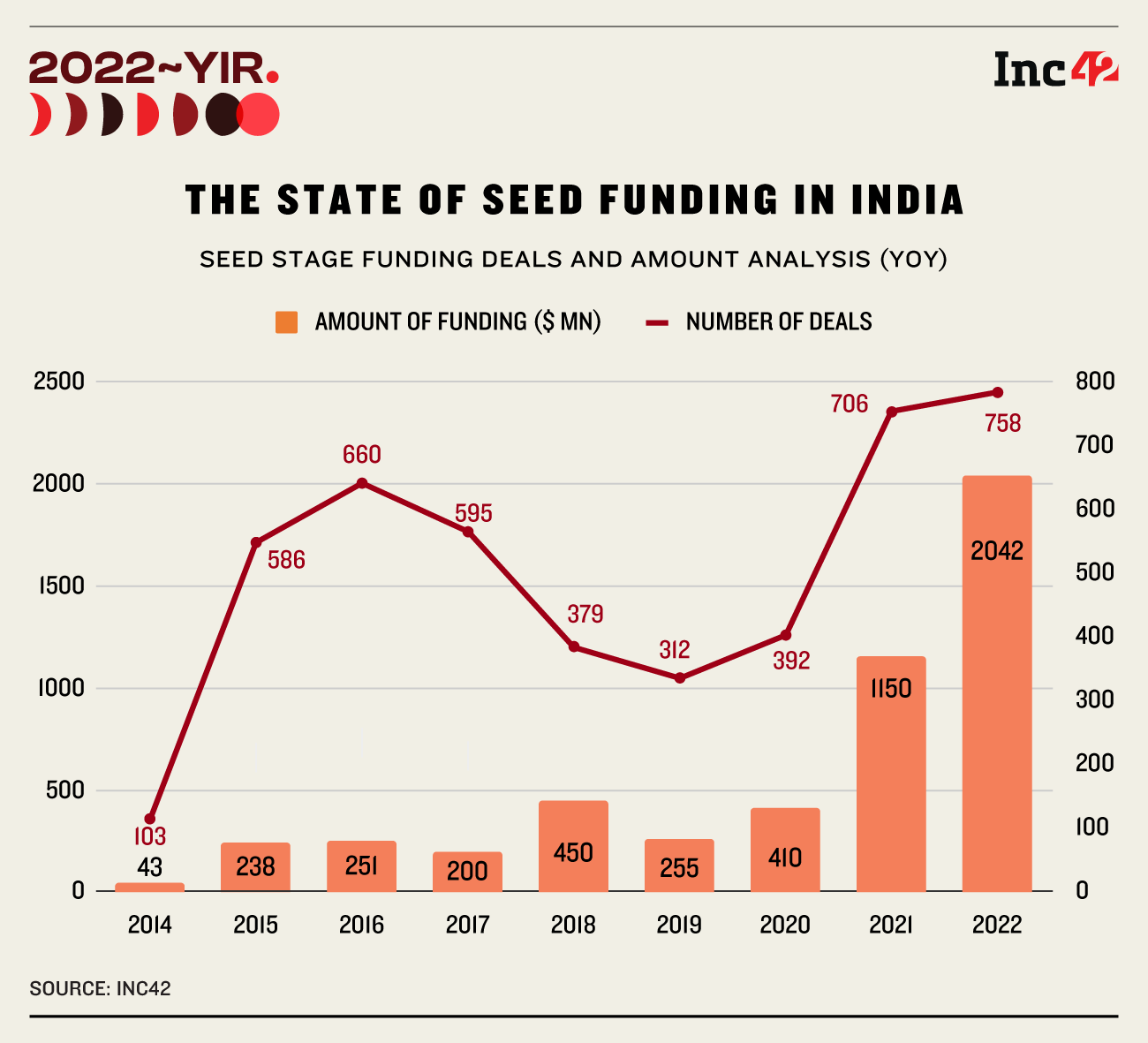

Despite the funding slowdown, 2022 emerged as the year with the highest seed funding between 2019 and 2022

Capital efficiency of Indian early-stage startups has helped them remain attractive to both domestic and foreign investors

