Ola Electric's tall claims of building a 100 GWh battery manufacturing plant and 10 Mn scooters annually is unrealistic, believe experts

Company’s plan to list at $10 Bn valuation is not sustainable, say valuation experts

Prepping for its IPO, Ola Electric has not even filed its financials for FY22 and FY23, the numbers reported are not audited

It was in August 2021 that Bhavish Aggarwal, founder of Ola Cabs and Ola Electric, revealed that both companies would be going for a public listing, with the ride-hailing business positioned to be the first of the two. But two years later, Ola Cabs has become something of an afterthought for Aggarwal, as all effort and focus is on the initial public offering for Ola Electric.

From a ride-hailing unicorn, Ola has changed its focus to become a two-wheeler electric vehicle original equipment manufacturer (OEM). And now Ola Electric

There’s little doubt that the big focus for Aggarwal and his team is on the Ola Electric business. In the past two years, Ola’s ride-hailing business has been out of the spotlight. In May 2023, Ola Electric was reported to have raised $300 Mn at a valuation of $6 Bn and was said to be planning to file the Draft Red Herring Prospectus (DRHP) ahead of an IPO by September 2023.

Plus, over the past year, Ola Electric has announced several products, including plans for two electric cars, electric motorcycles as well as India’s first-ever battery cell manufacturing facility, and more.

Ola Electric is in talks with Goldman Sachs and Kotak Mahindra Capital to act as the book-running lead managers (BRLMs) for the IPO. Additionally, the company has appointed Topsy Mathew, a veteran from Standard Chartered bank, as its corporate finance head.

Reports last week point to Ola accelerating the listing plans for its electric vehicle business. “Ola Electric has grown and matured faster than I had initially planned because the market response has been very strong,” Aggarwal was quoted as saying in a Bloomberg report on July 17, 2023.

However, some analysts and trade experts believe that Ola Electric’s ambitious claims do not align with reality and are exaggerated in many aspects. This scepticism suggests that even if the Ola Electric IPO manages to raise $1 Bn, the stock performance may fail to live up to those figures.

Ola Sets The Pace For Two-Wheelers

Thanks to a marketing blitz and its customer acquisition strategy of relying on the Ola app, the company has also set the pace in the electric two-wheeler market.

