Unacademy, BYJU’S and others have spent millions in offline models even as they look to cut employee costs and restructure teams in their core edtech platforms

Rampant marketing spending without a clear and measurable ROI, huge sponsorship deals and unproven acquisitions will continue to impact startup valuations negatively

Even as edtech unicorns go offline, many are asking what exactly edtech is bringing to the table that cannot be matched by legacy players such as Allen, who are launching their own digital plays

In a year where the credibility of edtech has been battered, India’s biggest startups — BYJU’S, Unacademy, Vedantu and others — are taking a step back from pure play online models and leaning towards hybrid or phygital models.

While this transition has been forced by changing market conditions and reopening of physical learning centres, it’s not like the online models were delivering profits.

Investors and valuation experts have concerns about how sustainable this will be in the long run, while the offline or hybrid learning competitive landscape also poses challenges for edtech startups. Simply put, edtech startups are still not out of the water with these ‘pivots’.

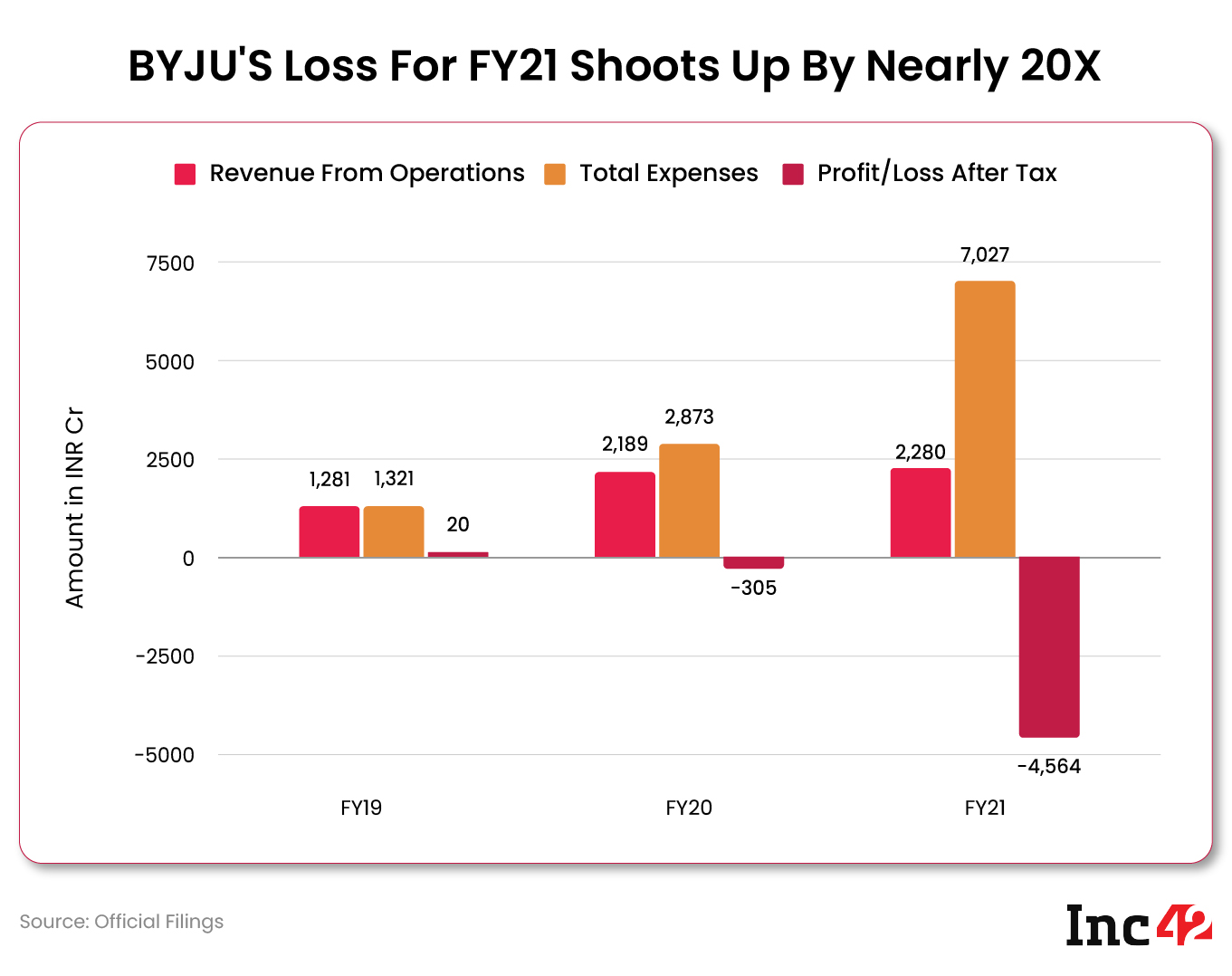

Edtech Losses Pile Up

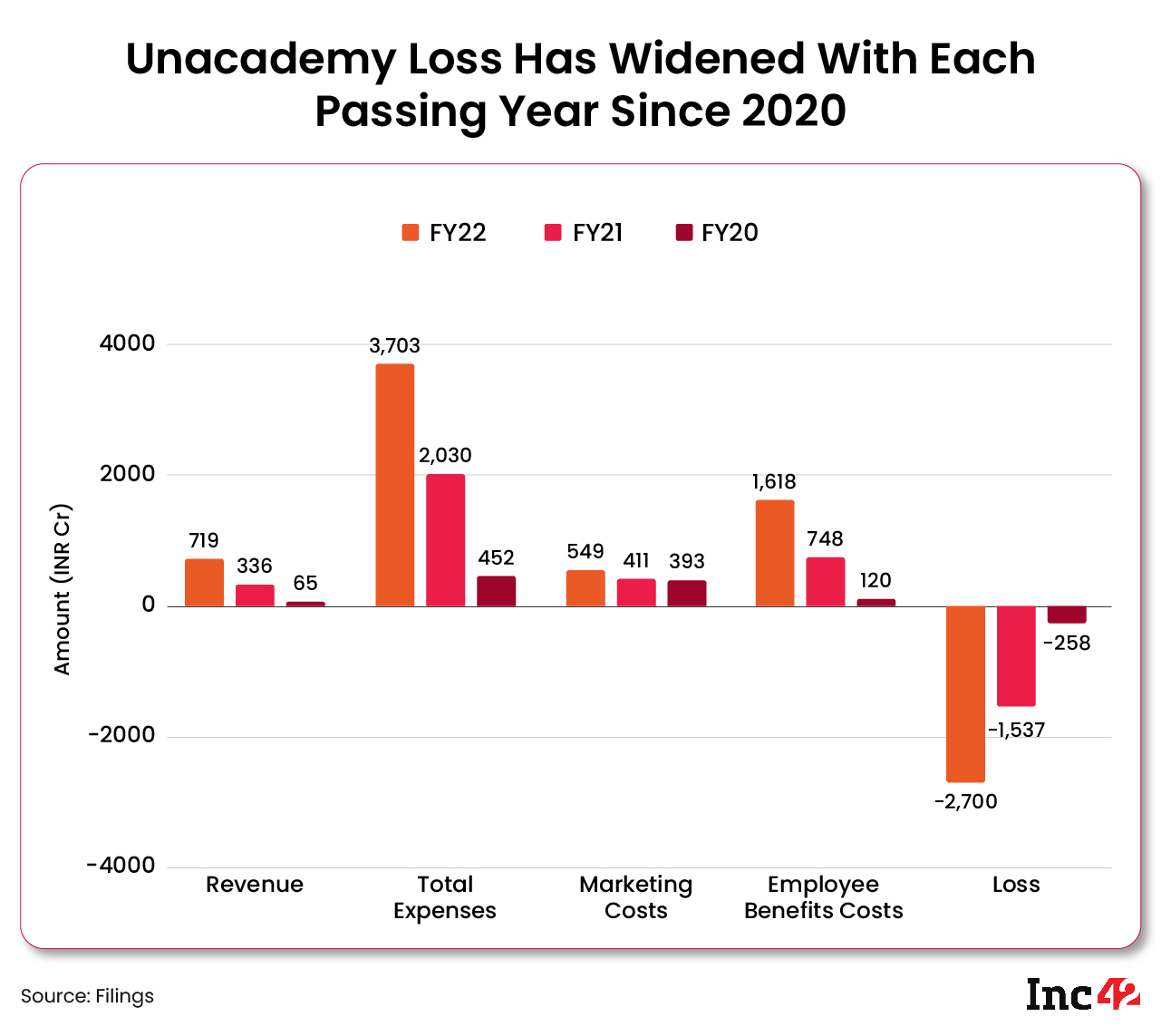

Last week, Unacademy announced a massive INR 2,700 Cr loss for FY22, which ended March 31, 2022.

Even as the dust had yet to settle over BYJU’S INR 4,600 Cr losses in FY21, the sorry state of affairs at Gaurav Munjal-led Unacademy epitomises the downturn in edtech.

BYJU’S is yet to reveal its FY22 numbers, and had earlier claimed that it had reached INR 10K Cr in top-line revenue for the financial year. But this is not likely to have come at a profit, since the company has gone ahead and laid off over 2,500 employees, shut offices in nearly 60 cities and restructured its sales team completely.

Signs point to another loss-making year in FY22 for Vedantu too, given that the company has also laid off employees to cut costs.

Despite mega promotional campaigns, multiple product launches, billions in funding, acquisitions, massive global sponsorship deals — in the case of BYJU’S — edtech startups have not been able to show any meaningful progress towards profitability.