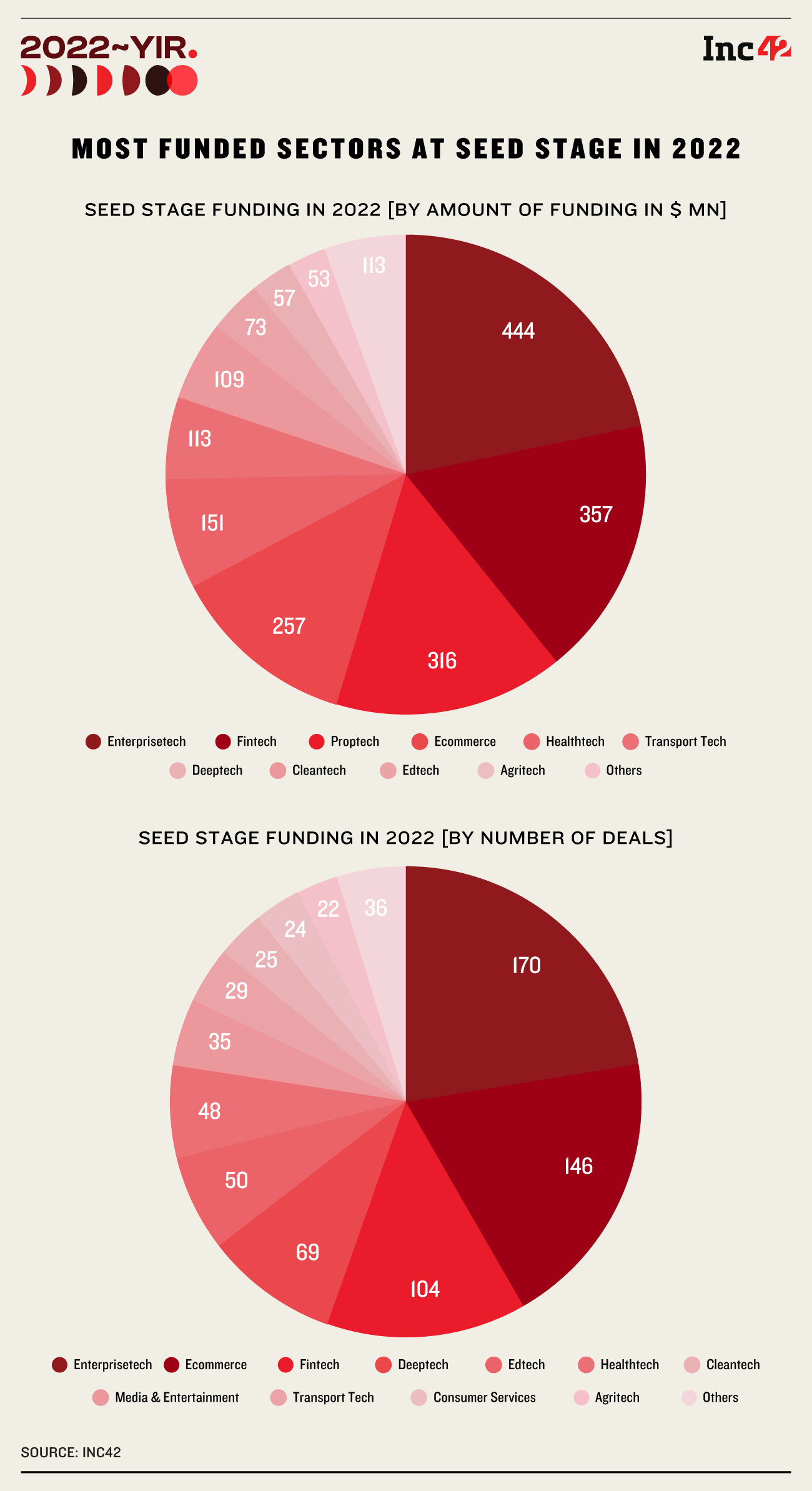

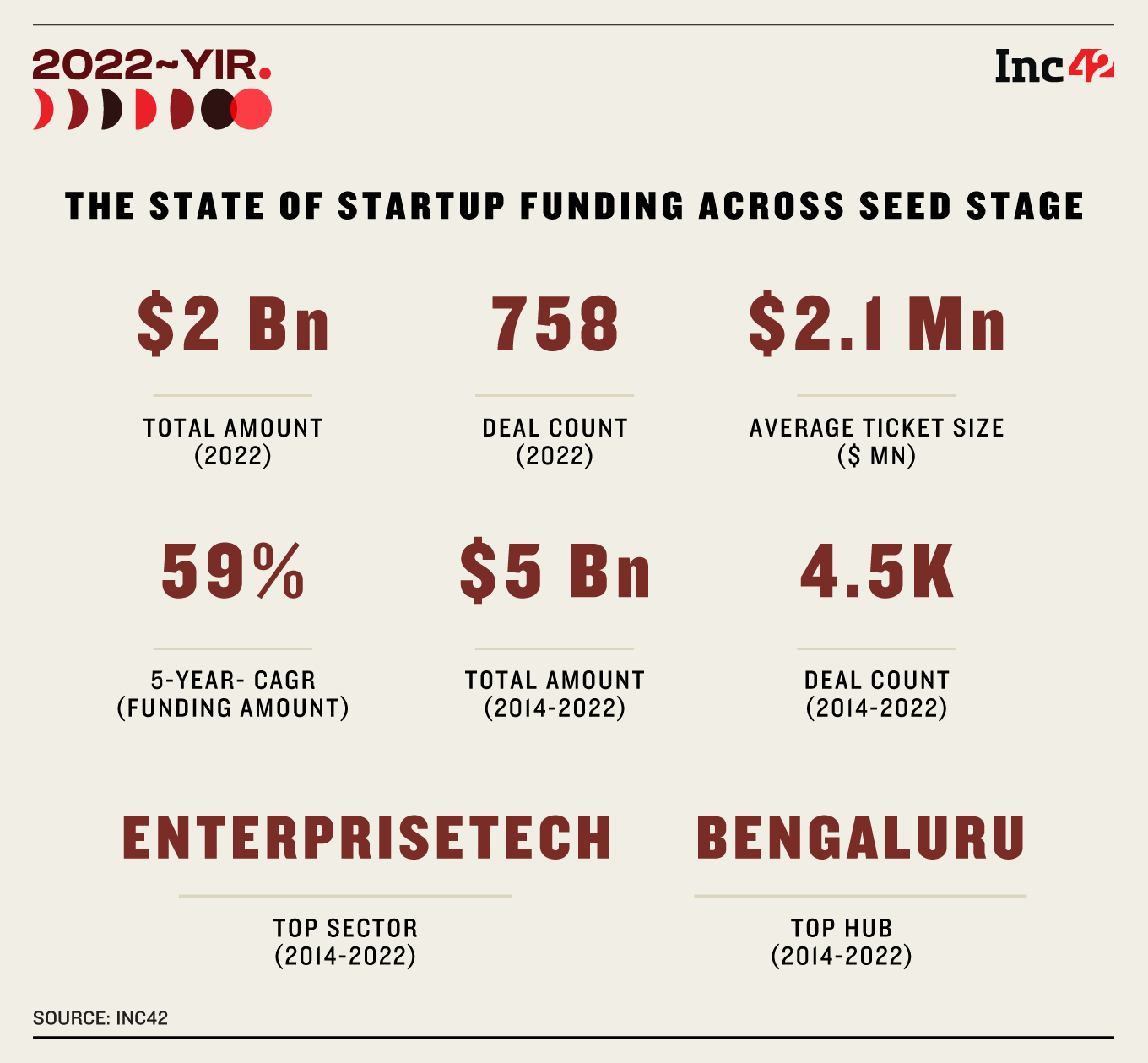

Between 2014 and 2022, Enterprisetech startups at seed stage secured 860 deals – the highest among all the sectors.

The Indian startup ecosystem saw a spurt in funding activities between 2008 and 2009, 2014 and 2015, and then in 2020 and 2021. The funding spike of 2020-21 was majorly led by the increased adoption of digitisation in an economy that was largely impacted by multiple pandemic-induced lockdowns and a low dollar interest rate regime.