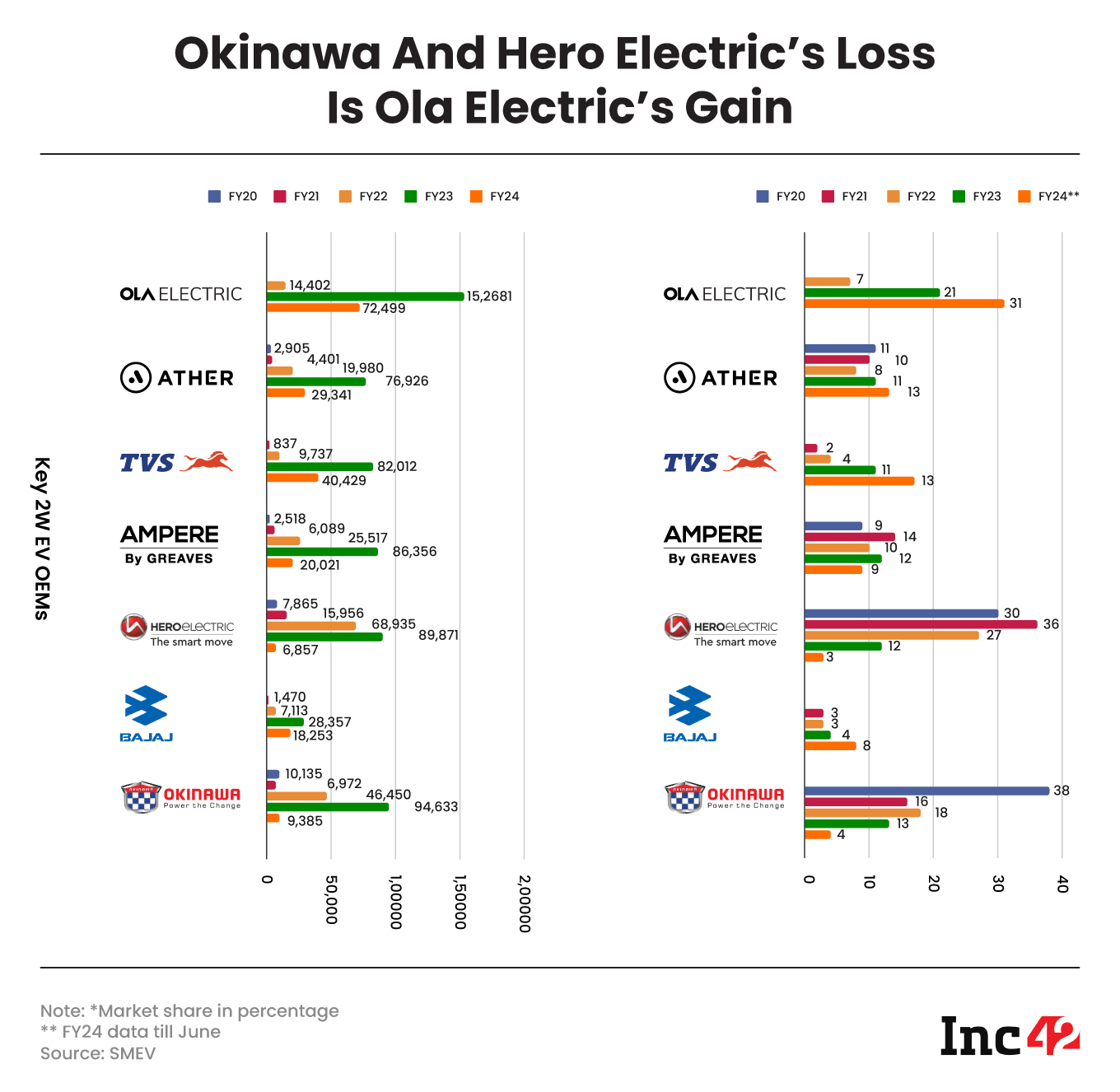

According to data from the Ministry of Transport, Ola Electric has emerged as the leading electric two-wheeler manufacturer over the past year and a half. While Okinawa and others have experienced significant declines in market share, from 38% in FY20 to 4% in FY24 (so far), Ola’s EV business has witnessed substantial growth, capturing 30% market share in just three years.

To maintain its dominant position and further penetrate the market, Ola Electric has outlined ambitious plans:

