief’s statement that he was ‘looking forward’ to bringing Startlink to India.

Meanwhile, the regulatory haze is also beginning to clear. Earlier, as per a report, TRAI was also finalising recommendations related to satcom spectrum sale, which it plans to send to DoT by August 2023.

Building on this, foreign players also began efforts to make their voice heard. In its representation to TRAI, Amazon said satellite and terrestrial services systems are fundamentally different and viewing both from a single lens and applying ‘same rules’ to the two systems would result in unfair and unequal treatment.

To allay concerns around loss arising due to direct spectrum allocation, SpaceX even suggested a new model under which it is willing to earmark a certain percentage of its annual revenue as a ‘spectrum value fee’.

While Airtel and Jio have disrupted the Indian telecom space with high-speed and cheap 4G/5G plans, it seems that satcom is emerging as the new frontier for homegrown telcos and foreign companies.

While the previous dogfight over cheap internet ended up being a race to the bottom, the satcom space now seems all set for a mega tug-of-war between some of the richest men in the world.

While only 50% of Indians come under the ambit of active internet users today, there seems to be much at stake for the big billionaires, even though the satcom space may seem a not-so-lucrative opportunity yet. With big names and billions of dollars on the line, it remains to be seen who emerges as the winner in this battle for the sky.

Ad-lite browsing experience

Ad-lite browsing experience