But this all changed in 2022, and the total funding came crashing down to $25 Bn from $42 Bn raised in 2021. Interestingly, despite the slowdown, 2022 emerged as the year that lapped up the highest seed funding in the last eight years. Almost 41% of the total seed funding ($5 Bn) raised by Indian startups since 2014 was secured in 2022.

Download Annual Funding Report 2022In the Indian startup ecosystem, traditional VC (venture capital) funding has been on a tear for almost a decade. But with several new companies entering the ecosystem every year and macro disrupters like the pandemic and a funding winter impacting the world of business, the VC segment has also seen significant changes.

“The rise of micro VCs, who are aggressively focusing on pre-seed and seed funding stage startups, is giving the right impetus to early-stage ecosystem growth and maturity,” said Vinay Bansal, the founder and CEO of Inflection Point Ventures.

“Investors are active in the early stages, investing in India’s strong and deep pool of founders and talent. Early-stage investments offer more ‘bang for the buck’ in this ecosystem, allowing for longer bets with less pressure on immediate returns. Furthermore, the capital efficiency of Indian early-stage startups has helped them remain attractive to both domestic and foreign investors,” said Madhu Shalini Iyer, a partner at Rocketship.vc

Key Seed Funding Trends In 2022

The early stage startup ecosystem continued to remain vibrant in 2022. As a result, the seed stage startups saw a significant surge in deal sizes and the number of deals secured. Here are the three key trends observed around startup funding at the seed stage:

