SUMMARY

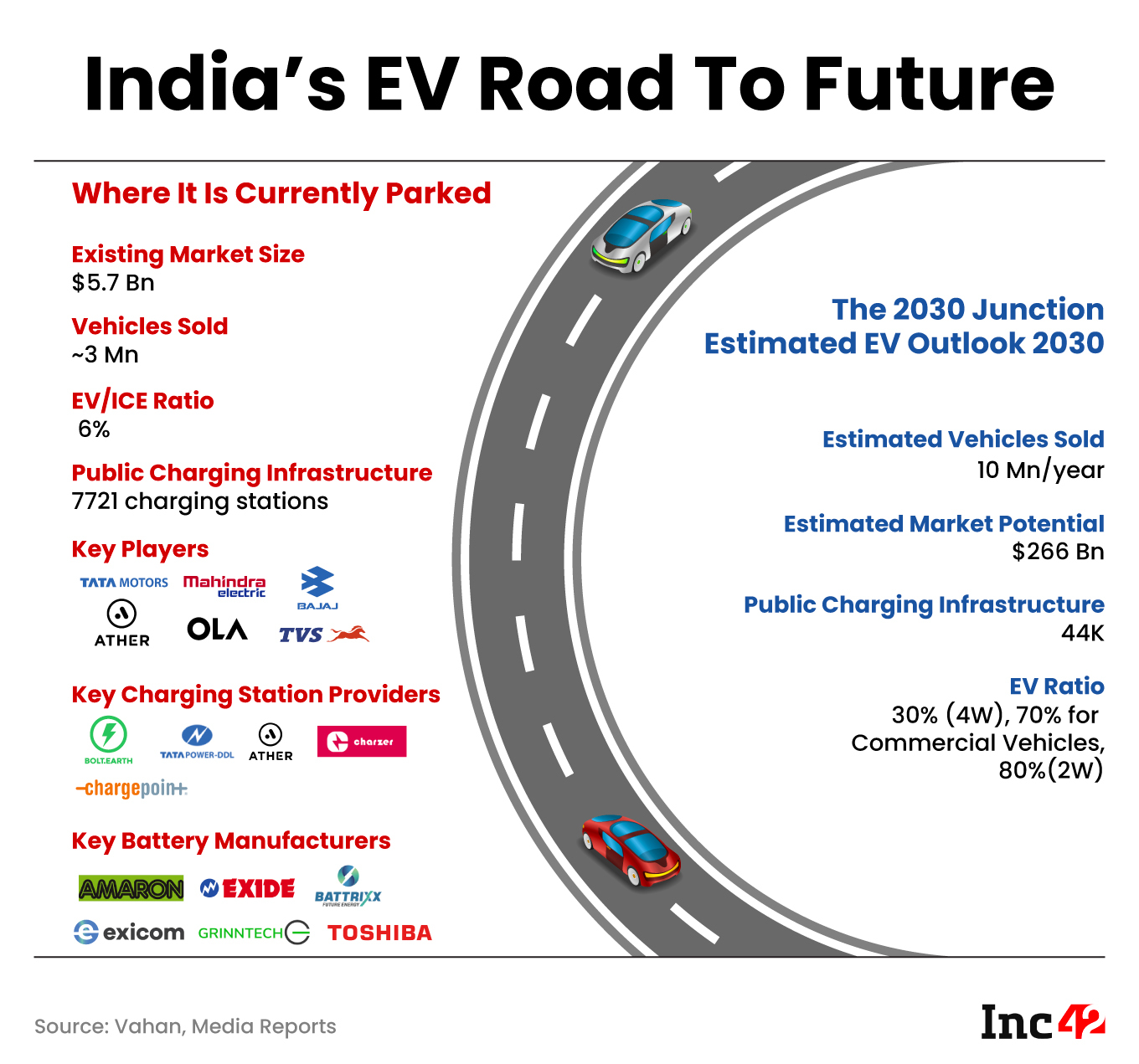

India's electric vehicle (EV) industry is thriving and is projected to become a $266 Bn market by 2030

In the first seven months of 2023, India notched up impressive cumulative sales of 8,38,766 electric vehicle (EV) units, underscoring the strength of the market

India currently boasts around 3 Mn registered EVs, with projected sales of 10 Mn EVs/year by 2030, generating employment for 50 Mn individuals

Despite challenges, India’s electric vehicle (EV) industry has shown remarkable resilience and growth. Both domestic and foreign companies, in collaboration with the Indian government, have pledged substantial investments, totalling over INR 1 Lakh Cr, over the next 5-10 years. This commitment mirrors the confidence that stakeholders have in the potential of the Indian EV market.

