How exactly have the likes of Zomato, Info Edge, Nykaa, Paytm and others fared in Q2 FY23?

The Q2 financial results are out for India’s listed new-age companies and tech stocks. All eyes have been on the financial performance of these giants after a year that has seen plenty of cutbacks, slow growth and economic slowdown.

So how have new-age tech stocks such as Zomato, Info Edge, Nykaa, Paytm and others fared in the September quarter, right before the festive season? We’ll look at the numbers, which suggest a muted quarter even for those companies in the black.

Before we proceed, here’s a look at the other top stories of the week:

- Twitter Mayhem Continues: After laying off over 150 employees in India, the social media giant may shut down offices in three cities as it looks to cut costs further.

- Edtech’s Offline Push: Unacademy, BYJU’S and co have spent millions to build their offline plays, while also downsizing online learning operations. But is this the magic pill to edtech’s problems?

- Spotlight On Tech Policy: India’s union minister of state for electronics and IT Rajeev Chandrasekhar delves into various regulatory issues — from crypto to data protection. Read the interview.

The Q2 Story For Listed Startups

Before we begin, it would be pertinent to clarify that we have analysed the quarterly financial performance of 15 listed Indian companies — 13 listed in India, with two listed on the Nasdaq in the US.

This is based on a QoQ comparison for the sake of standardisation, but we believe this also more accurately reflects the current state of the market. The total revenue for these 15 companies was INR 10,917 Cr ($1.3 Bn), with combined losses (for six companies) coming up to INR 1,777 Cr ($220 Mn).

