SUMMARY

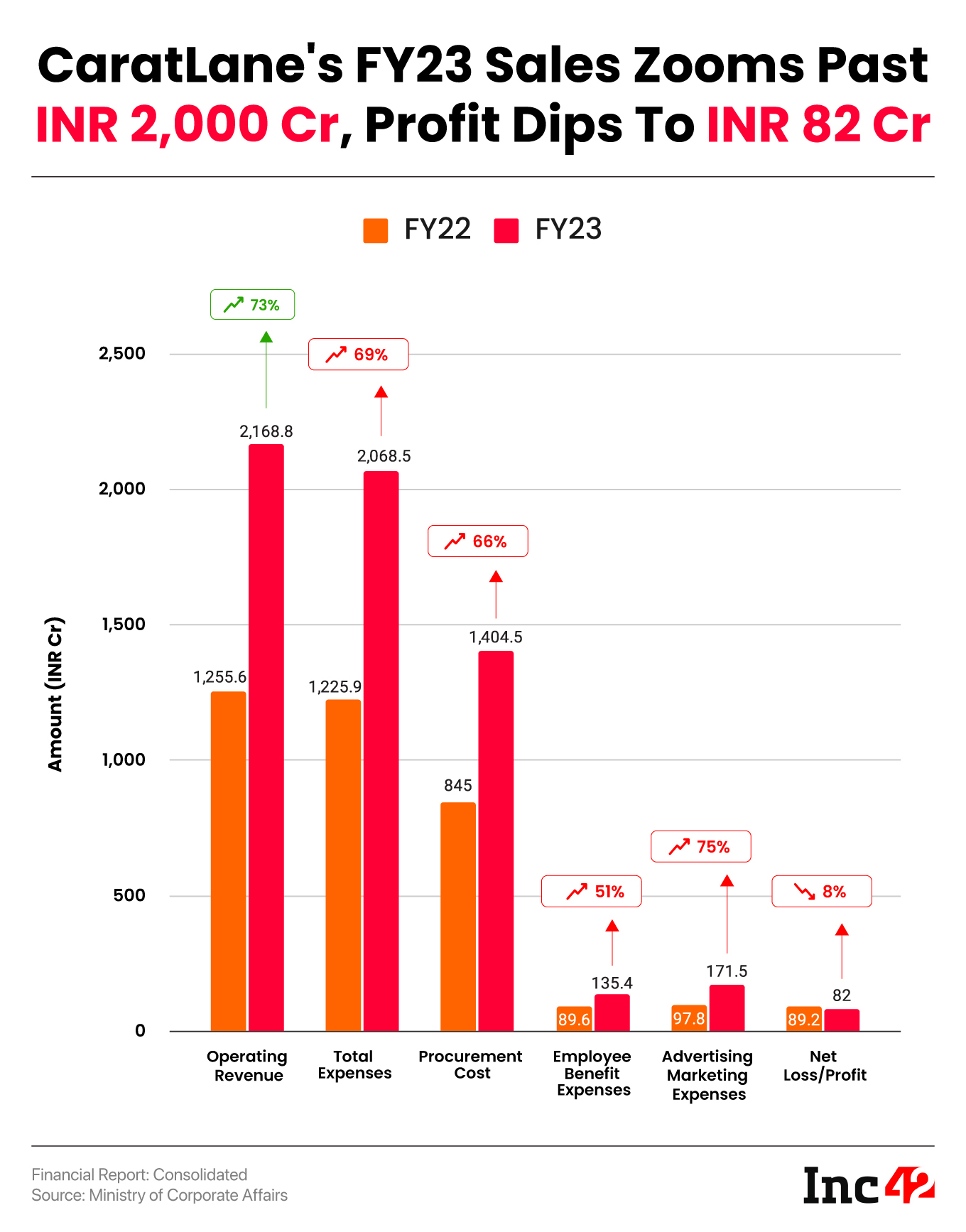

While CaratLane’s operating revenue grew 73% to INR 2,169 Cr in FY23, its net profit dipped 8% to INR 82 Cr

Total expenditure increased 69% to INR 2,068.5 Cr during the year under review from INR 1,225.9 Cr in FY22

Earlier this year, Tata-backed Titan acquired an additional 27.18% stake in CaratLane, valuing it at $2 Bn and taking its stake in the jewellery startup to 98.28%

Titan-owned jewellery startup caratlane

Founded in 2008 by Mithun Sacheti and Srinivasa Gopalan, CaratLane is an omnichannel brand that manufactures and sells jewellery items in India and the US.

Its business turnover from the US remained unchanged at INR 8.68 Cr in FY23.

Including other income, total revenue rose 73% to INR 2,187.8 Cr from INR 1,264.6 Cr in the previous fiscal year.

Despite the rise in revenue, CaratLane’s net profit dipped 8% to INR 82 Cr during the year under review from INR 89.2 Cr in the previous fiscal year.

Where Did CaratLane Spend?

Total expenditure jumped 69% to INR 2,068.5 Cr in FY23 from INR 1,225.9 Cr in the previous fiscal year.

Procurement Cost The Biggest Expense: Being a jewellery brand, the cost of procurement, including sourcing of gems, was the biggest expense for CaratLane. Its procurement cost rose 66% to INR 1,404.5 Cr in FY23 from INR 845 Cr in the previous fiscal year.

Employee Benefit Expenses Jump: Employee costs jumped 51% to INR 135.4 Cr during the year under review from INR 89.6 Cr in FY22, indicating that the startup has increased its employee headcount.

Advertising Expenses Zoom: CaratLane’s marketing and promotional expenses surged 75% to INR 172 Cr in FY23 from INR 98 Cr in the previous fiscal year.

EBITDA margin expanded to 9.75% in FY23 from 6.86% in the previous fiscal year.

In August this year, Tata Group-owned Titan acquired an additional 27.18% stake in CaratLane, taking its total stake in the jewellery brand to 98.28%. The deal valued CaratLane at over INR 17,000 Cr ($2 Bn), marking the startup’s entry in the unicorn club.

Last month, the Competition Commission of India (CCI) approved Titan’s acquisition of the additional stake in CaratLane.

Titan first picked up a majority stake in the jewellery brand in 2016.

Besides competing against traditional jewellery brands such as Senco Jewellers, Kalyan Jewellers, and Malabar, CaratLane also competes against new-age brands such as BlueStone and GIVA. However, CaratLane has a higher market share compared to its new-age peers as it was an early entrant in the space.

Among the new-age competitors, GIVA reported an operating revenue of INR 165 Cr in FY23 and a net loss of INR 45.2 Cr. Meanwhile, BlueStone’s sales stood at INR 770 Cr in FY23 while loss declined to INR 167.2 Cr.

Ad-lite browsing experience

Ad-lite browsing experience