Zepto is in the spotlight, but is out of the unit economics weeds?

So much has already been said about the unit economics problem in quick commerce, but startups in this space are ultra bullish and the revenue growth announced by Zepto

With the massive spike in its revenue, Zepto is definitely in the quick commerce spotlight for now, especially after becoming the only unicorn in India this year so far. But is there a deeper story behind the 14X revenue growth, which has unsurprisingly dominated headlines?

We’ll take a look at this major question for Zepto and indeed quick commerce, but take a a few minutes to check out these top stories from our newsroom:

- Mamaearth’s IPO Trail: Mamaearth’s parent company Honasa Consumer Limited is all set for its IPO this coming week, but what exactly do investors need to know before it opens. Read in our in-depth story

- Deeptech’s Moment: Peak XV Partners MD Rajan Anandan on why deeptech startups are all set to change what it means to be a technology company in India

- Startups Vs Network Fees: More than 130 startups have sent representations to TRAI over the telco plan to implement network fees, but will this actually calm the fears in the ecosystem?

Zepto’s Dream Start

It’s not often that one sees a company breach the INR 2,000 Cr revenue mark in its first two years, but that’s what Mumbai-headquartered Zepto has managed. Credit where it’s due in terms of scaling up quick commerce, bringing a competitive intensity to the segment.

Zepto has actually managed to disrupt players such as Zomato-owned Blinkit and Swiggy’s Instamart which should ideally have made the most of their existing scale when QC emerged as a category in 2020. Zepto, which rebranded from Kirana Kart in late 2021, clearly saw a gap and that was related to the mixed focus of Zomato and Swiggy.

As cofounder and CEO Aadit Palicha has said several times since last year, Zepto’s advantage is its singular focus on executing the quick commerce model. In terms of revenue, it has worked well.

But at the same time, losses have grown pretty significantly in absolute terms, even if Zepto has made quite a progress from an EBITDA margin point of view. The quick commerce startup reported a net loss of INR 1,272.4 Cr in FY23, an increase of 226% from FY22, which is a big number, but this blow is softened by the improvement in profit after tax margin from -277% to -63% in FY23.

The Unit Economics Question

So the question is: Is Zepto out of the unit economics weeds? Not quite say some former executives in the quick commerce space, including some who have come through Zepto in the past year.

“Zepto’s operating leverage is still very low. The company has to continue to spend money in expanding and scaling up revenue in the future. The trickiest part is maintaining this execution over a number of years,” according to a Mumbai-based retail and digital commerce analyst as well as investment advisor.

Operating leverage is the degree to which any company can increase its operating income through revenue, while keeping gross margins high and variable costs low. In the case of Zepto, the gross margin is not that high, as is typically the case in quick commerce.

“One might see around 15% gross margin in this space. In a typical INR 450 order, Zepto and others are losing around INR 15 to INR 20 per order, if you include discounts, last-mile delivery costs as well as warehousing costs,” added a Delhi NCR-based finance professional, who has worked closely with ecommerce players across segments.

Even a 15% margin of INR 75 is not enough to cover this, we were told, and the only way to solve this is to keep the older stores profitable for a period of more than two years consistently.

“If a dark store was opened 15 months ago, and it’s still making losses even at 100% warehousing capacity, then it will be very hard to make it profitable now. Such stores have to bring in profits for Zepto to cover corporate costs such as expansion of the network,” says the finance professional quoted above.

Cash Burn Remains A Problem

Given that we have not seen Zepto’s audited financial statements but only a part of the P&L, there are some other aspects that we are not yet privy to, which will only become clear after a deeper perusal of the startup’s financials.

The first of these is that there are abnormal losses in the quick commerce segment, which are below EBITDA line items and not always accounted for. There’s inventory pilferage, wastage, obsoletion of inventory, which are not always accounted for.

These are typically clubbed under EBITDA, but these should be accounted as business losses, we were told. Of course, we will find out more once we see how the below-EBITDA calculations are being done for Zepto in FY23.

The second problem is that as players such as Blinkit, Zepto and Swiggy Instamart expand, the working capital also increases. Even if a company has EBITDA of -INR 200 Cr or -300 Cr, the company will continue to need cash, added the first Mumbai-based analyst.

“In the case of Zepto, there are some monthly debt obligations, working capital needs, GST credit, inventory buying and inventory write-offs. If you put all this together the company will continue to need cash for buying inventory and to add more stores, which will also need more inventory. In Zepto’s case it will have to come from outside i.e investors.”

Fighting Deep Pockets

This is why some analysts and those who have worked in this segment believe that success in quick commerce essentially boils down to who has the most amount of cash. Zepto, some told us, will need to raise cash nearly every 12-15 months to scale up this revenue to compete with Zomato, which is likely to have profits to invest in Blinkit or Swiggy, which has a similar revenue mix advantage.

The company has stated that it will reach INR 10,000 Cr in lifetime revenue in the next few months. That would mean that it has doubled or tripled its revenue in FY24, at the very least, which is quite a tall claim. Zepto also said it is on track to achieve EBITDA breakeven (excluding ESOPs and other non-cash line items) in 10 months.

But this bullishness does not fit the view of the category among the experts. They believe margins may improve but losses will continue to grow unless a significant proportion of dark stores turn profitable or Zepto ventures into other verticals. The alternative is adding platform fees, which we have already seen in Swiggy and Zomato. But will this be enough to cover for the losses per order?

Essentially, the execution and singular category focus that allowed Zepto to push forward might be a bit of a problem in the long run, because it will need profitable streams to continue growing without relying on debt or equity funding. This despite raising $200 Mn in August 2023.

Zepto has quite clearly grabbed the quick commerce bull by its horns, but it’s still far away from taming the beast.