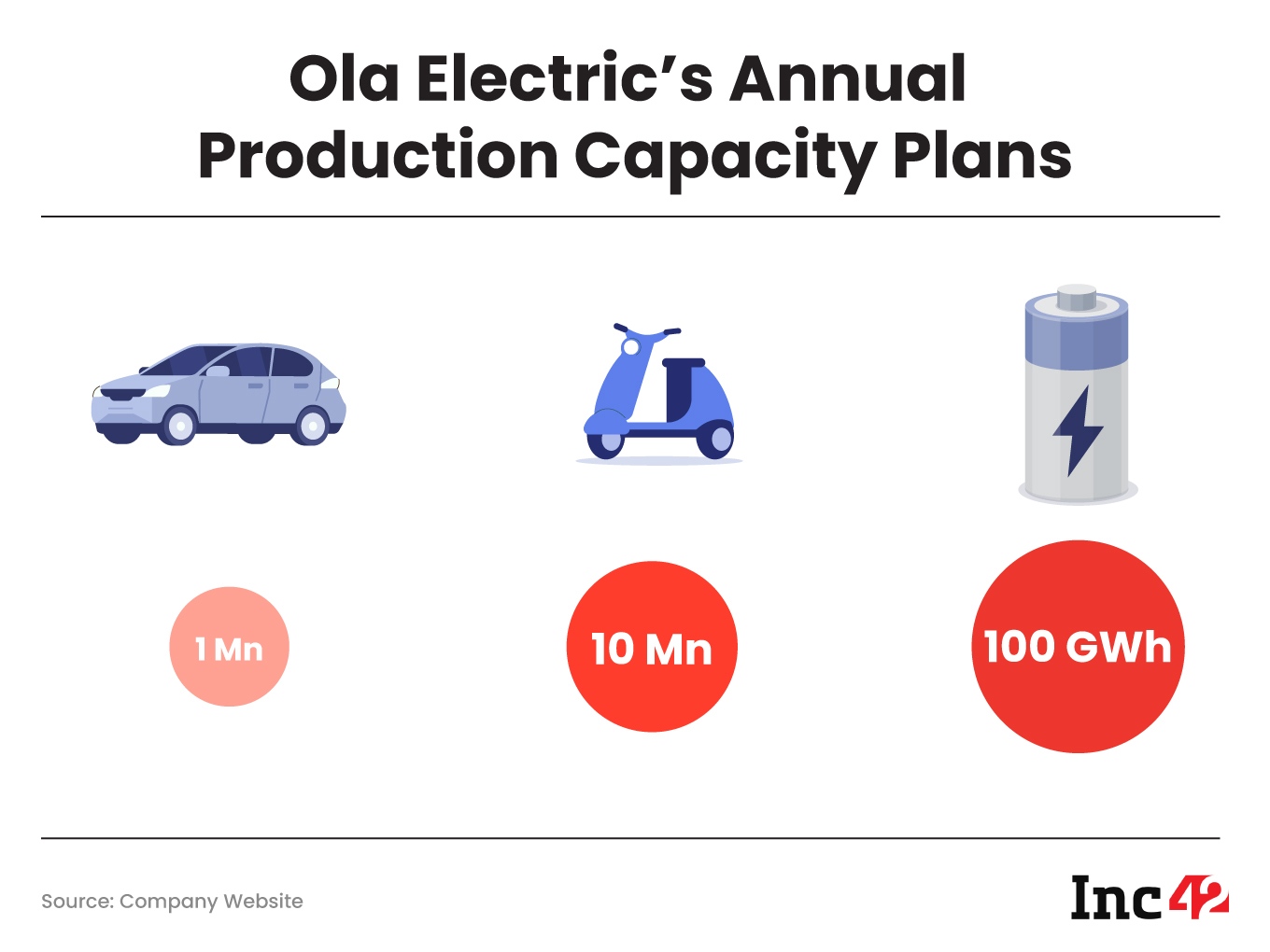

- Constructing the largest ‘future factory’ with an annual production capacity of 1 Mn cars and 10 Mn two-wheelers

- Establishing the largest battery cell manufacturing facility with a capacity of 100 Gigawatt hours (GWh)

- Opening an R&D Innovation Centre in Bengaluru

- Teasing scooters, motorcycles, and cars with impressive on-paper specifications — a range of 500 Km per charge, the ability to charge up to 80% in a 1 hour, or acceleration from 0-100 Kmph in 5 seconds

- Expanding its network of retail experience centres across the country, aiming to reach 1,000 by August 2023

However, executing these ambitious plans requires significant funding.

For instance, Ola has committed to investing INR 7,614 Cr to build battery cells and four-wheeler EVs in Krishnagiri, Tamil Nadu. Additionally, the company plans to invest INR 4,106 Cr in constructing a 500K sqft ‘Battery Innovation Centre’ in Bengaluru.

To build these ambitious projects, Ola Electric intends to raise $800 Mn to $1 Bn by March 2024. Given Ola Electric’s strong market position and a clear product pipeline, experts believe it won’t be a challenging task for the book-running lead managers to meet this target. The company reportedly generated over $1 Bn in revenue in FY23.

Ola Electric’s Plans: Too Big To Be True?

Experts in the automotive space express doubts over the claims made by Ola Electric, stating that some of them seem implausible.

For example, Ola Electric currently has a production capacity of up to 2 Mn scooters annually. The company plans to increase this capacity to 10 Mn scooters per year. However, last year the company sold only around 150,000 scooters.

Dr Deb Mukherji, managing director of Anglian Omega Group and former MD of Omega Seiki Mobility, a two-wheeler, three-wheelers, and commercial EV OEM, said, “India hardly consumes 6 Mn scooters in total. Even if we assume a 50% conversion to EVs, the figures [claimed by Ola Electric] simply don’t add up.”

It’s worth noting that Ola Electric plans to export two-wheelers to the European market, but even accounting for the appetite of the global market and the wider competition, these numbers don’t add up.

