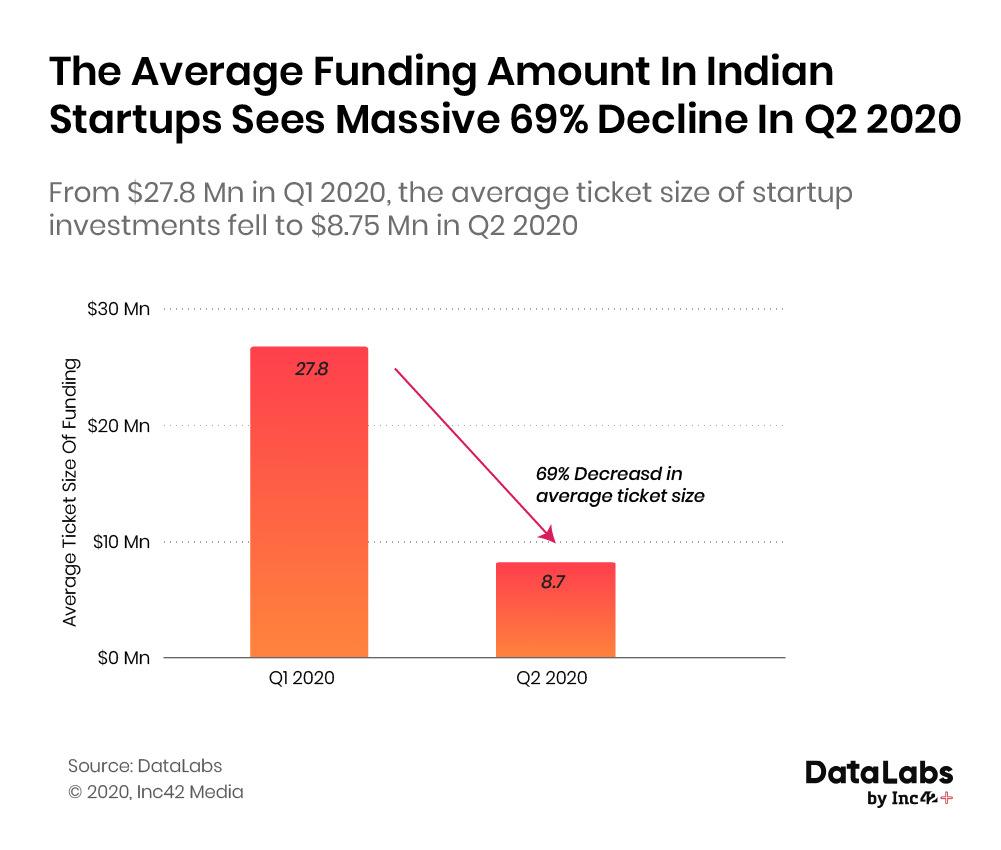

The Covid-19 economic impact and the lockdown restrictions drove capital inflow to all-time quarterly low in Q2 2020

DataLabs has recorded 69% decrease in the average ticket size of investment from Q1 2020 to Q2

The economic slowdown and recessionary conditions have shattered the expansion dreams of many Indian startups

