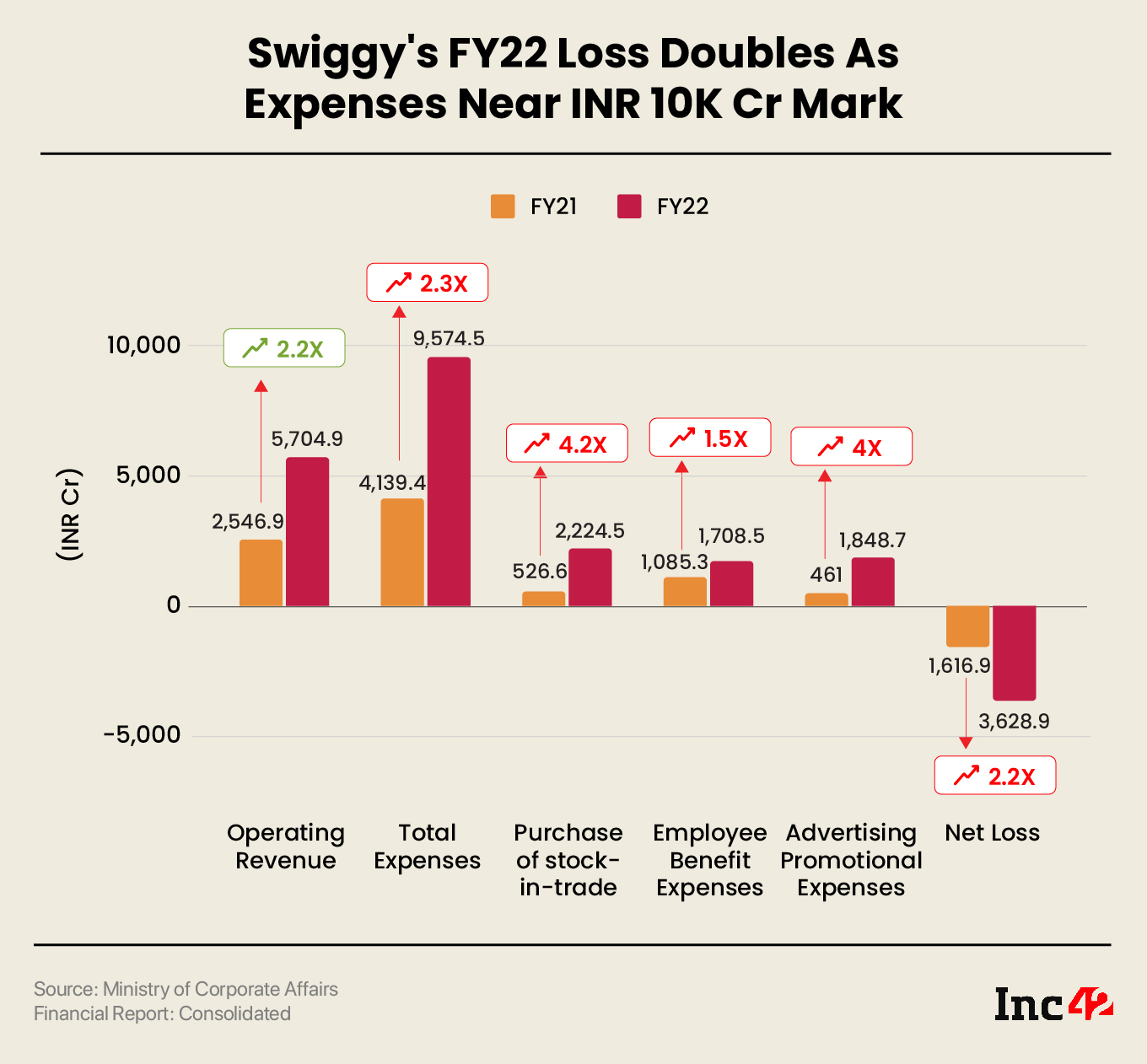

Swiggy’s revenue from operations rose 124% to INR 5,704.9 Cr from INR 2,546.9 Cr in FY21

