Despite many positive developments within the electric vehicle industry, the EV financing market is marred with several fundamental challenges

These challenges range from higher interest rates for non-premium vehicle categories to a general lack of understanding about EVs and apprehensions about their battery life

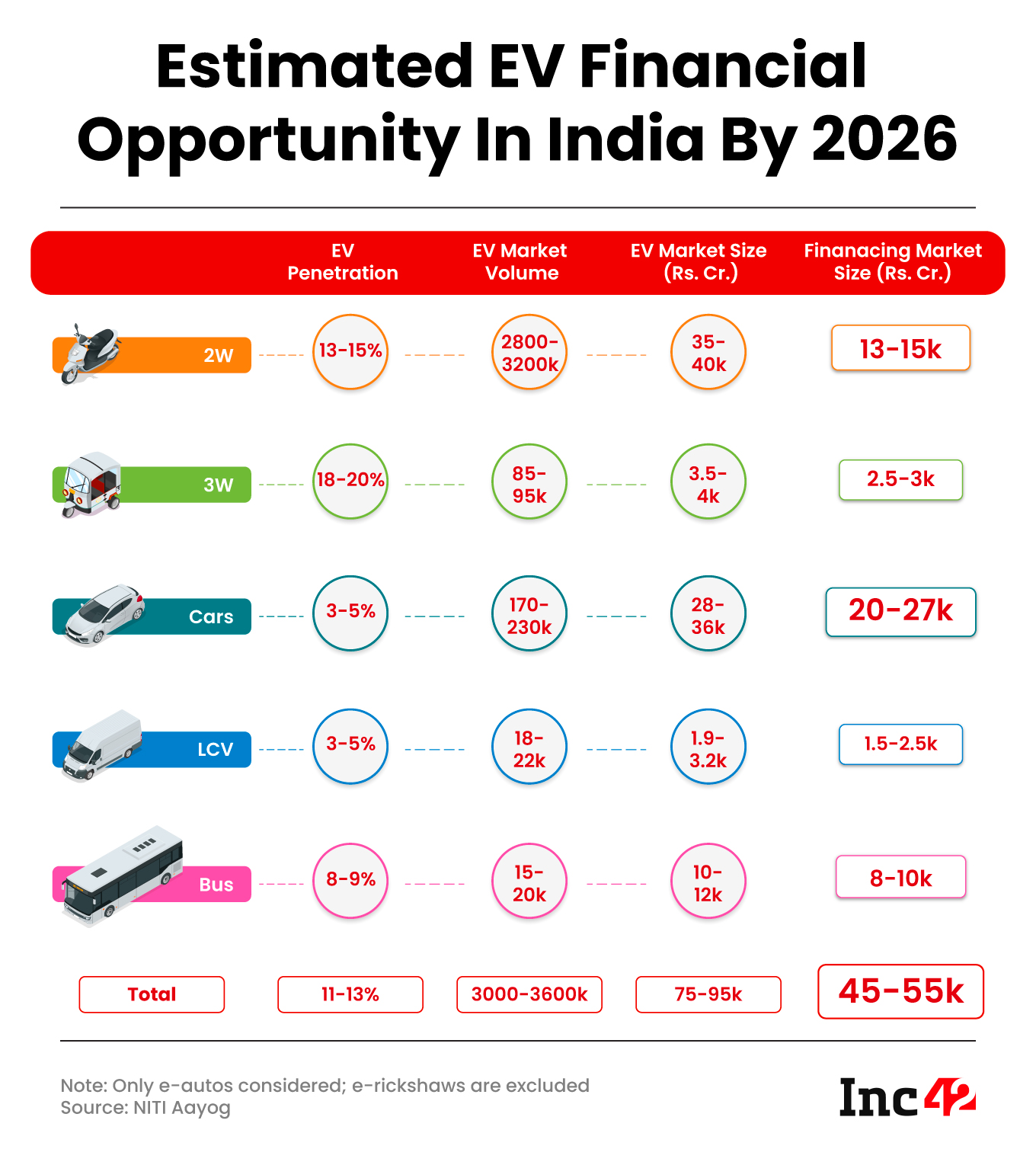

As per NITI Aayog, the two-wheeler EV market size is going to be as large as INR 35K Cr-INR 40K Cr by FY26, with the EV financing market for this segment expected to touch INR 13K Cr-INR 15K Cr by then

With the increasing adoption of electric vehicles (EVs) in India, the financial landscape supporting this emerging technology has evolved significantly in recent years. Banks, non-banking financial companies (NBFCs), and fintech startups are now collaborating to provide various financing options, reducing the initial costs associated with purchasing EVs.