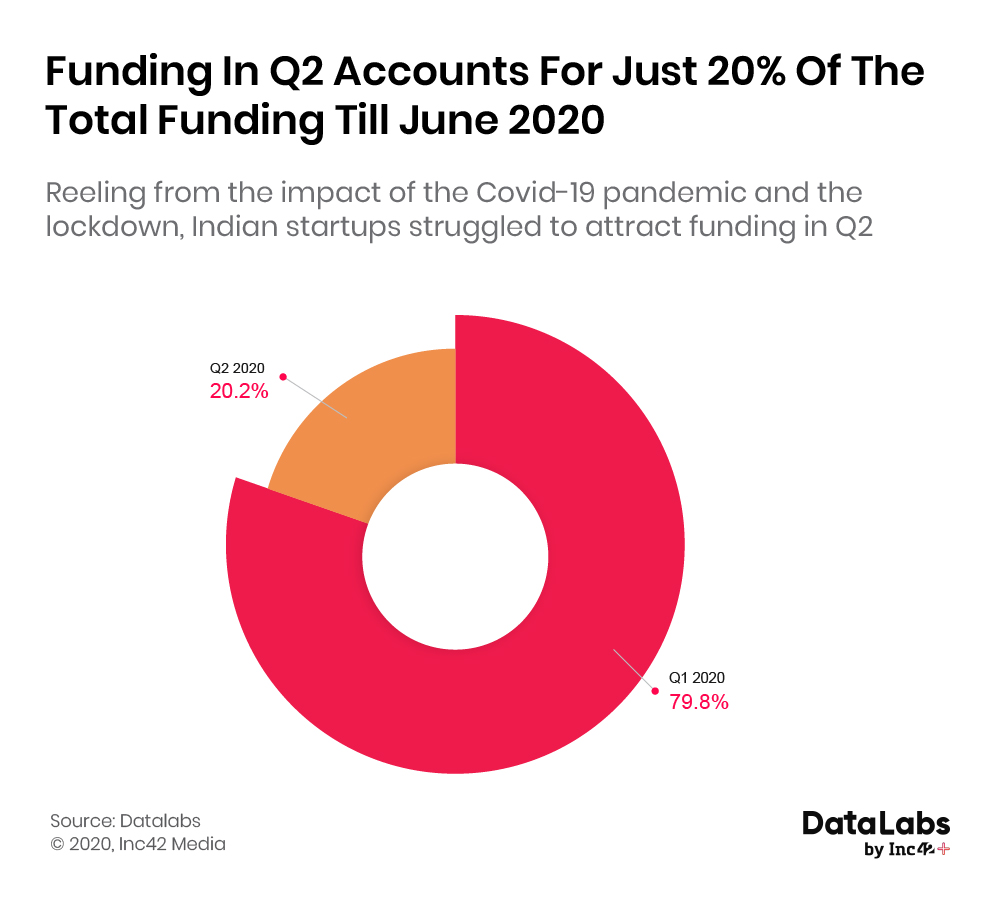

The first half of 2020 ended on June 30 and it was perhaps the worst one for many investors and businesses. Startups, in particular, have been hit hard by the economic upheaval. Compared to the first quarter, the second quarter of 2020 witnessed a shattering decline of 74% in total startup funding in India. This is an indication of the devastating impact the pandemic had on the Indian startup economy.

The adverse impact of the pandemic was not limited to the funding rounds, the Indian startups also had to shed a large chunk of their workforce. The analysis by DataLabs by Inc42+ showed that Indian startups on an average fired 22% of their total employee count during the pandemic-induced lockdown adding more fuel to overall unemployment in India. If the adversity of the pandemic was not enough, India’s rising geopolitical tensions with China have made it more difficult to procure capital from Chinese origin investors, who were indeed an active participant in the ecosystem.

