SUMMARY

From minting its first unicorn in 2011, the Indian startup ecosystem has today grown to foster 110 unicorns, accounting for 8.8% of the global number

Inc42 estimates that India’s unicorn club will have more than 280 startups by 2030

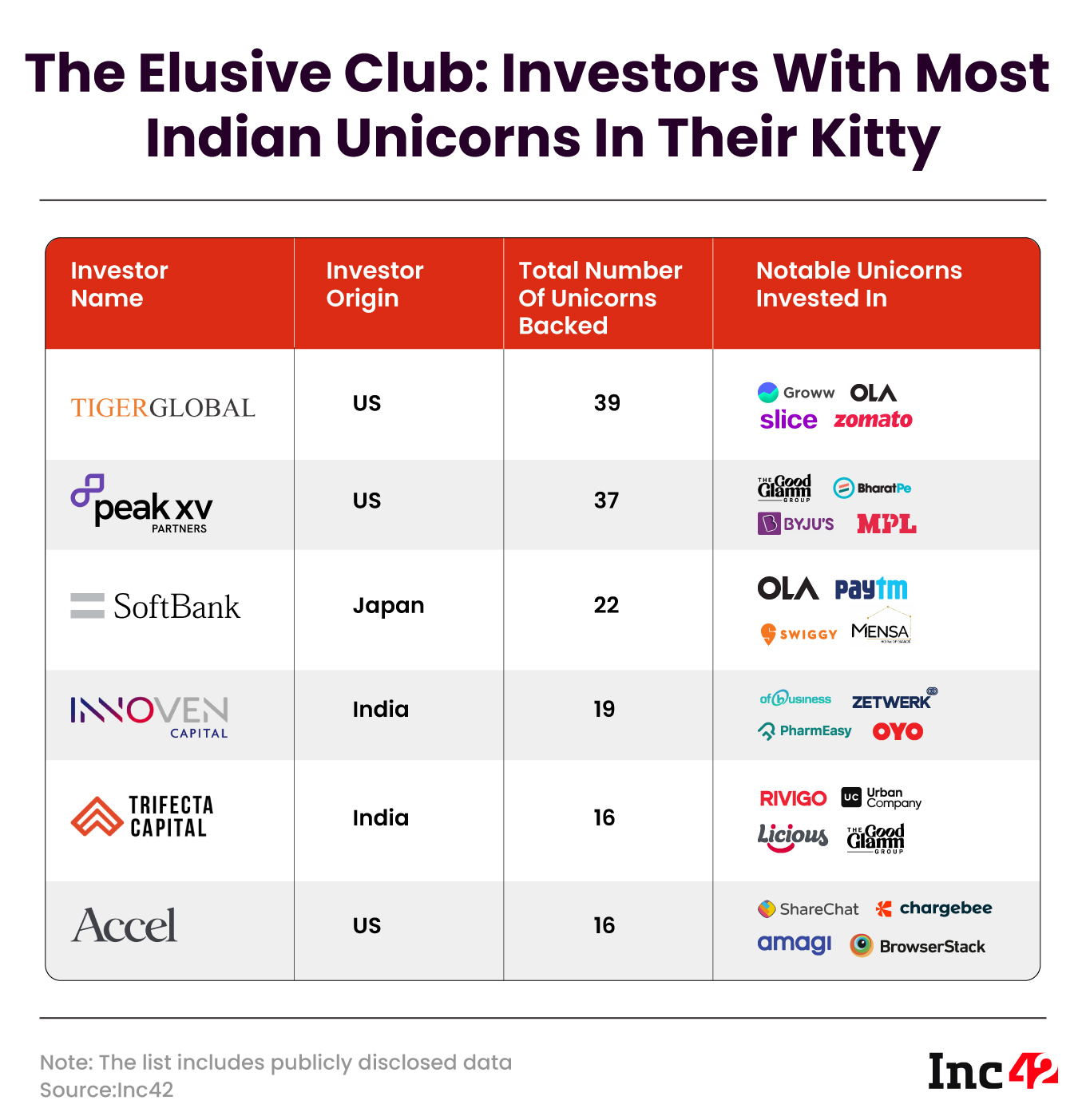

Inc42 has collated a list of investors who have actively contributed to the growth of the unicorns in India and are expected to pave the way for many more in the not-so-distant future

Back in 2011 when Indian startup InMobi acquired the elusive $1 Bn valuation, the word ‘unicorn’ was yet to be coined. Just two years later, in 2013, venture capitalist Aileen Lee came up with the term to refer to startups that were a ‘rare’ billion-dollar private tech enterprise.

A decade later, Indian unicorns seem to have taken the country and the entire world by storm. From minting its first unicorn in 2011, the Indian startup ecosystem has today grown to foster 110 unicorns, accounting for 8.8% of the global number.

According to Inc42’s Decoding India’s Unicorn Club Report 2023, the country had a mere 42 unicorns till 2020, which grew to 87 by the end of 2021.

Thereon, macroeconomic volatilities weighed on the Indian startup ecosystem, which could add only 22 unicorns to its kitty till September 2022. Since then, there has been a dry spell of unicorns in the world’s third-largest startup economy.

Interestingly, these uncertainties could not stop investors from accumulating dry powder and backing big-ticket Indian startups. The headwinds notwithstanding, Inc42 estimates that India’s unicorn club will have more than 280 startups by 2030.

Leading the charge will be the investors who have been pumping billions of dollars into the ecosystem and are expected to pave the way for many more in the not-so-distant future.

Download The ReportHowever, what’s striking is that only a handful of venture capital (VC) and private equity (PE) firms have been the biggest backers of Indian unicorns. Inc42 has collated a list of investors who have actively contributed to the growth of unicorns in India. Let’s take a look!

Editor’s Note: The list has been arranged in descending order of the number of unicorns backed by these investors.

Tiger Global

Since the fund ventured into India in 2007, Tiger Global has emerged as one of the most active investors in the Indian startup ecosystem. Largely stage-agnostic, Tiger Global focusses on Series A to pre-IPO stage startups.

The New York-based VC firm counts 39 Indian unicorns in its portfolio, including names such as Flipkart, Bharatpe, and NoBroker, among others.

In June 2023, the firm raised $2.7 Bn for its 16th fund, a far cry from the target of $6 Bn set by the investment firm previously.

Peak XV Ventures

Peak XV Partners, formerly known as Sequoia India, is one of the biggest investors in the Indian startup ecosystem. Since foraying into India with the acquisition of Westbridge Capital Partners back in 2006, the VC firm has invested in a host of Indian startups across sectors and segments.

Being one of the first marquee global investors to ride on the Indian startup wave, Peak XV Partners has previously backed names such as Flipkart, Paytm, and BYJU’S, among others.

With $9 Bn worth of assets under management (AUM), Peak XV Partners has so far invested in more than 400 Indian startups, of which as many as 37 have turned unicorns while some have even listed.

Some of its big-ticket unicorn investments include the Good Glamm Group, BharatPe, Zomato, Freshworks, Ola, OYO, Pine Labs, and Razorpay, among others.

SoftBank

SoftBank is a Japanese tech investor that operates a global fund called SoftBank Vision Fund, which invests in tech-based startups across the world.

So far, SoftBank has invested capital to the tune of $15 Bn in homegrown startups and counts India as its third-largest market, after the US and China, in terms of the number of deals.

The tech investor has so far backed 22 unicorns, including the likes of Ola, Paytm, and Blinkit (formerly Grofers), among others. As many as four unicorns in its India portfolio, Swiggy, Lenskart, FirstCry and OfBusiness, are also planning to go public soon. This could bring a major windfall gain for SoftBank.

Innoven Capital

Since its inception in 2008, Temasek-backed InnoVen Capital has emerged as one of the biggest players in India in the venture debt space. It has backed 200 startups so far and has deployed more than $800 Mn so far globally.

It backs early and growth stage tech-based startups. Other than India, it also operates in China and some parts of Southeast Asia.

Within India, the startup has had a stellar run and has so far provided debt funding to 19 Indian unicorns, including the likes of Myntra, OYO, BYJU’S, PharmEasy, and VerSe Innovation (Dailyhunt parent).

Trifecta Capital

Founded in 2015 by Nilesh Kothari and Rahul Khanna, Trifecta offers equity as well as debt funding to startups. The alternate financing firm also offers financial advisory services to its portfolio startups.

With more than $600 Mn in AUM, Trifecta focuses on startups from industries such as consumer services, consumer brands, ecommerce, mobility, edtech, and agritech, among others.

Trifecta Capital claims to have pumped in more than INR 5,500 Cr in Indian startups since 2015. It counts 25 unicorns in its kitty, including big names such as Meesho, NoBroker, BharatPe, Urban Company, Licious, and Rebel Foods.

Accel India

Headquartered in the US, Accel was one of the early global investors to enter India to back the burgeoning startup ecosystem. It entered India in 2005 with the acquisition of a $10 Mn early stage fund called Erasmic Venture Fund, which was rebranded as Accel India later.

Since its India entry, it has launched seven funds and invested in startups across sectors. Accel India, which invests across stages from seed to growth stage, had a cumulative portfolio valuation of well over $100 Bn as of mid-2022.

With more than 22 unicorns under its belt, Accel India has so far invested in the likes of Flipkart, Chargebee, Freshworks, Vedantu, BookMyShow, Myntra, Moglix, Ninjacart, and Swiggy.

Download The Report