There is still no clear roadmap for domestic manufacturing of Li-ion cells in the country

India also has a scarcity of primary raw materials required for manufacturing Li-ion cells or Li-ion batteries at large

If India becomes a manufacturer of Li-ion cells, it would change the country’s overall manufacturing industry landscape, impacting its economy as a whole

The government’s push for the adoption of electric vehicles (EVs) has translated into multiplying sales numbers, however, the country considerably lags behind in establishing an all-encompassing infrastructure that would support this growth sustainably.

Over the past few weeks, multiple EV fire incidents have caught the country’s attention, repeatedly pointing to the poor quality of imported Lithium-ion (Li-ion) cells as the most probable cause. India, currently, lacks a clear roadmap in terms of making the country a Li-ion cell manufacturing hub.

Li-ion cells are core components that go into making the Li-ion batteries for EVs. The cells, coupled with the battery packs that hold them, and the Battery Management System (BMS), which ensures the safety of the battery packs, make Li-ion batteries fully functional.

Though there are a few manufacturers of Li-ion batteries in India, like Amara Raja and Exide, most of the components that go into these batteries, including the cells, are largely imported and only assembling takes place in India. India largely lacks the domestic manufacturing capacity at a commercial scale, and imports Li-ion batteries primarily from the US and China.

India imported 450.3 Mn units of Li-ion batteries in the April-November period of the financial year 2019-20, valued at $929.26 Mn (over INR 7,200 Cr), the then union minister Harsh Vardhan informed the Lok Sabha in February 2020.

In 2021, the Indian government introduced an INR 18,100 Cr Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage, with a total manufacturing capacity of 50 GigaWatt Hour (GWh). In March this year, Reliance New Energy Solar, Ola Electric, Hyundai Global Motors and Rajesh Exports were selected under the scheme.

However, a considerable amount of capital and time will be needed to establish a 50GWh facility. A plant of this scale is estimated to cost around INR 30,000 Cr ($4.6 Bn) and take about 3 years to build, as per a 2018 research report published by the Center for Study of Science Technology and Policy (CSTEP).

The report also mentioned that an India-manufactured Li-ion battery is expected to cost INR 9,614/kWh ($148/kWh).

If we study all the data, there exists some major disparity in the sub-segments of the Indian EV market. While India’s total EV market is expected to reach about $15.40 Tn by 2027, the Li-ion battery market would reach $4.85 Bn by the same year, as per reports by Mordor Intelligence. If this huge gap is not gradually bridged, it might become extremely difficult for India to develop a complete EV ecosystem.

Why India Needs To Focus On Producing Li-ion Cells And Batteries

Earlier this month, NITI Aayog member and scientist V K Saraswat said that battery cells imported for EVs ‘may not be’ suitable for India, and emphasised the need for local manufacturing of the cells.

The statement from Saraswat came just a few days after a preliminary report by a government panel looking into the recent EV fires reportedly identified faulty battery cells and modules as the cause of such incidents.

According to a few government sources, issues in battery cells were partly responsible for both Ola Electric’s and Okinawa Autotech’s escooter fire incidents.

In fact, as the EV two-wheeler fire incidents started making frequent headlines, many industry leaders pointed out the use of low quality/cheap battery cells as the most probable reason behind these incidents. Many say that since the Li-ion cells are not manufactured in India, they are not exposed to Indian conditions during the R&D process, leading to such safety issues.

Amitabh Saran, founder and CEO at Altigreen, earlier told Inc42 that a majority of the foreign cell manufacturers mention that most of their batteries are best operational at 25 degrees centigrade, making them hardly ideal to function in the hotter Indian ambient temperature. But these cells are the cheapest available option as they are bulk produced, especially for the European countries, and lower the OEMs’ cost of production.

Progress So Far

A narrative for the importance of cell manufacturing in India and widening battery manufacturing at a larger scale has now kicked off and presents a hopeful picture against the current backdrop.

However, the country is running considerably late compared to some of the most prominent EV cell manufacturers in the world. According to many industry leaders, it would perhaps take at least five years before India starts getting self-reliant on its own cell production.

After all, 9.66 Lakh EVs are currently running on the Indian roads (as per the government’s February data), while the number of India-made Li-ion cells in the market technically stands at zero.

Gautham Maheswaran, cofounder and CTO at RACEnergy, an EV infrastructure company, said that even if the current battery manufacturers start stabilising the kind of technology required for manufacturing Li-ion cells now, it will take a few more years for these cells to enter the market and become economically viable for practical usage.

Maheswaran estimates a timeline between three to five years before the first cells come to the market for sale and, till then, India will be reliant on imports.

Echoing similar sentiment, Venkat Rajaraman, CEO and founder at Cygni, a Li-ion battery pack maker, also said that for the next two to three years India would be “heavily reliant” on importing EV battery cells.

According to Rajaraman, in contrast to countries like China, which took the initial steps in cell manufacturing over 20 years back, India’s overall EV industry is nascent and doesn’t have access to the major raw materials required for cell manufacturing.

While a lag is evident, the issues that have hindered India from becoming an EV cell manufacturing hub are multifold. From capital to access to raw materials to government support, there are issues that are interlinked and serious. They demand immediate attention if the EV industry has to full-fledgedly take off and ensure overall safety, along with sustainable growth.

Government’s Role In Incentivising Players

Since the capital investment for cell manufacturing facilities is huge, unless big players step in or the government pushes through incentives for cell manufacturing specifically, the drive is not going to be generated, opined Maheswaran.

“The government or its think tank NITI Aayog should come up with a clear roadmap, which includes policies, subsidies and other monetary benefits for companies going into cell manufacturing,” he said. “While a few policies have been introduced for setting up manufacturing units, there is nothing on the expenditure side for R&D.”

If we step a few years back in 2015, when the government launched its highly ambitious Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) India Scheme, it did not particularly focus on boosting the manufacturing industry related to EV components. The Phase-II of the scheme was supposed to end in March this year but has now been extended till 2024. It largely included plans related to incentivising EV manufacturing and adoption, and setting up EV charging stations.

Hence, it goes without saying that there has been a major gap from the very initial days. As many industry leaders opine, the push for making India self-reliant in Li-ion cells could have started long back.

Challenge In Accessing Raw Materials

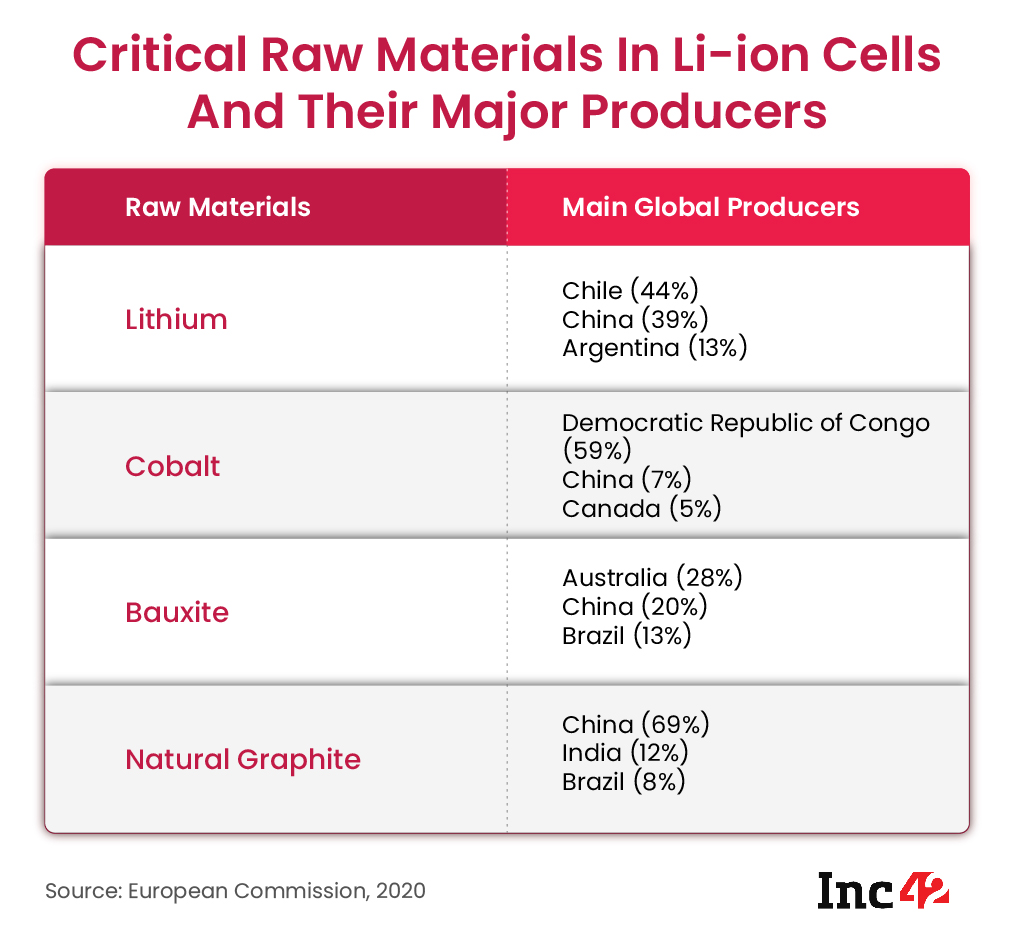

It is also important to note that India has a scarcity of the primary raw materials required for manufacturing the Li-ion cells or Li-ion batteries at large.

Besides lithium, the other key raw materials that are used in manufacturing batteries include bauxite, cobalt, manganese and natural graphite. Bauxite is the primary source for producing aluminium, and aluminium foil is used as the cathode current collector in Li-ion batteries. Battery cathode that stores lithium is made from a chemical compound that is a metal oxide, which is usually a mix of nickel, cobalt, manganese, along with aluminium.

On the other hand, graphite is mainly used in the Li-ion anode that also stores lithium, and this raw material is highly concentrated in China.

In fact, except for manganese and graphite, all the other raw materials are hardly available in India. Hence, India would end up relying on importing the raw materials even if the cells are manufactured in the country.

If we look at the above table, even the countries like China, South Korea and Taiwan that produce Li-ion cells in bulk do not have access to all the raw materials. Hence, the major cell manufacturing countries acquire mines in other countries and then process them.

Rajaraman believes that India too needs to reach that level to become truly self-reliant. After all, India might be an expert in manufacturing lead-acid batteries but the country needs to gain more expertise in building Li-ion batteries.

Importance Of Self-Reliance In Manufacturing Other EV Components

If India has to become truly self-sustainable in manufacturing EVs and batteries, a clear roadmap is required for all the companies in the EV ecosystem to incentivise the making of all other EV components in-house, in India.

In line with several experts’ opinions and the findings from investigations on the escooter fire incidents, it is clear that the issues are not with battery cells alone. BMS and battery casing, which are also largely imported by the EV OEMs, were also found to be faulty in some cases.

As Vinkesh Gulati, president of the Federation of Automobile Dealers Associations (FADA), told Inc42 earlier, a chunk of existing EV companies import most of the equipment from foreign countries and just assemble them in India, and their vehicles do not go through the rigorous R&D process that conventional vehicles do.

It is pertinent to note that the Indian roads and climate, usage of vehicles in the country and people’s psyche of loading vehicles are very different from the other regions, and thus, Indians require vehicles that would suit those needs.

How Li-ion Cell Production Will Help The Country?

According to several industry leaders, if India becomes a manufacturer of Li-ion cells, it would not only drive the independence and growth of the EV industry but also change the overall landscape of the country’s manufacturing industry, impacting its economy as a whole.

While we often jump to the conclusion that EV battery cell manufacturing would lower the overall cost of EVs, it might not be the ultimate truth.

It is true that batteries make about 40%-50% of the total cost of EVs, and importing them makes the EVs costlier than conventional internal combustion engine (ICE) vehicles. However, manufacturing cells in India would be cost-effective only when it catches up to the scale that is there in the other Li-ion cell manufacturing countries, said Maheswaran. According to him, reaching that point is still a matter of about a decade.

In fact, EV cell manufacturing in the country is not purely a cost consideration, rather it is for business and supply chain continuity, said Ranjita Ravi, cofounder of Orxa Energies, an ebike OEM.

Explaining how manufacturing cells would improve the broader supply-chain aspect of it, Maheswaran said that global disturbances such as a pandemic or a war situation like the ongoing Russia-Ukraine crisis always disrupt the international supply chain. If the country keeps relying on international shipping partners and other parties, it could hurt India’s EV industry. It might also result in halts or delays in producing the vehicles in the market.

If the EV supply chain is completely based in India, it will ultimately boost the EV ecosystem as a whole because the country won’t be any more dependent on any outside entities.

Moreover, it goes without saying that India’s Li-ion cell manufacturing would also spur growth in the overall manufacturing industry, creating jobs and bringing in investments. After all, Li-ion batteries are also used in other electronic devices such as smartphones, laptops, clocks, watches and remote controls.

According to Rajaraman, India’s Li-ion cell manufacturing would be a major boost to the country’s recycling industry as well.

In fact, it is now well-known that a majority of the components in Li-ion batteries, over 90%, can be extracted and reused. Rajaraman said that if India gets the technology and expertise in manufacturing the cells, it would also learn the extraction process, hence spurring growth in its recycling industry. For self-sustainability, it is particularly important to boost Li-ion battery recycling.

According to several studies, India is one of the leading e-waste generating countries, and it will increase every year. Along with the other electronic products and their components, EVs would now further augment this rise. However, if given enough attention, the scope for recycling and reusing the waste is also considerable.

According to a 2019 McKinsey & Company report, in 2025, second-life batteries could be 30% to 70% less expensive than new ones. India could eventually reap the benefit of this as well.

Moreover, India could save over INR 1 lakh Cr annually in crude oil imports with increased EV penetration, as per Council On Energy, Environment and Water’s report of 2020.

The government has created a pathway for startups and large industry players. The onus is now on the startups and industry to forge ahead, added Ravi.

Ad-lite browsing experience

Ad-lite browsing experience