GenAI In Spotlight

It is no longer hype, but indeed the next big thing in technology. Generative AI, or GenAI and intelligent automation has the potential to disrupt industries at large, changes many of the paradigms of Web 2.0 or even Web3, and opens up the possibilities for altogether new business models. And India is currently at the forefront of this global technology shift.

Inc42’s latest report titled India’s Generative AI Startup Landscape, 2023 delves into the revolution and our data shows that the GenAI opportunity is projected to surpass $17 Bn by 2030 from $1.1 Bn in 2023, growing at a CAGR of 48%.

This meteoric rise is attributed to the innovative prowess of India’s GenAI startups as well as how quickly startups across sectors are harnessing the powers of generative AI .

Get Our Much-Anticipated Report Now

Sunday Roundup: Tech Stocks, Startup Funding & More

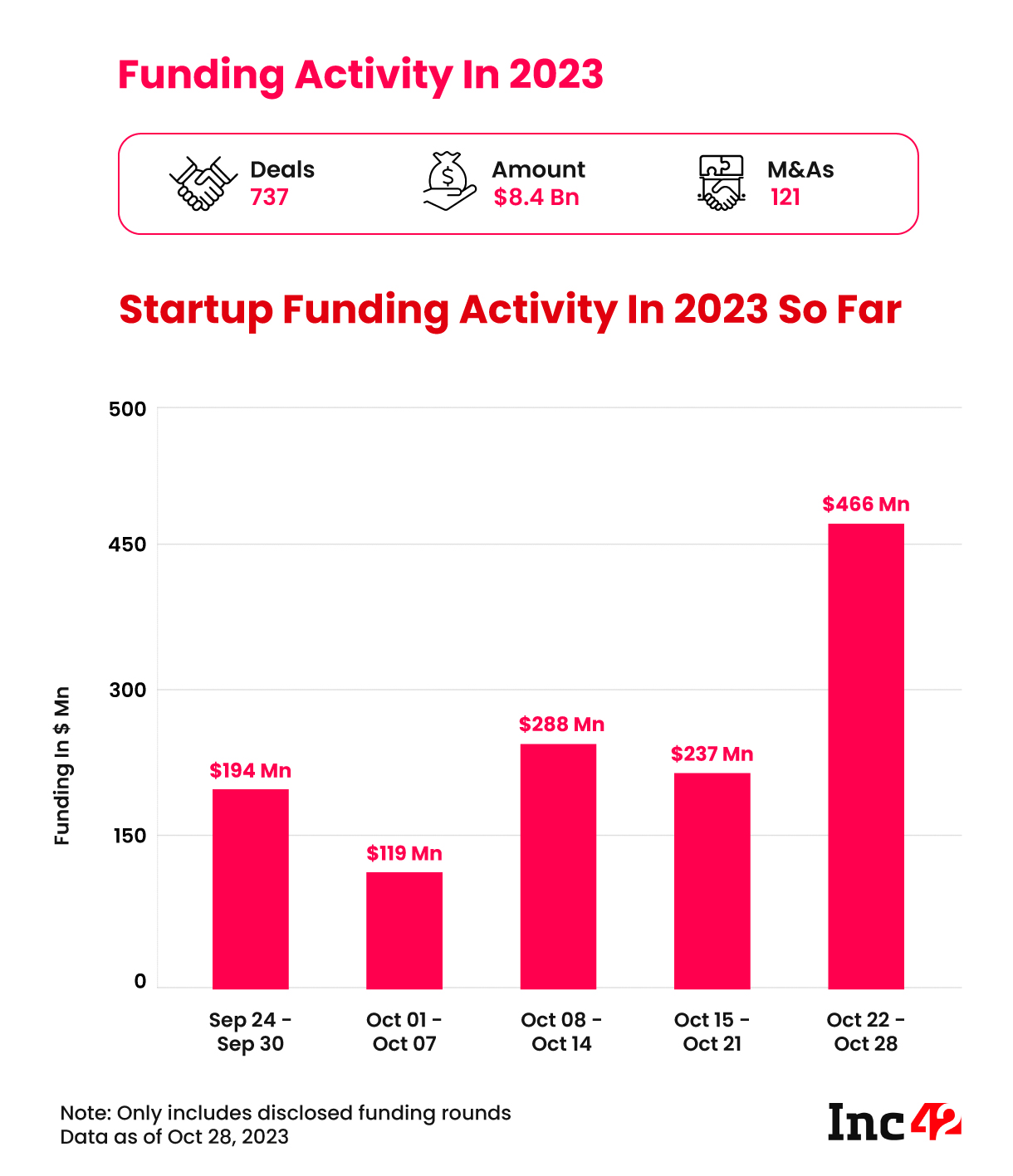

- Ola Electric’s Mega Round: This week’s total funding tally is well above the weekly average for 2023, but a bulk of the $466 Mn raised came from Ola Electric’s $384 Mn debt and equity round

- Another Finfluencer Fined: SEBI has slapped a disgorgement fine of INR 17 Cr on fintech influencer Nasiruddin Ansari aka ‘Baap of Chart’ for allegedly misleading investors

- RateGain Gains: Travel SaaS startup RateGain’s net profits more than doubled YoY to INR 30.04 Cr in Q2 FY24, as travel demand bounceback continued to drive revenue

- More Exits At BYJU’S: CFO Ajay Goel is the most recent high-profile exit from the beleaguered edtech giant, who is quitting just six months after joining BYJU’S

- Jio’s New Bet: Reliance Jio has entered the satellite-based internet race with the announcement of JioSpaceFiber, which aims to bring connectivity to remote regions

That’s all for this week. We’ll be back next Sunday with another roundup of the biggest stories and trends from the startup ecosystem!

Ad-lite browsing experience

Ad-lite browsing experience