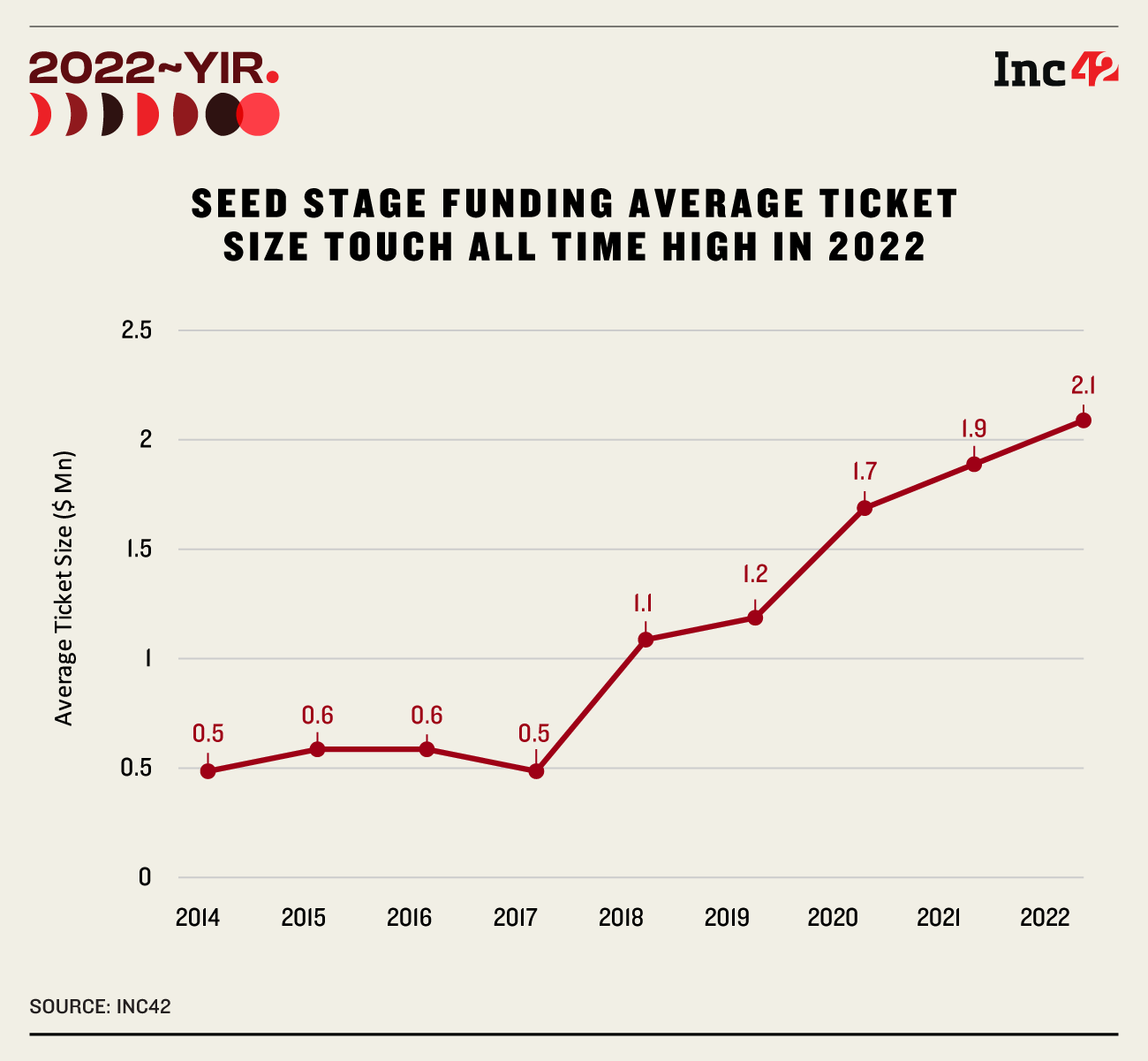

Bigger Deal Sizes

Typically, seed fundings are anywhere between $10K and $20 Mn. However, post 2020, the seed funding range widened. As Chinmaya Saxena, Partner, Community Strategy, BEENEXT, indicates, the value of early-stage investments has now grown, demonstrating investor confidence and the prospects for the Indian startup ecosystem.

For instance, in 2020, the highest outlier deal was $35 Mn, raised by Public app, a media and entertainment startup. The overall range of the seed funding during the year was between $20K and $20 Mn. Further, in 2021, the highest outlier deal stood at $60 Mn (raised by Zepto) versus the overall seed funding range of $30K to $40 Mn.

According to the data analysed by Inc42, in 2022, there were three exceptional deals – coworking startup Table Space’s deal of $300 Mn, ecommerce platform Neso Brands’ deal of $100 Mn and healthtech venture Lifewell’s deal of $80 Mn. Apart from these, all other deals remained within the range of $10K to $60 Mn.

The higher end of the seed funding range has continued to increase significantly in the last three years. This has further increased the average ticket size of seed funding in the Indian startup ecosystem.

Enterprisetech Remained The Most Funded Sector

Between 2014 and 2022, Enterprisetech startups at seed stage secured 860 deals – the highest among all the sectors. In 2022, the enterprisetech sector garnered 170 deals, raising $444 Mn in funding.

According to Kunal Upadhyay, the cofounder and managing partner of Bharat Innovation Fund, “While the majority of the current unicorns are focused on India’s consumer play, a significant number of Enterprise SaaS companies have gone global and are poised to become the darlings of growth-stage investors in the upcoming years. This has further increased investor confidence at seed stage.”

In 2022, enterprisetech was followed by ecommerce at 146 deals and fintech at 104 deals. In terms of the amount of funding, fintech took the second spot with $357 Mn, followed by proptech with $316 Mn.

Seed Funding Continues To Grow Despite Correction

In terms of YoY growth, the seed funding amount has grown exceptionally between 2020 and 2022. Although the total seed funding amount stood at $255 Mn in 2019, down 43% YoY, the same rose 60% YoY in 2020 to settle at $410 Mn.

The year 2021 remained exceptional in terms of seed funding, as the total investments skyrocketed 200% YoY to $1.1 Bn due to the rise of new startups, an increase in seed stage funds, and the entry of more mature and repeat founders in the ecosystem.

Then in 2022, seed funding saw correction and returned to its regular growth path. Unlike 2021, the year saw a 77% YoY rise, with the total investments reaching $2 Bn. This suggests that investors were back to making more experimental bets at seed stage, exploring different sectors and identifying new niches.

Key Factors That Led To The Rise In Seed Funding

The year 2022 witnessed sectors such as cleantech, consumer services, femtech, agritech, transport tech, travel tech, and media and entertainment grabbing investors’ interest. Although the number of deals in these sectors was considerably less than the top three sectors, namely enterprisetech, fintech, and ecommerce, investors were bullish on innovations, and B2B vertical-specific models and founders’ capabilities while pouring in investments, BEENEXT’s Saxena points out.

