Global investors are betting on India’s large base of schoolgoing kids, and fuelling the valuation of Indian edtech companies, but can Indian households afford this new shift?

Despite their claims about affordability and targeting the right income groups, edtech startups cannot run away from the fact that many edtech users have had to avail loans to gain access

The future of online learning hangs in the balance as investors and education experts question the true addressable base for edtech products given the income disparity in India

“I never expected that a laptop is very important as of now. I don’t have a laptop and am unable to appear for practical papers. I am afraid I may fail in these papers. Our family is completely in debt so there is no way to buy a laptop. I am not sure whether I will be able to complete my graduation due to lack of financial support.”

On November 2, 2020, Aishwarya Reddy, a second year student at Delhi University’s Lady Shri Ram College for Women took her life. A few weeks before that, Aishwarya had written the above words in an email to Bollywood actor Sonu Sood.

As news reports emerged about the extreme step she felt forced to take, it highlighted the dark reality that haunts India’s sunrise sector — edtech.

The untimely demise of a brilliant 19-year-old student is tragic and unfortunate as it is, but Aishwarya’s death is indicative of a deeper chasm in Indian society that even the so-called digital age is not able to overcome. Despite the talk of edtech democratising access to education in daily press releases, IPL ads and brand-building exercises, the reality is that it remains a right only of the privileged. Aishwarya had topped her class 12 exams, and secured a paid scholarship from the Ministry of Science and Technology. Yet, access was a problem.

Fuelled by the pandemic, India’s edtech segment has seen a massive uptick in demand in 2020. As students are forced to move their classes online. According to Inc42 Plus analysis, the market size of edtech in India is estimated to grow 3.7x in the next five years, from $2.8 Bn (2020) to $10.4 Bn (2025). Global investors are betting on India’s large base of school-going kids, and fuelling the valuation of Indian edtech companies. At the top sits Indian edtech’s posterboy BYJU’S, with its current valuation of $11 Bn. When BYJU’S was launched in 2011, its animated videos and gamified learning methodology was a novelty that caught many eyes. It was seen as a great leveller for students in the country’s nascent edtech market at that time, but this has certainly changed now.

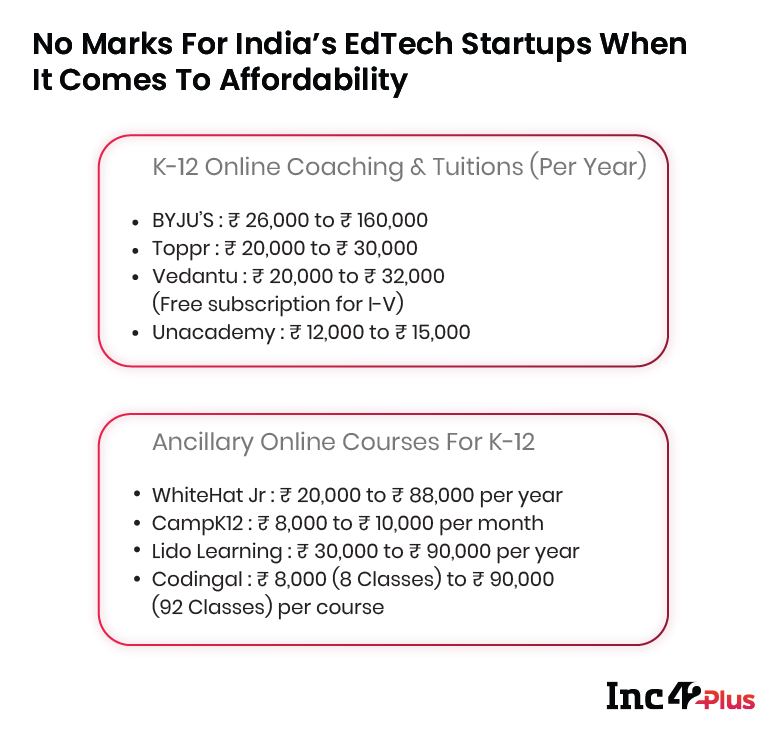

Today, a BYJU’S online course can cost anywhere from INR 26,000 for primary schools courses, to INR 85,000 for high school courses. The coveted JEE and NEET courses can cost a whopping INR 1.6 lakh. Other edtech products are no different.

Mumbai-based Toppr, which offers online courses for grades 5 to 12, estimates that out of the 250 Mn school-going students in India, around 40% would become edtech users by 2025. Its courses are offered at two different price points — the basic “learn+practice” priced at around INR 20,000 per academic year, while the advanced package which offers one-on-one tutor sessions, costs INR 30,000 per academic year for all classes.