Before delving deeper into understanding the factors driving the burgeoning Indian EV revolution, it’s essential to highlight that Union Minister for Road Transport and Highways, Nitin Gadkari, reported an astonishing 300% increase in EV sales in 2022. Furthermore, he anticipated that the Indian EV market would reach $266 Bn by 2030.

Additionally, India currently boasts around 3 Mn registered EVs (according to Vahan), with projections estimating sales of 10 Mn EVs by 2030, generating employment for 50 Mn individuals.

The EV boom is evident in the remarkable shift in sales trends. Between January and July 2023, EV sales skyrocketed 131%, surging from 25,100 units to 58,076 units. In contrast, internal combustion engine (ICE) vehicles recorded a mere 5% growth, bringing the total to 2.2 Mn units from 2.1 Mn units during the previous year.

India is home to over 700 EV startups, showcasing the industry’s dynamic nature. Concurrently, established ICE manufacturers have accelerated their transition to the electric vehicle segment. The industry is at a pivotal juncture, driven by urbanisation, environmental concerns, and government policies, leading to a surge in the adoption of electric two-wheelers and three-wheelers.

According to Sandiip Bhammer, the founder and co-managing partner of Green Frontier Capital, which has its investments in EV startups such as BluSmart Mobility, ElectricPe, Revfin, and Battery Smart Swap Stations, India is poised to excel in the electric two- and three-wheelers segments within five years, driven by indigenous technologies and robust local supply chains.

“India has the potential to lead the global EV ecosystem, spanning battery research and manufacturing, software solutions, and sustainable battery recycling. This transcends transportation – it’s about reshaping India’s energy paradigm, advancing sustainability, and setting global benchmarks, especially for developing economies mirroring India’s socio-economic structure,” Bhammer said.

On A Rapid Growth Trajectory

EVs encompass multiple market segments and offer diverse opportunities. These segments include original equipment manufacturers (OEMs), EV financiers, deeptech enablers, charging station providers, battery manufacturers, assemblers, BMS providers, and many more.

Each of these emerging markets presents fresh opportunities for startups and provides a competitive advantage for early entrants. Unlike other emerging markets like cryptocurrency and gaming, the growth of the EV industry is inevitable.

Amit Gupta, the cofounder and CEO of Yulu, credits the substantial traction within various segments of the EV industry to the rising environmental consciousness and supportive government policies. These segments encompass EV ownership, mobility as a service (MaaS), and battery as a service (BaaS), among others.

In its report, NITI Aayog estimates that the cumulative demand for 120 GWh of batteries during 2017-2020 would have incurred a cost of $24 Bn for imported packs if a domestic industry had not developed. In contrast, establishing a $6 Bn-$9 Bn pack assembly industry in India would significantly reduce costs, presenting a massive opportunity for Indian startups and companies to assemble batteries and manufacture cells.