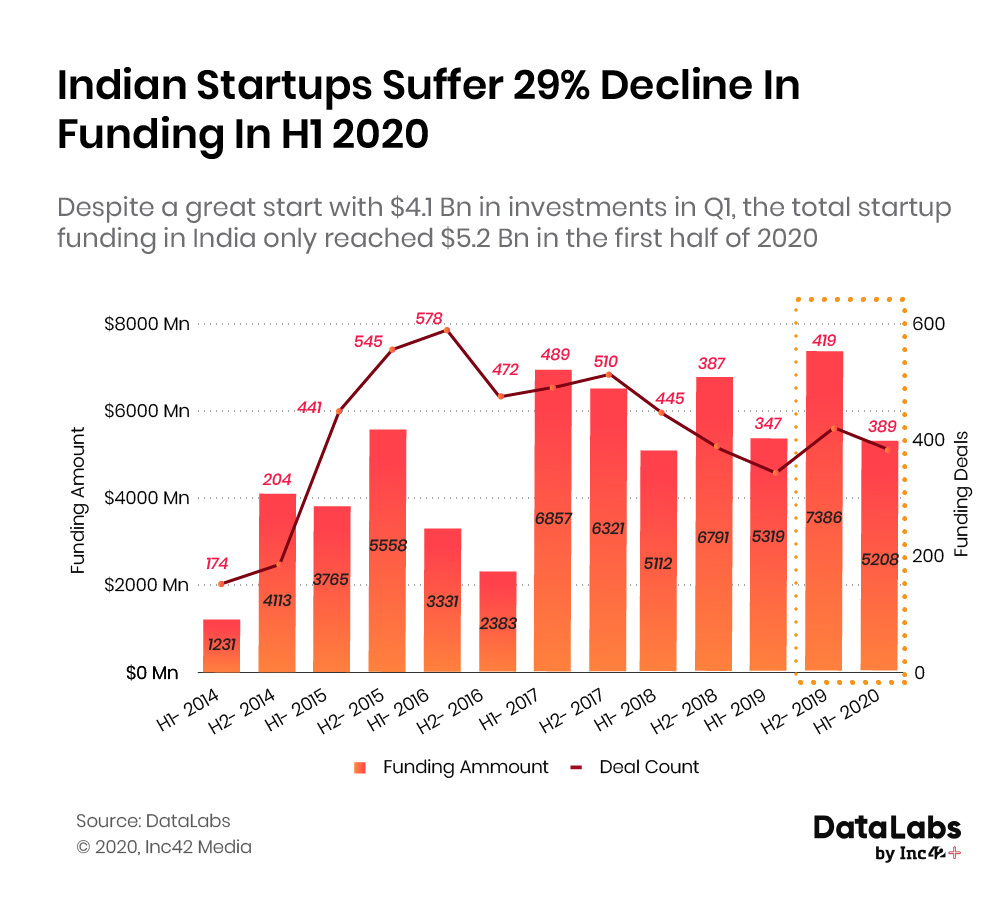

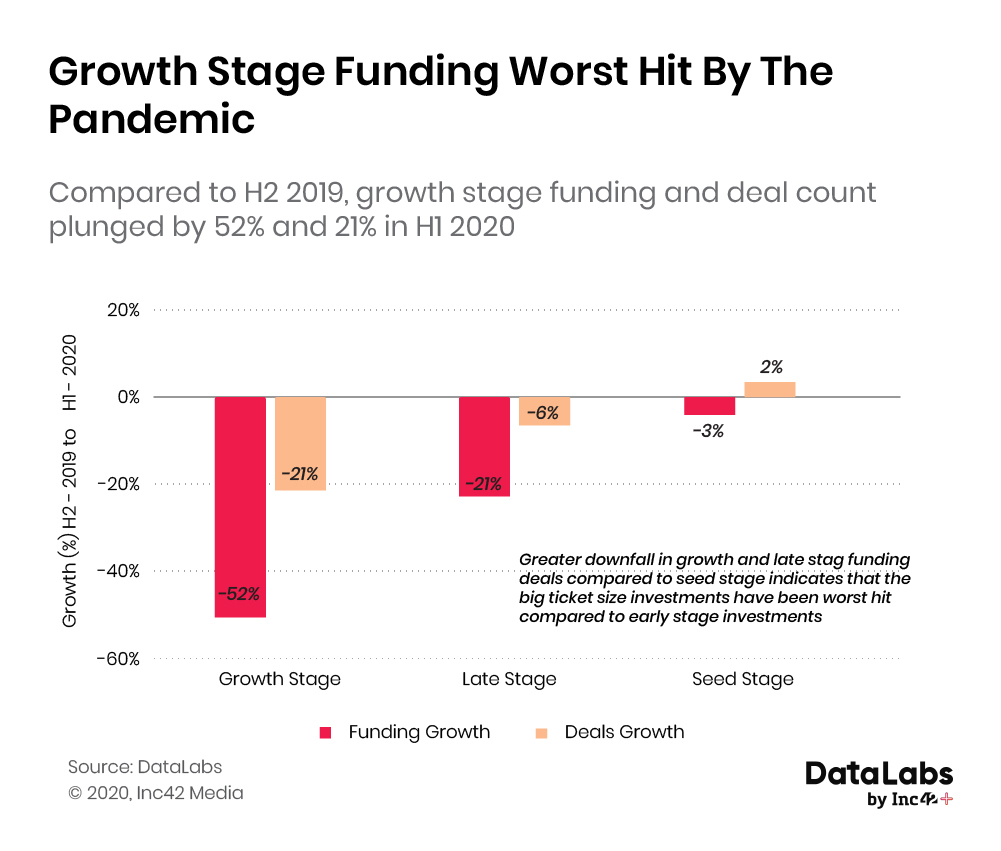

With so much happening around the world, the startup funding in H1 2020 closed at $5.2 Bn across 389 deals. The total capital inflow witnessed a decline of 29% compared to H2 2019 clubbed with all three major stages of funding growth stage, late stage and seed stage witnessing a negative growth of -52%, -21% and -3% respectively. The likes of few outliers such as OYOs’($806 Mn), RenNew Power ($450 Mn), FirstCry ($296 Mn) and others have boosted the aggregate value of the total funding in H1 2020. Removing such outliers (i.e. $200 Mn and above rounds) the total value of funding in H1 2020 stood at $3.2 Bn.