The startup claims that 15 Mn students would be paying for edtech subscriptions or value-added products and services by 2025 to supplement their learning. According to Toppr COO Prabhdeep Bedi, most of its users access the app using mobile devices, which is how the majority of India’s 500 Mn-plus active internet users go online. “Online learning is especially relevant to middle to lower-income households due to its convenience and affordability. In fact, 70% of our traffic comes from Tier2/3 cities,” he added.

But it’s hard to understand this optimism, given the income disparity in the Indian society. And if indeed, this is a major stumbling block for edtech startups, then are their towering valuations built on faulty foundations?

Edtech Hits India’s Income Wall

The latest Inc42 Plus report on the edtech sector estimated that startups had enrolled around 335 Mn students — including overlap in users — by the end of 2019, even before the boom in 2020. And now that online learning is slowly becoming a default mode of learning, the average Indian household is also expected to shell out more for edtech courses and services, not just for school fees. Beyond the cost of learning materials and courses is the cost of access — high-end devices, speedy broadband internet, and value-added subscriptions to edtech services.

That’s where the first challenge for India’s booming edtech industry comes in:

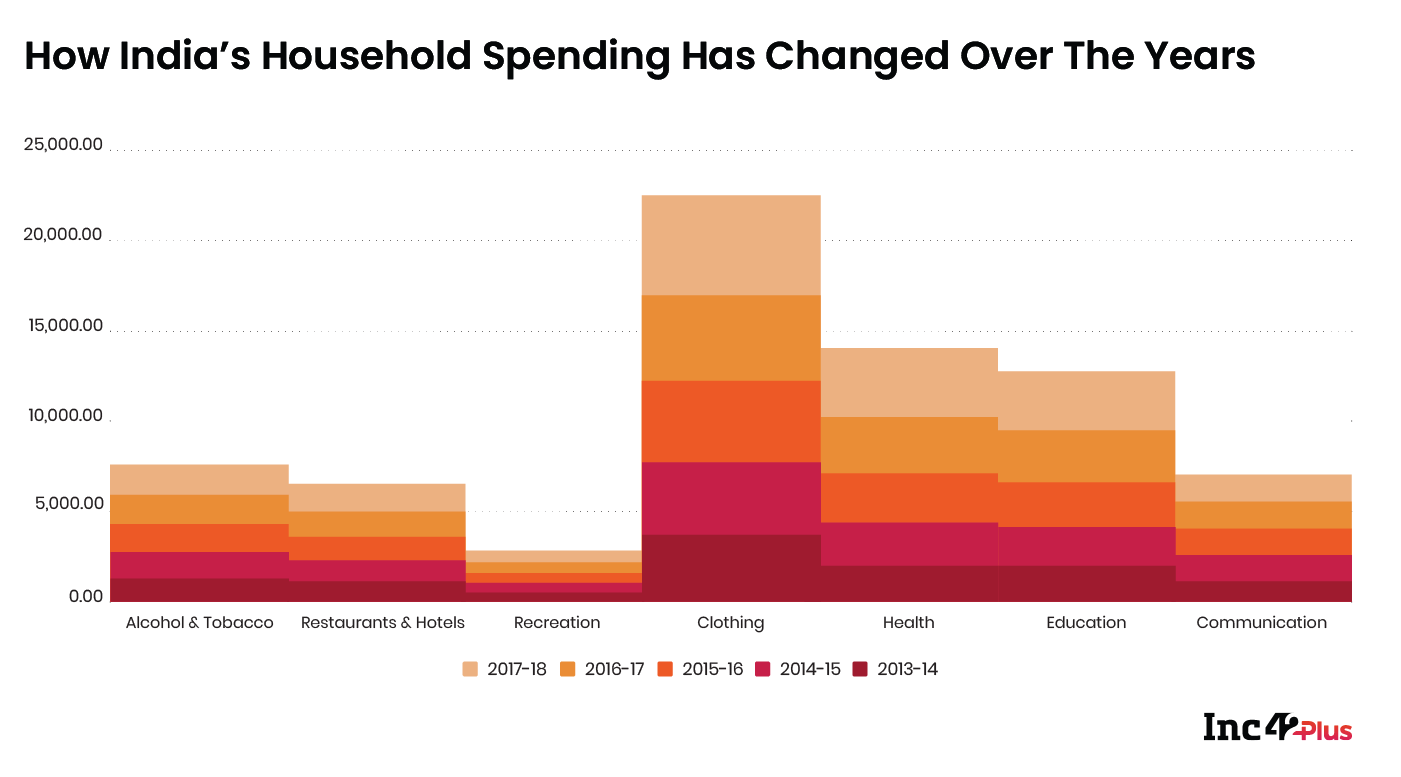

An average Indian household spends just around 18.5% of their income towards educational expenses, which is the third largest category after healthcare and clothing. With the arrival of edtech apps and other ancillary apps such as WhiteHat Jr and others, parents are expected to shell out a lot more.

