SUMMARY

Honasa’s IPO will open for bids from Monday, October 31, 2023, till Thursday, November 2, 2023, on the Indian bourses

The company is targeting a valuation of around $1.2 Bn through the IPO at a price band of INR 308 - INR 324.

Cofounder and CEO Varun Alagh owns 34.30% of the startup, with a total of 10,67,37,650 shares

mamaearth

The IPO will open for bids on Tuesday, October 31, 2023, and conclude on Thursday, November 2, 2023. The anchor issue will open on October 30, 2023. The price band at which the issue will open is INR 308 – INR 324. At the higher end of the price band, the company is expecting to raise around INR 1071 Cr.

The Delhi-based beauty and personal care company filed the RHP on October 23, 2023, for the initial offer, which includes a fresh issue of equity shares aggregating up to INR 365 Cr or $44 Mn.

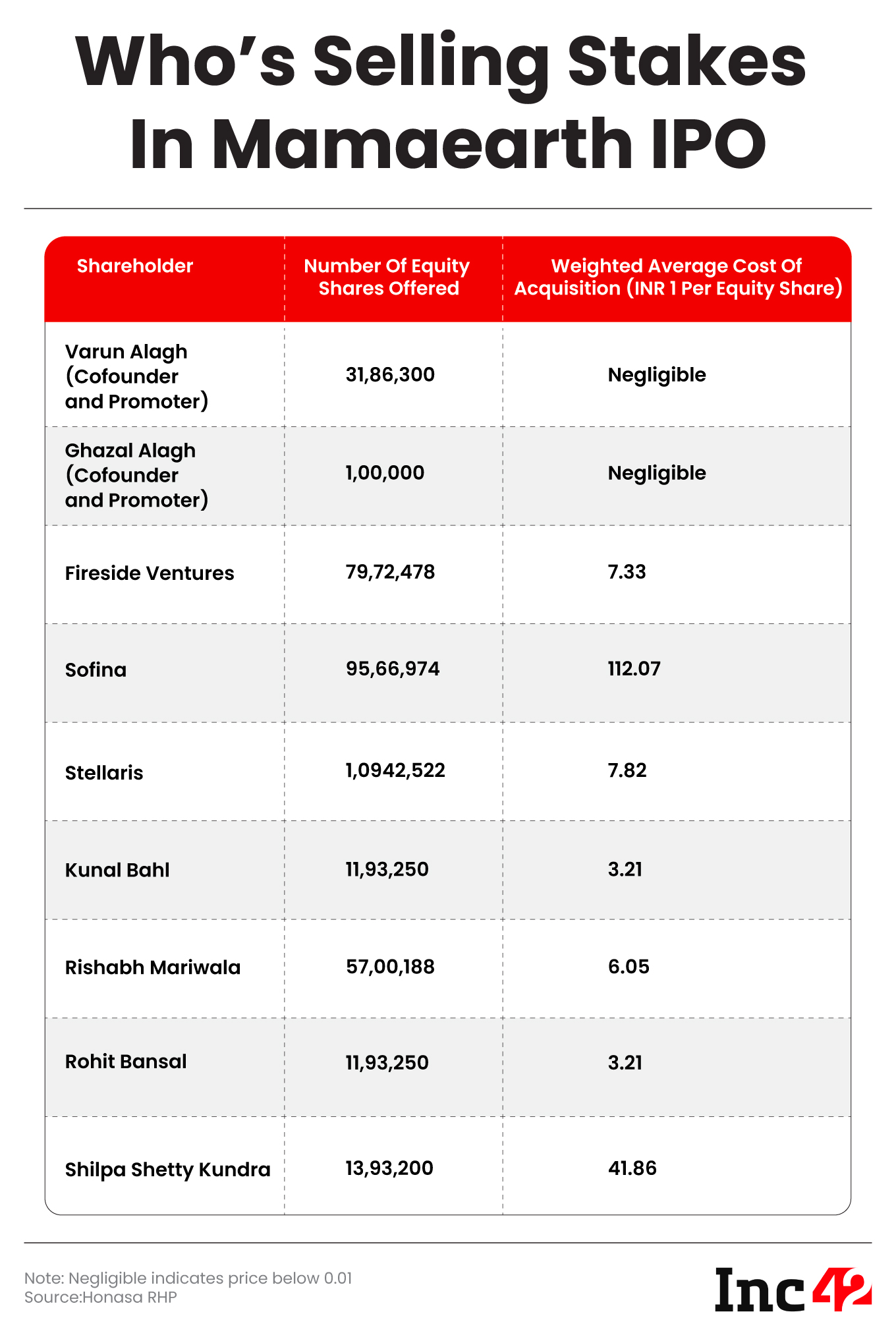

Besides this, there is an offer for sale (OFS) component of up to 4.12 Cr shares, which would see shareholders such as Kunal Bahl, Rishabh Harsh Mariwala, Rohit Kumar Bansal and Shilpa Shetty Kundra offloading their stakes in the company.

The company is targeting a valuation of around $1.2 Bn through the IPO.

The IPO is being run by Kotak Mahindra Capital, JM Financial, Citi, and JP Morgan, with legal advice provided by Cyril Amarchand Mangaldas, IndusLaw, and Khaitan & Co.

As per its RHP, Mamaearth claims proceeds from the fresh issue will be directed toward bolstering marketing efforts to enhance brand visibility, establishing new exclusive brand outlets, and expanding the network of BBlunt salons.

The allotment for the Honasa IPO is expected to be finalised on Tuesday, November 7, 2023, with the listing date tentatively fixed for November 10, 2023 (Friday).

Nykaa, which was listed publicly in late 2021, is a competitor to Honasa’s Mamaearth due to its private-label beauty brands. However, the Mumbai-based ecommerce giant is primarily a marketplace, and Mamaearth is one of the brands that sell through Nykaa.

Mamaearth’s IPO would be a true test for the Indian D2C brigade and as such plenty of eyes are eagerly watching the listing.

