In 2023, we expect the D2C ecosystem to go through a tough maturity phase as the house of brands juggernaut rolls on

Lowering marketing spends and cutting people costs meant D2C brands were working with one arm tied behind their back even as legacy players added new brands

While the house of brands model is relatively new to the Indian market, more than a dozen such startups vying for D2C brands today

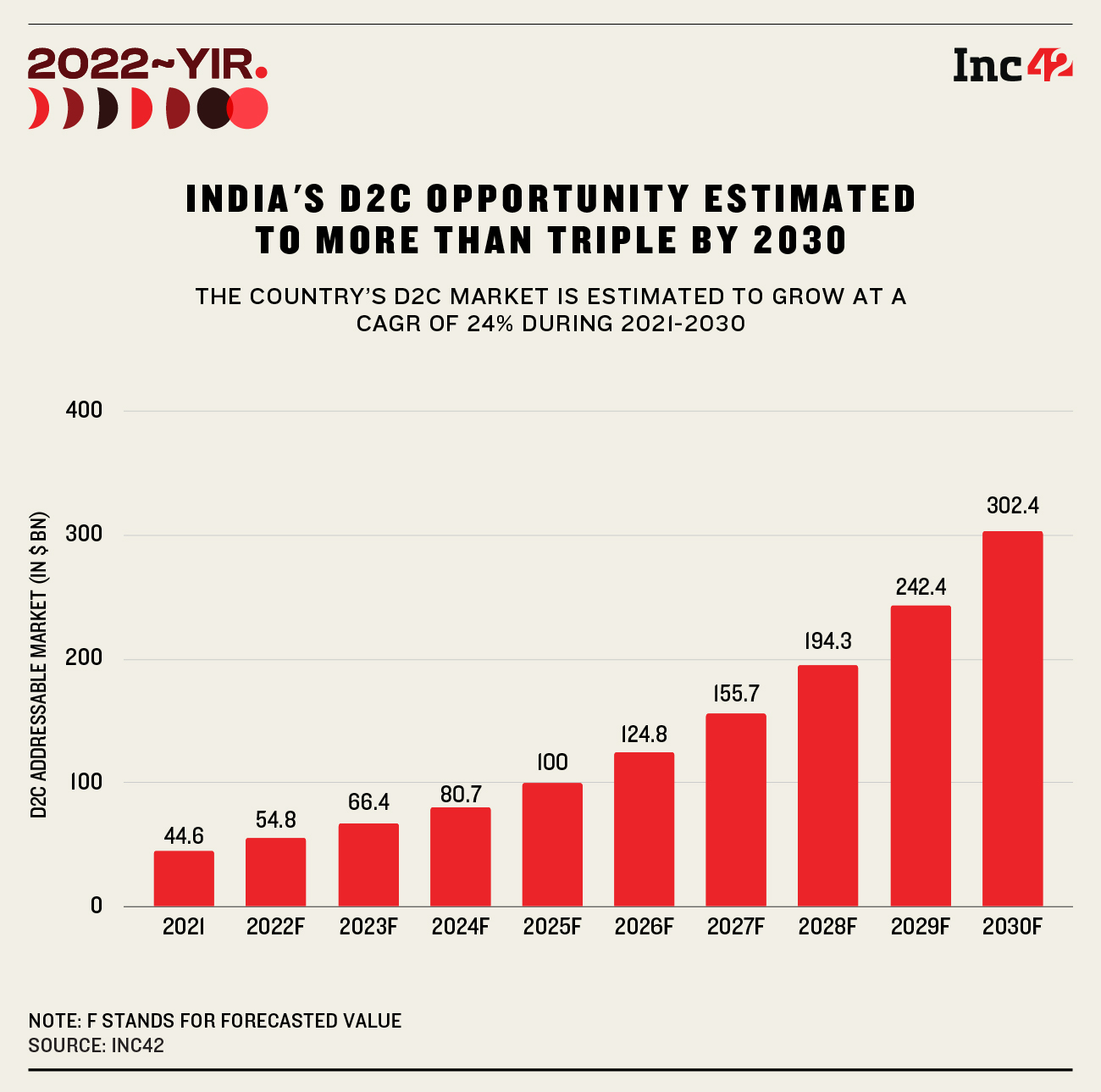

In more ways than one, 2022 was the growth killer for segments that flourished during the pandemic years. While edtech is the clearest example, the negative impact on India’s huge D2C ecosystem has been less visible.

It’s not that India’s online shoppers have given up on D2C brands altogether, it’s just that there’s so much noise in the market that consumer spending is being spread across brands instead of simply to a few. In other words, competition has reached fever pitch and we are on the cusp of a consolidation wave, particularly given the emergence of the house of brands model.

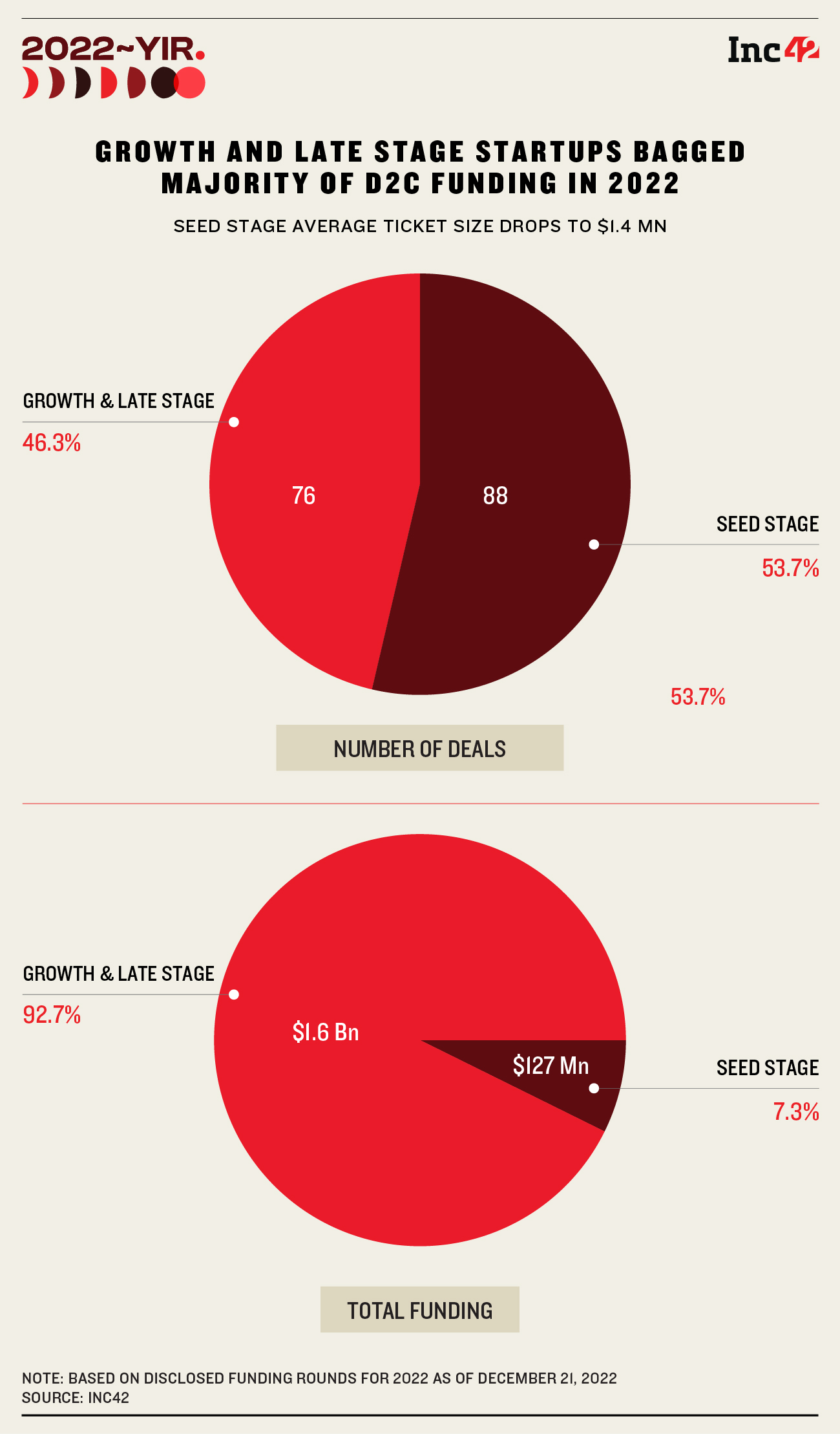

Download Annual Funding Report 2022While the D2C ecosystem suffered the same funding and growth challenges as most other startup sectors in India, 2022 was all about the major brands solidifying their base and looking to extend their lead in the market. Early-stage D2C brands took a backseat as investors put caution first and backed plays that already had traction in the market, which has created a top-heavy and long-tail market in the D2C context.

Given this, we expect the D2C ecosystem to go through a tough maturity phase that will see brands being snapped up by larger players, while the house of brands juggernaut rolls on.

Before we peer into the crystal ball and look at what 2023 might bring, it is pertinent to understand just why 2022 has not been a great year for the D2C ecosystem.

Quick Commerce Kills D2C Advantage

The pandemic turned most city-dwelling Indians towards ecommerce and this fuelled the appetite for D2C brands. Finally, consumers were playing on a turf that digital-native brands were familiar with. It was home ground, and it also ushered in the first phase of the creator economy led by social commerce.

But ecommerce exposure brought in instant deliveries or quick commerce and that has flipped the equation. Unlike social commerce or ecommerce, quick commerce depends heavily on distribution efficiency and network effect. The brands that are able to distribute their products more efficiently across a region to these quick commerce channels win.

Quick commerce targets the very consumer that D2C brands were going after and this overlap split the share of the wallet that was going towards D2C brands. Of course, this only applies for products in beauty, food and beverages categories.

Legacy and larger FMCG players clawed back their advantage thanks to the emergence of quick commerce, where they could fulfil the requirement of faster stock replenishment.

To compete, D2C brands relied on discounts to gain traction on the quick commerce channels. That’s a strategy that was simply not viable in 2022, given the focus on unit economics.

Interestingly, the fortunes of social commerce are tied to D2C for the moment at least. The likes of Trell faded away into the background, while Meesho more or less turned into a marketplace in 2022. Whether social commerce will make a comeback in the longer run is uncertain. For now, the model has been waylaid by the downturn in D2C.

People Costs, Marketing Spends Slashed

Cost-cutting was one of the themes of 2022 and the priority areas for most businesses were people and marketing costs. Brands such as Furlenco went for layoffs to automate parts of their operations.

“Customer success is the key in D2C especially from a retention point of view. Without enough people, customer support will suffer — you cannot automate all parts of this customer service,” according to the founder of a house of brands company which acquired more than half a dozen brands this year.

And when it comes to marketing, lowering the spends here meant D2C brands were working with one arm tied behind their backs. Digital marketing is critical for D2C brands and curbing this means lower reach. This is also why competition has been so tight this year since most brands are working with the same constraints.

The rise in lending interest rates, growing inflation, and depreciation of rupee against the dollar have led to marketing slowdown for brands as well.

There were exceptions such as IPO bound Mamaearth which turned a profit, but the company has been in the market for six years and had already turned to omnichannel much before the pandemic. Mamaearth’s retail and quick commerce presence has been crucial in keeping its revenue steady.

Festive Sales Battered By Headwinds

Usually, the biggest indicator of ecommerce traction is the year-on-year growth in festive season sales.

While this year’s total ecommerce festive season GMV touched $5.7 Bn, or 4X higher than last year, the number of online shoppers and average user spend fell.

The average user spend of INR 5,200 is 41% lower than 2018 and 30% lower than 2019, while the number of active shoppers in 2022 only touched about 50 Mn-55 Mn, which is 60% lower than 2020.

The shrinking on both counts indicates the Indian market might have hit a wall in terms of active internet shoppers, while long tail players that focus on small-ticket items might see an overall growth in GMV, the take rates would not be encouraging here.

Ecommerce fatigue is also said to be a factor as the reopening of retail outlets brought some relief from online shopping. Unlike the past years, this year the sales of premium smartphones has outpaced budget or mid-tier smartphones, which again indicates that it is the more affluent user that is spending higher for ecommerce.

New ecommerce users typically have a lower cart size and average order value, and their withdrawal from this season’s sale has therefore not impacted the overall GMV as much, but still ecommerce platforms essentially lost out on this business in 2022.

In fact, November’s Black Friday sales proved to be a bigger draw for online D2C shoppers, according to ecommerce tech startup GoKwik. The company said D2C brands powered by its platform saw 63% higher GMV over the three-day Black Friday sale than the 10-day Diwali sale.

Big Brands Attract Big Funding

The funding in ecommerce in 2022 was dominated by growth stage and late-stage startups. Those with years in the market were able to raise large rounds to extend their runways and continue product development alongside marketing.

The likes of Licious, Lenskart, Lenskart-owned Neso Brands, boAt, Country Delight, Paperboat, SUGAR Cosmetics were at the top of the funding charts in 2022. While overall, D2C startups raised more than $1.9 Bn till December 21, 2022, the funding for growth and late stage startups contributed a whopping $1.6 Bn to this tally.

Lenskart’s house of brands business Neso Brands, which raised a $100 Mn seed round is also an outlier within the seed stage cohort. And excluding this mega round, only $127 Mn was raised at the seed stage by D2C startups in 2022, with an average ticket size of $1.4 Mn. This clearly shows the wide capital access gap between established brands and new players in the Indian market.

While funding has been slightly harder to come by, brands did have one new avenue to accelerate their growth. At the tail end of 2021, there was a new trend emerging that has seamlessly fit into the Indian context.

You can call them ‘house of brands’ or ecommerce roll-ups, but their rise came right before the funding winter and it also meant they had the capital and resources to become investors or acquirers of D2C brands.

House Of Brands Dominate

While the house of brands model is relatively new to the Indian market, there isn’t any shortage of players and we have more than a dozen such startups vying for D2C brands today.

In fact, the segment has seen three unicorns with over 100 brands acquired as per Inc42’s analysis

While the basic idea of a house of brand is to build and create its own brands, in the D2C context, this means acquiring brands or investing in them to accelerate their growth by centralising resources and talent.

The likes of Mensa Brands, FirstCry’s Globalbees, 10Club, Upscalio, Evenflow, CureFoods, Good Glamm Group, GOAT Brand Labs among others are looking to acquire digital-native or online-first brands across categories. Even Nykaa has joined the rush, while Aditya Birla’s TMRW is the latest entrant and has already made a big splash.

Many of these companies focus on particular verticals — CureFoods with QSR, TMRW with fashion, Good Glamm with beauty — but the idea remains the same. Acquire and grow brands that would otherwise require significant capital infusion to scale up.

Given the slowdown in funding, it’s not surprising that HoBs have seen rapid growth in their portfolios. One way of looking at it is surrogate capital passed on by VCs that have backed the likes of Globalbees, Mensa, 10Club and others. From a business point of view, it is inorganic product development with an already established leadership handling everything else.

Mensa Brands’ founder and CEO Ananth Narayanan said at a recent Inc42 event, “In India, there are 4,000 brands worth INR 10 Cr to INR 100 Cr in the fashion, beauty and home decor space. But they all stagnate at that level for various reasons such as [the lack of] technology, people and capital.”

He added that Mensa’s portfolio was clocking an ARR of $200 Mn in November 2022.

For many D2C startups that have shown the initial traction and product-market fit, a house of brands acquisition is the surest path to scale. Of course, how much operational autonomy they are willing to give up.

What Awaits In 2023?

While the house of brands model will continue to corner VC money because of its very premise of consolidation, there will be significant new launches in this segment as well as major corporate-backed plays.

Like TMRW, which benefits from some of Aditya Birla’s established network and legacy, other outfits are very likely to spring up. There’s already some speculation about Reliance focussing on private labels, while Tata Digital has the platform and the acquired brands to make a house of brands run as well.

Among the categories hottest on the radar of houses of brands are fashion and beauty given that these are truly long-tail segments and brand synergies are more fluid.

As we see after any major boom — hyperlocal in 2015 and edtech in 2021 — there is a bust. Not all brands will find themselves acquired. Indeed, the house of brands model requires some degree of independent success or traction, failing which many brands might have to shut shop.

We also expect consolidation within the house of brands. As is obvious from the depth of acquisitions by each platform, some like Mensa & Globalbees have the deep pockets to outpace others that have not raised as much. The platforms that do not have capital simply cannot compete unless their revenue sees major growth organically.

This is also why only a few players are getting the large rounds, while others are surviving on smaller fundraises.

For brands that do not take the HoB route, the focus will come back to metrics such as lifetime value (LTV) and customer acquisition cost (CAC), instead of just GMV which does not indicate the unit economics situation.

As one D2C men’s beauty brand founder put it, “Product-market fit was so far about how well your product is received by the customer, what problem it solves. But in 2022 it’s not about the problem or the customer but these acronyms CAC and LTV. When everyone is down, only the most sustainable will survive.”

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience