SUMMARY

While the government has clarified that lending startups cannot charge compound interest during the moratorium period, the Supreme Court has paused the NPA hearings until further notice

A significant number of digital lenders have opted for unethical and even illegal recovery practices and charging hefty illegal penalties, legal and financial experts have alleged

Will the lending tech startups that are leveraging predictive analytics, behaviour-based risk models, and invoice recording platforms help change the recovery game and solve the supply and demand-side headaches?

India's Digital Lending Reset

India’s digital lending sector is currently in a reset mode as the contracting GDP, moratorium, & Covid-19 has forced companies to adopt digital, review credit models & more. This playbook takes a deep dive into the challenges and new pathways adopted by digital lending startups for survival and scale!

Last month, a family of five in western India committed suicide citing huge debt and harassment from lenders.

This year, with two months still left on the calendar, the number of suicides has doubled from the last year. And the financial crisis, debt and harassment by recovery agents have been at the core of many of these suicides, be it, farmers, entrepreneurs or others.

In post lockdown coupled with moratorium, longest economic recession and lowest ever consumer spending, the stories of #OperationHaftaVasooli have exponentially risen across the country with lending startups using aggressive tactics to achieve some semblance of a recovery.

While banks and large NBFCs prefer to outsource loan recovery to agents, most of the startups which act as either small NBFCs or as distribution partners of banks/NBFCs have to get their own hands into the mud for their loan recovery, and most rely on tactics such as calling contacts and other known associates when borrowers are unable to repay on time.

For Amit (name changed), a resident of India’s heartland Madhya Pradesh, these tactics came as shock. The multiplex employee took a personal loan worth INR 30,000 before the lockdown from Red Carpet loan app in January this year. And, life was quite normal till the complete lockdown was announced on March 25, 2020. Amit who had paid two monthly installments till March was out of the job due to the sudden nature of the lockdown. The loan app, he claimed, offered the moratorium for the first two months and thereafter, they started threatening and abusing him.

“They sent messages to my relatives claiming that I am a fraudster and that they are taking legal proceedings against me.”

Amit is not alone, Sanjit (name changed) from Jammu too faced the same. The Red Carpet app sent similar messages to his fiancee and her father which resulted in a broken marriage even before it could happen.

One of the key issues that recovery agents from lending startups lacked was empathy. Sharing the screenshots and call records with us, Sanjit and Amit claimed that despite having made some payments, recovery agents are now demanding a hefty amount of money to stop harassing and threatening calls. The story is the same for many customers of India’s lending startups, since the early days of the lockdown. But will the focus on technology in the months since then change the future for lending recovery and collections?

Where’s The Consent For User Data?

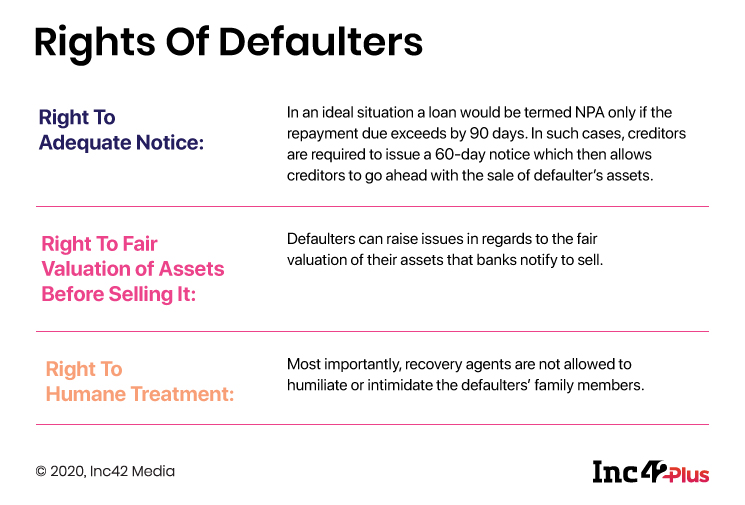

The horror and horrific stress of recovery agents have seldom looked into the rights of defaulters and in most cases, they have clearly missed the mark by a huge margin. However, as the personal data protection bill is set to be enacted by India, the unethical data practices which include fetching contact list of borrowers for calling and messaging in case of defaults without consent might come to an end.

Earlier too the recovery tactics have led to deaths. In November 2019, 40-year-old Amol Francis Vaity from Dahisar had committed suicide citing constant harassment from recovery agents. Vaity in his suicide note begged that his family should not be held responsible for the loan he took.

If the recovery by lending startups and digital NBFCs involve harassments, abusing the defaulter and their family members, it is not a recovery but extortion of money through illegal means, especially when they start prying upon right to privacy and right to liberty, Nakul Sachdeva, Partner, L&L Partners, told Inc42.

In terms of legal frameworks and ongoing hearings in the Supreme Court, advocate Sachdeva said that a petition pertaining to the moratorium is pending in the Supreme Court and at the same time, the government has also issued a notification stating that new accounts will not be added to the NPAs. This changes the legal interpretation completely. Recovery agents can’t make certain moves if the people are not officially declared defaulters. At the same time, as the case is pending, the creditors can’t go for legal proceedings as they have threatened in the case above.

With banks, large NBFCs mostly looking to outsource the recovery process, in recent years, an increasing number of startups have joined the bandwagon of EMIs collection and recovery space. These startups have looked to the technology to achieve a higher, cost-effective, and more empathetic way of recovery.

Interestingly, some of the startups that have NBFC licenses such as Loantap, Capital Float have also developed their own technology for this. In a nutshell, as the uncertainty in lending continues, the recovery area market opportunity gets wider, attracting more partnerships and startups into the game. The key questions are here what role does technology have to play and to what extent would it address the mounting defaults?

The Weight Of A Financial Crisis

“It’s an extraordinary time. We’ve never seen such a thing at least in our lifetime. And, that’s true for most of us,” – Neel Juriasingani, founder and CEO, Datacultr

The current global recession is different from what the world has witnessed in the past, including the most recent global economic crisis circa 2008. The pandemic is much larger in magnitude than a single stock market catastrophe, and has inflicted permanent damage in a slew of sectors that will never be able to recover, experts argue.

According to World Bank forecasts, the global economy will shrink by 5.2% in 2020 alone. That would represent the deepest recession since the Second World War, with the largest fraction of economies experiencing declines in per capita output since 1870. Who knows what the ripple effect of this will be.

Among its peers, India has been the most ill-prepared from the point of view of GDP decline. Rating agency S&P Global in its report said,

“We have taken negative rating actions on Indian banks and NBFIs as operating conditions have deteriorated through the crisis. The country entered the pandemic with an overhang of high non-performing assets,” — S&P Global

It also observed that India along with Mexico, and South Africa will be the last banking systems to recover to 2019, well behind the world.

However, the impact of the recession isn’t the same on all the lending startups but varies across the sectors and subsectors. The recovery strategies of startups are therefore segment-specific, agreed founders.

For instance, the restaurant business, travel, tourism and hospitality were the worst impacted and therefore loans to these segments are performing weaker when it comes to recovery. The ailing real estate, MSMEs and automobile sectors have also recorded critical hits with global players like Harley-Davidson exiting India, Toyota stopping its expansion plans and so on. This has a cascading impact on the small businesses operating in these sectors and therefore the ratio of NPAs among SME lenders.

Only a handful of sectors such as edtech, pharma and healthtech have shown positive growth in the times of coronavirus and have attracted the lion’s share of this year’s total funding. Even lenders are now only exclusively offering loans to businesses and individuals associated with these fields.

Despite banks, NBFCs, and MFIs diversifying their portfolio, most of these players have seen a downward trend in terms of growth as the majority of sectors have been under stress and are estimated to be so for the next few years.

On who will be facing the recovery issues the most, Juriasingani of Datacultr, which develops loan recovery and management solutions said that due to the moratorium, the repayments were delayed. Both, consumer as well as business finance loans have suffered. However, it’s the small businesses that specifically have suffered a lot. The businesses were completely stopped during the lockdown and a lot of these businesses have also taken loans.

Similarly, loans taken by restaurants, aviation and hospitality players either for expansion or as working capital loans have gone rogue to a large extent. And, besides, restructuring among the possible solutions, the lending startups which have been largely left out in the Kamath committee report are also demanding a segment-based package that could help keep the supply on track.

Under the garb of the moratorium, the issue of low collections has been played down by the government, many founders told Inc42 without willing to be named.

But it’s not just them; the point was also raised by former RBI governor Raghuram Rajan. In a recent Q&A session, he said that the moratorium will have to come to an end at some point. The longer the moratorium lasts, the higher is the unpaid loan amount and tougher is it to restart the payments.

“Do you recall the Andhra Pradesh microfinance crisis? Once you told people didn’t pay, it became hard to get them back into the payment habit because they have not saved any money. They did not have any money. So, those became serious NPAs and a lot of microfinance institutions were severely impaired after that. The longer we tell people not to pay, the harder it will become for banks to collect anything on those loans,” Rajan had said at the time.

Startups compared to large NBFCs and banks adopted faster and better approaches while tackling the moratorium issue, even though the horror stories of recovery threats have also come from startup customers largely. Many founders believe that because the market had become so open after the emergence of loan service providers catering to NBFCs that these tactics were bound to surface. The entry of consumer tech companies into digital loans through third-party partnerships added to the conundrum too.

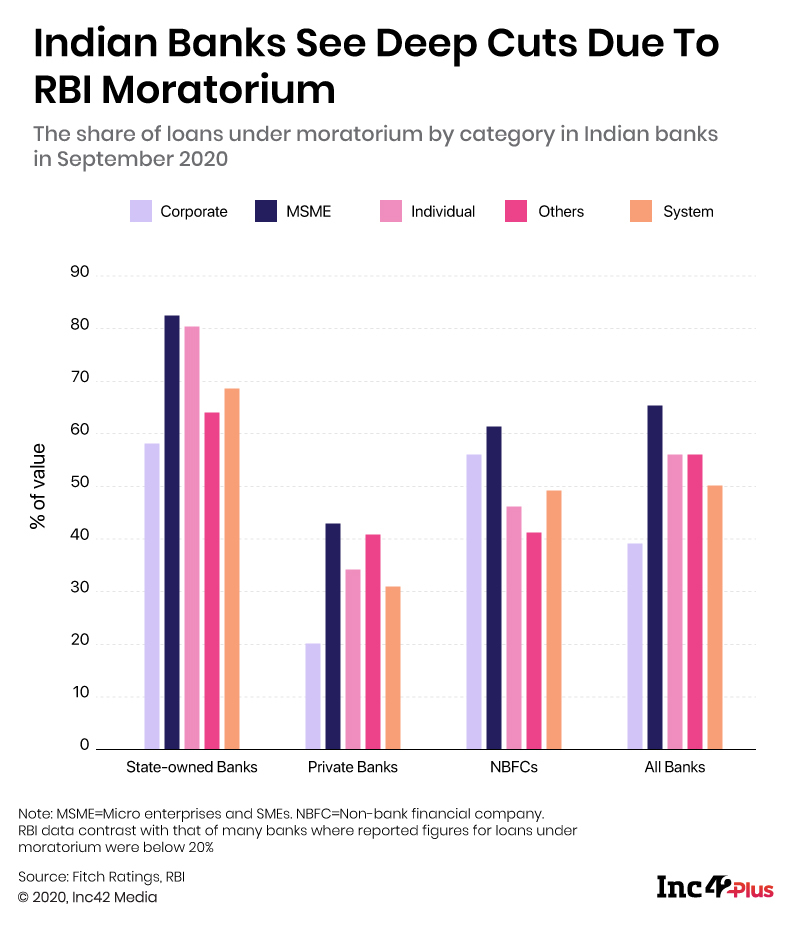

Anuj Kacker of MoneyTap which offers credit line-based lending products said, “At least 5-15% every creditor’s outstanding book is under moratorium which also means they have been able to convince around 85% of their consumers to pay their dues regardless of the moratorium.”

As Recovery Demands Increased Focus, Startups Bring In More Men For The Job

In July 2020 the RBI in its semi-annual Financial Stability Report had asserted that non-performing assets may rise four percentage points to 12.5% of total advances by March 2021, the highest since 2000, under the baseline stress scenario.

In such a worsening situation, restructuring alone won’t help in recovery. By the end of Phase 1 of the moratorium, lending startups had this sense of the upcoming gloom. Hence, many began work on the technology side of things to track collections and recovery of the loans.

MoneyTap’s Kacker said that as the moratorium has now ended, everybody is figuring out how they can do their collections, everybody’s in overdrive for doing collections. “We too have got a lot of our operations team into collection because it is important to get the money back and protect the balance sheet. That’s what everybody has been doing. There will be more clarity regarding the defaults in a few months once people get back to their paying credit habits.”

Since most of the lending startups have been extending loans to the underserved or sections lacking access to formal credits, the risks were always higher. As a result, lending startups have been sleeping on the collection issue since the end of phase 1 of the moratorium in July 2020.

The startups, particularly the B2B sector lenders, have had to spend more on communication about the moratorium than on acquiring new customers. Many also stressed that it may not be as beneficial as many borrowers might think. The government has now issued a notification granting relief to individual borrowers as well as MSMEs by waiving off the compound interest charges on loans of up to INR 2 Cr for a six-month moratorium period.

Madhusudan Ekambaram, CEO of personal loan startup Kreditbee said that collection has always been the tricky piece of the complete lending process pre-Covid-19 or now. There are a lot of people who have lost their jobs and some of them may not be getting their jobs back.

There are definitely these issues. However, what we are seeing parallelly is that the economy is also reviving in certain sectors. The collection, as a process, has to accommodate some of these customers who have really suffered, lenders do agree. The question is how can they segregate such customers from others who claim to have suffered but have not. This is where technology will come into the picture to fill in the data gaps or the alternative is spending time and money to investigate each loan customer.

The Legal Puzzle And The Rights Of Defaulters

In order to help creditors recover their bad debts, the Indian government has made a host of laws namely Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993, Insolvency and Bankruptcy Code, Legal Services Authorities Act, 1987 and Securitization and Reconstruction of Financial Assets and Enforcement of Security Interests (SARFAESI) Act, 2002 which have paved way for the Debt Recovery Tribunal. Creditors and lenders are expected to knock on the doors of the DRT for redressal.

The SARFAESI paves way for the constitution of asset reconstruction companies or ARCs which are not applicable for unsecured loans, loans below INR 2 Lakhs, or where remaining debt is below 20% of the original principal — the kind of loans that digital lending startups typically offer.

Besides, the RBI has released a guideline on recovery agents and fair practices code for lenders. However, these norms would be applicable to the RBI-regulated entities only, and hence some of the lending startups which are not directly regulated by the RBI won’t essentially have to follow these guidelines.

Explaining the legal way, advocate Sachdeva told Inc42 that recovery of money by creditors is allowed in the framework of the law, which states that if an arbitration clause is present in the loan agreement, then the customer has to go for an arbitration — “you can go in for a SARFAESI action, you can go for a DRT action” as he puts it.

If the loan is to a company, then the company can go under the insolvency code to the arbiter. And if none of this exists, then the creditor can go to by way of a suit or they can even file a criminal complaint if there is some criminality involved.

However, these conventional methods won’t be applicable to fresh matters. Sachdeva stated that hearing a slew of petitions regarding increasing the moratorium period, the Supreme Court has de facto extended the moratorium period as banks normally take action only when an account is categorised as NPA. The central government has come out with the notification that stopped categorisation as of August 3. Now, the Supreme Court on the 3rd of September has specifically stated that no fresh accounts will be termed NPAs till further order.

“At the request of Tushar Mehta, learned Solicitor General, the matter is adjourned for 10.09.2020. Mr. Harish Salve, learned Senior Advocate (Representing Indian Banking Association), submitted that no account shall become NPA at least for a period of two months. In view of the above, the accounts which were not declared NPA till 31.08.2020 shall not be declared NPA till further orders.”

The Supreme Court on September 3, 2020, ruling on the NPA matter

In Technology Lies The Solution

“Machine learning can help lenders build predictive models which will further help them take action before the actual default happens. So, if the model predicts customer X will probably not be in a position to pay this month, then the lender could be ready with an alternate option to this same customer to be paid in smaller chunks on a weekly basis or something else. So, if you can predict, then you can build products and solutions around it,” said Datacultr’s Juriasingani, summing up the company’s model for risk monitoring.

As indicated by S&P Global, India’s NPA issues are not something that mounted overnight, or during the pandemic but have been a big issue for over a decade now. An issue that the RBI and the government both intentionally chose to push behind the carpet.

Lending startups, unlike banks and large NBFCs, have come up with ML and AI-based solutions which not only helps in loan monitoring but also in loan recovery by significant margins. Helping lenders to identify and categorise the risk-based accounts and assessing the chances of recoveries from NPA with the help of AI and ML, startups claim to fasten the entire process by over 70-90%.

Since its launch, CreditMantri claims to have increased collection for lenders by 15-20%. On how Creditmate helps creditors through the intensely decision-driven collection process, Jonathan Bill, cofounder of Creditmate had earlier told us, “Our job, using AI and machine learning is to extract all of that individual knowledge and make a single ultra-smart and evolving intelligence layer. Recommender systems match content to a user. Behaviour models predict strategy for collection resolutions and Propensity models drive efficiency.”

The company has also introduced its Sherlock product which uses proprietary machine learning algorithms to score debt defaulters, manage debt resolution processes and optimise results and costs.

Datacultr too is offering ML-based predictive fraud management and helps identify potential frauds by modelling changes in borrower’s smartphone usage patterns. The Gurugram-based startup also offers services such as programmable messaging and calling to reduce the cost of collections and make it more transparent for all parties involved.

Lending startups which are also NBFCs such as Capital Float, Loantap have been looking at developing inhouse technology for collections and recovery. For instance, Capital Float has rehashed its underwriting algorithms and has invested deeply in collections. This allowed them to structurally improve the quality of the credit and build out a digital “collections stack” to complement their origination capabilities.

Recovery Needs Deep Understanding Of Consumers

Datacultr’s Juriasingani averred that lenders need to be creative and must try to understand their perspective empathetically. Like lenders, consumers too are reprioritising their money spend and hence may not be in a position to pay certain EMIs just because someone is forcing them to.

For instance, people always keep health and education on top, then they will ensure that home loans are being paid on time and so on. Lending is an area which requires building a long term relationship with consumers and hence understanding the honest consumers, and the creditors must be flexible enough to restructure the EMIs and timeline accordingly.

Datacultr is working on building empathy scores of consumers which will help them understand their consumers. This will help them not only help reduce their risk but would also suggest what kind of action should be taken with a consumer.

AI and ML have evolved a lot in terms of deep learning. Most of the banks, NBFCs and startups have already plugged in some kind of chatbots to respond to the immediate queries generated by the consumers. But there are some challenges here too and one of them is the cost and time for development. Further, most solutions may not address custom and specific challenges that are ailing certain sectors and will continue to given the current market conditions.

While recovery calls and similar solutions using AI and ML might solve the problem, a significant problem is the cost of development of such products, as the likes of Kacker and Juriasingani indicated. Another issue is the ability for them to scale up or be customised for various sectors. Lastly, the human factor cannot be ignored — after all computers are not going to empathise with customers.

US-based IT giant Computer Generated Solutions (CGS) in its annual Global Consumer Customer Service Report has stated that chatbots have delivered speed but consumers prefer human agents over chatbots.

Therefore the major question in the balance is — will startups have to go the tried-and-tested route by adding more human resources feet-on-the-street to solve the recovery problem or will technology be able to move beyond the current one-size-fits-all model and solve niche problems for digital lenders of all walks and sizes?