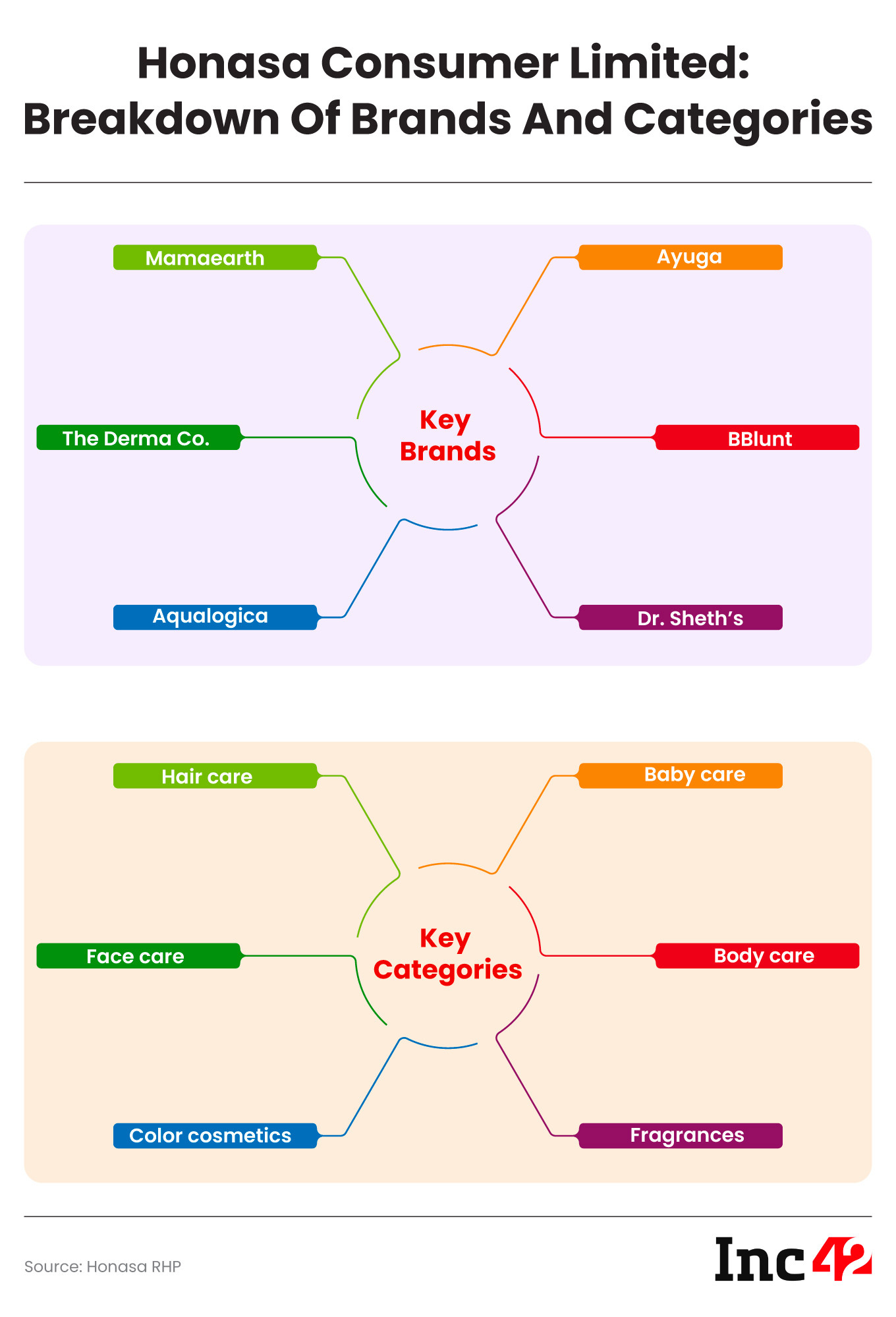

Breakdown Of Key Brands And Categories

Founded in 2016 by the husband-wife duo of Varun and Ghazal Alagh, Honasa’s product portfolio comprises six beauty and personal care brands which include Mamaearth, The Derma Co., Aqualogica, Ayuga, BBlunt and Dr. Sheth’s. This product portfolio is supplemented by our professional salons chain, BBlunt Salons.

Here’s a brief overview of each brand:

- Mamaearth: Mamaearth is the company’s flagship brand with a focus on developing toxin-free beauty products made with natural ingredients. Mamaearth was India’s largest digital-first BPC brand in India in terms of revenue from operations in FY23 according to the RHP

- The Derma Co.: Launched in 2020 to provide solutions for skin and hair conditions through a range of active ingredient-based products. The brand offers consumers an AI-enabled experience through real-time skin assessment analysis to help them detect skin conditions and identify specific products or regime for treatment. The brand has achieved an ARR of INR 300 Cr within three years of launch.

- Aqualogica: Launched in November 2021, Aqualogica is a specialised skincare brand that leverages the science of hydration to introduce products suited to Indian skin-types and has achieved an ARR of INR 150 Cr in less than 18 months.

- Ayuga: Launched in December 2021, Ayuga aims to make the traditional wisdom of Ayurveda relevant for Indian millennials by curating products in easy-to-use, modern formats that can easily fit in a consumer’s daily skin and hair care regime

- BBlunt: The company acquired BBlunt in March 2022 with the objective of extending its portfolio to specialised professional hair care and styling segments

- Dr Sheth’s: Acquired in April 2022 and operating through its Subsidiary, Fusion Cosmeceutics Private Limited, which became wholly-owned by Honasa in December 2022. Dr. Sheth’s offers specialised skincare solutions crafted with a combination of natural and active ingredients. Since its acquisition in 2022, the brand has grown 21 times, as highlighted by the founders during the press conference.

The parent company’s multiple brands together boast 301 new SKUs and 252 products as of March 31, 2023. Its core strength over the past few years has been an omnichannel distribution strategy besides its native ecommerce channels. The current online and offline split for the company is 64.01% and 33.47% respectively.

“Varun and I started as middle-class parents trying to find right products for our son, just as a babycare product. But we realised while many are selling to India, not many are crafting for India, which marked our entry into other categories,” said Ghazal during a press conference today on October 26, 2023.

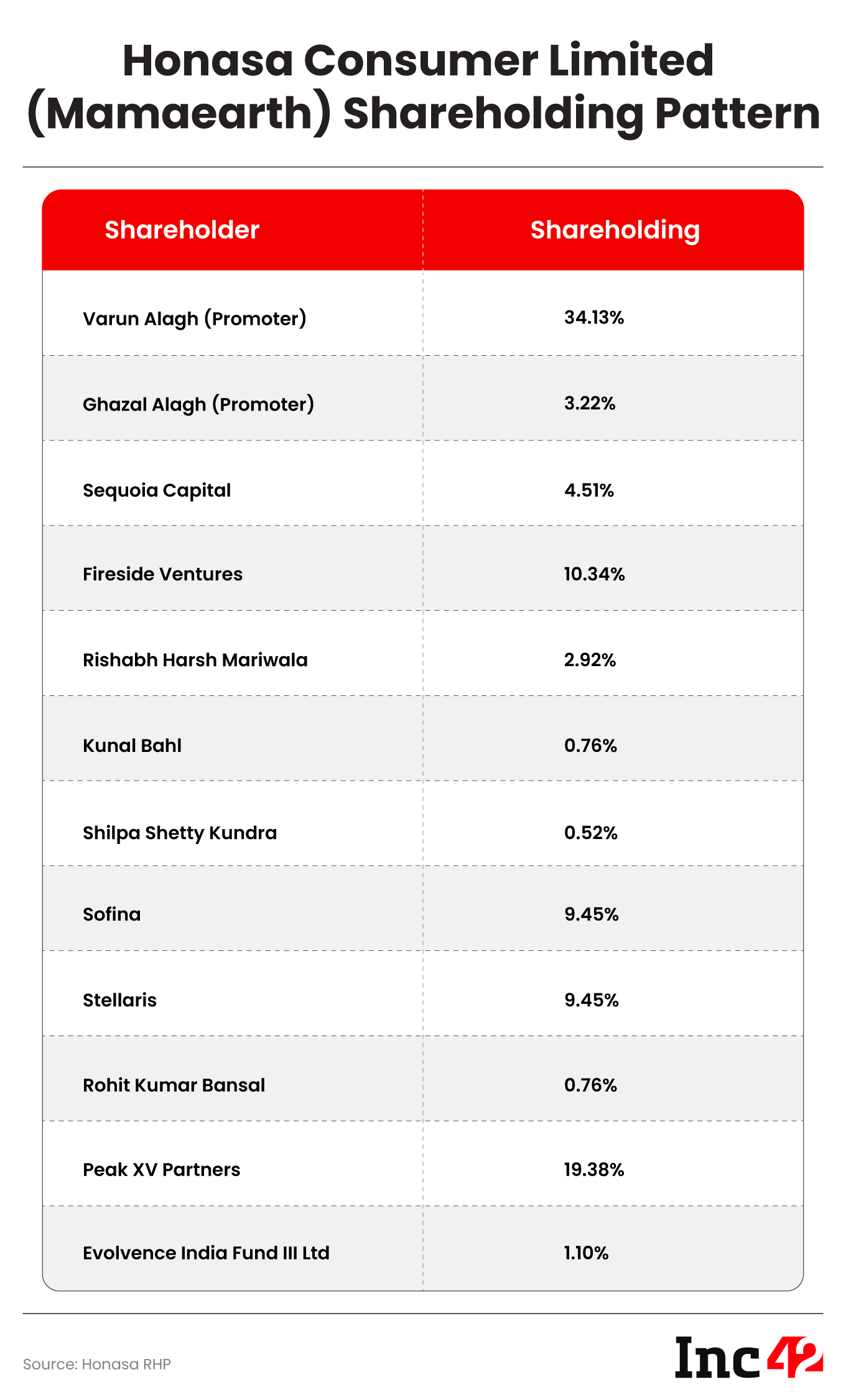

A Snapshot Of The Group’s Shareholding Pattern (Pre-Issue)

Cofounder and chief executive officer (CEO) Varun Alagh owns 34.30% of the startup, with a total of 10,67,37,650 shares. Meanwhile, cofounder and chief innovation officer (CIO) Ghazal Alagh owns 1,00,65,200 shares, or a 3.23% stake, in the D2C brand. Together, they own 37.53% of the startup. The promoter group, comprising three members, owns a 37.6% stake in the company.

Venture capital firm Sequoia India is the second-biggest shareholder, with a 24.01% stake in the company. Through its two funds – SCI Investment VI fund and SCI Investment III fund – the VC firm owns 80,10,900 shares of Honasa Consumer Limited.

Honasa achieved its unicorn status in December 2022 after securing $52 Mn at a valuation of $1.2 Bn in a funding round led by Peak XV Partners (Sequoia Capital).

Sofina Ventures, Fireside Ventures, Kunal Bahl, and Rohit Bansal are among the other key investors in Honasa.

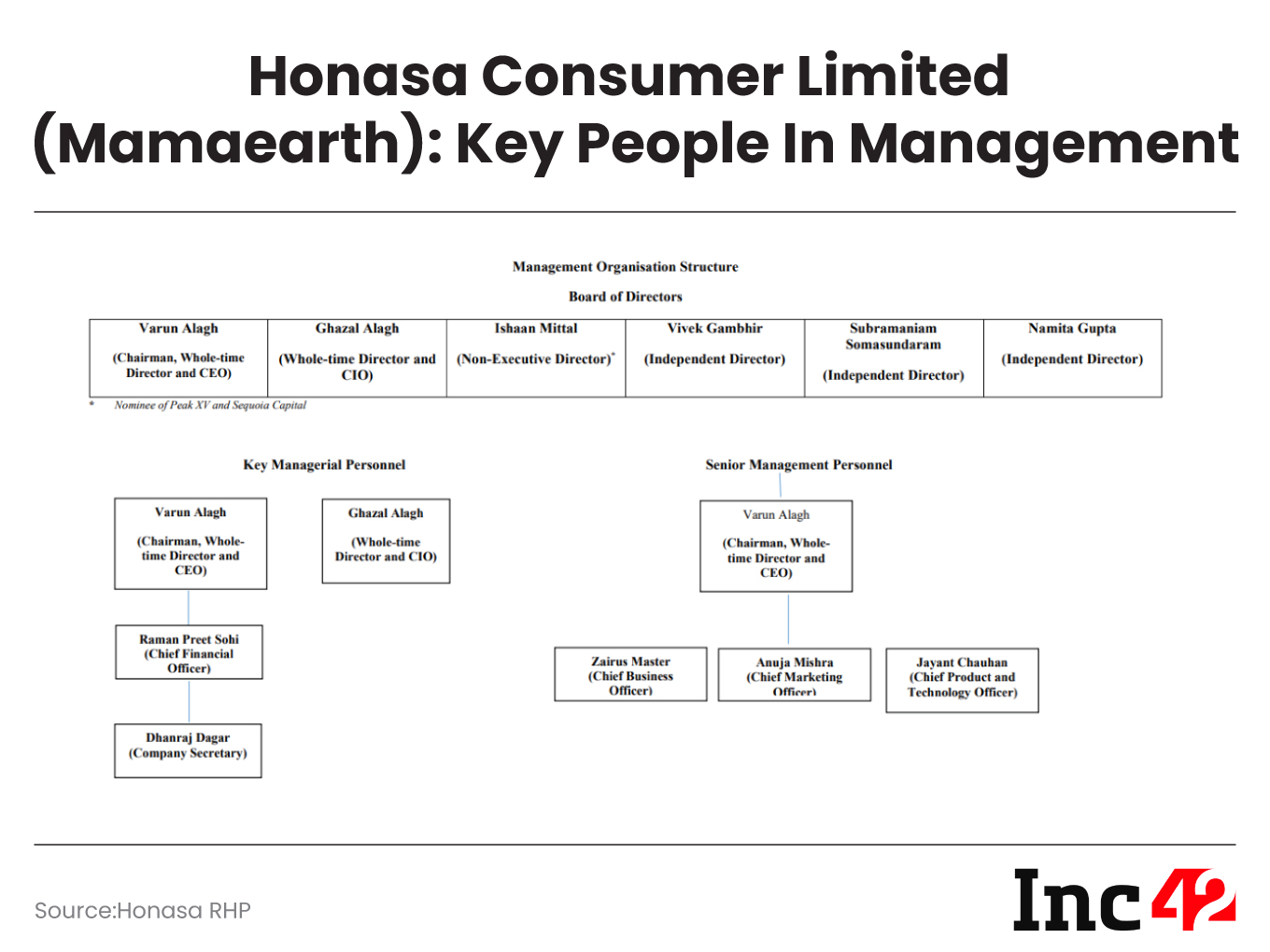

People At The Helm

As of June 30, 2023, Honasa had 993 permanent full-time in-house employees. These employees were supported by 1,767 contractors and consultants. Apart from founders Varun and Ghazal, there are five other key managerial personnel as per the RHP. The leadership team together boasts a combined professional experience of 100 years and the average employee age is 29 to 30 years.

