SUMMARY

With confessions of revenue fraud and layoffs impacting 70% of its workforce, GoMechanic is the latest Sequoia-backed startup to come into the limelight for such discrepancies

As investors have called for a forensic investigation of its financials, and with the founders likely to be asked to step away, the company’s future hangs in the balance

The admission by the founders after misleading investors for years by showing fake numbers raises questions about the wilful fraud. Investors believe this puts the reputation of other startup founders at risk

The story of GoMechanic sounds familiar. A tech startup looks to disrupt an unorganised segment and scales up rapidly, before the cracks begin to appear.

With confessions of revenue fraud by cofounder Amit Bhasin and announcement of layoffs impacting 70% of the workforce, GoMechanic is the latest Sequoia-backed startup to come into the limelight for such discrepancies.

What’s different is the admission by the founder about the discrepancy and reporting false numbers to shareholders, and how these fake numbers escaped the attention of reputed auditors, such as PwC, KPMG and others.

The duplicity also raises questions about the wilful fraud. Investors believe this puts the reputation of other startup founders at risk.

Following the major controversies at Sequoia portfolio companies, BharatPe, Zilingo and Trell from early 2022 onwards, GoMechanic is the latest to face the heat. Now, as investors have called for a forensic investigation of its financials, the company’s future hangs in the balance.

Before we get into how exactly these problems came to light, let’s see how GoMechanic’s business model has evolved since its inception, and why the need to have tighter control on the operations resulted in many of these revenue recognition problems.