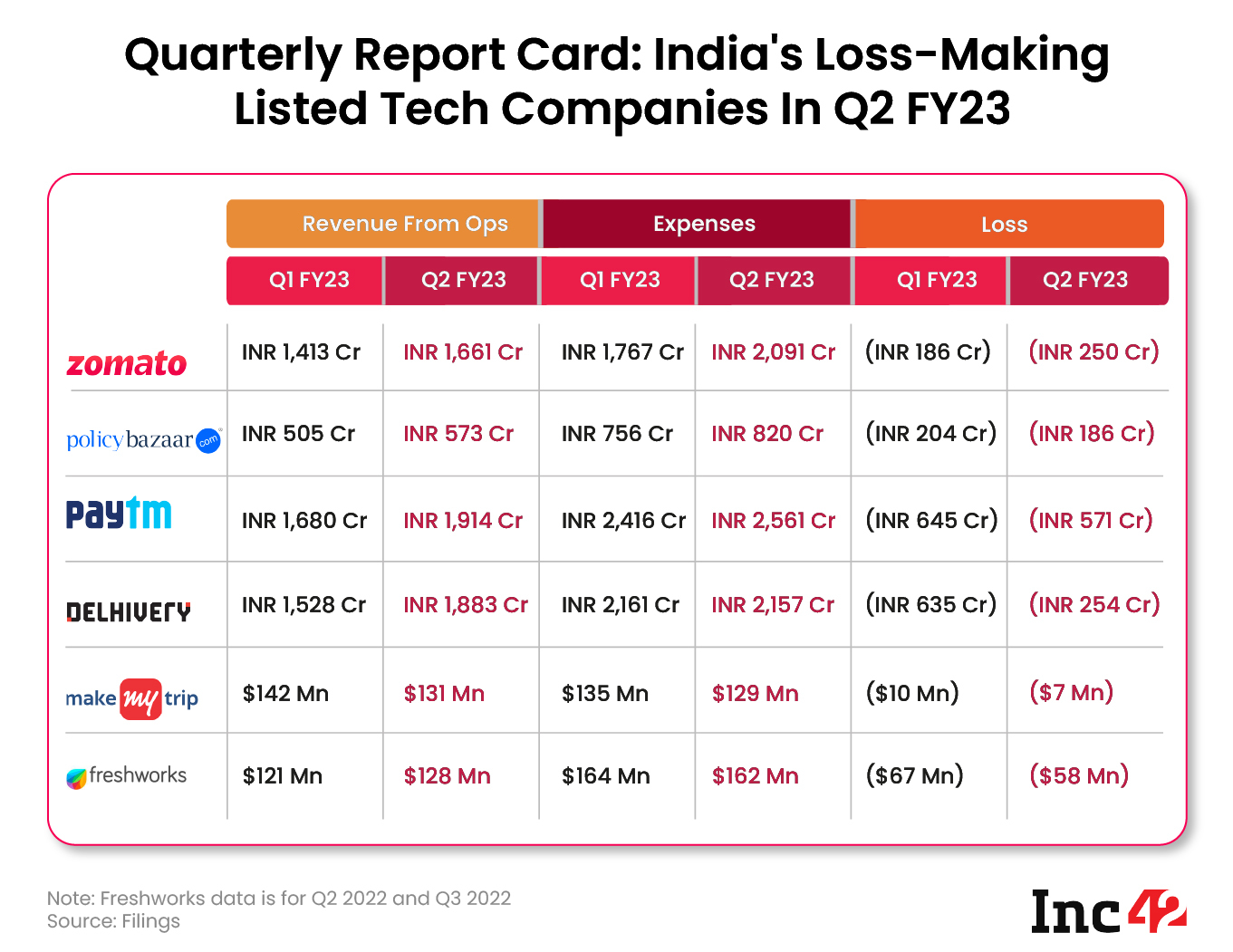

The Loss-Making Club

First, let’s look at the companies in the red — and this includes some of the largest startups that have gone public.

While across the board, we have seen losses reduce quarter-on-quarter, the exception is Zomato, which has gone deeper into the red. Zomato’s wider losses are pretty much all down to Blinkit. The quick commerce acquisition weighed down Zomato’s P&L, even though it reported improved unit economics and adjusted EBITDA margins in the food delivery segment.

While Paytm has significantly improved its operating performance in the loans vertical, the fintech giant managed to pull back its losses by just 11%. This has elicited mixed reactions from those observing the markets, as the strong loan disbursement and GMV growth has been offset by rising competition in the merchant loans segment and weak unit economics despite a healthy revenue mix.

Besides this, Paytm Payments Bank continues to be under an audit and this has impacted the ability of the company to upsell customers on more profitable services, and it’s also forced Paytm to rely heavily on lending.

Among the US-listed tech stocks, MakeMyTrip inched closer to the black with a quarter that saw it reduce expenses even as its hotels and bus ticketing businesses each saw more than 2X revenue growth.

SaaS giant Freshworks continues to face major challenges in growth, with revenue only increasing by a minor 5.7%, while expenses more or less remained flat. Even though Freshworks stock has rallied in the past week, there are still some challenges for the company, particularly a potential class-action lawsuit, which might do further damage to the stock itself.

Whether this will have a cascading effect on the business performance remains to be seen.