Can average Indian parents afford to enrol their wards in the courses offered by India’s edtech giants?

According to public data news platform Factly, there is a massive difference in average annual spending of an urban and rural Indian household at both pre-primary and primary levels. Average rural spends on pre-primary education is currently at around INR 5,600 while urban households spend 3x more at around INR 14,500. At the primary level rural Indian households spent around INR 3,454 per academic year, while urban households have the capacity to spend up to INR 13,500 per academic year.

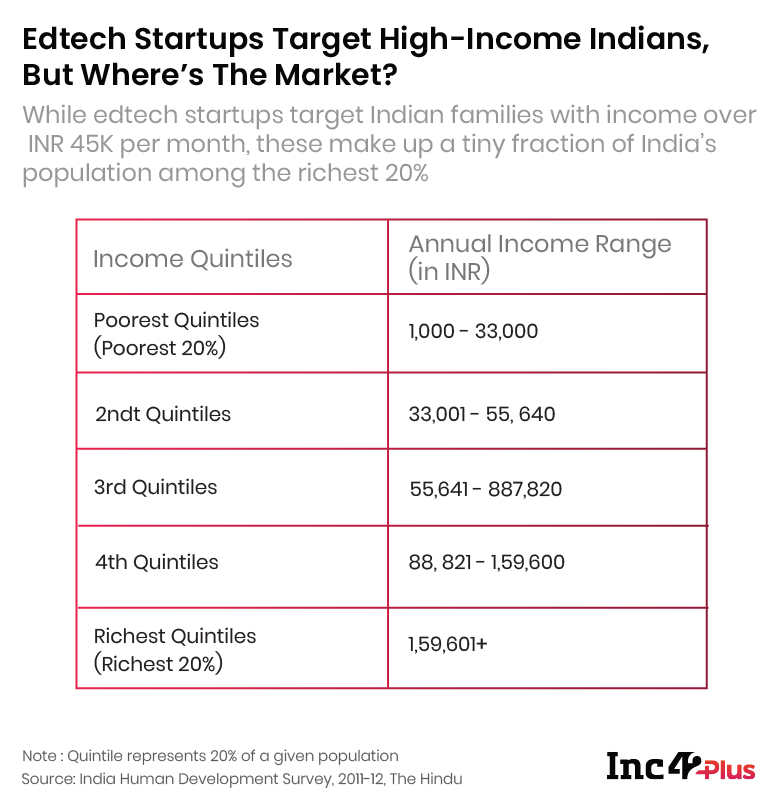

But Toppr’s Bedi has an answer to this conundrum too. According to him, in terms of paying capacity, a majority of the startup’s customers are from households with a monthly income of over INR 45K, who can spend about INR 2K per month on online education. “Usage is already there and wallets are following too. People are in a cautious spending phase and expenditure that can be delayed is being put on hold for the time being. However, edtech is becoming more of a necessity than being discretionary,” he claimed.

If we believe in Bedi’s optimism and consider it to be representative of the edtech industry’s target group, there’s a harsh truth that all of them are evading.

According to India’s Human Development Survey of 2011-12, if an individual’s annual household income is greater than INR 1.6 Lakh – which comes to INR 13,333 per month – that person is counted among the richest 20% of the country.

Against this backdrop, one needs to look beyond their tall claims and examine BYJU’S, Unacademy, WhiteHat Jr, Toppr and others of their ilk from a different lens, one which shows a narrower target market.

Fear And The Pressure Of Justifying High Valuations

Despite the questionable projections of addressable base and the mismatch in the ground reality when it comes to what Indian families can afford without breaking the bank, the prospects of India’s edtech players and money flowing into the sector have grown unabated.

BYJU’S acquired WhiteHat Jr for an eye-catching $300 Mn earlier this year, and overall edtech funding reaching 1.4 Bn till October 29, 2020. It was also during the lockdown that Unacademy reached new heights as SoftBank crowned yet another unicorn in India with its funding of $150 Mn.

Armed with fresh VC money — nearly across all stages — and looking to capitalise on these towering valuations, edtech startups have been using all tricks of the trade to increase their customer base. Edtech ads on social media and TV sell the dream of turning kids into entrepreneurs and geniuses — the next Sundar Pichai, Bill Gates, and even Barack Obama — with rarely a thought paid to hyperbole.

WhiteHat Jr, founded by Karan Bajaj, is one of the startups caught in the thick of the controversy surrounding the tall claims and promises by edtech startups. Clearly, the ads have worked as WhiteHat claimed its annual revenue rate grew from $12 Mn in 2018 to $150 Mn in just five months.

But social media users, parents, and other edtech founders have publicly criticised WhiteHat Jr’s marketing and promotional campaigns, terming them “unethical”. On October 28th, India’s advertising industry watchdog Advertising Standards Council of India (ASCI), came down heavily on the startup and told it to pull down at least five of its advertisements which were in violation of the advertising code for making dubious and unsubstantiated claims.

A parent, who had enrolled their child on WhiteHat Jr in 2019, told us that although she found the platform userful, the marketing campaign has been problematic.

Ronnie Theresa, a marketing expert with over 15 years of experience across automotive, beverages, BFSI, consumer products and real estate sectors, recalled an incident during a live WhiteHat Jr class that was a red flag for her. She recalled that some time before BYJU’S acquired the company, one of WhiteHat’s ads asked her to share the app’s referral link with five friends in exchange for a free Macbook.

According to her, the ad’s exact text went something like this when her son was in a live class: “Damien (Theresa’s son) is missing a chance to win a laptop, and don’t miss out on the chance. Share the referral link with 5 other people to participate”

Theresa believes such tactics can coerce parents to force others they know into signing up. “If I want to buy my son a MacBook for me, it is a single card swipe on the apple website. So for me, as a parent, it’s not a problem. Unfortunately, for a lot of other parents, that is not the case. So when my son comes back and tells me that he doesn’t have five friends to send this to because of the cost, imagine the ramifications of this on multiple levels.”

Edtech solutions have undoubtedly created a wider urge for learning among Indians, but as highlighted tragically by the death of Aishwarya, the fear of missing out is a huge psychological hurdle for children and young adults. “At the end of the day, I think the fear is what they (WhiteHat Jr) are selling,” added Theresa.

Edtech Startup Valuation Tower Built On Loans

It is this fear that has created a huge market for edtech loans in India. Despite their claims about affordability and targeting the right income groups, edtech startups cannot run away from the fact that many edtech users have had to use some form of financing to get access. This is creating a culture of ‘student loans’ even before a kid has left school.

If an average Indian household cannot afford a coding class course for their six-year-old kid — equivalent to two months’ income — there’s a lending startup there to help them out.

Over the past few years, a slew of lending startups have launched products that help families meet edtech aspirations. Startups such as Eduvanz, Leap Finance, ZestMoney, and many others have recently started making their entry into the edtech segment trying to provide access to credit to parents who wish to invest in purchasing online subscriptions.

ZestMoney, for example, has been providing credit to working professionals and students who are looking to upskill online via online upskilling platforms. The startup said in a statement in July that over 57% of the applicants who choose for upskilling programs come from Tier 3 markets with an average ticket size of the loans stands at INR 50,000.

“There has been a massive boom in the K-12 segment. With kids having time at home and parents worried about supplementing school education, courses like Robotics, Coding, Critical thinking have found many takers (via credit purchases),” Lizzie Chapman, cofounder and CEO of ZestMoney, said in a press statement in June this year.

Eduvanz, a Mumbai-based lending startup targeting edtech and the offline K-12 segment, has seen a 15X growth after the lockdown in March. Eduvanz has tie-ups with various lending institutions and NBFCs to offer loans to students in K-12, test prep, upskilling and college-level courses. “Today, we will be touching close to INR 40 to 50 Cr a month in disbursal…On the K-12 segment, we have signed up over 130 and 140 schools, and we have already processed loans worth $3.5 to $4 Mn worth of loans in the K-12 segment alone,” cofounder and CEO Varun Chopra told Inc42.

He added that the startup uses proprietary underwriting mechanisms to score its potential users by examining the placement records of educational institutions or the coaching centre, as well as the employability of the segment that the student is targeting. This is in addition to other data such as bank statements, and CIBIL scores of the parent.

Eduvanz has also installed “lending dashboards” directly at coaching institutes where typically an educational counsellor has control over it. If the parent chooses for credit-based payments during a sales enquiry, then the coaching centre can simply collect requisite details such as Aadhaar, PAN and more to check for in-principal approval. The technology sits right in the institute, and the first level of underwriting is done in real-time.