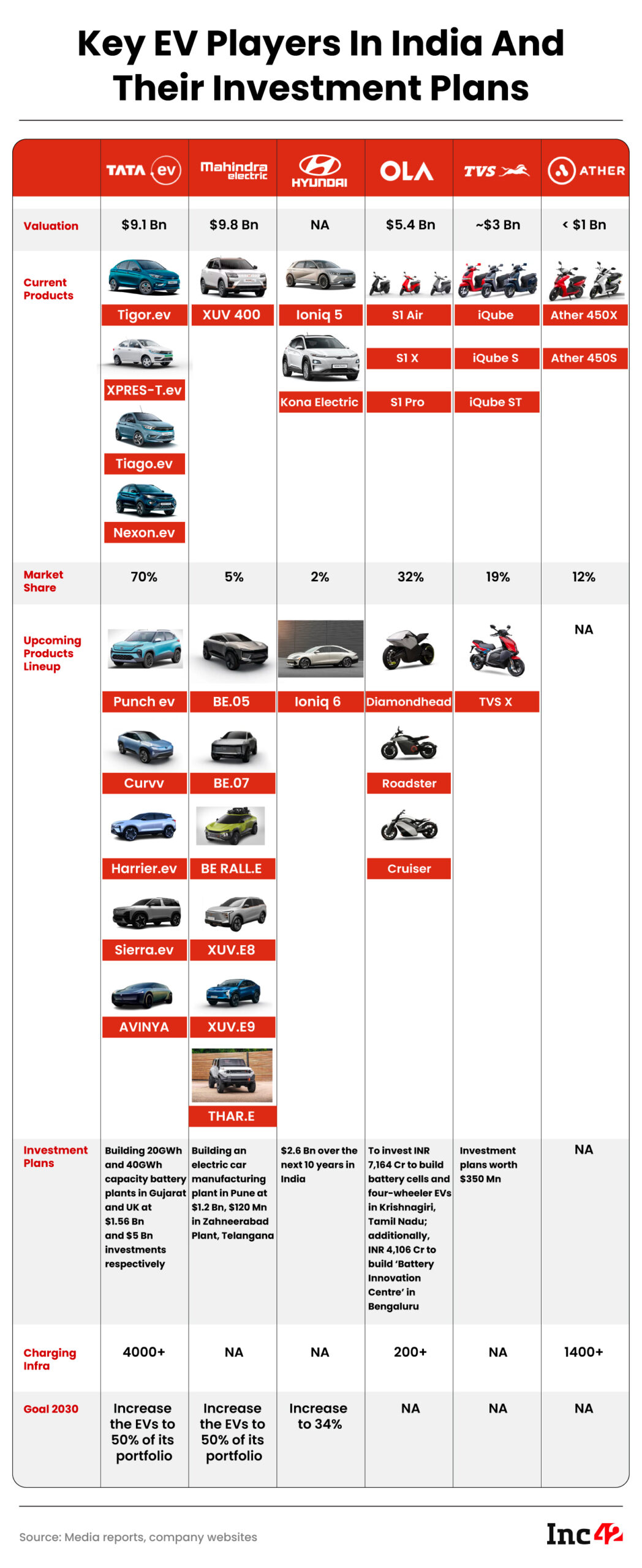

Understanding the math, prominent companies like Ola, too, have made substantial commitments to battery manufacturing. Ola has plans to invest INR 7,614 Cr to build battery cells and four-wheeler EVs in Krishnagiri, Tamil Nadu, and an additional INR 4,106 Cr in constructing a 500K sq ft ‘Battery Innovation Centre’ in Bengaluru.

Similarly, Tata has signed a deal to establish a lithium-ion cell factory with an investment of about INR 13,000 Cr ($1.58 Bn). Ola aims to build a 100 GWh battery plant, while Tata targets a 20 GWh capacity.

Other major players, too, have committed significant investments, with Hyundai planning to invest $2.4 Bn over the next 10 years. Maruti Suzuki and Toyota are also allocating substantial investments of $1.3 Bn and 630 Mn, respectively, towards their EV lineups.

Besides, the government has also announced a couple of production-linked incentive (PLI) schemes to bridge these supply gaps. One of them, with an outlay of INR 25.9K Cr, is designed for the auto component sector. The other one, with an allocation of INR 18.1K Cr, is meant to bolster the advanced chemistry cell (ACC) battery industry at a pan-India level.

Reliance New Energy, Ola Electric and Rajesh Exports were earlier shortlisted under the PLI Scheme for ACC battery storage.

The effort will reduce the overall cost of manufacturing by significant margins. The plants under PLI schemes are expected to be operational by 2024-end, according to industry experts.

The development of charging infrastructure, aggregation of public charging stations, real-time vacancy information, and component manufacturing are also the key imperatives of an evolving EV ecosystem.