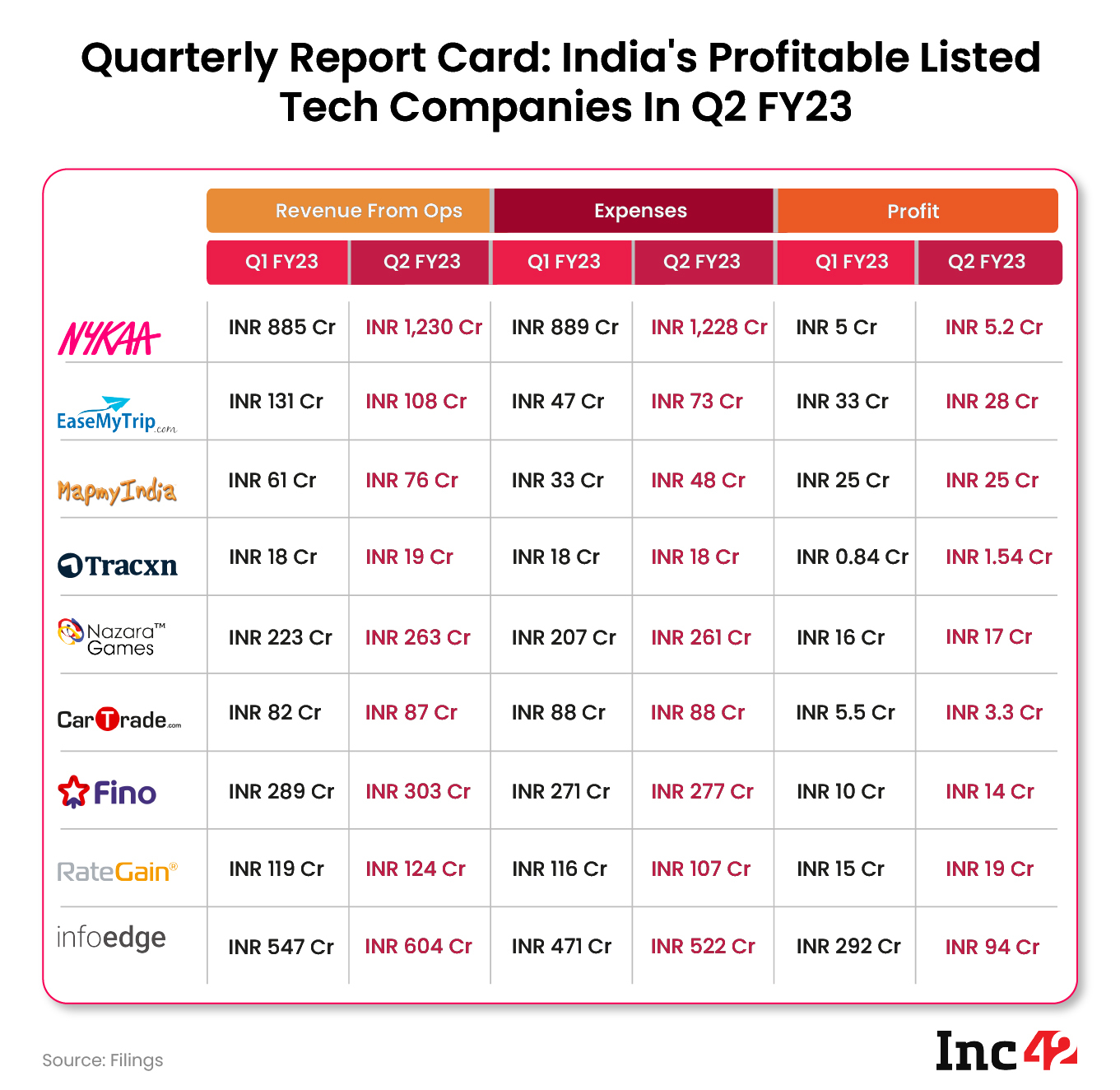

The Profitable Bunch

Even though there are more profitable listed new-age companies than loss-making ones, the profitability has come on a low revenue base in most cases. Here’s some perspective: The total loss-making companies had revenues of INR 8,103 Cr, while the profitable companies had total revenues of INR 2814 Cr.

With INR 1,230 Cr in Q2 FY23, Nykaa is head and shoulders above the profitable list in terms of revenue, but it has only managed to eke out a profit of INR 5.2 Cr in this quarter, more or less flat from the previous one.

When it comes to net profit margins, MapmyIndia has the lead with a nearly 33% profit margin, while EaseMyTrip is next best at just over 25%. But considering MapmyIndia’s revenue quarter was INR 76 Cr and EMT’s base of INR 108 Cr, it is not exactly clear whether such healthy margins will be sustainable as the business scales up.

For context, MapmyIndia’s profit margin was closer to 40% in the yearago period of Q2 FY22 when it reported a revenue of INR 56 Cr and a profit of INR 25 Cr. So if the past year is any indication, the profit margins could very well slip as the company pushes for higher revenue.