For context, a report by Bain & Company estimates 40%–45% EV adoption for two-wheel (2W) vehicles and 15%–20% for four-wheel (4W) passenger vehicles by 2030, with 12 Mn to 13 Mn new 2W EVs and 1 Mn new 4W PVs being sold in India annually by 2030. So how exactly does Ola Electric plan to ship 10 Mn scooters in such a market?

Ola Electric’s Blueprint: BYD

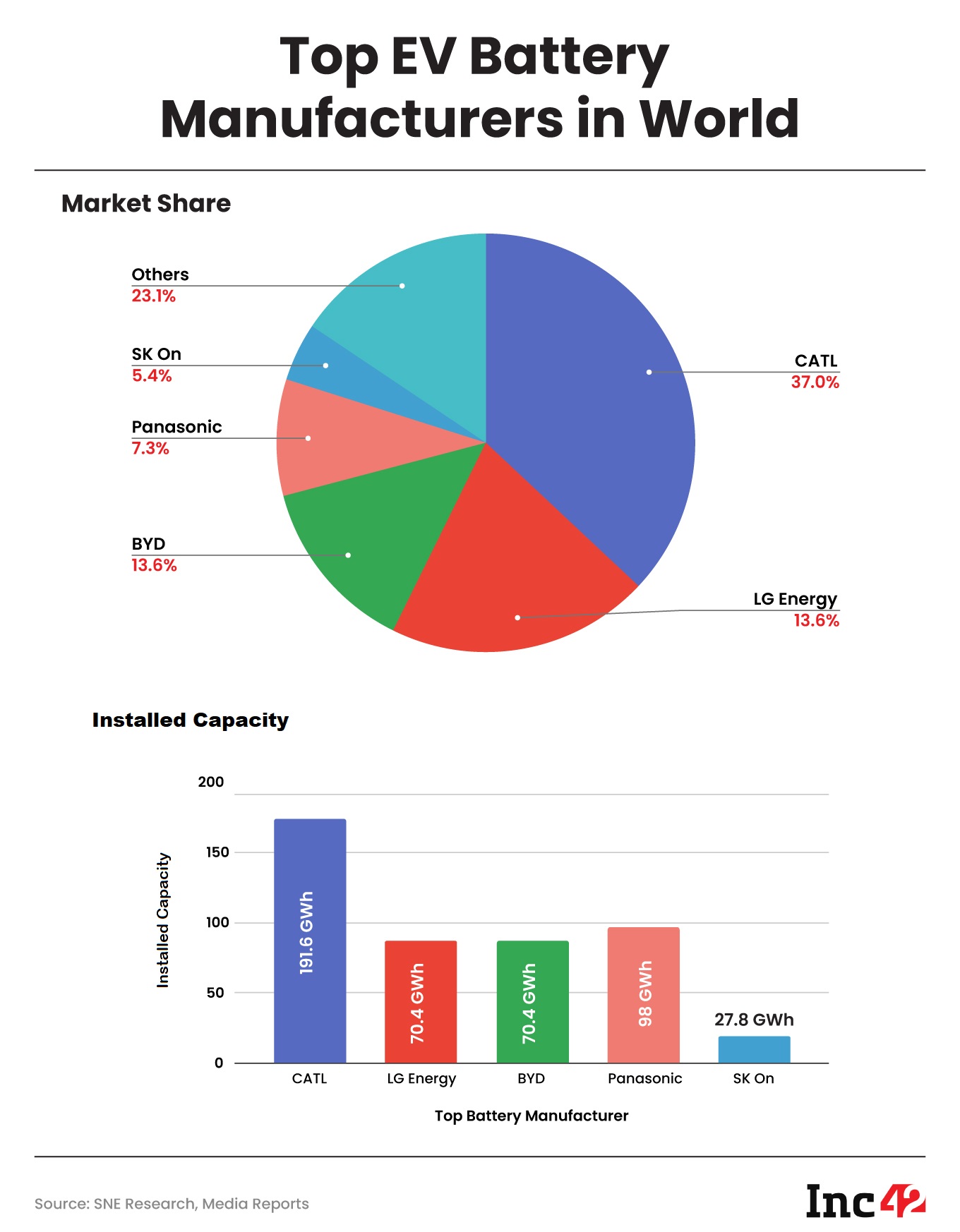

A former employee of Ola Electric, now working for a competitor, told Inc42, “If you look closely, Bhavish Aggarwal is following the path of the Chinese company BYD in order to succeed. Back in 2018, BYD set up then the largest battery manufacturing plant in the world with an installed capacity of 24 GWh, while Ola Electric claims to build a plant with 100 GWh capacity.”

