It’s audit season for Indian startups. Each passing week brings in fresh corporate governance trouble and more focus on the issues at Indian startups

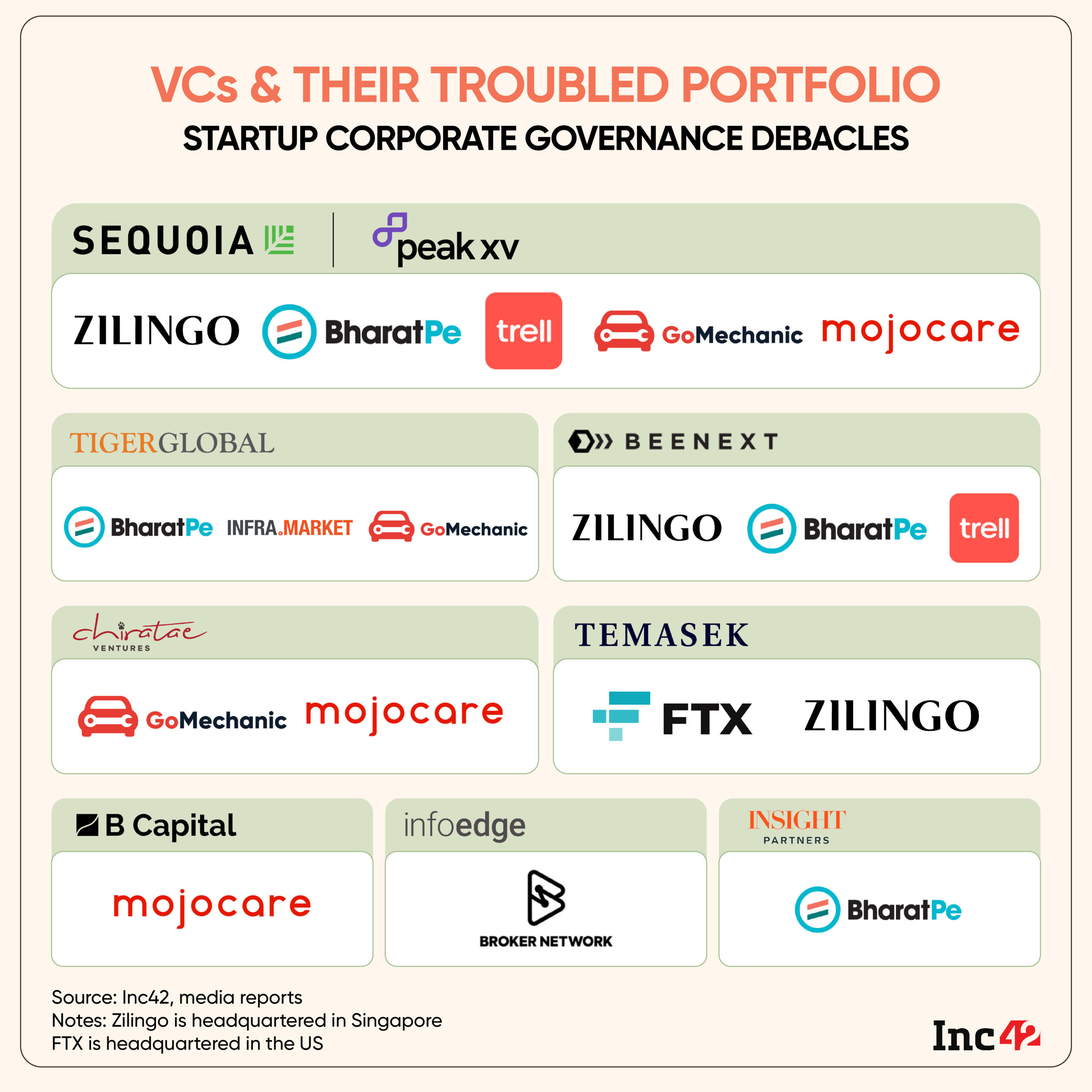

Mojocare joined the list of startups going through a forensic review, following the likes of BharatPe, Zilingo, Trell, GoMechanic, Broker Network, Infra.Market and others

Conversations in the VC world have turned from deal flow to audits and inspection rights and strengthening similar clauses in future term sheets

It’s audit season for Indian startups. Each passing week brings in fresh corporate governance trouble and more focus on the issues at Indian startups.

“In our private groups, VCs are swapping numbers of independent auditors, sharing their audit experiences with the Big Four. VCs are reviewing their SHAs with Indian startups to see how they can exercise inspection rights.” — a founding partner of a prominent Bengaluru-based early-stage venture fund.

With more than a dozen companies and at least half a dozen prominent venture capital firms entangled in controversies related to corporate governance and due diligence debacles, conversations in the VC world have turned from deal flow to audits and inspection rights.

This past week, Mojocare joined the list of startups going through a forensic review following similar investigations into BharatPe, Zilingo, Trell, GoMechanic, Broker Network, Infra.Market and others. And many VCs are facing questions from LPs over similar issues at US-based FTX, and Southeast Asian startups Spenmo and PayFazz.

Raining Audits In The Funding Winter

And this might just be the tip of the iceberg when it comes to Indian startups, sources in the VC ecosystem told Inc42. “You will start to see more reports about such audits in Indian companies. Several informal conversations are ongoing between co-investors and those with board seats are being asked to take charge of such matters,” the fund manager quoted above told us.

More than anything, the list of startups that have been alleged to have misreported revenue or those that have confessed to such fudging has led VCs to take all numbers with a pinch of salt and eroded trust in the monthly income statements that are usually prepared for shareholders.