“For us, founder bets are crucial at an early stage. So, we look for founders who are driven and accomplish their goals, irrespective of the cycle, while being conscious about the market conditions. When founders have robust business models based on actual consumer insights and can address real problems, they manage to develop a solid foundation and firm it up with capital assistance. This goes a long way in helping them overcome the funding winter and emerge victorious,” Saxena added.

According to Vinay Bansal of Inflection Point Ventures (IPV), growth-stage funds have also realised the importance of gaining a foothold into high-potential startups at an early stage. However, the biggest game changer has been the entry of established angel networks and platforms that have made it possible to do angel investing in a structured manner.

They have set up processes to secure, curate and fund high-potential startups and make them accessible to a larger investor community looking to grow their wealth and diversify their portfolio.

“The early-stage ecosystem started slowing down before the later-stage ecosystem, thereby cooling the valuations much earlier. However, early-stage funds were sitting on record piles of dry powder. Thus, when valuations became palatable for investors, money started flowing into the early-stage startups,” said Artha Venture Fund’s managing partner and director Anirudh Damani.

Some of the other key factors that have contributed to the rise of seed-stage funding in 2022 are as follows:

- The proliferation of technology and the internet made it easier for entrepreneurs to start and scale businesses. This led to an increase in the number of startups and a need for seed funding to support their growth.

- The success of many tech startups created a culture of innovation and risk-taking, encouraging more people to start their own ventures and seek seed funding support.

- Many angel investors and venture capital firms recognised the value of supporting early-stage startups and established seed funds or joined hands with angel networks.

- With people aspiring for better products, the D2C sector witnessed huge growth and the creation of several brands and new categories

- Fintech and financial inclusion became the most promising sector in the country on the back of ideas with great potential.

Seed Stage Startup Funding: What To Expect In 2023?

Experts believe that the future of India’s seed-stage startups is quite promising. As the investors’ focus shifts to profitability and unit economics for higher valuation rounds, mentoring-led investment models at an early stage can bring in a paradigm shift in the way seed startups evolve and scale.

From startups’ perspective, here are some of the key trends experts anticipate emerging in 2023.

Founders’ Role Will Be Crucial For Investors

In 2023, Investors will remain bullish on the founders who are focused on innovation to solve real problems and build for the world.

BEENEXT’s Saxena says, it could get challenging to raise rounds for companies that are yet to demonstrate a solid product-market fit and a robust roadmap to profitability and growth. That being said, great founders focused on building amazing businesses will keep on shining in the long run irrespective of macrocycles.

“We expect investors to keep building upon their own ground-up insights to be able to test these models against and therefore the decision cycles may also take longer,” Saxena said.

Meanwhile, 3one4 Capital’s Founding Partner and Chief Investment Officer, Pranav Pai forecasts that there could be some seed/early stage participation by the mid stage/growth specialists, which can increase round sizes.

“We also anticipate seeing more Indian capital enter into the VC market, with new funds and co-investors building their portfolios more aggressively,” Pai said.

Climatetech To Emerge As The Star Sector In 2023

Almost all investors that Inc42 spoke with believe that climatetech will get continuous focus from the early-stage investors in 2023.

According to IPV’s Bansal, overall, the cleantech/sustainability sector is seeing an increased VC and investors interest, as startups in clean energy, with a focus on reducing carbon footprints of businesses and end users, will continue to see funding inflows.

DroneTech Will Gain Impetus

Drone technology has also become quite popular, and the government is continuously providing support in this area, which is helping many deeptech startups emerge in India.

Almost all modern defence organisations and tech-savvy consumers are aware of drones and unmanned aerial vehicles (UAVs) gaining popularity. They have a variety of applications ranging from military and commercial uses to recreational purposes.

EVs Will Rule In 2023

Electric vehicles (EVs), including electric two-wheelers, will be a growing trend in the transportation industry, as they offer a more sustainable and efficient alternative to traditional vehicles. Many investors in the EV space are particularly interested in the startups that are working on innovative battery technologies. Investors also expect that many innovations will come to the fore in B2B and D2C spaces.

Lastly, in specific sectors such as space tech, public-private partnerships will continue to drive growth immensely. Further, the regulatory and support framework from the government will help the sector grow exponentially.

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience