Investors expect a shakeup in 2022 and 2023, as startups amass capital and high valuations

Dear reader,

You may have noticed something different about the startup ecosystem this year. Everyone’s flush with capital and there’s unbridled optimism in the air.

This is when things start to get tricky.

Troughs in the startup landscape are more regularly seen in the immediate aftermath of a funding glut.

Analysis that we did last year shows that out of 3.1K Indian startups funded between 2014 and June 2020, 385 startups have shut down operations. Bear in mind those are startups that received VC backing, cumulatively squandering $760 Mn worth of capital.

During the peak of the dotcom bubble, VC funding in the US startups had reached a record high of $66.4 Bn (2000) but by 2002 when the bubble burst, capital inflow fell to below $20 Bn annually and then stayed more or less the same for the next 11 years.

Closer home, we saw this in 2016, when 11 startups shut down in two months after the funding boom in 2015. Thereafter, startup funding hovered around the $12 Bn mark annually, and only rocketed up in 2021, where just in the three months of July, August and September, over $17.1 Bn was raised.

Paper Unicorns?

Overall, this year we have seen over $33.8 Bn in funding. It’s a staggering number that is on course to eclipse the total funding raised in the three years between 2018 and 2020. Naturally, it’s been breakneck and it’s also brought in a mind-boggling 35 unicorns, with the entry of Zomato and Tata-backed Curefit and MyGlamm this week.

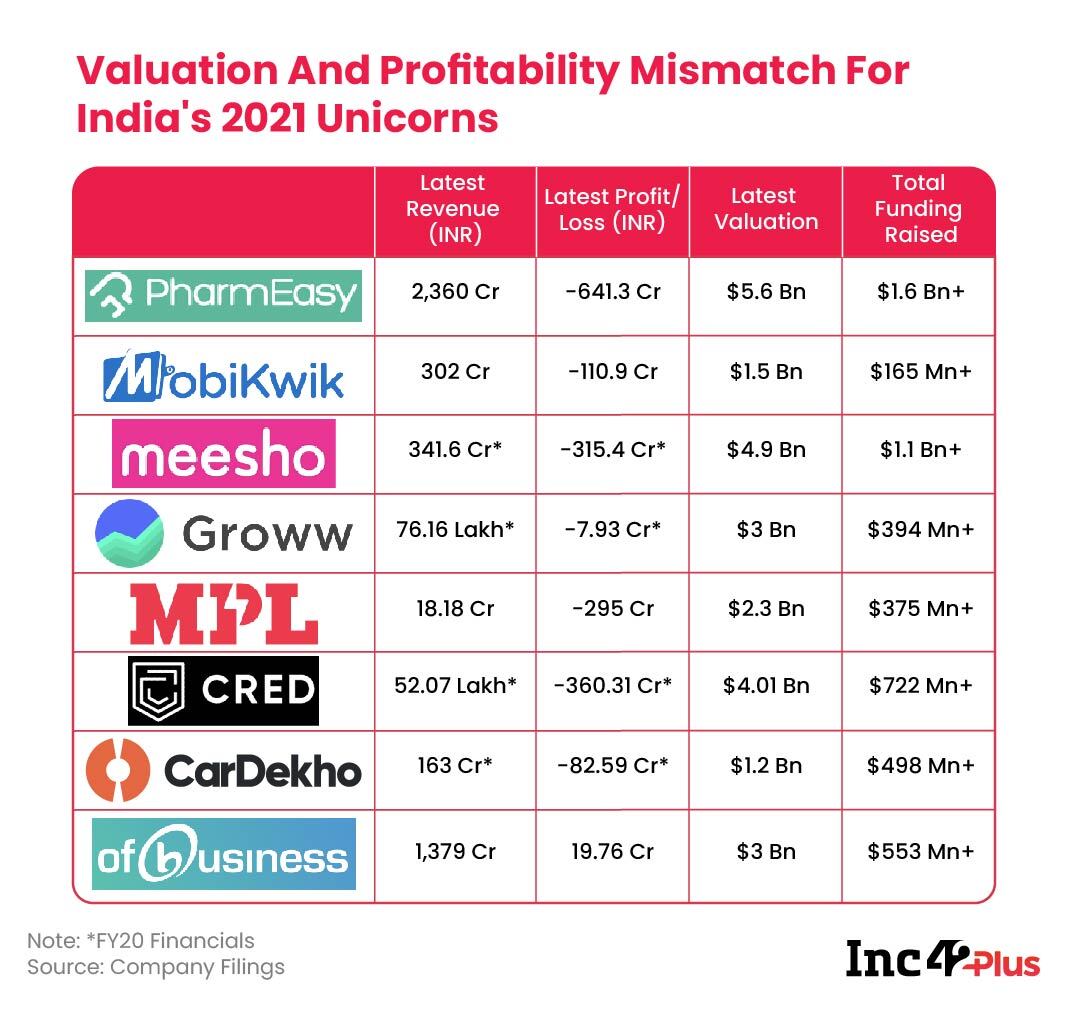

Like one analyst told me, the $1 Bn valuation club startups are now as ubiquitous as cows rather than unicorns. Because the real rare find is a profitable company.

When viewed through the lens of what has played out in the past, there’s a question of a funding bubble or a valuation bubble at the very least. If unicorns are dime-a-dozen, do we need to look at such companies from the point of view of revenue and not just valuation.

In new sectors, some of the valuations are astronomical and joining at such high valuations means acquiring minority stakes, unless it is a PE investor with seriously deep pockets. This is not attractive enough for investors.

Investors still want startups at reasonable valuations, which is simply not the way the market is trending. And even if some sectors allow cheap entry points, these are soon exhausted — look at the spate of investments in Thrasio-like platforms, which has now sent valuations in a tizzy in that space.

On the startup side, founders face the problem of plenty — having too much capital and not knowing what to do with it at times. They would seek more patience from investors, which may not always be available.

Investors told me there will be a shakeup in 2022 and 2023, when we will see mass consolidation in enterprise tech and ecommerce sectors, after the heights of 2021. The same pace of funding cannot be sustained and either startups will fall by the wayside due to non-performance or will be snapped up mid-development by bigger rivals.