EV Players Are Collborating Not Competing

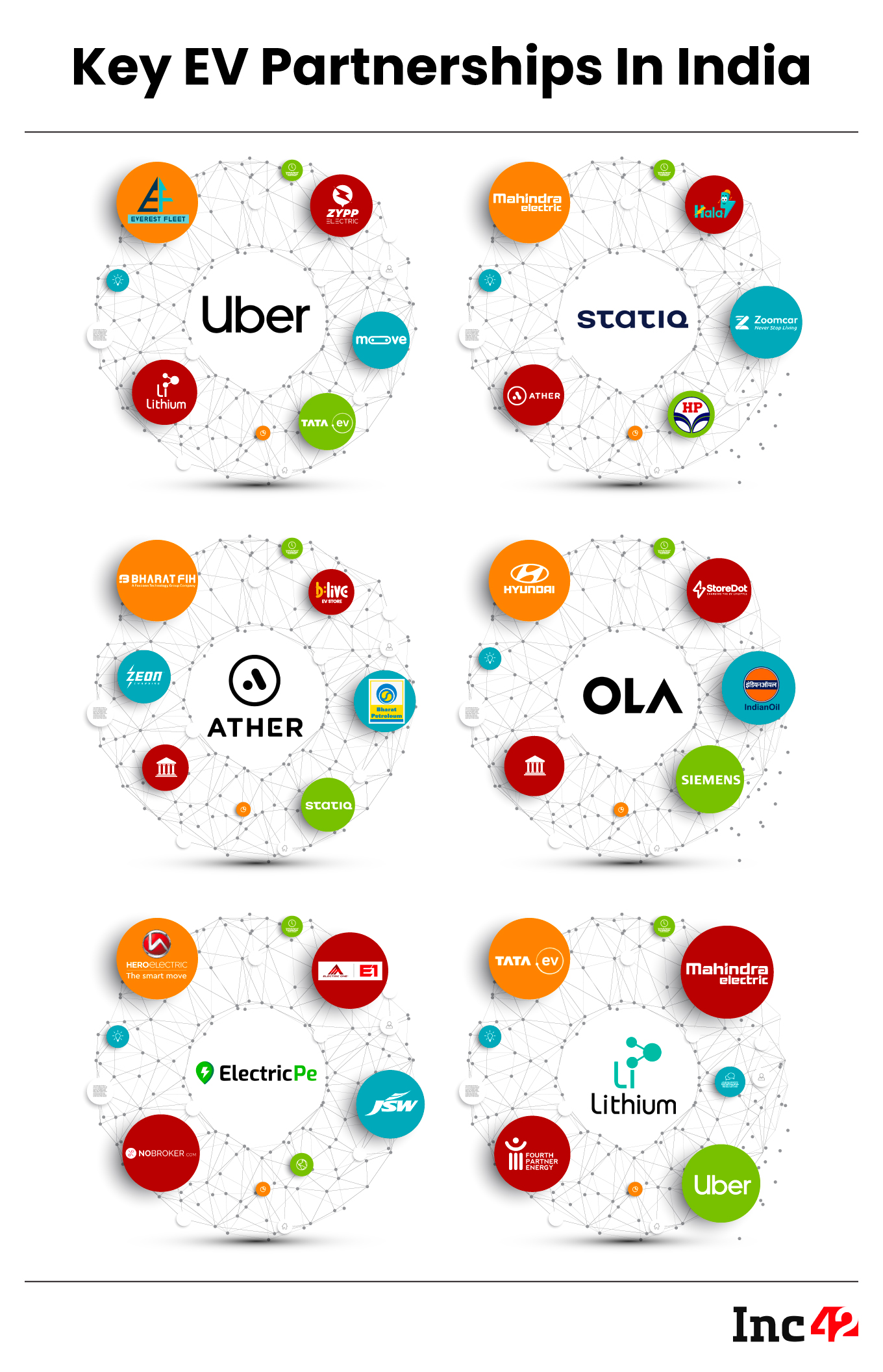

In pursuit of the ambitious 2030 goals, the Indian EV sector has seen significant partnerships and initiatives taking shape, and, along with fintechs, EV is another area where we have witnessed an increased collaboration between startups and giants.

Unsoo Kim, MD and CEO of Hyundai Motor India, had earlier emphasised the pivotal role of strategic partnerships in expediting EV adoption among customers, aligning with the national objective of achieving carbon neutrality.

This collaborative spirit holds the essence of India’s burgeoning EV landscape. Rather than intense competition, the industry is witnessing a surge in collaborations. For instance, Tata Power has joined forces with Hyundai Motors to develop fast-charging infrastructure. Mahindra & Mahindra is contemplating a partnership with Volkswagen for their modular electric drive matrix (MEB) platforms.

Earlier this year, Uber India inked an agreement with Tata Motors to supply 25,000 EV sedans by the next year. Uber has further expanded its partnership portfolio, collaborating with EV fleet partners Lithium Urban Technologies, Everest Fleet Pvt Ltd, and Moove to deploy 25,000 electric cars on the Uber platform in India over the next two years.

Uber has also forged a partnership with Zypp Electric to introduce 10,000 EV two-wheelers in Delhi by 2024. Uber has additionally announced a partnership with SIDBI to unlock INR 1,000 Cr in financing.