Another Bengaluru-based venture fund partner believes that usually VCs look more closely into the books in the case of a fundraise or exits, but such deep scrutiny is becoming more common. “Not many people outside the VC world might even know about inspection rights that VCs have. Even angel investors are requesting such rights now, which was atypical before last year,” the partner added.

Simply put, inspection rights allow certain shareholders to get to the facts of the matter in relation to any reports sent by the company. Typically, this is done to weed out aspects related to revenue leaks, mismanagement of funds, allegations of unexplained related party transactions or other corporate governance hurdles. Inspection rights also allow VCs to investigate the startup in case of a potential legal action against the entity.

Take the case of GoMechanic — founders admitted to have falsified revenue by creating fake garages and inflating the sales numbers. Or Mojocare, where founders also admitted to fabricating invoices and manipulating inventory to show higher GMV. But without these admissions, even the monthly income statements would not indicate any foul play.

That’s where VCs exercise inspection rights to verify the authenticity of the numbers they are shown.

Questions about the authenticity of sales and revenue have added to the pressure on venture capital funds in India, several of which are also being questioned by upstream investors about how this will impact returns in the long run.

The global macroeconomic slowdown has hit tech investors and unicorns badly with the likes of BYJU’S, PharmEasy, Swiggy, Pine Labs, Ola going through valuation markdowns in recent weeks. These companies that have towering valuations, particularly those that have IPO ambitions, were expected to be potential exits for investors.

“There’s no certainty even around mature startups, and at the same time, the growth portfolio is stumbling due to wilful fraud and misreporting. After the 2021 funding peak all startups were well capitalised so when startups face a cash flow crunch ahead of their previous projections, VCs are bound to wonder what happened,” says a Bengaluru-based corporate accounting and audit expert who has conducted due diligence and investigated a host of startups and tech companies for over two decades.

While the larger picture is about cleaning the startup ecosystem of bad practices, there is fear among founders about increased investor compliance and stringent clauses in term sheets or shareholder agreements.

How Startup Audits Typically Work

So what exactly are investors looking for when they begin inspections or a review of the business?

The first port of call on the audit journey is the revenue cycle. “If investors see abrupt growth in a revenue cycle, it’s now a red flag. Earlier, this was celebrated as growth, but now it’s looked at with scepticism,” the auditor added.

The auditors will typically look into how the claimed growth compares with industry metrics and get some market context.

The next crucial aspect is diving into the revenue graphs. Typically, B2C companies have seasonality in sales so there will be spikes in revenue for certain months and this would typically be seen year after year. On the B2B side, there are dips when businesses look to curb spending in the fourth quarter of the fiscal year. So B2B startups will usually have lower collections in this period.

Of course, everything might look fine when diving into the revenue cycle and growth data. The next indicator of potential fudging of numbers comes from customer data. Auditors will ask the companies for specifics of CRM data. This is easier for B2B companies that usually have 1000s of customers, but B2C companies can even have millions. Auditors look for red flags through dipstick testing, since examining every customer is not always possible.

For instance, multiple B2B startups in one segment might claim they have a certain market share, but it’s simply not possible in B2B fintech for example, where there is a fixed TAM for all startups.

“So we do a sentiment analysis to understand how authentic these claims are. You will find indicators on social media, review sites and forums that can give us an approximation of the number of users. If a startup claims to have millions of customers but only has a handful of app reviews, that’s definitely a concern,” the accounting expert added.

Startups have also found themselves in a spot of bother due to ties with vendors that are relatives or don’t exist altogether. In such cases, auditors do a relationship analysis between vendors, employees, founders and even investors to find commonality that could indicate cash flowing to suspect vendors.

“We can do address analysis between all the parties to find common patterns or look at which vendors have been paid without a GST certificate. A startup may have a lot of vendors with invoices under INR 20 Lakh where a GST certificate is not needed. This can be legitimate or a source of cash misappropriation, so our job is to look at what’s the real picture.”

Erosion Of Trust: VCs Question Founder Claims

Even though investors have spoken in public about audits, forensic reviews and other probes into startups recently, the reality is that many don’t want these inspections to come under the spotlight. “There’s a lot of focus these days on the cash flow crunch for startups in media and other reports, so VCs are definitely looking more closely at startups that come into this negative spotlight. But even in other cases, founders are being grilled over each and every claim,” the early-stage investor quoted above added.

Another ‘trend’ that’s catching on is founders confessing to misreporting when the audit hammer is around the corner. We saw this in the case of GoMechanic and most recently Mojocare, where founders confessed to having inflated GMV and fudging books.

“It’s not like everyone is cutting corners because they want to. Sometimes they don’t realise the consequence of booking a receivable that will never actually materialise. There’s a difference between wilful fraud and oversight such as this, and even a forensic audit might never fully reveal the intention of a founder,” a Delhi NCR-based venture fund founder told Inc42.

Nevertheless, as VCs look to weed out the bad apples, it has even brought unwanted scrutiny on founders who are known to have pristine reputations. It also creates a trust issue and a lot of the venture capital world runs on trust in entrepreneurs.

Of course, any kind of churn pulls in even those startups that are not actually overstepping the line. It’s expected, but there is a risk of such audits completely derailing founders’ focus from growing their business to covering their bases. And this could very well end up dragging the overall growth of the ecosystem.

A second Delhi-based angel investor says,”This is much needed. Only after separating the bad actors can the ecosystem grow in the right way and direction. Unfortunately, some good founders will be caught in the middle, but it is actually a correction that will help them in the long run.”

Indian startups are not the only ones facing this scrutiny, but at this point it’s feeling the pinch due to its maturity stage. The erosion of trust has shaken up deal flow even further and made it difficult for founders to raise funds now. Investors are finally standing up to bad actors in the ecosystem, but the pressure has increased for startup founders.

Ad-lite browsing experience

Ad-lite browsing experience