Eight out of the 20 new-age tech stocks under Inc42’s coverage increased this week in the range of 0.9% to 27%, with TAC Infosec emerging as the biggest gainer

DroneAcharya turned out to be the biggest loser this week by falling 6.4% while 10 other losers included RateGain, Yatra, Nykaa, and Mamaearth

In the broader market, benchmark indices remained volatile; Sensex and Nifty50 gained 0.2% and 0.25%, respectively, this week

Indian new-age tech stocks witnessed mixed performance this week as the broader market also remained volatile amid global political tension and FIIs continued to sell domestic shares.

We must note that the Volatility Index India (VIX) rose sharply over 8% on Friday (May 3), indicating significant volatility and cautiousness in the market.

Eight out of the 20 new-age tech stocks under Inc42’s coverage increased this week in a range of 0.9% to 27%, with TAC Infosec emerging as the biggest gainer for the third straight week.

In early April, the stock got listed at INR 290 on the NSE Emerge and has rallied over 116% since then, currently trading at INR 626.75.

On the other hand, following its Q4 FY24 earnings, shares of IndiaMart InterMESH rallied 6.3% on the BSE, becoming the second biggest gainer.

Other gainers of the week were Zomato, PB Fintech, CarTrade, Tracxn, ideaForge and Nazara.

Meanwhile, DroneAcharya turned out to be the biggest loser this week by falling 6.4%, followed by RateGain, which declined 5.6%.

Shares of Yatra, Nykaa and Mamaearth fell over 2% this week while EaseMyTrip, MapmyIndia, Yudiz, Paytm and Fino Payments Bank fell 1% or higher.

In the broader market, benchmark indices Sensex and Nifty50 gained 0.2% and 0.25%, respectively.

While Sensex ended Friday’s trading session at 73,878.15, down almost 1% compared to Thursday’s close, Nifty ended the week at 22,475.85, down almost 0.8% compared to Thursday’s close.

Speaking on the week’s market trend, Prashanth Tapse, senior VP (research) at Mehta Equities, said, “I feel geopolitical tension would make headlines again giving traders an option to go short on markets.”

“Overall, Q4 earnings are neutral to positive and not so impressive. There are few reports which suggest that FIIs have reduced holding in large caps stocks like HDFC Bank and ITC. For the short term, the trend remains cautious and the focus would be on fresh geopolitical headlines, he said, adding that the brokerage would advise traders to remain light on positions.

Meanwhile, Siddhartha Khemka, head of retail research at Motilal Oswal expects the market to now consolidate in a broader range and the base to gradually shift higher.

“On Monday, markets will react to US Employment data and Q4 results of companies like Dmart and Kotak Bank that will be announced on Saturday,” he said.

However, IPO fever continues in the domestic market. Another new-age tech stock, TBO Tek announced the launch of its INR 1,551 Cr IPO next week.

This week had four trading sessions with May 1 being a market holiday on the occasion of Maharashtra Day.

