PhysicsWallah is potentially staring at the same problem that has befuddled edtech startups so far — i.e. how to get to sustainable growth while adding new products and verticals

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

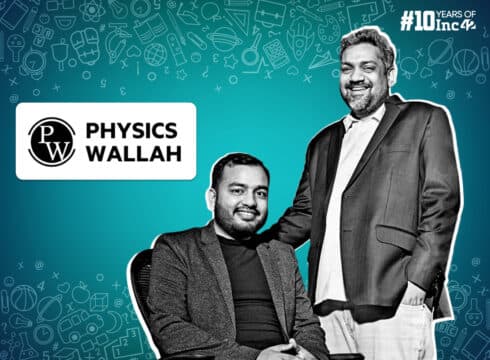

In June 2022, PhysicsWallah or PW emerged out of nowhere to become the 101st unicorn startup from India with its very first external round. Since then PW’s growing significance in India’s edtech ecosystem has coincided with the fall of edtech incumbents.

Much of this has come due to the company relying on its profits thus far. But now with its profits shrinking due to investments to expand into new products and markets, the edtech startup is on the same page as its rivals, including Unacademy, BYJU’S and Vedantu.

Now, PhysicsWallah is potentially staring at the same problem that has befuddled edtech startups so far — i.e. how to get to sustainable growth while adding new products and verticals. Can it solve this puzzle without taking the same drastic steps as the competition?

We’ll try to answer after these stories from our newsroom:

- Swiggy’s Revenue Milestone: Food delivery giant Swiggy is on course to report close to INR 10K Cr in revenue in FY24 as it builds up towards a potential $1 Bn IPO

- Risky Swipes: India’s dating apps market is booming but the success is punctured by the rising incidents of crime, fraud. Are platforms to blame?

- What’s Stalling Ather? Despite Ather Energy’s first mover advantage, its market share has slipped to new players and auto giants, raising questions about its strategic choices and ability to compete

From PhysicsWallah To Everything Edtech

When we spoke to PhysicsWallah founder Alakh Pandey in 2022, edtech platforms were transitioning from online-only to hybrid models and he believed that things would settle down in a couple of years.

In the two years since then, Unacademy and BYJU’S have had to rejig a lot of their operations, Vedantu has taken a slower route, but PW — riding on profits — has pretty much entered every edtech category in some way or the other.

Besides test prep, which is its bread and butter, the company has plans to expand its study abroad business to take on Leverage Edu and others, while PW Skills is gaining traction and ready to compete with upGrad, Scaler Academy, Unacademy-owned Relevel, NxtWave and others.

Among these, PW’s Parent app (launched in Feb 2024), PW Drona (course management for educators), PW Olympiad (gamified early learning platform) and PW LearnOS (productivity tracker) do not have revenue levers.

Earlier this month, the startup ventured into offline education for primary classes with the launch of PW Gurukulam School. The edtech unicorn said it would invest INR 100 Cr to strengthen its UPSC vertical and INR 120 Cr to shore up PW Skills.

The New Revenue Levers

On the other hand, PW Unigo offers a big upside for PW in the long run, but it’s not possible to scale up revenue in this space quickly. For instance, seven-year-old startup Leverage Edu reported INR 68.9 Cr in revenue in FY23, and a loss of INR 103 Cr. This after raising more than $70 Mn in the past five years.

“Firstly, it takes time to build relationships with lenders and educational institutions, and secondly, there is a lot of competition in the overseas education counselling market. There are plenty of offline-only counsellors that have a big presence in smaller towns and cities,” according to one former Leverage Edu exec.

One high-level employee at PW has told us that the company has already started the ground work with a team of 20 employees for PW Unigo. The source added that so far, this is not a big focus area for the company but that could change soon.

The other major opportunity is PW Skills, but this is just over a year old, having been launched in October 2022. PW Skills only has a handful of courses today, compared to dozens on competing platforms.

For PW, the need to add revenue-generating edtech components is critical. PW Unigo and PW Skills have the potential to offer a more sustainable revenue stream, even as the offline vertical grows at its own pace.

PW’s Profits Shrinking

One thing that did set PhysicsWallah apart from the rest was its profitability. The company saw its net profit tank 91% to INR 9 Cr in FY23 from INR 98.2 Cr in FY22, due to a steep rise in expenses. This drop has come as a result of the company adding more talent for its various verticals and the capital expenditure needed to expand the offline vertical.

As we reported exclusively this past week, the company is on course to report more than INR 2,000 Cr in revenue in FY24. Cofounder Prateek Maheshwari revealed that PW’s adjusted EBITDA will be slightly lower in FY24 but did not speak about the bottom line.

This after the company’s profits shrunk in the first full fiscal year after it raised funds in 2022.

Interestingly, offline learning, which comprises PW Vidyapeeth and Pathshala centres, is the fastest growing category for PhysicsWallah in FY24, which shows just how much the company has invested in the past year and a half to gain momentum in this space.