The GoMechanic Scale-Up Journey

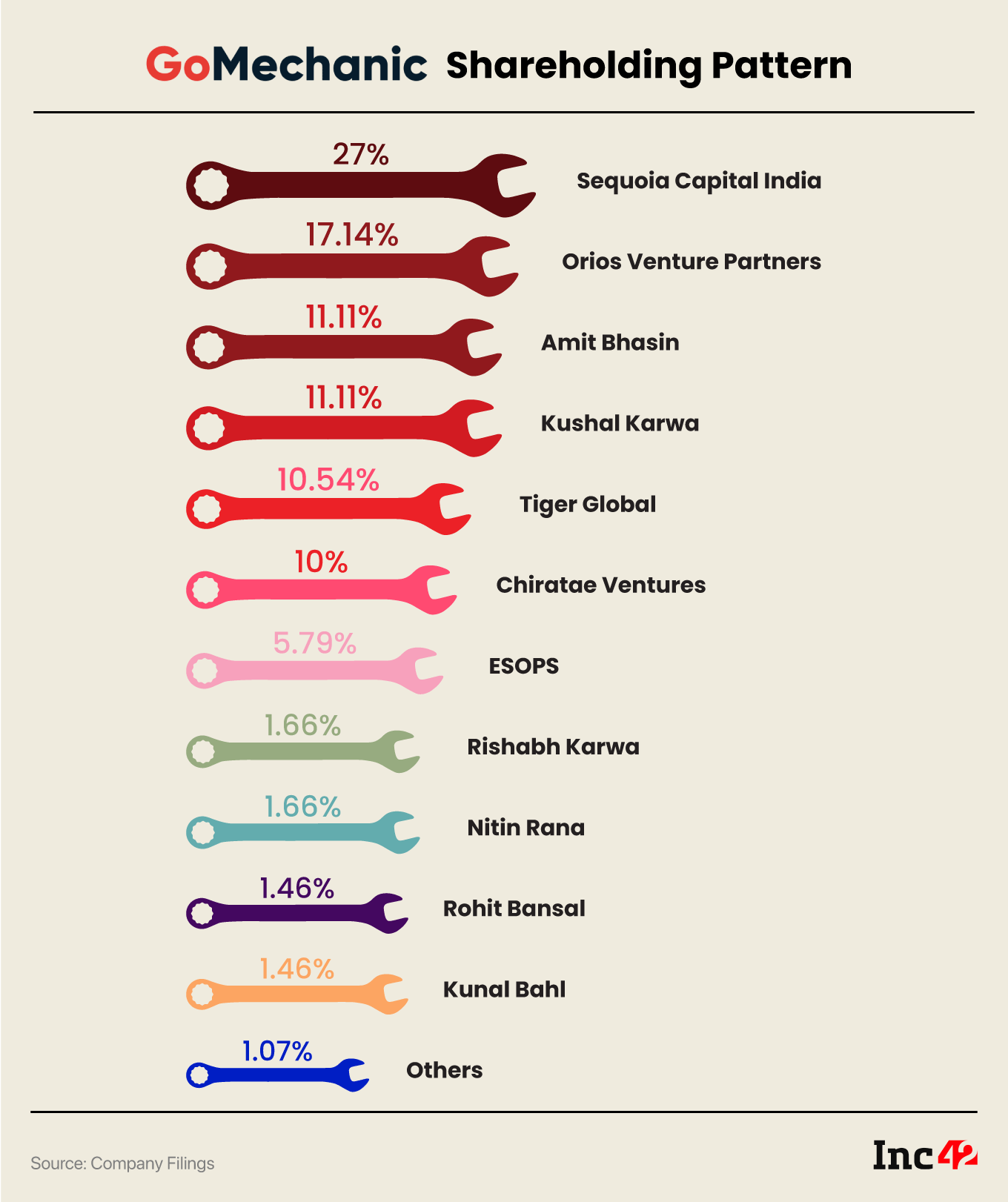

Founded in 2016 by Amit Bhasin, Kushal Karwa, Rishabh Karwa and Nitin Rana, GoMechanic set out to infuse tech and structure to the unorganised automobile repair industry. You can call it the OYO model, but the idea was to partner with disparate auto garages and bring in some standardisation in terms of processes and service quality.

While automobile OEMs have looked to do this through their brand-name service outlets, the space was ripe for disruption. GoMechanic converted neighbourhood garages into GoMechanic-branded workshops by offering them standard operating procedures, technological support and original spare parts.

In essence, it was looking to ease the backend friction that often leads to poor service quality and opacity in pricing or service costs.

Uniform pricing and standard service quality were the two big pillars for the startup. Like OYO, GoMechanic signed exclusivity deals with these garages and revenue-sharing agreements.

In over five years, it had scaled up with roughly $55 Mn (or over INR 440 Cr) in funding from influential investors such as Tiger Global, Sequoia Capital India, Orios Venture Partners, and Chiratae Ventures.

The company started off with a single garage in Delhi NCR in 2016 and by March 2021, GoMechanic was said to be operating 617+ garages, which had serviced more than 1 Lakh cars.

In October 2020, it entered the spare parts business to supply parts directly to its authorised garages. Prior to this, it exclusively used the services of over 1,000 spares retailers as authorised GoMechanic distributors. Soon after the first wave of Covid, it launched private label products in car and bike engine oils, before adding brake oil, coolants, wiper blades and horns to its inventory.

It seemed that the company had built a vertical auto repair stack that could stand the test of times. Then, in early 2022, GoMechanic entered the insurance category, with the launch of extended warranty packages for all types of car brands and models in India.

Many thought this was the final piece of the puzzle to capture a larger chunk of the customer lifecycle in the repairs segment. But less than a year later, everything unravelled.

So, What Exactly Went Wrong?

As it raised funds, GoMechanic moved into new lines of business to build vertically-integrated operations and overstretched itself during a tough time. The story is similar to Zilingo in many ways, given the issues around revenue recognition in a cash-reliant space.

“Their problems began when they entered the spare parts business. That was a logical step but this is a highly unorganised space and old habits are hard to break,” says the founder of a rival automobile repairs startup.

He claimed to have observed the evolution of GoMechanic’s model up close, given his close connections to a cofounder of the company.

“Most transactions in the repair business are done in cash, whether it is minor repairs or spares procurement. No one uses digital payments when buying spare parts and GoMechanic had to fall in line with this,” the founder added.