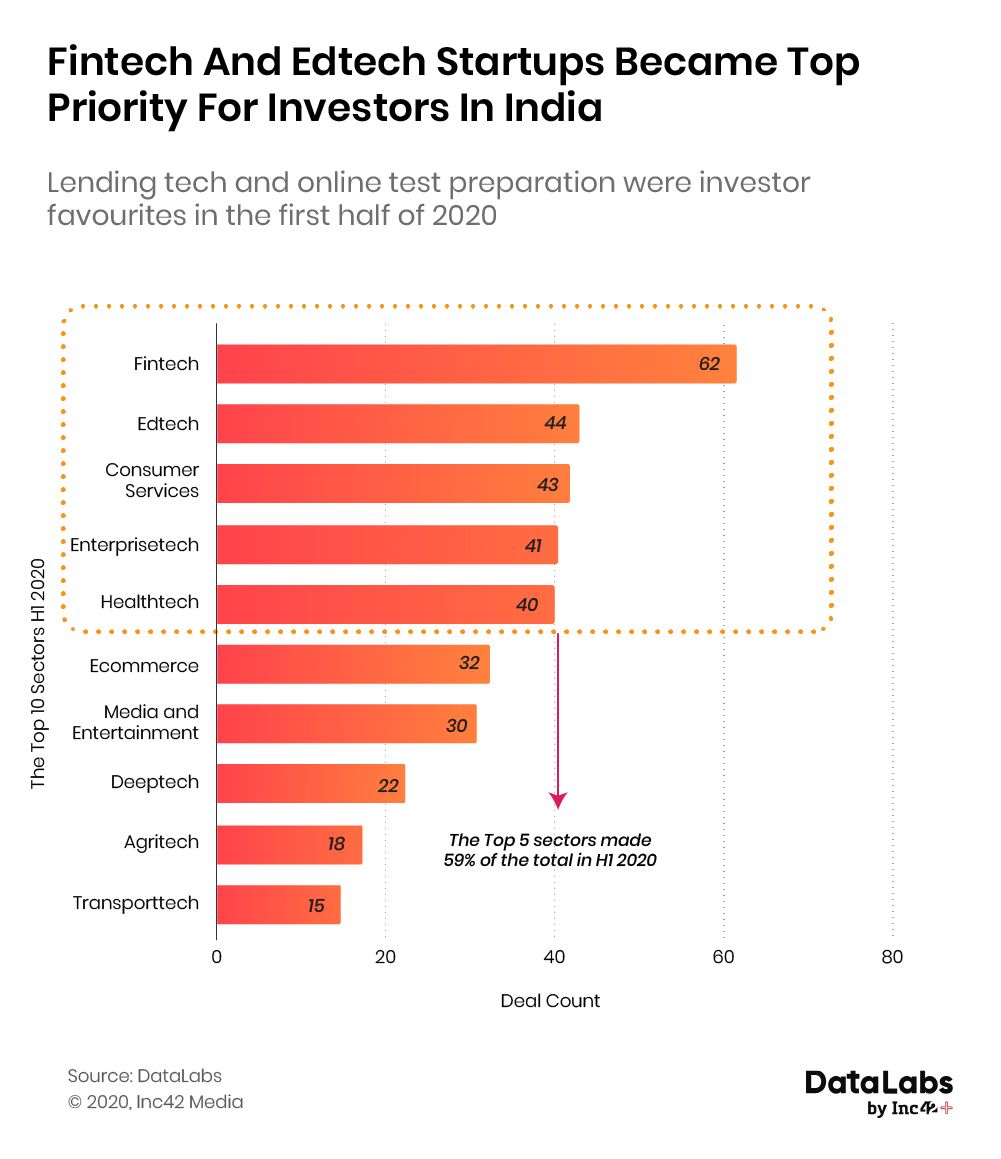

Despite such hardships, some startups aren’t failing to impress the investors. Fintech, edtech and consumer services are luring investors with the increased demand for their products and services in the post-pandemic world. Even at the seed stage, these three sectors have witnessed a rise in their deal count compared to H2 2019 — edtech (175%), fintech (26%) and consumer services (7%).