Eduvanz is in talks with several edtech platforms to allow credit purchases. Not that most startups need to be convinced about the merits of education financing. The likes of Unacademy, BYJU’S, WhiteHat Jr, Toppr and others offer credit card-based EMI options and other financing help to parents who may not be able to afford the fees in one go.

Analysts and investors point out that access to cheap loans for edtech players may help bring down the cost initially, and raise demand gradually, and over the next few months, more edtech players may start including an in-built EMI option at the check-out page itself.

But is this the right way to sell? After all, the point of a student loan is that the student would graduate and start earning money by themselves to pay back the loan — however tall the order may seem. So the risk seems to be magnitudes higher in this case where students (through proxies) borrow.

Investors, teachers and other experts have raised these questions on the sustainability and longevity of the study-now-pay-later model.

Roshan Mishra, a policy analyst, and a teacher with 8 years of experience working for edtech startups such as PlusPrep and Jamboree, believes that when edtech startups enter Tier 2 and smaller markets, the value proposition of the loans offered has to be clear: whether they are making quality education accessible and affordable or just adding to the EMI outflow.

“The income levels are very low in Tier 2 and 3 markets, which would mean that whenever a parent defaults it becomes harder for edtechs to recover the amount via litigation and the recovery rate may fall very rapidly if there is an economic downturn. There is definitely a supply and demand problem in the education sector and the supply (of teachers) could be short in smaller towns and villages, but it is unclear if you can solve this with EMIs (vid edtechs) since most parents here do not have any kind of valid or sufficient credit scores,” Mishra added.

Tracking Kids And Parents: Ethical Dilemma Of Edtech Lending

While the availability of loans for edtech products and offline education may solve the problem of equal access, the business of lending to edtech users does have its own inherent disadvantages. Recovery and collection of loans due to defaults can become a delicate task when compared to other types of loans since the average ticket sizes of these loans hover between INR 80,000 and INR 1 Lakh a year. Eduvanz has deployed technology to aid the collections process including GPS-based tracking through its mobile app.

“We maintain contactability with them (borrowers), and track their movement (using GPS). We also check if students have stopped attending the classes, or if their performance has dropped, that is a red flag for us in advance. Although we have a feet-on-street kind of approach for collection of loans, we think technology will in fact play an important role in recollection of loans in the next 12-24 months,” Chopra added.

Another startup founder, who heads an online lending platform similar to Eduvanz, told us that the loan sizes disbursed to users of edtech apps are “too small” to initiate legal action in case of non-repayment. “We just have to be very persuasive and do follow-ups. We do try sending a team. But if you have to do litigation for an INR 90K average ticket size loan, with an overdue of INR 30K, or 40K, you will end up spending more money on litigation than by recovering the whole amount. That amount is too low to use legal means of recovery efforts,” the founder said, requesting anonymity.

As the emerging new wave of edtech starts to sway towards a more credit-based, instant underwriting model, founders and investors predict a heightened demand for online learning.

Edtech apps and video conferencing tools have already become a default part of both students and teachers. For now, it’s not even a certainty that teachers would ditch their years of experience teaching in classrooms to embrace online learning, especially given that most are awaiting the release of the vaccine for things to get back to normal. In such a situation, the future of the edtech segment in India hangs on many questions.

There are some ethical considerations as well when it comes to tracking kids and their learning progress just to monitor loans — it feels pervasive in a manner that regular lending does not. But nevertheless, it is one solution to the ground reality challenges in India.

“As per our research, parents these days are spending most of their educational spends in ensuring children get quality school by moving them away from public schools to private schools, and the stats around this are very astounding. For example, even in rural India what we have understood is educational spending has almost doubled in the last four years,” Eduvanz’s Chopra said.

He added that while earlier, it was all about school fees, now parents have to spend extra on electronic devices, tuitions, co-curricular activities, and even edtech apps. “That is becoming a very exorbitant expense for our average household to manage on a monthly basis. So rather than paying for these things upfront, there is now need for availability of EMI credit.”

As soon as schools and colleges reopen, edtech will have to stand the test of conventional offline learning becoming the main focus again. Will parents put edtech spending on the backburner once school and post-lockdown life resumes?

Even if one assumes that physical schools and colleges are a thing of the past, edtech startups will have to survive the chopping block in household spending curbs that are likely to come if India’s economic recovery is not ideal and there is a further impact on per-capita income. Either scenario brings threats, but for now edtech startups may not be focussed on the dangers on the horizon, given the undoubtedly great view right now from their enviable perches, even if they have been built on unsteady rocks.

Ad-lite browsing experience

Ad-lite browsing experience