- Raman Preet Sohi is the chief financial officer and is responsible for establishing and executing the financial strategy

- Dhanraj Dagar is the company secretary and compliance officer

- Zairus Master is the chief business officer and is responsible for setting and achieving business targets of the company and providing guidance for different revenue channels

- Jayant Chauhan is the chief product and technology officer. He is responsible for formulating a vision for the use of technology in the company.

- Anuja Mishra is the chief marketing officer. She is responsible for drafting and executing the marketing strategy of the organisation. She joined the company on March 10, 2022

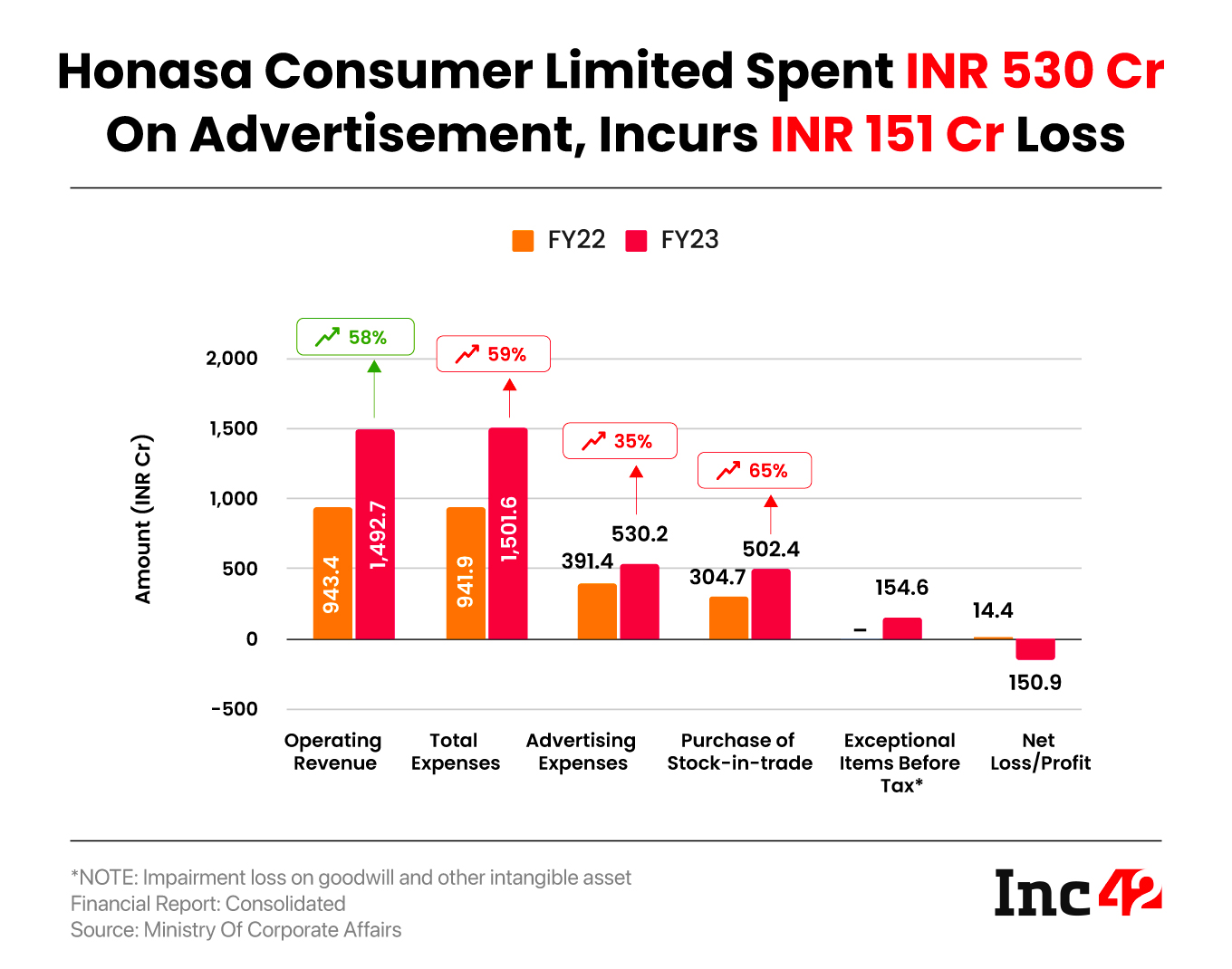

Diving Into Honasa Consumer’s Financials

Honasa Consumer reported a net loss of INR 151 Cr in FY23 as against a net profit of INR 14.4 Cr in the year-ago fiscal. It reported an operating revenue of INR 1,492.7 Cr in FY23, a jump of 58% from INR 943.4 Cr in FY22.