Total expenses grew 131% to INR 9,574.5 Cr in FY22, as promotional expenses surged 301% to INR 1,848.7 Cr

Swiggy spent INR 1.6 to earn every INR 1 from operations

Bengaluru-based foodtech giant Swiggy’s net loss jumped 2.2X to INR 3,628.9 Cr in FY22 from INR 1,616.9 Cr in FY21 as its expenses more than doubled. The SoftBank-backed decacorn’s total revenue grew 2.2X to INR 6,119.8 Cr in FY22 from INR 2,675.9 Cr in FY21. Revenue from operations rose 124% to INR 5,704.9 Cr from INR 2,546.9 Cr in the previous year.

The startup generates revenue mainly by providing online platform services to partner merchants (including restaurant merchants, grocery merchants and delivery partners), advertisement services, sale of food and traded goods, subscriptions and other platform services.

It gets a majority of its revenue from operations by selling services, which includes lead generation income, carousel income, and delivery income. In FY22, the startup earned INR 3,444.4 Cr from sale of services, which was an increase of 83% from INR 1,878.9 Cr in FY21. Its sales from services also surpassed the pre-COVID levels. In FY20, the startup’s sales from services stood at INR 3,050 Cr.

Swiggy’s revenue from sale of products jumped 253.4% to INR 2,123.1 Cr in FY22 from INR 600.7 Cr in the previous year. The revenue from sale of products includes revenue from sale of food as well as traded goods.

While Swiggy

Meanwhile, its total expenses more than doubled and inched closer to INR 10,000 Cr mark in FY22. Total expenses grew 131% to INR 9,574.5 Cr in FY22 from INR 4,139.4 Cr in FY21. The purchase of stock-in-trade contributed a fair share in the startup’s total expenses, rising 322% to INR 2,22.5 Cr in FY22 from INR 526.6 Cr in FY21.

One of the reasons behind the increase in purchase of stock-in-trade could be Swiggy’s rapid expansion of Swiggy Instamart.

Swiggy’s EBITDA margin worsened to -55.73% in FY22 from -49.25% in FY21.

Employee benefit expenses also rose 57.4% to INR 1,708.5 Cr in FY22 from INR 1,085.3 Cr in FY21. Employee benefit expenses mostly comprise employee salaries, PF contributions, gratuity, and other employee welfare benefits. An increase in employee benefit expenses is an indication that the startup has increased its employee headcount.

In FY22, Swiggy spent INR 1,848.7 Cr on advertising and promotional activities, a whopping 301% increase from INR 461 Cr in FY21. Besides, the startup also spent INR 2,350.2 Cr on outsourcing support cost, while it incurred an expense of INR 156.4 Cr on order cancellations and others.

Swiggy spent INR 1.6 to earn every INR 1 from operations.

In comparison, publicly listed startup Zomato reported widening of its net loss for FY22 to INR 1,222.5 Cr from 816.4 Cr in FY21. The Gurugram-based startup’s revenue from operations more than doubled to INR 4,192.4 Cr from 1,993.8 Cr in FY21, while total expenses soared to INR 6,205.5 Cr from INR 2,608.8 Cr in the previous year.

In January this year, Swiggy raised $700 Mn in a fresh round of funding led by Invesco. The round also saw participation from new investors including Baron Capital Group, Sumeru Venture, IIFL AMC Late Stage Tech Fund, Kotak, Axis Growth Avenues AIF- I among others. Swiggy was valued at $10.7 Bn in that round, becoming the third Indian startup after Patym and BYJU’S to cross the $10 Bn mark.

Swiggy seemed to be on a mission to diversify its business in 2022. The startup first acquired DineOut from Times Internet for $200 Mn to foray into restaurant discovery and table reservation space in which its rival Zomato had a monopoly. Besides, it also launched Minis, an ecommerce enabler platform for sellers, earlier this year. It helps sellers establish online presence to increase their customer reach.

Ad-lite browsing experience

Ad-lite browsing experience