Meanwhile, Amazon India has set ambitious targets, aiming to transition 50% of its end-mile fleet to EVs by 2030. The company has already established partnerships, including one with TVS Motors to supply 100,000 iQubes during this period.

Neuron Energy, a battery assembly startup, is actively engaged with multiple brands in the two-wheeler battery segment and is exporting its products to various countries, including Africa, the Middle East, Sri Lanka, Bangladesh, and Nepal. Furthermore, the company has plans to expand its horizons by exporting solar batteries to Africa by 2024.

“Neuron Energy has also forged a partnership with an Italian manufacturer to export golf cart batteries to the US and Canada. With an extensive lineup of projects, the company aims to capture a larger market share and achieve substantial sales growth in the dynamic and rapidly expanding EV industry,” said Pratik Kamdar, the CEO and cofounder of Neuron Energy.

Building The Big EV Infrastructure

India currently boasts nearly 8,000 public charging stations, a notable achievement considering the country has sold around 3 Mn EVs thus far.

According to the International Energy Agency (IEA), India is one of the top five countries in the world in terms of EV/EVSE (Electric Vehicle Supply Chain). Clearly, there’s a big gap to fill in.

Among key players in this charging infrastructure landscape, Tata Power has taken the lead by installing over 4,000 EV public and semi-public charging stations across 250 cities. Similarly, Ather has made strides with over 1,400 charging stations operational in 99 cities. Notably, battery charging startup Bolt has surged ahead by installing more than 30,000 charging points.

The Indian government, with its eyes set on the future, has an ambitious plan to establish 46,000 public charging stations nationwide. It is also providing incentives to stimulate the development of these charging stations under the FAME II initiative.

Parallely, India has also ventured into the concept of battery swapping. The Telangana government has piloted 50 battery-swapping stations, while Delhi Transco Limited (DTL) has installed over 250 battery-swapping stations in Delhi. Further, Sun Mobility, in collaboration with Amazon India, has laid out plans to deploy over 2,000 battery-swapping points by 2025.

Notably, Maharashtra has embarked on a substantial $2.5 Bn partnership with Taiwan’s Gogoro and a local automotive systems supplier to establish electric vehicle (EV) battery-swapping and charging stations.

Seeing a significant opportunity in ‘energy as a service’, Yulu created Yuma Energy in a joint venture with Magna International.

Yuma Energy is currently doing close to 500,000 swaps a month and expects a 50% QoQ growth for the next couple of years. The business currently has a network capacity of a million battery swaps a month and will double this capacity in the next 3-6 months. “In the next five years we are confident that we will be able to expand to the top 25-30 cities in the country with a capacity of over 50 million swaps per month, while maintaining strong unit economics,” said Gupta.

Amit Gupta of Yulu believes that India’s increasing adoption of EVs owes much to the government’s timely measures aimed at incentivising indigenous EV and battery manufacturing through various PLI schemes. However, Gupta also emphasised the need for dedicated policies to promote Mobility-as-a-Service (MaaS) solutions such as shared electric two-wheelers and Battery-as-a-Service (BaaS), which are essential for the holistic growth of the Indian EV industry.

Meeting The Big Finance Gap

In the first seven months of 2023, India notched up impressive cumulative sales of 8,38,766 electric vehicle (EV) units, underscoring the strength of the market.

Nevertheless, challenges persist, primarily revolving around the perception of higher upfront costs associated with EVs. To tackle this issue, lenders have begun introducing innovative financing models aimed at making EVs more accessible to the Indian consumer.

Sameer Aggarwal, the CEO and founder of Revfin, emphasises the need to educate consumers about the long-term cost savings and environmental benefits associated with EVs. Given that EVs tend to be pricier than their internal combustion engine (ICE) counterparts, financing has played a pivotal role in popularising them among consumers.

Several startups, including Revfin, AMU Leasing, and Ecofy, have ventured into the EV financing space to meet the growing demand from consumers.

However, several key hurdles remain when it comes to leveraging EV financing to bolster India’s EV ambitions.

Moving on, Nehal Gupta, the director of AMU Leasing and EMFAI, acknowledges the higher upfront cost of EVs stemming from advanced battery technology being a prominent concern. Addressing this necessitates innovative financing models to enhance EV accessibility.