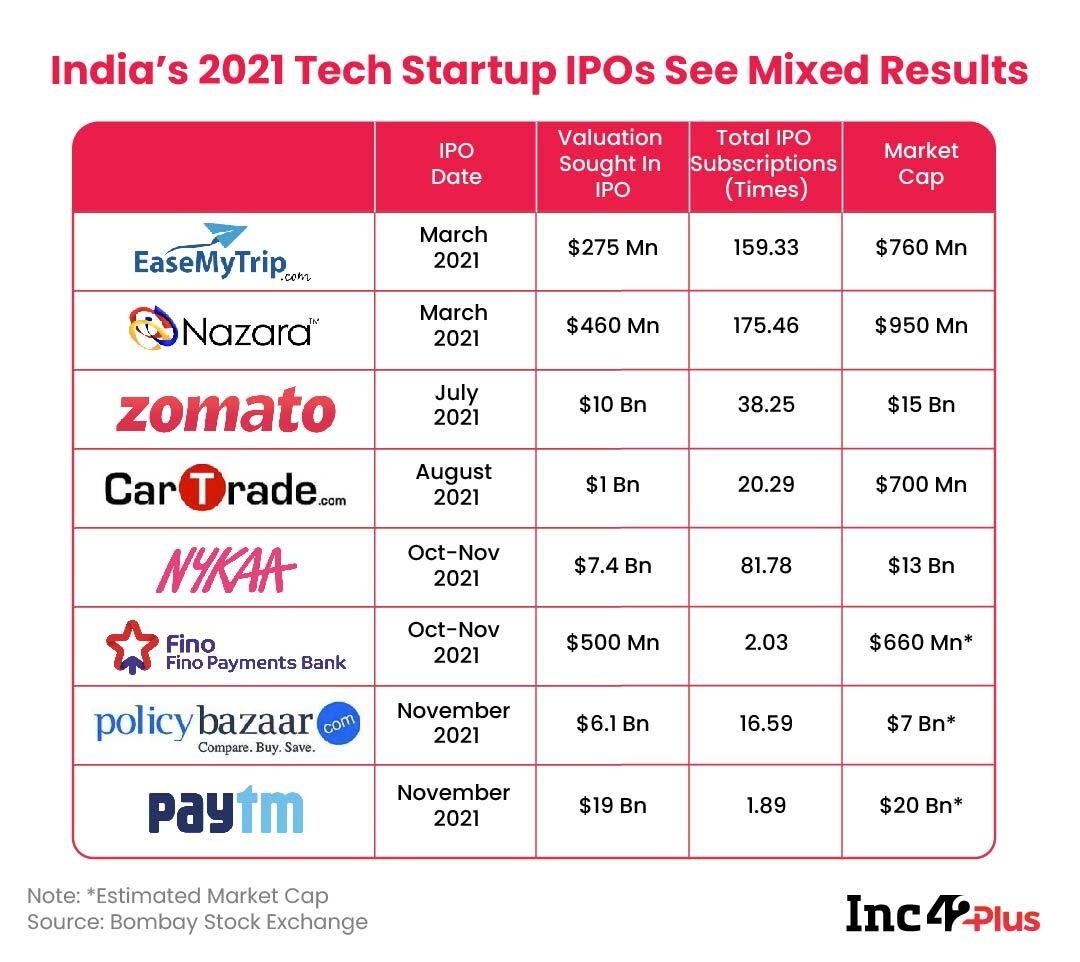

The IPO Valuation Hype

Concerns and scepticism about valuations were also manifested in the rather lukewarm reception for Paytm’s INR 18,300 Cr ($2.2 Bn) IPO, touted as India’s largest. In the run up to the IPO, many investors had cautioned about the potential overvaluation of Paytm, when the company sought a valuation of $19.5 Bn – $20 Bn in the IPO.

Paytm even said it could have IPO’d at a higher valuation, but the company claimed it does not “believe in getting every last dollar of valuation”.

Aswath Damodaran, valuations guru and professor of finance at the Stern School of Business, New York University, has been one of the more vocal critics of Indian startup valuations, particularly around the public offerings. He had raised some concerns about the ultra-high valuations of Zomato and Paytm.

Damodaran said he believes that investors should only have a minor allocation in their portfolio for Paytm and the likes, while also keeping a close eye on the company’s actions, financial performance in each quarter as well as the trends in the fintech domain and whether Paytm is capable of capitalising on them.

One of the cited factors behind the big parade of IPOs in India is the abundant liquidity in the market. But is this drying out now? The subscription track record of recent IPOs — Nykaa, excepted — is not great. The size of the Paytm IPO may also have daunted some investors.

IPO subscription performance is not everything though. Paytm is still a good bet in the long run, according to Santosh N, Managing Partner, D and P Advisory. He also raised a great point about how in 2018, when Paytm raised money from Berkshire Hathaway, it was valued at $16 Bn. One can only assume that a shrewd investor such as Warren Buffett had seriously drilled down on the valuation.

And now consider the leaps taken by Paytm since 2018. It has seriously beefed up its lending business, diversified beyond UPI payments (which does not bring in revenue), focussed on merchant services — so does a $19 Bn valuation for the IPO in 2021 seem too lofty?

Buffett, incidentally, saw a 68% ROI from Paytm’s IPO for its 2.8% stake in the company, but again that does not mean a retail investor should bet big on Paytm. The first and foremost problem is the lack of profits.

Dude, Where’s My Profit?

Profitability means controlling costs while scaling up revenue, which is proving a hard balance for startups, even those which have massively deep pockets. Just one profitable company among the 10 highest valued tech startups and the sheer lack of profits among the newest unicorns — it’s telling.

When it comes to digital services and products, marketing and advertising costs are usually quite high coupled with high costs for talent and employees, but according to valuation experts, the former is not necessarily a bad thing and the latter will even out in the long run as the talent pool expands.

Traditional companies would spend on building up their assets and manufacturing, while tech startups have asset-light models and spend on marketing. Those real world assets have been considered an advantage for traditional companies, but the ability of tech startups to build their business through marketing has always been seen through a negative lens. If anything, it is a blessing since expansion requires less capital.

The overall funding boom helps companies expand, scale and hire more but it comes with a catch. If the long-term financials are not great, despite a long rope, there are likely to be consequences such as distress sales or other forced exits.

While every PE or VC investor works in a different manner, there’s a certain herd mentality even in their world. It’s great to see capital flowing in and valuations rise now, what no one wants is a blow-up or a bubble. Because then the herd mentality is likely to kick in and investors are prone to withdraw into their shells or become highly stingy — even good companies then will not get funded.

At the moment, there are no alarm bells ringing. The feeling is that startups and investors will cross that bridge when it comes.

So perhaps, the fears of high valuations may not be all that justified yet. The peril in this is believing that we have seen the last of the impact of the pandemic. There may be more shocks in store, so perhaps startups should look to save water while it’s pouring.

Till next week,

Nikhil Subramaniam

Images: Gayatri Sharma

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Startups & Their Valuation Towers-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience