SUMMARY

In 2021, Adda247 acquired UPSC focussed test prep startup StudyIQ in a cash and stock deal

Both have experienced significant growth in their offerings and user base as a result of this strategic partnership

In 2022, the edtech industry witnessed a 2.5X increase in M&A activity from 2020, signalling a focus towards consolidation

No industry has borne the brunt of the funding winter quite like the edtech sector. Following a streak of Covid-led good fortune of 2020-21, a bleak season has set in. According to Inc42’s ‘The Future Of Edtech Report’, the edtech sector saw a YoY (year-on-year) decline of 49% in funding amount and 42% in deal count last year.

However, many edtechs are turning this adversity into an opportunity through strategic mergers and acquisitions (M&As). In 2022 alone, there were 33 M&As in edtech — a 2.5X increase compared to 13 recorded in 2020. This surge underscores the importance of consolidation, not only for survival but also to unlock synergies and utilise talent and resources.

The consolidation wave cannot be attributed to the funding winter alone though.

Edtech giants have been leveraging acquisitions to establish their foothold across edtech segments for quite some time and to diversify their offerings and increase the customer base. Consider BYJU’s aggressive acquisition spree of 2021 when it acquired K-12 edtech rival Toppr, upskilling and higher education startup Great Learning, US-based digital reading Epic and offline behemoth Aakash Institute, after it had already acquired WhiteHat Jr in August 2020.

Edtech startups are fast realising that diversity in revenue streams is key to ensure optimal customer lifetime value.

It’s also the route taken by Adda247. The Google-backed startup offers online live classes, on-demand videos, e-books and more for 500+ national and state level government competitive exams in Indian regional languages.

Most recently, Adda 247 acquired 3D experiential learning startup Veeksha, with an aim to offer interactive learning modules and cater to K12 students and JEE/NEET aspirants more efficiently.

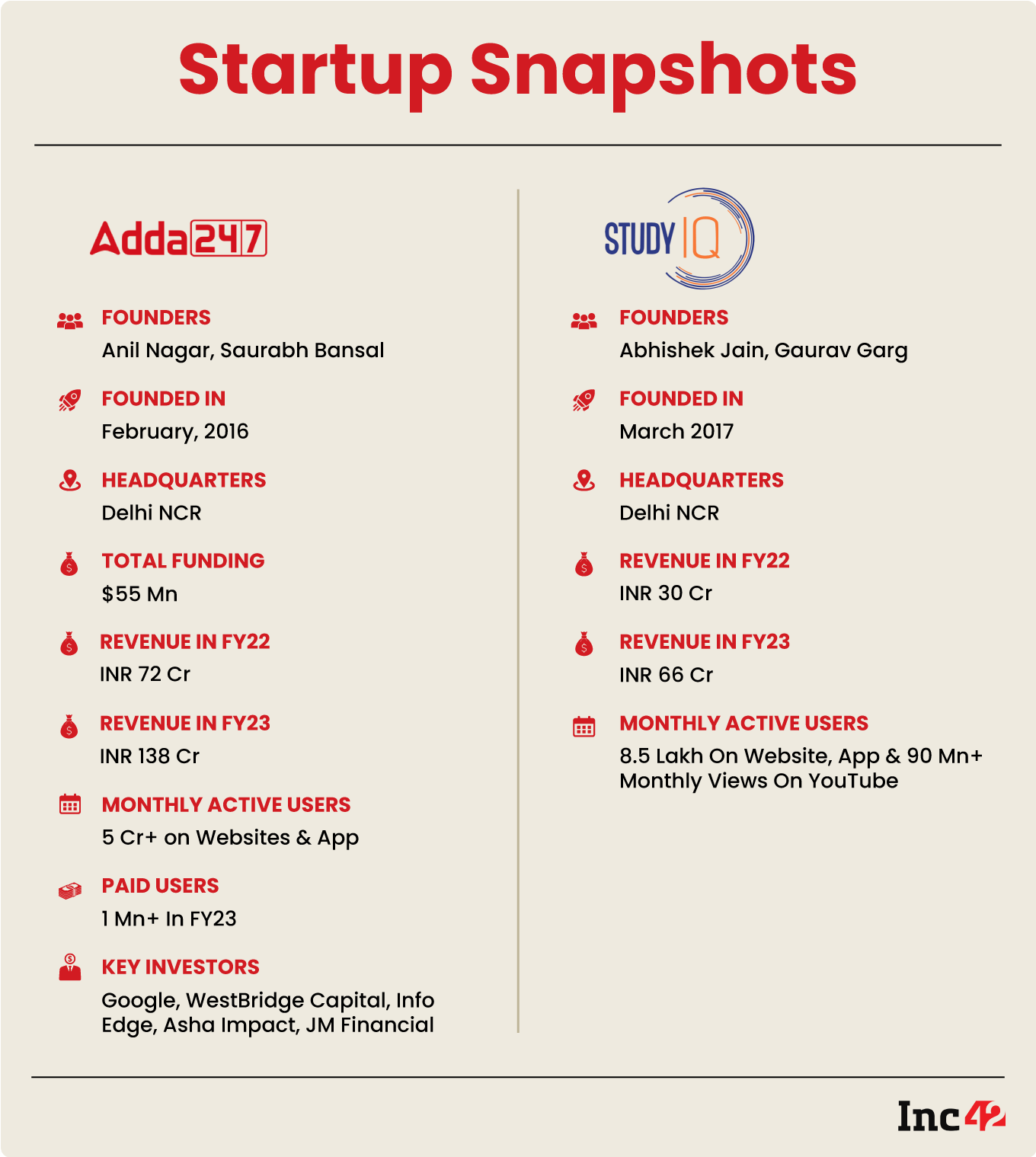

This is the startup’s second acquisition in the past 18 months, after it had acquired StudyIQ, a Union Public Service Commission (UPSC) exam-focussed test prep startup for $20 Mn in a cash and stock deal.

In many ways, it was the success reaped by the StudyIQ acquisition that Adda247 is hoping to use as a playbook for the Veeksha deal. This playbook revolves around leveraging overlaps in operations (distribution and target audience), and the tech platform that Adda247 has built.

For instance, while Adda247 primarily focusses on test prep for state government exams, StudyIQ (SIQ) has carved a niche in UPSC. Leveraging SIQ’s extensive YouTube presence, Adda247 was able to enhance its UPSC arm and strengthen its position in that domain since late 2021.

On the other hand, with Adda247’s technology, reach and capital, SIQ launched a live classes feature on its app, and shifted away from recorded course content. It’s proven to be a symbiotic relationship.

Delhi-NCR based StudyIQ and Adda247 have experienced significant growth in their offerings and user base as a result of this strategic M&A. Today, SIQ’s YouTube channel has 14 Mn+ subscribers and it clocks 90 Mn+ views every month, up from over 11 Mn subscribers as of 2021.

SIQ cofounder Abhishek Jain also revealed that the startup registered a 2X revenue increase from INR 30 Cr in FY22 to INR 66 Cr in FY23 and credits the acquisition deal for this feat. On the other hand, Adda247 claimed to have increased its revenue close to 2X from INR 72 Cr to INR 138 Cr in the same time period.

StudyIQ’s Journey: From A YouTube Sensation To A Mobile App

StudyIQ cofounders Abhishek Jain and Gaurav Garg first met as faculty members at a renowned coaching institute. Bitten by the proverbial entrepreneurial bug, the teachers decided to make a greater impact in test prep by launching their own YouTube channel called StudyIQ in 2014.

Within two years of its launch, SIQ reached a milestone of 20K subscribers on YouTube and established its presence in the test prep content space. Consequently, in 2016, it launched a dedicated website to sell pre-recorded course lessons on USB drives, catering to competitive exams like UPSC, railways, defence, SSC (Staff Selection Commission), banking exams and more. These courses were taught both in English and Hindi. A year later, SIQ was officially incorporated as a company.

In a previous conversation with Inc42, Garg claimed that SIQ was profitable from day one, with no external funding. In three fiscal years, the startup’s revenue grew 7X — from INR 1.9 Cr in FY17 to INR 13 Cr in FY20.