The company claimed to be using AI/ML at five warehouses in India to enhance the complete procurement and spare parts management experience for service providers. It also claimed to be shipping to “South Asian, South American, African and Middle East countries,” according to its brochure for global trade fair Messe Frankfurt.

Essentially, the company, which was so far something of a middleman between OEMs and garages, was looking to take on the very OEMs and at the same time playing the role of a middleman. OEMs have strong networks within garages and GoMechanic was trying to squeeze through.

Covid Changes The Game

Of course, like all companies in the automobile sector (mobility, transport tech included), GoMechanic was battered by the pandemic. Given that personal mobility had come to a standstill for many months, its garages were not seeing any cars except those required by essential services, which is what the company turned to survive during 2020-2021.

As per cofounder Kushal Karwa, in April 2020, the company was “doing around seven to eight vehicles per day and repaired over 100 vehicles across various cities” in the first month of the lockdown, a far cry from the 30,000 cars serviced every month pre-pandemic.

Despite the massive decline, GoMechanic was left with huge operational overheads, including manufacturing of its private label spares, inventory pile-up, managing a marketplace and thousands of garages and distribution centres.

Naturally, as the market and economy opened up, the company looked to raise funds to sustain this scale and operational depth. In June 2021, GoMechanic raised $42 Mn in a new round led by Tiger Global at a post-money valuation of $285 Mn.