The concern here is that despite BYD’s initial plans to increase its capacity to 60 GWh by 2020 and become the largest manufacturer, the Chinese EV giant has faced challenges in delivering batteries on time. In spite of acquiring significant lithium and cobalt mines in Africa and other countries, BYD has been facing issues in scaling up its manufacturing. Till 2021, BYD had an installed capacity of 26.4 GWh which increased by 167% to 70.4 GWh by 2022 end.

The employee quoted above questioned how Ola Electric plans to achieve these numbers without having direct access to the same raw materials, despite which BYD has not been able to pull off its grand plans.

Seconding him, Dr Mukherji said, “Ola does not have access to these raw materials, so how will they achieve these numbers?”

With its large targets for manufacturing, EV waste management will be a critical factor in Ola’s ambitions. Experts believe this would create a whole host of environmental issues, if not addressed timely. So far, Ola Electric has been mum on managing e-waste.

In light of these challenges, Aggarwal’s lofty claims may only serve to attract investments but not hold a lot of weight in reality.

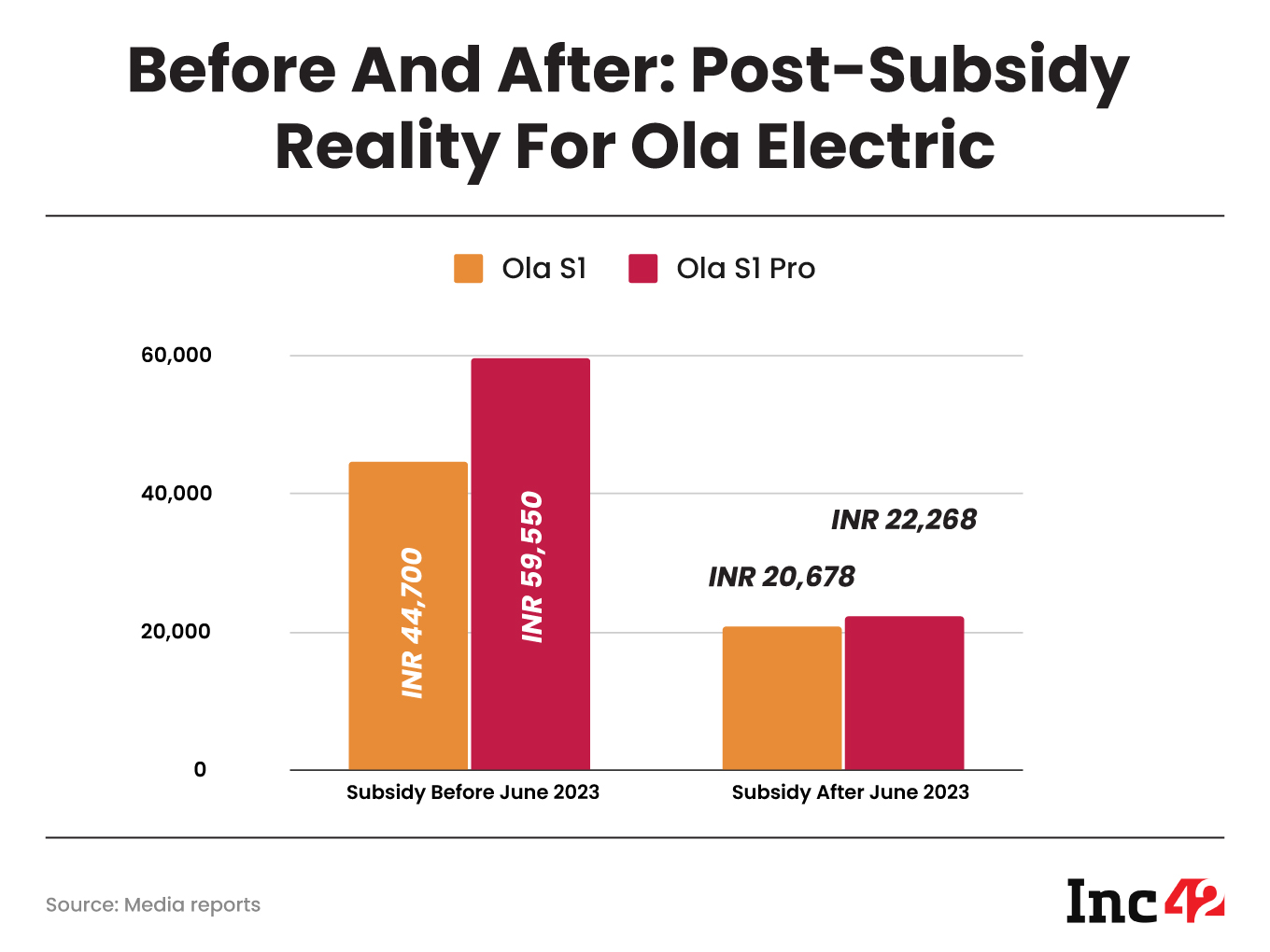

How Govt Subsidies Drove Ola’s Growth

Even while it has led the market, Ola Electric’s sales have declined in recent months by up to 40% — from 28,638 units in May 2023 to 17,590 units in June 2023. This decline can be attributed to the Indian government’s decision to reduce EV incentives for 2-wheelers from 40% to 15%.

Prices of Ola S1 and Ola S1 Pro have increased from INR 1 Lakh and INR 1.25 Lakh to INR 1.29 Lakh and INR 1.39 Lakh respectively.

The fate of Ola Electric scooters after the complete removal of FAME II subsidies remains uncertain, as it does for the rest of the market. The government’s plan for launching FAME 3.0, following the expiration of FAME 2.0 on March 31, 2024, is still unclear. So EVs, which attracted an automatic discount for consumers, may not be as attractive from a price point-of-view.

According to sources, the chances of a new subsidy scheme are slim, considering the government’s announcement of an INR 18,000 Cr package under the PLI scheme for battery and component manufacturing. Additionally, a lack of compliance with the rules of the existing scheme by two-wheeler OEMs may deter the government from introducing a new scheme.