Moreover, addressing concerns related to the total cost of ownership, including potential battery replacements, is crucial to instil confidence in both consumers and lenders. As the EV market matures and technology becomes more cost-effective, these challenges are expected to gradually diminish.

Another pertinent issue is extending loans for used EVs. Sumeru Shah, business head-EV of Ecofy highlights the difficulty in determining the residual value of these vehicles, as very few have run a full cycle of the entire battery warranty period or the battery life.

“Unlike ICE vehicles, which have a well-established secondary market influenced by supply and demand dynamics, EVs currently rely on estimations based on algorithms for battery life. OEM assurances play a significant role in determining the residual value, which differs from the ICE vehicle market’s pricing structure for second-hand vehicles,” added Shah.

The EV financing gap will go away as the industry as well as the battery technology gets more mature, believe experts.

ICE Majors VS EV Startups: The Battle Ahead

With a few exceptions like Tata Motors and Mahindra, the electric vehicle (EV) sector in India has largely been led by startups such as Ola Electric, Ather Energy, Bolt, and Yulu, just to name a few.

However, in recent years, major players like Hero MotorCorp, TVS, Bajaj, Tata Motors, Suzuki, Mahindra and Mahindra, Hyundai Motors, MG Motors, and others have announced ambitious plans for the Indian EV market.

It’s also important to note that Ola Electric is backed by Tata and Hyundai, while Hero has more than 35% stake in Ather Energy. This raises concerns about whether a large section of EV startups are adequately equipped to compete with these industry giants.

Sushant Kumar, the founder and MD of AMO Mobility, an electric scooter and bike manufacturer based in Noida, affirms that the entry of established internal combustion engine (ICE) players into the EV market will indeed intensify competition for EV startups. Established brands are likely to draw more attention, potentially reducing the market share of EV startups. Consequently, this may raise entry barriers for new players.

However, Kumar believes that this increased competition can stimulate innovation in the sector, ultimately leading to more affordable EV prices. This innovation will benefit both EV manufacturers, especially startups, and consumers.

According to Bhammer, ICE manufacturers entering the EV space present both challenges and opportunities. Their presence underscores the potential of EVs, leveraging their brand equity and established supply chains. However, these established players also carry legacy constraints. In contrast, EV startups are known for their agility and innovation but face challenges related to scaling up operations and ensuring quality.

From an investor’s perspective, this healthy mix of competition is likely to drive innovation, enhance consumer choices, and open avenues for potential collaboration between startups and established players, fostering growth in the EV industry, Bhammer pointed out.

Miles To Go?

Multiple industry stakeholders and experts agree that the government has made commendable progress in the electric vehicle (EV) sector.

Kamdar of Neuron Energy says, “The Centre has played a pivotal role in fostering the growth of the EV industry by giving tax benefits, subsidies, and investing in infrastructure. The development of a strong manufacturing infrastructure, including battery production facilities, assembly plants, and supply chain networks, is essential. Investments in infrastructure by both domestic and foreign companies are likely to determine India’s competitiveness in EV manufacturing at a global level.”

However, is this enough?

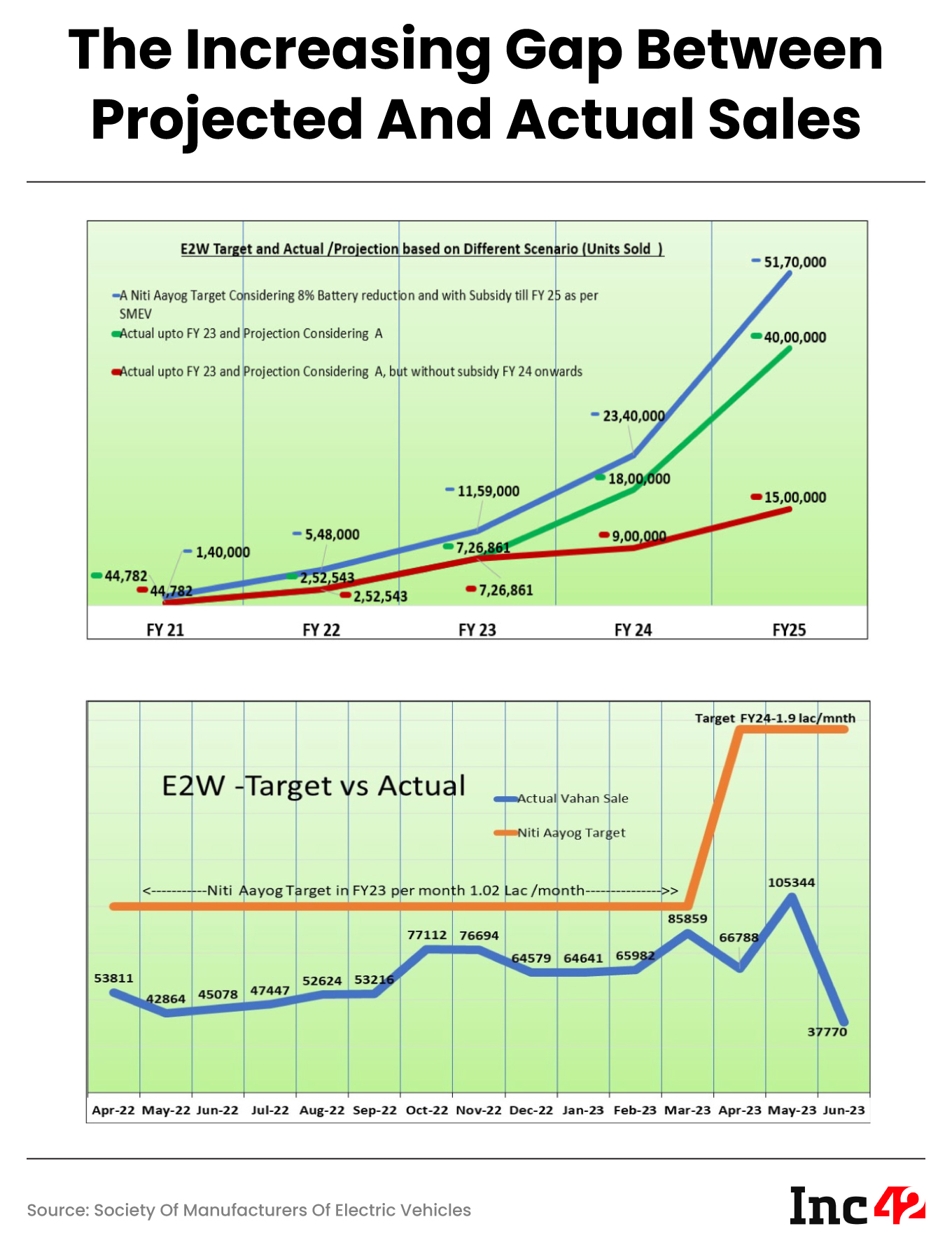

While companies like Tata, Mahindra, Hyundai, MG Motors, Ola Electric, Uber and other stakeholders have set a higher bar for themselves, this is not going to help achieve the 2030 target, experts believe.

The gap between the projected sales of two-wheeler EVs and actual sales has been increasing, and the Society Of Manufacturers Of Electric Vehicles (SMEV) estimates that the gap will only widen if the government keeps reducing incentives.

In a bid to achieve its EV ambitions, Bhammer recommends several accelerators that India can employ. These encompass the expansion of charging infrastructure in both urban and rural areas.

Additionally, there needs to be consistent government backing through subsidies, tax incentives, and incentives for both manufacturers and consumers. Public awareness campaigns highlighting the economic and environmental advantages of electric vehicles (EVs) can also stimulate adoption.

Furthermore, promoting research in battery technology to enhance the efficiency, affordability, and adaptability of EVs to India’s unique conditions is crucial. Lastly, there should be a strong emphasis on education and training programmes aimed at cultivating a skilled workforce proficient in EV technology.

This is important as, despite the higher initial cost, the total cost of ownership (TCO) of a 4-wheeler EV is much cheaper than that of ICE counterpart. According to a NASSCOM report, for a period of 10 years, TCO is INR 3.78 per Km cheaper for an EV than that of an ICE counterpart. For 3W, ICE is 60% costlier for the same period.

Another significant effort is to reward carbon credits where they are due. Carbon credits can be offered to EV manufacturers, users, charging station providers, and others. This could offset costs by an estimated 5% to 15%, depending on their utilisation.

While a lot is happening behind the scenes, India seems to be well abreast of its EV goals. Although there are a few hiccups, the tailwinds driving the Indian EV space are too strong a factor contributing to its growth.

[Edited by Shishir Parasher]

Update: September 18, 2023 | 7PM

The Bolt.Earth logo in one of the images has been updated.