Among the profitable companies, EaseMyTrip, CarTrade and InfoEdge reported lower profits in Q2.

Sanjeev Bikhchandani-led Info Edge’s expenses were significantly higher in the quarter due to the acquisition of Coding Ninjas, and investments in Adda 24×7 and Broker Network.

As startups and IT service majors have pulled back on hiring, InfoEdge’s Naukri.com and other job verticals have seen some slowdown. Besides this InfoEdge’s profits in the previous few quarters were much higher due to the realisation of gains from selling Zomato stocks owned by the company.

Given the number of layoffs in the Indian startup ecosystem this year and the hiring freezes by even large companies such as Facebook, Amazon and Google, Info Edge is likely to see some more headwinds for its Naukri.com business.

What Next For Tech Stocks?

Throughout the year, consumer-focussed tech stocks have witnessed a sharp decline due to investor selloffs, withdrawal of liquidity and rising treasury yields, which led to a brutal valuation correction that has trickled down to retail investors as well.

But there could be more pain in store with the lock-in period for pre-IPO investors ending this month for Policybazaar, Paytm, Delhivery and Nykaa, which could potentially bring in $14 Bn worth of shares into play.

Nykaa’s lock-in period expired on November 10, but the company has tried to arrest a massive sell-off by issuing 5:1 bonus shares the next day.

Incidentally, the bonus issue happened on Friday, November 11 and the market then closed for the weekend, which will be a nervous one for Nykaa investors and the company as they wait to see what happens when bonus shares are in investor accounts.

Whether there is a sell-off after these bonus shares hit demat accounts is unclear. Given the bear run of the stock market this year, some investors may look to book profits, but the issuance of bonus shares is a way for the company to restrict them from completely exiting their positions.

Waiting For The Tide To Turn

Besides the threat of lock-in expiry, the market conditions have not improved for consumer tech startups. Inflation continues to wreak havoc with growth expectations and many marketplaces are being battered by supply and demand-side headwinds.

For Zomato & Paytm, the problems are more related to unit economics, since the companies already have massive scale. Zomato is trying to build a connected ecosystem but the quick commerce problem will not be easy to solve.

Paytm is suffering from having too many touchpoints in its funnel where customers can come in and exit without contributing to the bottom line in any manner. Fintech’s revenue model problem seems to have just one answer: lending. Paytm has banked on this, but how long can it keep churning out loans to its customers, especially when the likes of BharatPe, PineLabs, LendingKart and neobanks are also chasing the same customer?

Of course, with the macroeconomic situation far from clear and the possibility of war in Europe not eliminated, we cannot predict how the tide will turn.