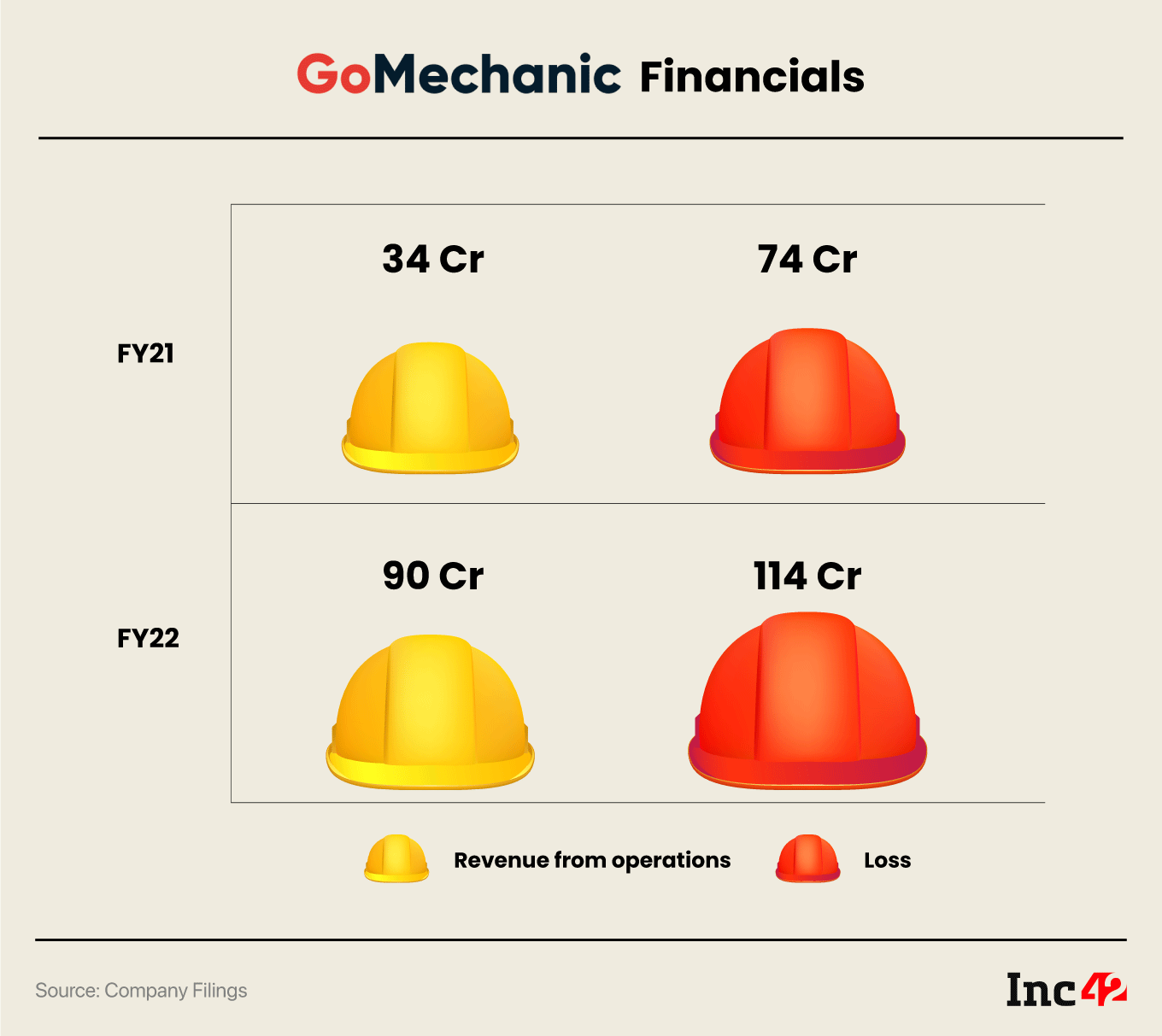

GoMechanic reported revenue from operations of INR 34.1 Cr in FY21, which grew 2.6X to INR 90.5 Cr in FY22 (March 2022). Its expenses grew faster in the fiscal, surging from INR 74 Cr to INR 210 Cr. As a result, the losses ballooned to INR 114 Cr ($15 Mn as per 2022 rates) from INR 74 Cr ($10 Mn as per 2021 rates) a year ago.

The higher losses are down to a major increase in costs for purchase of stock in trade with INR 37.6 Cr spent on this line item in FY22, 3X higher than FY21. Employee costs doubled from INR 30 Cr to INR 61.7 Cr in the fiscal.

The biggest expenditure is bracketed under ‘other expenses’ at INR 108 Cr, again 3X higher than FY21. This opaque expense item has not been further explained in the company’s regulatory filings.

It must be noted that the company’s filings for FY22 show a higher loss for FY21 than its earlier financial filings for FY21.

In the FY21 numbers reported and approved by the board in October 2021, the losses stated were INR 27.4 Cr. In its FY22 filings reported and approved by the board in September 2022, the losses for FY21 grew to INR 74 Cr.

It is not yet clear how this adjustment was made because there is no explanation for the same attached in GoMechanic’s filings.

Sources close to one GoMechanic investor informed us that there was no reason to doubt these numbers, as the auditors had given their unqualified approval. In FY21, the accounts were audited by PwC, whereas the FY22 numbers were ratified by KPMG, and neither of these audits raised any red flags, the source said.

Of course, growing losses or adjusted losses are not unique to GoMechanic within the startup ecosystem, but the fact is that, since March 2022, the focus of investors and startups has shifted to cost-cutting measures, extending runway and sustainable growth.

Given that the company raised close to $55 Mn until June 2021, it essentially spent half of that in FY21 and FY22 combined ($25 Mn), with revenue only touching ($15 Mn) in those two years.

The revenue is where things fell apart, as the company is said to have reported inflated numbers for certain authorised garages. Inc42 could not independently confirm exactly how the revenue was inflated, but according to reports, the company is said to have misreported revenue from some of its major garages and diverted funds to these customers.

An Expansion Without A Plan

The funds infusion in July 2021 allowed GoMechanic to launch new lines of business and expand its service network. As per its current and former employees, the company also hired rampantly. However, there was no plan to manage these new hires.

“We would be given a task but there was no plan of action on how we can achieve the task. The company also lacked mid-level managers that could solve these problems. Almost everything needed to be taken to the founders,” said a former business analyst of GoMechanic.