Know More About India’s Healthtech Landscape

Funding Dips In H1 2020 Compared To The Previous Half

Out of the total 389 funding deals till June 2020, 12 were mega-rounds ($100 Mn and above). The first quarter of 2020 witnessed significant rounds of funding but the inflow of capital faded away in the second quarter when the pandemic intensified in the country. This can be ascertained from the fact that nearly 80% of the total $5.2 Bn was raised in Q1 2020.

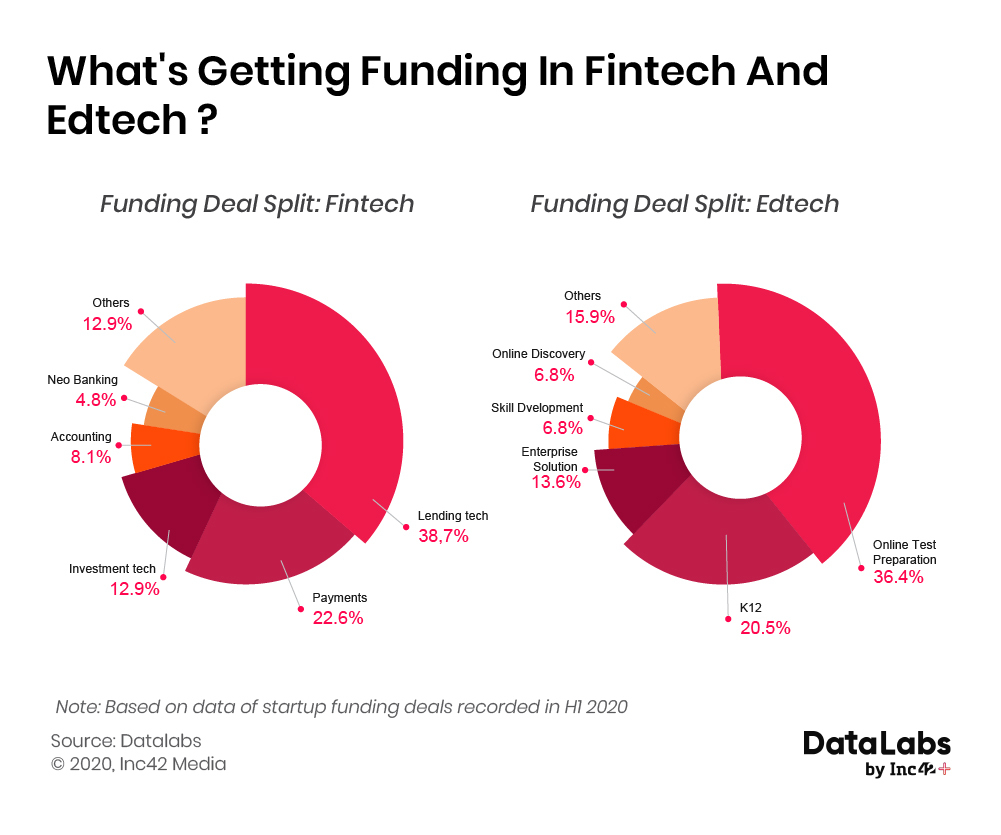

Fintech And Edtech Outshine Others In H1 2020

Positive investor sentiments towards the fintech (primarily lending) is justified based on the fact that the revenue loss incurred by the business (especially SMBs) is poised to create greater demand for credit in the market. The fact that uncertainty in the context of the pandemic still remains intact the degree of default risk in underwriting these loan is also going to high.

Similarly, the pandemic-induced market conditions have worked in the favour of edtech (primarily online test preparation). With social distancing measures still intact and the fear of going out remains prevalent. As a a result, on-demand learning is witnessing an unprecedented boom with even universities and schools are opting for online learning until the pandemic is managed. The number of unique startups funded increased by 65% in H1 2020 compared to H1 2019.