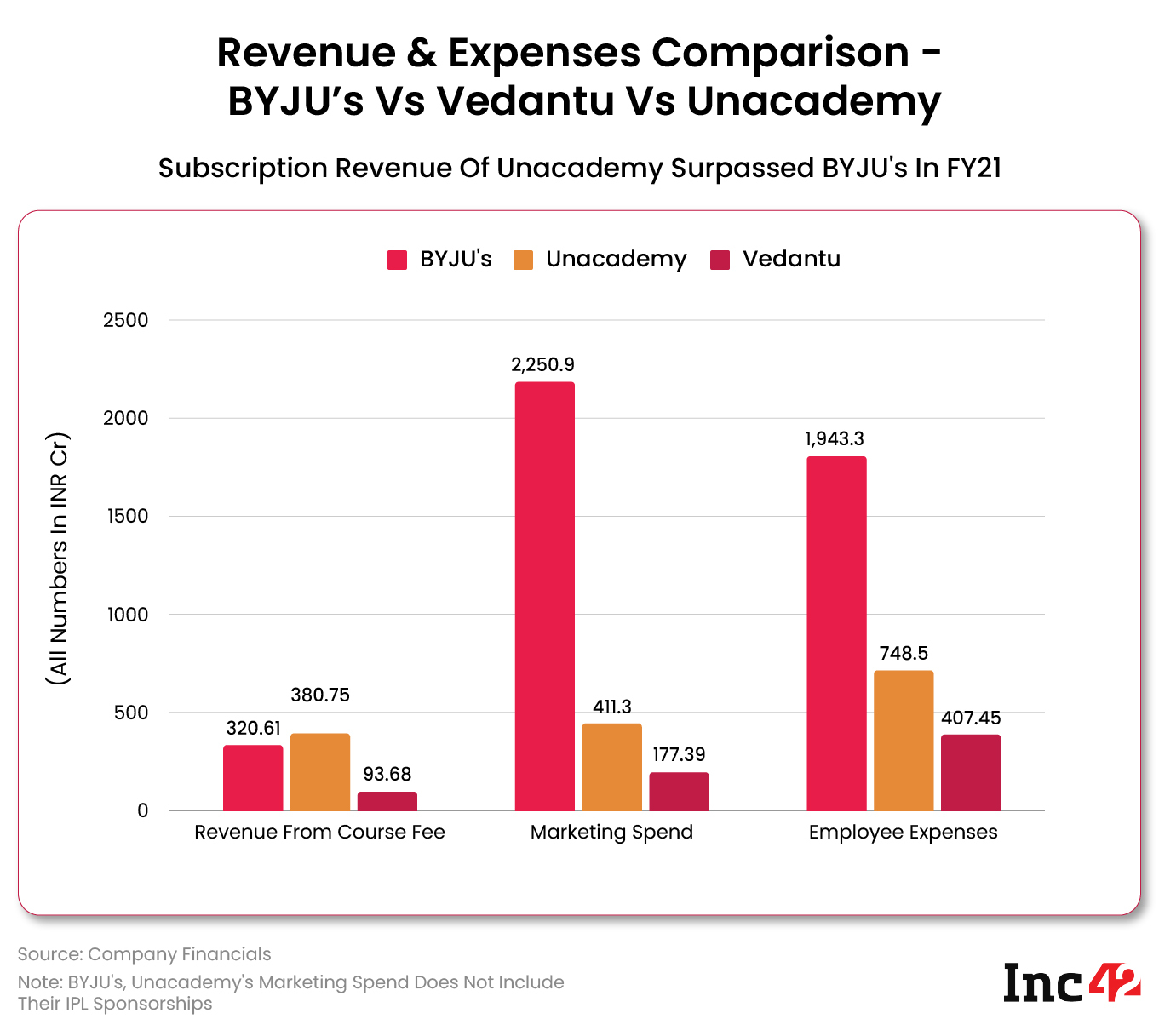

Unacademy’s marketing costs grew 33% in FY22 to INR 549 Cr, but this is a fraction of the INR 2,250 Cr BYJU’S spent in FY21.

The difference in scale between BYJU’S and Unacademy aside, what we are trying to highlight is that both companies have pumped in a huge amount of cash into building their brand and telling their story.

Like this week, when BYJU’S announced signing football superstar Lionel Messi as a global brand ambassador for its non-profit arm.

But how effective has this media onslaught been? Investors and valuation advisors believe that such spending without a clear and measurable ROI will have a negative impact on startup valuations — primarily because it is not in line with sustainability.

Flat Rounds Are The New Normal

Umakanta Panigrahi, managing director of Kroll’s valuation advisory team in Mumbai, told Inc42 that startups are already dragging their feet on announcing funding rounds, because some of them have seen downrounds and they don’t want to send that signal to the market.

“The correction is already ongoing. If you see the new normal, flat rounds are considered to be an up-round. And right now, investors also expect a better return on investment in physical learning rather than edtech,” Panigrahi added.

Acquiring startups to enter various verticals is one thing, but proving that they can generate revenue has been the biggest challenge — as in the case of BYJU’S and WhiteHat Jr or Toppr, and Unacademy with its failed PrepLadder and Mastree acquisitions.

Dry powder or not, startup investors have learnt a tough lesson in the past year.

“Revenue projections for new products cannot be based on cash burn. Right now, all investors are questioning any business plan edtech companies are putting forward and they are asking pertinent questions,” Panigrahi added.

A lot of the problems in edtech, he believes, are due to over-hiring and not having a clear plan for new verticals. BYJU’S, Vedantu, Unacademy splurged on new hires in 2020 and 2021, but now they are all downsizing.

Overall, edtech companies have laid off over 7,000 employees this year and many more part-time educators have been impacted by the downturn as well. But this does not mean all spending has been paused.