As cofounder, Bhasin admitted in a LinkedIn post this week that the company’s expansion was fraught with errors.

The cofounder said the company had made “grave [omitted after posting] errors in judgement as we followed growth at all costs, particularly with regard to financial reporting, which we deeply regret.”

“We take full responsibility for this current situation and unanimously have decided to restructure the business while we look for capital solutions. This restructuring is going to be painful and we will unfortunately need to let go of approximately 70% of the workforce. In addition, a third party firm will be conducting an audit of the business. While the situation is far from anything we could have ever imagined for GoMechanic, we are working on a plan which would be most viable under the circumstances.”

From nearly 1,000 employees in December 2022, GoMechanic has trimmed its workforce to 300 employees, and more are expected to go. “The offices are getting emptier, and a lot of the on-ground responsibility is set to fall on a few individuals,” the employee quoted above said, requesting anonymity.

Employees claim that while operations at certain GoMechanic garages are ongoing, the burden of ensuring standardised and quality service is now on fewer individuals. “We used to have 5-6 garage managers on the ground in each city, who would do routine checks on garages, but now 1-2 managers have to manage the entire city.”

Due Diligence Unearths Discrepancies

According to reports in early 2022, GoMechanic was in talks to raise a round of funding led by Tiger Global at a valuation of over $1 Bn. Soon after, the company was said to be in discussions to raise funds from Japanese VC giant SoftBank and Malaysia’s Khazanah.

The due diligence process for the latter deal is said to have unearthed discrepancy in revenue recognition, according to media reports.

Inc42 reached out to Sequoia India, Orios Venture Partners and other investors of GoMechanic for a comment, but did not receive any response.

Sources within the shareholder base told Inc42 that the founders made a confession about the revenue discrepancies earlier this month, which was received with shock and outrage. “They (the founders) basically admitted that whatever numbers they have presented to shareholders in monthly income statements (MIS) and other reports were not true.”

This prompted the major shareholders to initiate a separate EY probe into the financials, the results of which are expected within the next month. “At the moment, even the shareholders don’t know what is wrong because they are waiting for the EY report,” said the source quoted above.

In a joint statement, GoMechanic investors said the startup’s founders recently informed them of the “serious inaccuracies in the company’s financial reporting.”

“We are deeply distressed by the fact that the founders knowingly misstated facts, including but not limited to the inflation of revenue, which the founders have acknowledged. All of this was kept from the investors. The investors have jointly appointed a third party firm to investigate the matter in detail, and we will be working together to determine next steps for the company,” they added.

Given the presence of such marquee investors, there are a lot of pertinent questions about due diligence or lack thereof on the part of the shareholders as well as the auditors, which had given unqualified reports about GoMechanic’s books in the years past.

What Will Happen To GoMechanic?

Sources indicate that the company’s founders have been asked to go on leave until the EY financial forensics report is final. “While the Softbank DD was going on, we were asking them why this round was not closing, and we asked the founders to answer their (Softbank’s) questions so we can all move on,” said a source close to GoMechanic’s investors.

The source added that besides quarterly reports, GoMechanic furnished shareholders with MIS, which were reconciled with auditor reports on the accounts.

“This kind of behaviour does a great disservice to the founder and startup community as a whole who are not taking shortcuts and working in tough markets with full integrity. But it also shows that if someone in the company wants to take shortcuts and make a mess, they will find ways,” the source close to one of the investors said.

Of course, without a potential funds infusion, GoMechanic’s future hangs in the balance. While it is expected that the company will close a number of garages that it cannot support, due to a shortage of funds, its very survival is in doubt.

Given the problems, GoMechanic’s future can pan out in one of two directions – either getting acquired by an OEM or a rival for its existing technology, or a change of management with a fundraise at a lower valuation.

The biggest question is whether GoMechanic’s lies and duplicity will prove to be a deal-breaker, whichever way it goes.