After an investigation under the FAME scheme, Ola Electric agreed to refund INR 130 Cr to over 1 Lakh consumers for the cost of chargers, for which the company had previously charged separately.

Sources close to the company alleged that these chargers were sold separately and are priced at around INR 15,000. If the charger had been included with the Ola scooter from the beginning, the company would not have been eligible for the FAME II incentive. “The sale numbers would have been halved,” one of our sources added.

The reliance on government incentives and subsidies raises concerns about Ola Electric’s self-reliance once these support systems are removed, leaving the market without clarity, according to Umesh Chandra Paliwal, cofounder and CEO of Unlisted Zone.

Is Ola Electric Overvalued?

“Ola Electric’s $10 Bn valuation is not sustainable in today’s market,” – Umesh Chandra Paliwal, cofounder, UnlistedZone

Paliwal expressed doubt about Ola gunning for a huge valuation, saying that investors were uncertain about their valuations when new tech companies like Paytm, Zomato, and Nykaa entered the market.

However, now that their performance is evident, it’s critical that companies planning an IPO have strong financials, including bottom-line profitability and positive cash flows, not just high top-line revenue or GMV.

Hero MotoCorp, the world’s largest two-wheeler maker in the internal combustion engine (ICE) sector, is currently valued at around $7 Bn for context, Paliwal added. Meanwhile, Bajaj Auto, the world’s third-largest two-wheeler maker in the ICE sector, is valued at $16.7 Bn. So the reported IPO valuation for Ola Electric is definitely richer than some of the more established players that have built large manufacturing and distribution networks.

While ICE companies like Bajaj, TVS, and Hero MotoCorp are mostly recognized for their traditional offerings, Ola Electric’s valuation could potentially be justified due to the technology that the company has built and acquired.

If ICE OEMs are valued at 2-3.5 times their revenue, Ola Electric, which is an EV disruptor, can justify its current valuation of $6 Bn.

Pankaj Passi, a partner at Pro Legal Solutions, acknowledges that the global shift towards sustainable transportation and growing environmental concerns have contributed to the rise of electric vehicles (EVs) worldwide. Companies operating in the EV space often attract higher valuations and multiples due to their potential to disrupt traditional industries and tap into the expanding EV market.