The reason? A firm grip on content and an outstanding faculty. Jain explained, “In edtech, you either build your own star faculties from scratch or poach them from competitors. We didn’t have the money for option two, so we just had to build a stellar team.”

Jain further disclosed that the platform’s well-crafted content, supported by thorough research and animations, has garnered widespread recognition from students. “We use graphics to explain and simplify concepts,” he added.

In 2020, the startup introduced its own app to enhance the learning experience. This marked a significant transition from offering courses in physical format (USB drives) to providing in-app recorded courses.

Despite relying heavily on YouTube in its initial years of operation, SIQ saw a remarkable transformation in terms of its revenue model since the launch of the app. Today about 97% of its revenue comes from the mobile app, with the remaining comes from YouTube.

Creating Synergies For Strategic Expansion

“Our interests aligned right in the first meeting, and the rest is history. We closed the partnership within two months by December,” Anil Nagar, cofounder of Adda247, recalled about the acquisition.

Nagar revealed that Adda247 was closely observing the growth of its competitor (SIQ) and found its content very compelling. “We used to admire its fan following, especially among UPSC aspirants,” said Nagar.

At the same time, it also identified a vast potential in the UPSC online prep market and sought to seize the opportunity by leveraging SIQ’s expertise.

Edtech giants such as Unacademy, Vedantu and BYJU’s had already established themselves in the field of UPSC preparation, compelling even traditional players like Delhi’s Drishti IAS and Rau’s IAS Study Circle to embrace digital expansion in order to stay competitive.

Given its technological expertise and extensive reach in nearly 15 states in north and south India, Adda247 decided that it was the right time to enter the UPSC market with full steam. Post 2021, startups such as PhysicsWallah have also looked to tap the UPSC opportunity, so Adda247 had found the right opportunity at the right time.

However, as with any other acquisition or merger, when the two companies joined forces there were some problems in the transition phase.

One such hurdle was establishing trust in the StudyIQ team and convincing them to relocate from the SIQ office in Delhi to Adda247’s Gurugram office. Further, SIQ’s team was resistant to the proposed changes to the app and website’s technological architecture.

The two startups had to invest a lot of time to align with each other’s vision, Nagar added.

“As a bootstrapped venture, we were fighting to remain profitable and were trying to scale multiple exam categories. Through this deal, we have been able to narrow our focus to UPSC,” said Jain.

In 2022, SIQ made a pivotal shift from pre-recorded classes to live classes. It now even offers one-on-one mentorship and personalised study plans to its users.

The Way Forward For Adda247 & StudyIQ

Over the next two-three years, Adda247 aims to provide content in more regional languages and reach a greater number of competitive exam aspirants. “We are focussing on increasing the portfolio offerings accordingly and become a household name,” said Adda247 cofounder Nagar.

Although the edtech funding outlook has been gloomy, test prep could still attract investor interest. But here too, only startups that have expanded into offline operations are raising big rounds.

Inc42 data shows that the test prep segment is expected to reach $9 Bn by 2030, growing at a CAGR of 29%. It is the second fastest growing segment within edtech, just behind skill development.

StudyIQ’s Jain, however, aspires to double down on the government competitive entrance exams, including the State Public Service Commission (PSC) and add more solutions to enhance learning for UPSC aspirants .

While industry experts believe test prep and skill building will continue to grow, edtech companies must tread with caution when it comes to expanding and scaling up. Sustainability will remain a key consideration for founders even post the funding winter.

According to Inc42’s layoff tracker, as many as 22 edtech startups have let go of close to 10K employees since last year. Moreover, the corporate governance and debt issues at BYJU’S, which is said to laid off 1,000 employees in June, has further dampened investor interest in the edtech sector.

However, not all edtech players are in the same boat. Nagar revealed that his company has not resorted to layoffs even amid the downturn, which demonstrates the startup’s commitment to creating a resilient and sustainable edtech brand.

This is why, despite the turbulent state of edtech, Adda247’s Nagar remains optimistic. “The edtech industry has a lot to offer to the society at large. Not everybody has the means to move to metros and online learning still has room to make great strides in Tier 2+ cities and towns,” he said.