Till 2022, PhysicsWallah was a completely online proposition, before it raised funds to expand its coaching centre base. It is expected to report around INR 680 Cr in revenue, up 115% year-on-year (YoY).

But as one Bengaluru-based edtech founder told us it takes at least a year for each coaching centre to break even, if that happens. The collections from the first year are only enough to cover some of the costs such as teacher salaries, rent, infrastructure costs and more for each coaching centre.

For context, PW currently has 77 Vidyapeeth centres from a mere seven centres in 2022. A source within PW told us, “We had to spend in 2023 to make money in 2024. Right now, all edtech startups are fighting for collections since this is the peak enrollment season. So PW had to focus on building these coaching centres before the collections started.”

Interestingly, the startup intends to launch 55 new Vidyapeeth centres by the end of 2024. At the moment, Vidyapeeth centres operate in around 105 cities. “Pathshala is working phenomenally well in Tier II, Tier III, and Tier IV cities and towns. We will open 50 more centres in the next two years,” Maheshwari said earlier this week.

Edtech Battle In 2024

The investments of 2023 and 2024 will only start to pay off in 2025. This is why PhysicsWallah needs to show revenue growth in the online learning space as well. And it’s also why the company is looking increasingly like the competition these days.

The burgeoning PW product lineup reminds us of the moves edtech unicorns made before 2022. In the years before, BYJU’S, Unacademy and Vedantu took every path to maximise their user base and acquired startups to enter new verticals. This led to uncontrolled losses and eventually many of these verticals had to be shut down.

PW has also taken the inorganic route, with three acquisitions in 2023 and thousands of employees hired for new verticals. Given that its new revenue-generating products are relatively untested means it has to invest in improving the product-market fit as well.

Even as PhysicsWallah is eyeing experiments and expansion, the competition is focussed on sustainable growth, and has pretty much turned off the new products tap (save for Unacademy’s new launch this week).

Unacademy narrowed its net loss by almost 40% in FY23 to INR 1,678.1 Cr with INR 907 Cr in revenue. CEO Gaurav Munjal claimed that the edtech unicorn managed to reduce its cash burn by 60% in 2023.

Vedantu is adding 30+ offline centres over the next year, but the company, which had INR 600 Cr in losses in FY22, is yet to file its FY23 numbers. Vedantu is likely to see a revenue decline in FY23 as it scaled back the offline play.

BYJU’S-owned Aakash saw its profit widen by 82% to INR 79.5 Cr in FY22 on a revenue base of INR 1,421.2 Cr, and despite some headwinds in terms of corporate governance, the company is likely to finish FY23 on a profit as well.

To make matters worse, offline coaching giant Allen has bulked up its leadership structure in the past year and is making a big play for online learning now.

On the other hand, PhysicsWallah has seen its profits shrink, which is not an ideal situation in 2024 for a company that is likely to have to raise funds in the near future. The company has hired thousands of employees just like the competition did in 2020 and 2021, and there’s no certainty that these investments in new products will work out.

So one has to ask: has PhysicsWallah become the very rivals that it set out to beat?

Introducing The GenAI Summit By Inc42

There’s little doubt that generative AI is the future. But even as this realisation is settling in, there is also fear and confusion about how this will shape the destinies of Indian startups and tech.

As always, Inc42 has taken on the mantle of getting to the core of it all. Which is why we are hosting The GenAI Summit 2024 — decoding GenAi’s potential in India’s startup economy — in Bengaluru on April 3, 2024.

There is no better time than now to cut through the clutter and come down to the brasstacks of where startups are heading in this GenAI world. How are investors viewing this booming space and does India have the ‘right to win’ in this global battle?

This one-of-a-kind summit will bring together an impressive lineup of over 25 leading minds from the startup, policy and enterprise ecosystems for panel discussions, fireside chats, demos and more.

Know More About The GenAI Summit And Sign Up To Be Invited

Sunday Roundup: Funding Galore, Tech Stocks & More

- Slow Start To 2024: With $125 Mn raised across 18 deals in the past week, the total funding tally for 2024 is on the verge of touching $1 Bn after the first two months

- Ullu, ixigo Ready For IPOs: Travel tech platform ixigo is back to the IPO table with a fresh DRHP seeking to raise over INR 120 Cr through a public offering, while OTT platform Ullu has also joined the IPO parade

- Paytm ❤️Axis Bank: Ahead of the February 29 deadline, fintech major Paytm has shifted the nodal account for merchant settlements to Axis Bank as it looks to replace Paytm Payments Bank in its operations

- Yatra’s Rebound: The online travel aggregator returned to the black in Q3 FY24 with air travel bookings leading the recovery after a loss-making previous quarter

Key Highlights

Funding Highlights

Investment Highlights

Acquisition Highlights

Financial Highlights

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.