Further, for the three months ended June 30, 2023, the group registered INR 464.46 Cr as consolidated revenue from operations. For the same period, the net profit stood at INR 24.71 Cr.

The exceptional loss in FY23 was largely attributed to the impairment of goodwill, arising out of the acquisition of Just4Kids Services Private Limited, the parent entity of Momspresso. Without it, the startup would have reported a net profit of about INR 3.7 Cr during the year under review.

Breaking this up amid the six brands, Mamaearth is one of the most revenue-generating brands for Honasa.

In FY23, the company derived INR 172.5 Cr or 11.56% of its operating revenue from the sales of its top two products, which were under the Mamaearth brand.

Further, for the same period, INR 408.68 Cr or 27.38% of the operating revenue was derived from the top 10 brands under Mamaearth, The Derma Co., Dr Sheth’s and Aqualogica.

Omnichannel Scale & International Presence

As mentioned above, the omnichannel (retail and ecommerce) strategy has been one of the key competitive strengths for Mamaearth and its sister brands. In the competitive beauty ecommerce landscape, it faces competition from companies such as Nykaa (private labels), Purplle, Pilgrim, Pureplay Skin Sciences (Plum and Phy), SUGAR, Wow Skin Science and a host of other D2C brands.

The company has a presence in over 500 cities in India. The online distribution network covered over 18,000 pin codes in India, with products accessible in 715+ districts. Besides this, it also sells products through more than 100,000 retail outlets.

Beyond India, the company is looking to take Mamaearth to international markets and is looking to replicate the omnichannel strategy in Bangladesh, Malaysia, Vietnam, and Thailand. This would supplement the company’s other key international markets such as the UAE, Qatar, Nepal, Malaysia, Maldives, and Mauritius, where it sells primarily through Amazon.

Challenges And Market Opportunity

According to a RedSeer report quoted in the RHP, the market for BPC products in India is expected to grow at a CAGR of approximately 11% from approximately $20 Bn in 2022 to approximately $33 Bn in 2027.

The BPC products market lends itself well to digital penetration, and the online BPC market, which is currently sized as $3 Bn, is expected to grow at 29% annually to be around $11 Bn by 2027, translating to an online penetration of 34%.

However, one of the key challenges for the company is its high dependence on third-party manufacturers. In FY21, FY22 and FY23, the top three manufacturers for each period contributed 81.95%, 70.97%, and 51.73%, respectively, to the total value of its purchase of traded goods. It currently works with 37 such contract manufacturers.

Not only this, being a D2C brand it faces stiff competition, and a large chunk of its marketing expenses include engaging influencers, entering into celebrity endorsement agreements and maintaining a presence on social media platforms.

For FY21, FY22 and FY23, the promotional costs incurred on a standalone basis in connection with its engagement of celebrities and social media influencers stood at INR 22.74 Cr, INR 39.93 Cr, and INR 67.14 Cr, respectively.

Also, being able to innovate and maintain product differentiation continuously is another key challenge for the company. One of the risk factors that the company mentions in its RHP is related to the launch of new brands and products. This is because the company fears that consumer preferences can’t be predicted as they tend to change swiftly. Also, the company is not sure if its new launch will be “commercially viable or effective or accepted by our consumers”, which is typical in the FMCG space.

In the RHP, the company mentions its ability to innovate, quality assurance, supply chain and logistics as few of its many strong capabilities. However, at the same time, the continued losses over the years may keep retail investors at bay from applying for the IPO.

Having said that, the Indian startup ecosystem has gradually started to rise above the funding winter and tech stocks are expected to see positive growth amid stability across global markets. Being one of the most anticipated startup IPOs of the year, the Mamaearth listing comes with high hopes, but how well these hopes will get fulfilled, we will find out in less than two weeks.

Ad-lite browsing experience

Ad-lite browsing experience