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

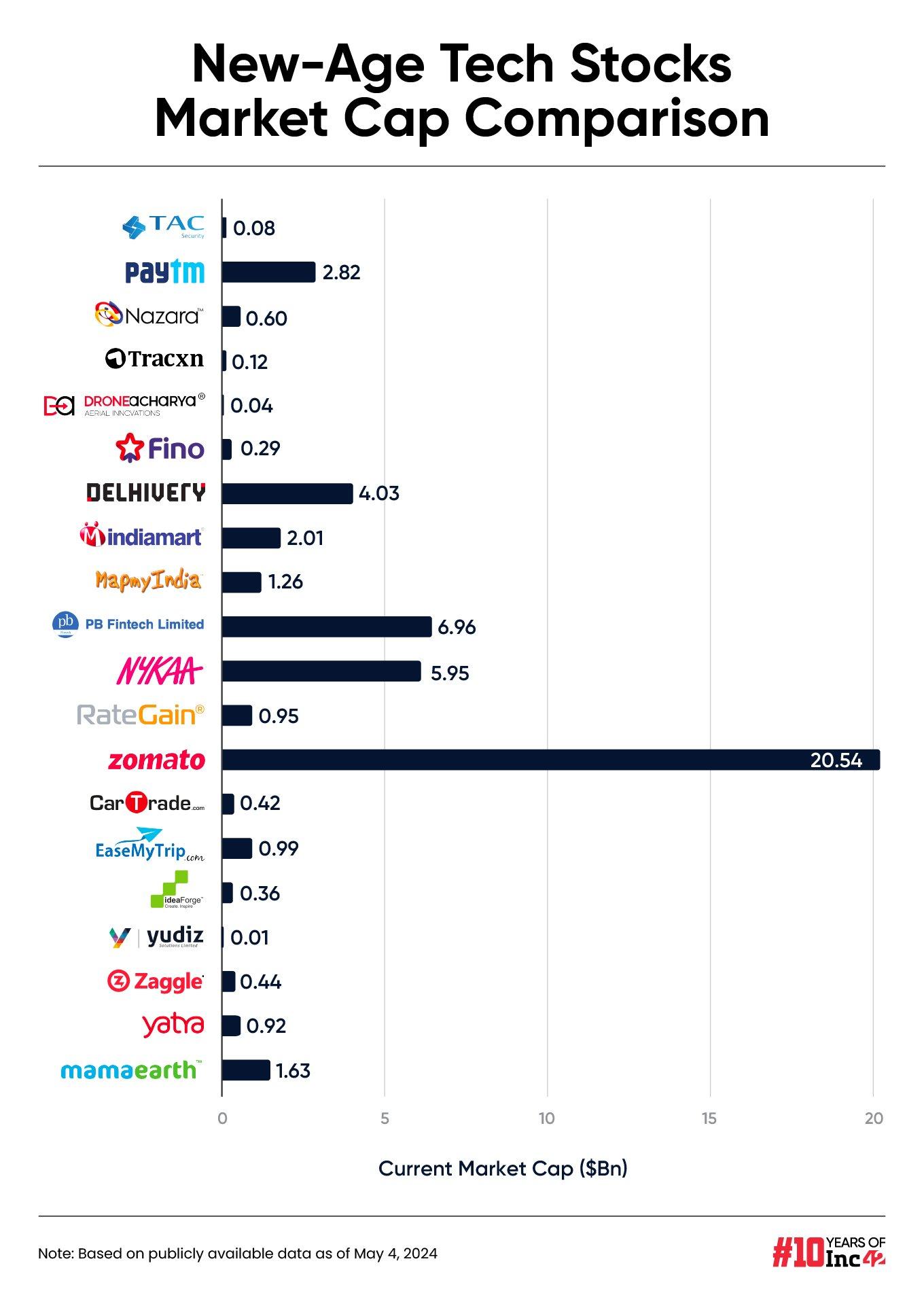

The 20 new-age tech stocks ended this week with a total market capitalisation of $43.46 Bn as against $49.17 Bn last week.

The 20 new-age tech stocks ended this week with a total market capitalisation of $43.46 Bn as against $49.17 Bn last week.

DroneAcharya Emerges As The Biggest Loser

DroneAcharya Emerges As The Biggest Loser

Shares of drone startup DroneAcharya slumped sharply in three consecutive trading sessions at the beginning of this week.

Its 4.4% on Thursday was triggered by ace investor Shankar Sharma offloading his 2 Lakh shares or a 0.83% stake in the company.

However, by the end of the week, DroneAcharya picked some pace and rallied almost 3% on Friday, ending the week at INR 155.85 on the BSE.

We must note that after a significant rise last year, the stock has remained under pressure in the recent past despite some major important business announcements by the company.

In fact, this Thursday, DroneAcharya also said that it has bagged a work order of INR 53 Lakh from Alter Dynamics & Artificial Intelligence, which will entail the utilisation of its drones for inspection of piles above water, catering to the requirements of Abu Dhabi National Oil Company (ADNOC).

Speaking on DroneAcharya’s share performance, Amol Athawale, VP of technical research at Kotak Securities, said that the texture of the stock remains on the downside with INR 145-INR 150 being the immediate support level.

“If the stock continues to trade above that level then the immediate target would be INR 170-INR 175,” he said, adding that the larger texture indicates it would continue to trade between INR 145 and INR 175 price range.