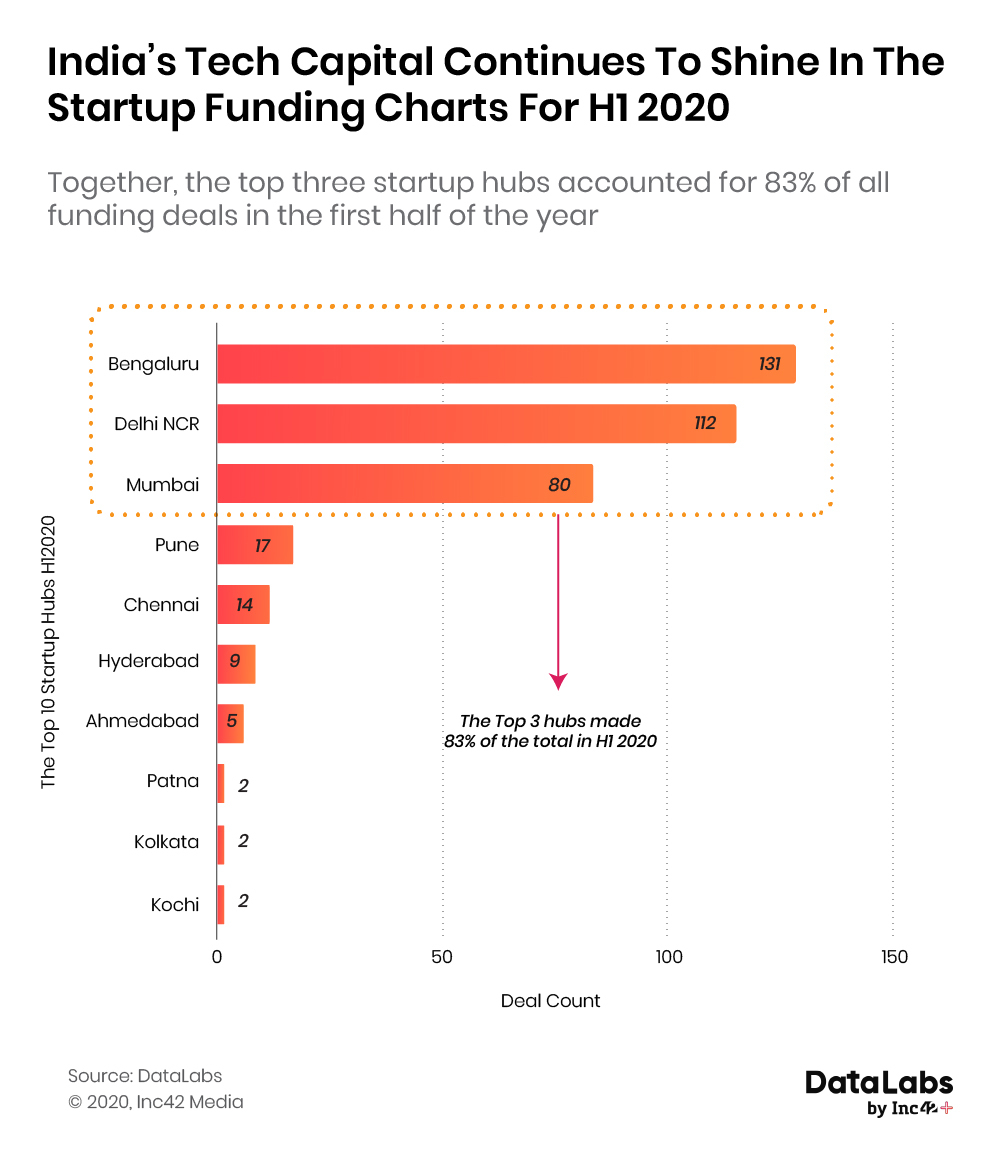

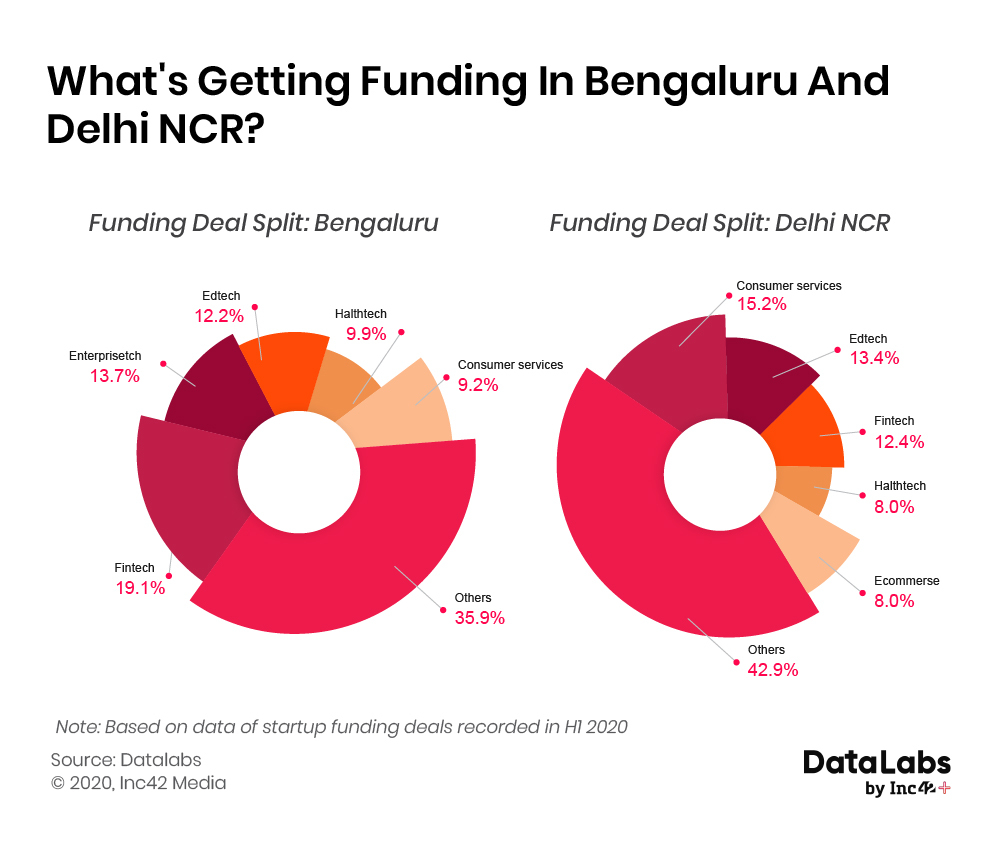

Bengaluru Usurps Delhi NCR To Be The Top Startup Hub In H1 2020 As Compared To H2 2019

Fintech emerged as the investor favourite in Bengaluru, the sector bagged 19.1% of the total funding deals poured in the city followed by enterprise tech. The well-versed investor ecosystem of Bengaluru’s market is relatively easier for startups operating in nascent and emerging markets like Neo- banking, alternative lending, robotics, AI/ML etc. to raise funding compared to other hubs.

On the other hand in Delhi NCR, consumer services emerged as the top sector. This can be ascertained to the fact that the capital has one of the highest per capita income in the country along with a large urban population.

Clubbed with the growing adoption of consumer services subsectors such as hyperlocal deliveries and F&B products is growing by the passing of time. Startups such as Chaayos, Blue Tokai, Sleepy Owl, Milkbasket and others have disrupted some traditional markets with their innovative ideas.

Growth Stage Funding Worst Hit And Hit On Valuations

The expansion and scaling up dreams of startups seems to be impacted the most due to the pandemic. This is apparent from the fact that out of the three major stages of startup funding i.e seed, growth and late, the biggest drop in capital inflow was seen growth stage and late stage, compared to H2 2019. The growth stage funding amount plunged by nearly half from $2.1 Bn in H2 2019 to $1.02 Bn in H1 2020. Whereas the late-stage funding dipped from $144 Mn in H2 2019 to $140 Mn in H1 2020.