When comparing Ola Electric with established two-wheeler companies like Hero and the Bajaj Group, it is crucial to recognise that Ola Electric is a relatively new player in the automotive sector.

Hero and Bajaj have successfully gained significant market share in the two-wheeler industry, building strong brands, loyalty, trust, and a solid customer base. Despite their market dominance, these companies typically trade at revenue multiples of 2X-4X, highlighted Passi.

Ola Electric’s estimated valuation of approximately $10 Bn is based on the company’s future plans for 2025-26.

Venture capitalists are willing to pay a premium price, knowing they are investing in the future. However, Paliwal suggests that public market investors would exercise caution after observing the experiences of Nykaa, Zomato, and Paytm. Typically speaking a long product roadmap would require multiple years of investment, which would hamper Ola Electric’s potential for profits.

While Ola Electric may rely on Tata Passenger Mobility Ltd for valuation benchmarking, Paliwal notes that it may not serve as a direct comparison for evaluating Ola Electric’s valuation. Each company operates in differentiated segments which have unique market dynamics and distinct competition.

Despite reports of Ola Electric generating $1.2 Bn in revenue for FY23 and turning profitable in the last quarter of the fiscal year, the company has yet to even file its financials for FY22. We have to take these claims with more than a pinch of salt.

Paliwal argues that revenue figures alone do not provide a complete picture, citing the case of BYJU’s and PharmEasy, which reported substantial revenues but experienced significant drops in valuation. He emphasised that bottom-line profitability and consistent financial reporting are really the only true benchmarks for the right valuation of a company.

Consistent reporting of financials shows good corporate governance. Currently, Ola Electric does not have a great track record for this. Before filing its DRHP, experts believe that Ola Electric needs to consistently report its financials, which shows the company is being transparent in its disclosures and is actually ready for a public listing and the spotlight from regulators.

Can Ola Electric Cross The Two Ts: Trust & Technology?

Tata Passenger Mobility Ltd drives its brand value from the century-old brand ‘Tata’ which is known as one of the most trustworthy brands in India. The same could be said for the likes of Hero, Bajaj and others in the OEM space.

In contrast, Ola drives its brand value from Ola Cabs, which is only a decade old. Neither Ola Cabs nor Ola Electric has anywhere near the trust that has been garnered by Tata and others.

Besides ANI Technologies saw a whopping 150% decline in revenue for FY22, due to the overhang from the Covid pandemic.

Paliwal says, “When you go to Twitter, and other social media and search Ola, you will find that there are numerous complaints. For no other EV brand, you would find such a high number of complaints. The problem is they have scaled so fast that they have not concentrated on the performance. And, if the performance is not good, there will be a huge trust deficit sooner or later, which may backfire.”

In the automotive sector, trust comes from strong after-sales services, and despite having sold lakhs of scooters across the country, Ola Electric is struggling to meet expectations in this regard.

The former employee quoted earlier in the story added, “There are trust issues within the company too. You have to be a ‘Yes Man’ to Aggarwal or you’ll become a nobody. This is why almost two dozen top executives have left the company within a short period of time, including a cofounder, HR head, production head, and many others.”

Finally, the heart of the EV industry is technology, and technology is still evolving. At a time when Ola Electric is building Lithium-ion battery manufacturing plants, battery technology seems to be slowly moving to sodium and aluminium air batteries.

“It’s not unsurprising that Honda and Suzuki are slow towards the adoption of EVs. They do the in-house testing of their technologies, at least for five years before launching into the market. Ola Electric is not even five years old since it started manufacturing. Can its technology really bring trust?” asked Anglian Omega’s Dr Mukherji.

In the automobile industry, building a good product is not enough. Consistency and high levels of excellence are just as critical. It is not like building software that can be easily replicated. This can’t happen without developing a resilient ecosystem.

Ola Electric has reported some very impressive results. However, its products and its numbers are not time tested as seen in the case Honda, Toyota, Elon Musk’s Tesla or even Indian automotive giants.

Clearly, Ola Electric needs time. Is an IPO coming too soon?

Ad-lite browsing experience

Ad-lite browsing experience