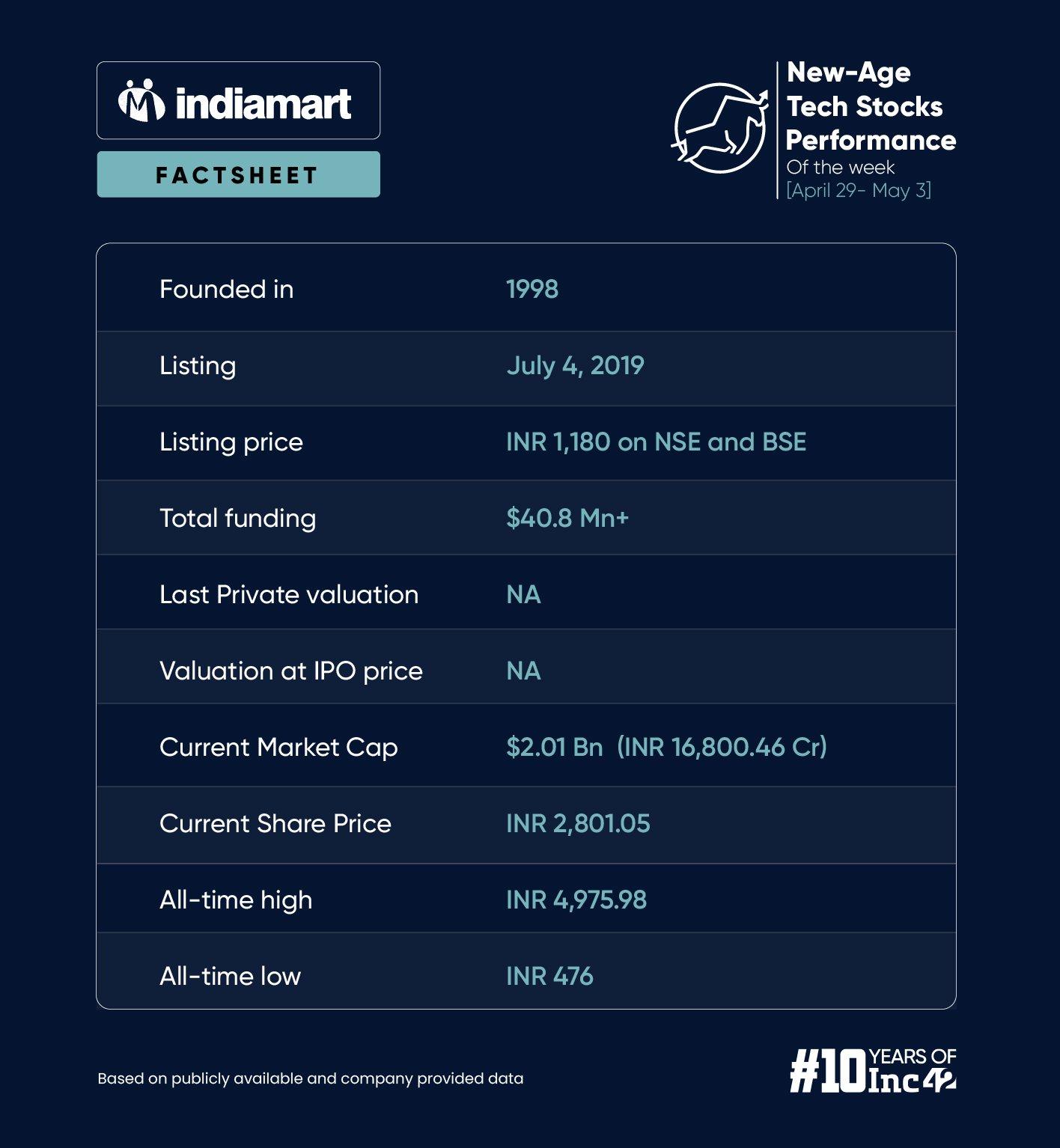

IndiaMart Jumps On Q4 Earnings

Shares of IndiaMart touched almost a seven-month high this week, at INR 2,913, after posting its Q4 earnings.

IndiaMart’s consolidated net profit jumped over 78% year-on-year (YoY) while its operating revenue rose 17% YoY to INR 314.7 Cr.

Overall, the shares surged 6.3% this week, ending Friday’s session at INR 2,801.05 on the BSE.

However, brokerage Nuvama maintained its ‘hold’ rating on the stock and revised its price target to INR 2,650 from INR 2,800 earlier, rolling forward to FY26.

The brokerage noted that the company’s paid supplier addition continues to remain subdued.

“While we appreciate the company’s strong position and leadership in the B2B ecommerce marketplace, we believe that elevated churn would keep subscriber addition counts lower, thereby impacting collection/revenue growth,” it said.

Meanwhile, ICICI Securities said that given the stock remained rangebound over the last year on account of limited visibility on growth, the company’s improving earnings outlook could drive re-rating.

The brokerage maintained its ‘buy’ rating on the stock and target of INR 3,500.

Kotak Securities’ Athawale said that a short-term rally is possible on the dismissal of INR 2,900 level, which is a crucial resistance for the stock.

The immediate support for the stock is at INR 2,650-INR 2,600, he added.

Challenges Continue In Paytm

The shares of Paytm continued to remain under pressure for another week. Its shares fell 1.8% further and are currently trading at INR 370.2 on the BSE.

In The News For:

- Following the regulatory actions against Paytm Payments Bank, its mobile wallet business operation has come to a grinding halt. RBI data showed that in March, Paytm Payments Bank registered 7.4 Mn fund transfer transactions in its prepaid payment instruments division, which was a 64% decline from the 20.7 Mn transactions reported in December 2023.

- In major reshuffles in the company, Paytm COO and president Bhavesh Gupta has stepped down from his position.

- Meanwhile, its wealthtech arm Paytm Money’s CEO Varun Sridhar has stepped down and switched to a different role within the company. Rakesh Singh has been appointed as the new CEO of Paytm Money.

Kotak Securities’ Athawale said though the larger texture continues to be on the downside, the INR 400 level remains the immediate level for the bulls.

There could be a technical bounceback above INR 400 level, which could touch INR 440. On the lower side, Paytm could touch INR 350 level also, he added.

DroneAcharya Emerges As The Biggest Loser

DroneAcharya Emerges As The Biggest Loser

Ad-lite browsing experience

Ad-lite browsing experience