Overall there is a fundamental shift happening in the Indian startup ecosystem, with hollow valuations and negative margin growth no longer being propped up by investors, whose own assets have dropped in value due to the global stock market bloodbath. As the trend to conserve capital becomes prevalent, investors will bet on startups that have better unit economics and can achieve sustainable growth without burning external capital.

Therefore capital-intensive businesses that have achieved high growth at the cost of profit margins will find it difficult to attract VC investments in the following quarters in 2020. Positive EBITDA and free cash flow (FCF) will be crucial for startups in the context of raising funds.

Fintech, edtech, enterprise tech, media and entertainment and consumer services are attracting substantial investors interest at the seed stage. In H1 2020, 60% of the total funding deals at seed stage was poured into these top five sectors. The primary reason being that in one way or the other the demand for products and services linked to these sectors has witnessed an unprecedented rise in demand. For example, in the case of edtech, BYJU’s a leading online test preparation company added a whopping 13.5 Mn to their userbase during the lockdown.

Similarly, in the case of media and entertainment, online content consumption (short form and news) grew 35% from January to April 2020. In a nutshell many tech-enabled products and services are turning into necessities rather than a luxury. Identifying these demands and changes in consumer behaviour will offer the best good entrepreneurial opportunity for the next quarter or two.

Know More About India’s Healthtech Landscape

Ad-lite browsing experience

Ad-lite browsing experience