Notably, there has been a surge in collaborations between EV original equipment manufacturers (OEMs) and lenders to improve access to loans for EV buyers. For instance, Ather Energy, a prominent electric scooter manufacturer, has recently partnered with Bajaj Finance, IDFC First, and Hero FinCorp to offer 60-month electric two-wheeler loans to EV buyers.

Similarly, Ola Electric has entered into partnerships with Shriram Finance and other financial institutions to facilitate vehicle sales through accessible loan options.

In the commercial vehicle sector, Omega Seiki Mobility has joined forces with Punjab National Bank to assist its dealer partners in providing enhanced retail financing solutions to customers.

Despite these positive developments within the vehicle industry, the EV financing market still faces several fundamental challenges, according to the industry experts that Inc42 spoke with.

Notably, these challenges range from high-interest rates to a general lack of understanding about EVs and apprehensions about their battery life.

On World EV Day, we aim to explore the reasons behind the reluctance of traditional NBFCs and banks to offer EV financing options. Additionally, we will discuss how these issues could be addressed to accelerate India’s EV ambition.

Before delving into the complexities of these challenges and the opportunities they present, let’s take a brief look at the landscape EV financing in India.

We must note that these players are some of the pioneers in the EV financing market, which, as per last year’s NITI Aayog report, is expected to grow to over INR 45k Cr-INR 55K Cr by 2026.

EV Financing In A Complex Landscape

The loan market for internal combustion engine (ICE) vehicles has evolved over several decades, while the EV industry is relatively new. This makes it complex for both loan providers and consumers to determine the resale value and lifespan of an EV.

Another significant challenge is the absence of a robust second-hand market for EVs, making the resale value more uncertain compared to ICE vehicles. This uncertainty often renders traditional term loans less suitable for EVs, prompting financiers to avoid such risks.

Moreover, due to the perceived higher risks associated with EVs, interest rates for EV loans are generally higher than those for ICE vehicles, particularly in the non-premium categories. Hence, this discrepancy is particularly noticeable in the case of electric three-wheelers and low-speed two-wheelers.

According to the NITI Aayog report from the previous year, depending on the vehicle segment, the down payment for EV loans can be up to 20% higher, and EMIs can reach 1.5-1.8X that of ICE vehicles. This applies to short-term loans too.

Additionally, the cost of batteries constitutes a significant portion (40%-50%) of the total EV cost, yet they have a shorter lifespan. Consequently, it becomes essential to offer tailored financing solutions for different types of EVs.

Has The Industry Matured Enough?

Speaking with Inc42, Sandeep Divakaran, ED and CEO of Greaves Finance, highlighted the unique nature of EV financing compared to traditional vehicle financing. He emphasised that understanding the lifespan of Li-ion batteries in various vehicles, taking into account factors like ride conditions, usage patterns, and ambient temperatures, is crucial in assessing the overall longevity of EVs.

To address this, Greaves Finance has adopted an asset lifecycle management approach. This method allows the NBFC to gain a comprehensive understanding of battery performance over time, enabling the provision of customised solutions to customers, rather than relying on traditional loans.

Not only this, the approach also enables the company to predict the resale value of EVs to encourage greater adoption of these vehicles.

Similarly, Bengaluru-based EV financing startup Vidyut Tech has taken a distinct approach by separating the financing for batteries and vehicle chassis. This separation allows Vidyut to offer tailored financing solutions, specifically designed for commercial L5 vehicle buyers.

Xitij Kothi, the cofounder of Vidyut, opined that in the EV context, the upfront cost of the vehicle is higher due to the battery, and assessing the vehicle’s residual value is complex, given battery lifespans vary based on usage and other factors.

To address this issue, Vidyut provides batteries on lease to customers.

However, this is not followed by most EV financers, particularly traditional banks and non-EV focussed NBFCs, which makes their financing products less suitable for commercial three-wheeler buyers.

While banks like SBI, Axis Bank, and HDFC Bank provide EV loans at lower interest rates compared to ICE vehicles, they are often for four-wheelers and premium category two-wheelers.

Pankaj Gupta, the CEO of Mufin Green Finance, opined that customers of EV players like Ola Electric, Ather Energy, or TVS Motor, who largely have good CIBIL scores, do not face many challenges in getting loans from banks. However, these banks hardly provide loans to the buyers of e-rikshaws, e-autos, or electric three-wheeler cargos, as a majority of these users are largely new to credit and bring more risk to the table.

“This is where NBFCs and other financing startups are trying to find their niche today,” Gupta added.

