It’s become a bit of a media game now, but regardless of the reputational harm on BYJU’S, there are some serious questions

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

What’s happening at BYJU’S? That’s the question everyone is asking this week, and the answer is not clear even after the past few days of talking to sources, and the back-and-forth of statements from investors, auditors and the company.

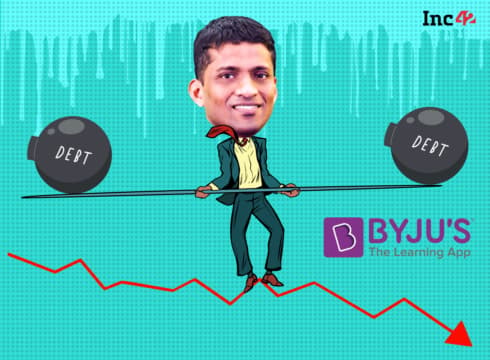

It’s become a bit of a media game now, but regardless of the reputational harm on BYJU’S, there are some serious questions — from the lack of filings to the legal battle against lenders of the $1.2 Bn Term B loan and the future of the company.

If indeed there is any material risk from the recent resignations of board members, then it’s not just BYJU’S that will be shaken, but the ripple effects of the highest valued company in India will reach far and deep, including the reputational damage for the startup ecosystem.

Before we dive into the questions for BYJU’S, take a detour through our top stories this week:

- Dark Side Of Shark Tank: With Shark Tank India comes the limelight, but also the risk that the Sharks may never actually invest in your company despite committing. Here’s what happens when the show ends

- Corporate Governance Storm: It’s investor audit season for Indian startups and VCs are scrutinising every claim made by founders. How does this impact the ecosystem? We take a look

- How Mojocare Faked It: B Capital, Chiratae and Peak XV-backed Mojocare is the latest startup to face the heat after its founders confessed to fudging books. What led the startup to the point of lying?

Torrid Time For BYJU’S

It’s been 18 months to forget for BYJU’S — caught between a trifecta of pressures from carrying a massive organisation, the global macroeconomic slowdown, the post-Covid headwinds, the company looks weary and wounded. Last year, CEO Byju Raveendran even admitted going through sleepless nights as he looked to solve the many problems and deal with personal emergencies.

These problems necessitated layoffs and a change in its operations, but it does not seem to have delivered right results. At least that’s what a reading of the past few weeks would tell you.

The legal fight with its $1.2 Bn TLB lenders aside, the company was also hit by raids by the Enforcement Directorate, inquiries from the Ministry of Corporate Affairs, questions over lack of regulatory compliance, and lack of profitability for expensive acquisitions such as WhiteHat Jr.

Nothing has gone right for the company in the past few months, and this past week’s resignations of three key board members and the auditor Deloitte raises even more questions for the edtech giant which has a towering $22 Bn valuation — at least on paper.

While the company claims this move was necessitated due to a change in shareholding, it did not elaborate on when this change occurred.

Breakdown Of Trust In The Board

BYJU’S declined to speak to Inc42 and did not respond to our questions on shareholding, the delays in filings and whether the vaccuum in the board will be filled any time soon.

Sources told Inc42 that three board representatives had been mulling exits for the past several weeks due to a breakdown in trust and communication between these director and BYJU’S cofounder and CEO Byju Raveendran.

There was also dissatisfaction over how the company has dealt with the issues surrounding the lenders of its $1.2 Bn Term B loan. BYJU’S has sued lenders over alleged harassment in recovery of the loan. “He did not take the board’s advice under consideration when dealing with recent issues at the company,” one of the sources added.

At first, the company denied that any board members are stepping away and then later said it is looking to reconcile with these investors and then suddenly claimed that the resignations were needed due to a change in shareholding. These series of contradictions in a matter of days point to a serious problem at the company.

Will FY22 Numbers Be Delayed Further?

It’s hard to ascertain much about the company because unlike most other private companies, BYJU’S is usually tardy when it comes to filings.

Even by the lackadaisical standards of Indian companies in reporting their financials, BYJU’S has taken things to another level. It was only in September 2022 that we were shown the state of the company’s financials in FY21. Though it was 18 months late, many thought that BYJU’S had turned a new leaf and would perhaps be more consistent in its filings.

But that is clearly not the case. The company has not filed its FY22 numbers, 15 months after the completion of that fiscal year. We can’t even begin to estimate when the FY23 numbers might come. And with Deloitte resigning from its role as auditor due to the company’s lack of readiness for an audit before releasing the FY22 numbers.

The new auditors will likely take months to get familiar with BYJU’S systems and even the company’s CFO is barely a few months old at the company.

BYJU’S In A Pinch

Without audited FY22 numbers, it’s hard to see how BYJU’S will get out of its current financial mess. If indeed it has to accelerate its TLB repayment, it will need to raise funds from other investors.

And while the company is said to be in talks to raise this amount, it’s not clear who might invest in BYJU’S right now without seeing how sustainable its operations are. Plus, the sudden exit of investors from the board gives out wrong signals to upcoming investors.

As we reported this week, investors are going through founder and startup claims and projections with a fine-tooth comb, so BYJU’S will also need to pass that benchmark to raise funds. And right now, the company’s ability to work with investors is being questioned.

According to a report by The Arc this week, CEO and cofounder Raveendran claimed to have raised $250 Mn in his personal capacity from BYJU’S investors Qatar Investment Authority, Tiger Global and others. This was in 2021 when the Aakash deal came into jeopardy after BYJU’S failed to make a final payment of nearly INR 2,000 Cr on time to complete the transaction.

It’s doubtful that Raveendran can pull off the same move twice, and in any case the company owes a lot more than $250 Mn right now to meet its debt repayments and to extend its runway.

In fact, if anything investors are looking to sell shares as per reports in January this year. Several early investors including Lightspeed Investment Partners and Chan Zuckerberg Initiative are reportedly looking for buyers to offload stake in the edtech major.

What Hurts BYJU’S Hurts Indian Startups

The biggest problem for BYJU’S is that it raised mounds of debt and equity at a time when capital was free flowing and it has not used these capital infusions to fix the holes in its operations. It’s only done that in the last 8-9 months when these holes grew too large.

It remains to be seen if this issue will be settled without major spending for BYJU’S. While the lenders are open to negotiations, they have rejected the edtech giant’s proposal for one-on-one meetings, and are also considering options including further litigation or seizing collateral as recovery.

The problems have definitely dented the image of edtech in India, but there’s also the question of what this means for the Indian startup ecosystem. Given the funding track record BYJU’S, the list of investors in this chain (funds and their LPs) would be longer than many public companies.

This is not just another startup. The feeling in the ecosystem is that this will further dent the image of the Indian startup ecosystem, where VCs are already being asked questions about returns and the lack of corporate governance standards.

By some measures, BYJU’S is close to being too big to fail given the huge and serious repercussions this will have on the confidence in India’s tech economy, but even a giant that’s shaking and stumbling might be enough to scare away new investments. It’s time for BYJU’S to steady itself soon or it’s not just one company that will pay the price.

Startup Spotlight: How To Build An App For Senior Citizens

India is said to have over 700 Mn internet users and this number is rapidly growing. Just as startups have looked to tap the younger new-to-internet users, GenWise is looking to solve digital challenges for the senior citizens who are coming online for the first time.

Founded in 2023, the app is looking to make senior citizens ready for digital financial management, social engagement, communication, healthcare and more. Having raised $3.5 Mn, GenWise plans to develop a digital personal assistant to help elderly users grasp concepts and information without seeking assistance from relatives.

The startup’s biggest challenge is the relatively low maturity of the tech ecosystem in India when it comes to the seniors care space. How will GenWise overcome this and also unlock monetisation?

Sunday Roundup: Startup Funding, Tech Stocks & More

- Minor Uptick In Funding: Indian startups collectively raised $149 Mn across 20 deals in the past week, which is over 20% lower than the week before. H1 2023 has seen close to $5.4 Bn in funding with one week to go, a huge fall from the $19 Bn raised in H1 2022

- Apple Cards In India Soon? The tech giant is said to be in talks with banks to launch its co-branded credit cards in India

- PhonePe’s Big Lending Play: After launching its payments gateway, PhonePe is now taking on Paytm with a merchant lending vertical

- Paytm’s Moat? Analysts believe that Paytm can fight off its new fintech competition with a sharper focus on the soundbox product for merchants, where it enjoys a first mover advantage which will be hard to erode

- Amazon Adds To India Bet: Amazon has claimed it will invest another $15 Bn in India by 2030, in addition to the $11 Bn it has already invested in the country

That’s all for this week. We will see you next Sunday with another weekly roundup, and till then you can follow Inc42 on Instagram, Twitter and LinkedIn for the latest news as it happens.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.