✨ Sunday Roundup: Funding, Top News & More

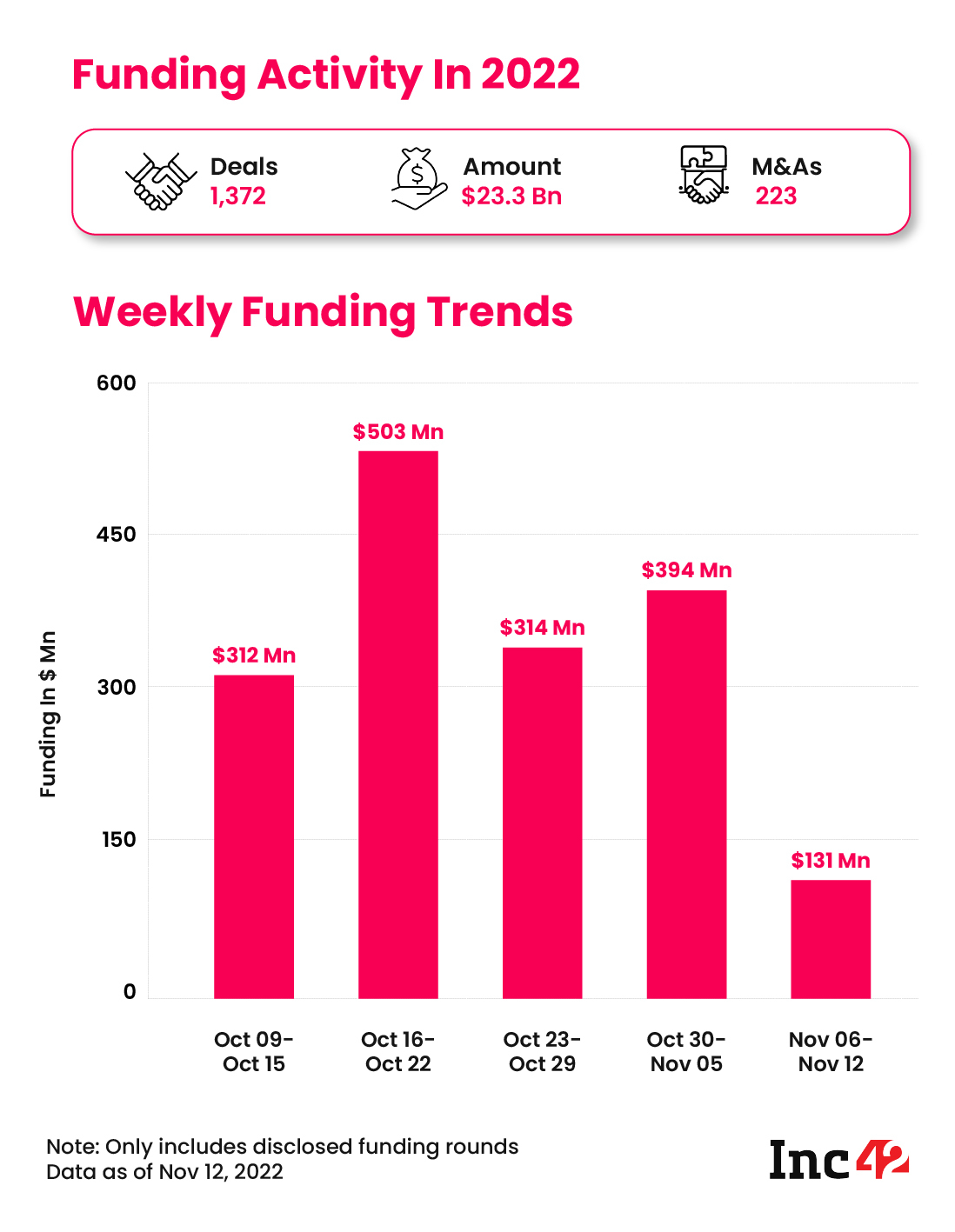

- Startup Funding This Week: Indian startup funding has definitely slowed down as we near the end of the year. In the second week of November, startups raised $131 Mn across 23 deals, with HRtech startup Keka’s $57 Mn Series A round accounting for nearly half of this tally.

- Dunzo Shuts Dark Stores: Reliance-backed Dunzo is scaling down quick commerce ops by shutting down some dark stores to manage costs

- Meta Layoffs: Indian employees of the Facebook parent company in the US and other locations have spoken out about the cutbacks and layoffs at the social media giant

- Zoho’s R&D Focus: Zoho chief Sridhar Vembu says the company’s commitment to R&D has helped it remain profitable even after reaching $1 Bn in revenue in 2021

- CRED, WhatsApp’s UPI Gains: UPI data for October 2022 shows that CRED and WhatsApp were the biggest gainers, even as PhonePe continued to lead the market

- Mamaearth’s IPO Run: After turning profitable in FY22, Mamaearth has now converted into a public company and is preparing for an IPO

- Skyroot’s SpaceX Moment: Spacetech startup Skyroot’s Vikram-S rocket launch will take it into the highly lucrative private space launch segment. Here’s the full story of Mission Prarambh

That’s all for this Sunday’s roundup of the past week’s biggest stories.

We will see you next week,

Team Inc42

Ad-lite browsing experience

Ad-lite browsing experience