Here, it is pertinent to note that the borrowing cost of NBFCs is high. There is an augmented asset and credit risk associated with financing these EVs, leading to users paying a higher interest rate while repaying loans.

As per last year’s NITI Aayog, NBFCs charge 1%-7% higher interest rates for passenger EVs compared to ICE vehicles and 1%-8% higher rates for cargo EVs compared to commercial ICE cargo vehicles. Furthermore, the loan tenure for EVs is generally shorter, ranging from 24-42 months compared to 24-60 months for ICE vehicles.

Banks offering loans for electric two-wheelers in both low- and high-speed segments charge 1%-4% higher interest rates compared to ICE vehicles, while NBFCs impose 1.5%-3% higher interest rates than ICE vehicles.

This disparity becomes more glaring when three-wheelers and commuter two-wheelers are leading the charge in EV penetration in India. Of the 9.9 Lakh EVs sold in India so far in 2023, 57% were electric two-wheelers, while three-wheelers comprised 37%, as per Vahan data.

However, according to experts, the existing disparity in the EV financing ecosystem, pertaining to repayment terms, can be solved to a great extent if the government brings the EV industry under the ambit of priority sector lending, which is a long-pending demand for EV players. Besides, this will also increase the scope for lenders to spread across the EV ecosystem.

How Priority Sector Lending Status Could Speed Up EV Adoption

Mufin Green Finance’s Gupta believes that bringing EVs under priority sector lending will give a big boost to EV adoption in the country as capital will increase. He added that many investors will then be willing to expose their capital to risky products like EVs.

Echoing similar sentiments, Kothi said that once EVs come under priority sector lending, major lenders will look forward to deploying their capital in the segment.

“Bank will deploy capital either via their existing NBFC partnerships or they will partner with EV financing startups, which will definitely increase the supply of capital and liquidity in the market. However, this might not have a direct impact on bringing down the interest rates.” Kothi said.

We must note that in January 2022, NITI Aayog and Rocky Mountain Institute (RMI) and RMI India released a report outlining the importance of priority-sector recognition for retail lending in the electric mobility ecosystem.

The former CEO of the government think tank, Amitabh Kant had said that financial institutions have an important role to play in accelerating the adoption of EVs in India.

“RBI’s PSL (priority sector lending) mandate has a proven track record of improving the supply of formal credit towards areas of national priority. It can provide a strong regulatory incentive for banks and NBFCs to scale their financing to EVs,” the former CEO of Think Tank had said then.

Meanwhile, Greaves Finance’s Divakaran says that once the priority sector lending norms come into the picture, it will not only increase the capital but also bring down the cost for end consumers.

While this was one of the major demands of the industry in the Union Budget of 2023 as well, no such announcements were made by the Finance Ministry.

Nevertheless, some updates are expected on this front in a few months.

Moving on, a few other policies and regulations also need changes to address the fundamental challenges in EV financing, and the disparity in GST rates is one of them.

While Li-ion batteries, separate from vehicles, attract an 18% GST, vehicles, along with batteries, are taxed at 5%. But if the industry has to emphasise looking at options to finance batteries separately from vehicles, bringing the battery GST rate on par with the vehicle would go a long way in giving a boost to EV adoption.

What’s At The Core Of EV Financing Opportunities

As per NITI Aayog’s data, the two-wheeler EV market size is going to be as large as INR 35K Cr-INR 40K Cr by FY26, leading to a financing market size of INR 13K Cr-INR 15K Cr.

While the challenges are many, we must note that there has been an exponential increase in the number of financing options available for EVs in the last 2-3 years. An increase in the number of financing startups and NBFCs as well as certain government policies, have made this possible.

In the case of electric four-wheelers, green loans offered by the likes of SBI and Union Bank allow a 20-25 basis points (bps) discount, along with a higher tenure of up to 10 years.

Besides, under Section 80EEB of the IT Act, electric car buyers can claim tax savings of up to INR 1.5 Lakh on interest paid towards the EV loan.

Earlier this year, the Small Industries Development Bank of India (SIDBI) launched a financial scheme to fund the purchase of 50K EVs in the country.

Though the government has rolled out various other policies to push the adoption of EV two- and three-wheelers, these segments are yet to receive major support from state governments.

According to Sushant Kumar, founder and MD of AMO Mobility, the low-speed electric two-wheeler segment is in dire need of financing.

“With proper and timely access to financing solutions, we can make two-wheelers more affordable and boost the overall EV segment’s growth,” he said.

Ad-lite browsing experience

Ad-lite browsing experience