Offline Push Comes At A Cost

Indeed, large sums of money have been invested in offline models. But the move to a phygital model will not immediately result in more solid unit economics.

Setting up offline centres, hiring teachers for centres is also an expensive proposition. The competition for real estate is also about to get hotter among startups.

BYJU’S acquired Aakash Educational Services for $1Bn to enter this space and has expanded its Tuition Centre hybrid model at the same time. It has borrowed INR 300 Cr (around $40 Mn) from Aakash in the form of an unsecured loan to fuel the marketing for the core business of BYJU’S Aakash.

Unacademy has taken on legacy coaching giants such as Allen Career Institute and others with its new centres in Kota and other student hubs. Unacademy’s offline learning foray includes 2x-3x pay hikes for teachers being poached from Allen, with annual income ranging between INR 1 Cr and INR 10 Cr for some of the more high-profile educators.

Vedantu spent $40 Mn to acquire offline learning chain Deeksha, an acquisition that will only show results in the next few months. With this deal, Vedantu is hoping to make a bigger dent in the test prep and higher secondary coaching (11-12 grades). This came soon after the layoffs of more than 700 employees.

PhysicsWallah raised $100 Mn to set up its first physical learning centre in Kota this year and is also looking at expanding the blended learning model, backed by its YouTube-based acquisition.

As per a report by Moneycontrol, PW has recorded INR 98 Cr as profits in FY22. However, the company has not released its financial report yet and this figure could not be independently verified.

Even as these edtech unicorns take on established offline coaching classes, many are asking what exactly edtech is bringing to the table that cannot be matched by legacy players. In fact, Allen and others are following suit by building digital platforms to come on par with startup offerings.

Edtech Winter To Get Colder

While BYJU’S has had its share of challenges in 2022, Unacademy has not been able to capitalise on this slip-up. The litany of issues at the Gaurav Munjal-led company include over-hiring, failed acquisitions, an unsuccessful multi-product strategy.

Thus far, Unacademy has laid off around 1,000 employees (including teachers) over three phases. The SoftBank-backed company conducted a restructuring exercise in August at Relevel By Unacademy by moving its employees to other parts of the larger Unacademy group.

All this in the hope of reaching profitability. As Munjal tweeted this week:

Sources told us that Unacademy was in talks with investors to raise up to $150 Mn – $200 Mn in funding this year, even as it turns its focus to cash conservation and profitability.

Munjal also tweeted that Unacademy’s monthly burn is down from $20 Mn a month to $7 Mn a month and will further go down.

The company is going back to its roots with a YouTube-centric acquisition strategy called Unacademy One. Will this pay off in terms of sustainable revenue growth?

BYJU’S has consolidated most of its K-12 operations and has moved to inside sales in the hopes that it will be a leaner way to acquire new students. But its product pitch has to be extremely attractive for this ‘passive’ sales strategy to catch on.

The road ahead will not be easy for edtech unicorns. As Munjal has hinted already, the winter will get worse in the next few months.

Plus, as we had reported, many employees at BYJU’S and Unacademy fear that the cost-cutting measures and restructuring of teams will result in further layoffs.

The traditional year-end sell-off trend in stock markets will likely give investors more pause over backing companies in. “There’s no rush or FOMO today. Everyone is waiting and watching,” Kroll’s Panigrahi added.

So VCs and startup investors are not yet pushing the panic button when it comes to the promise of edtech in the long-term. There’s still some bullishness that edtech will turn the corner, but the short-term horizon for edtech startups does not look rosy.

Experts predict the funding winter would likely last for another 12 months or more for some sectors such as edtech as startups figure out the most sustainable models. By that time the wheat will be separated from the chaff and this can lead to consolidation in the startup ecosystem.

While the phygital mode is the hot trend now, if it doesn’t prove to be the magic bullet that edtech companies expect, edtech giants will need to swiftly move to something else or be left by the wayside.

Ad-lite browsing experience

Ad-lite browsing experience