Sood, through his company Sood Informatics LLP (SIL), has purchased around over 8.69 lakh shares of Spice Money

Sood has also been appointed as a non-executive advisory board member in Spice Capital

Spice Money is a tech-enabled hyperlocal payments network, offering services such as cash deposit, Aadhaar enabled payments system for cash withdrawal, mini ATM, insurance and loans, among others

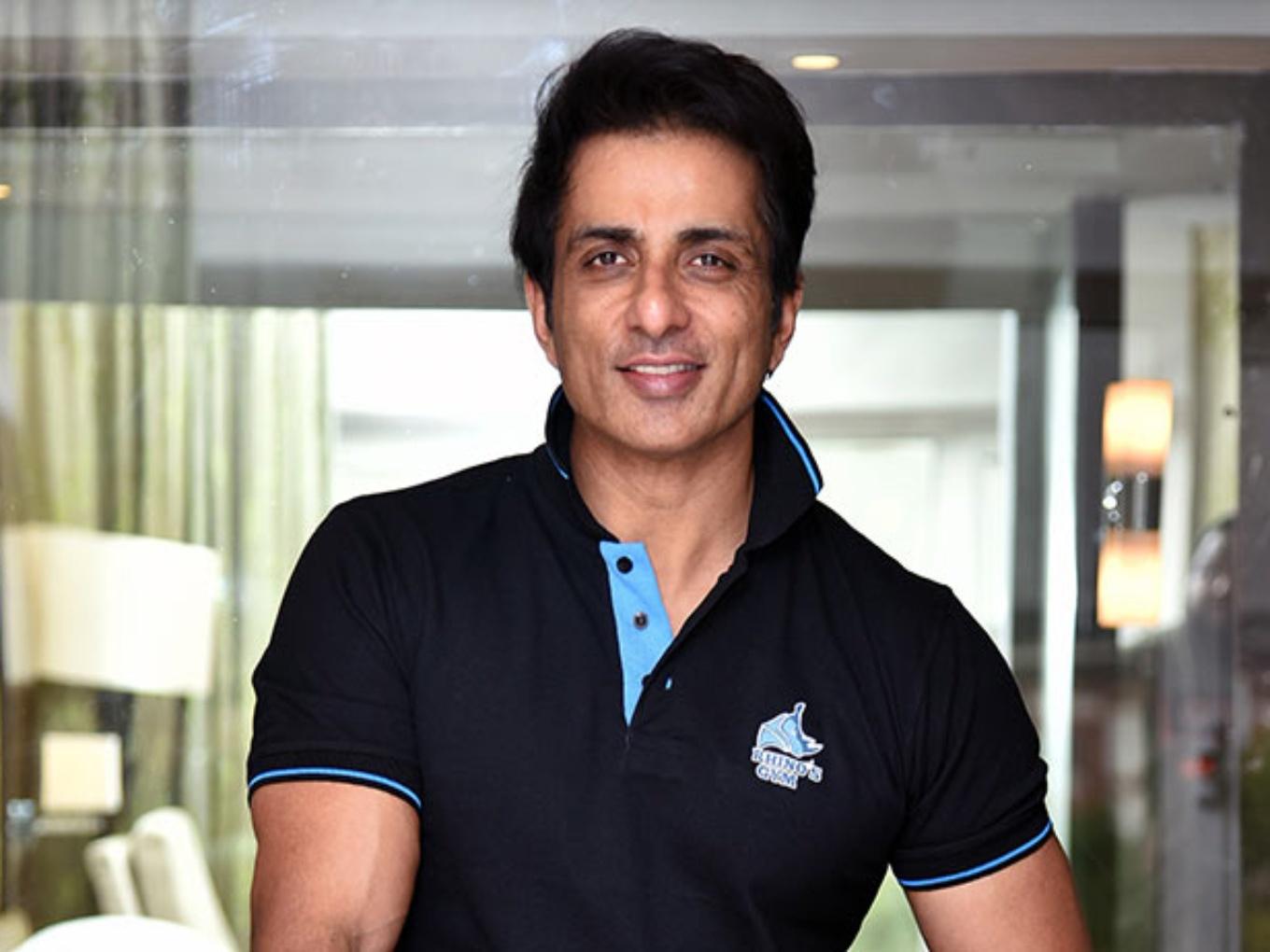

Rural fintech firm Spice Money, on Monday (December 14), appointed Bollywood actor and entrepreneur Sonu Sood as its brand ambassador and as a non-executive board member, following the actor’s investment in the startup.

Sood, through his company Sood Informatics LLP (SIL), has agreed to purchase 8,69,030 Class B Equity Shares of Spice Money at a price of INR 10 per share. This amounts to approximately 2% of Spice Money’s present share capital, the company informed the National Stock Exchange on Monday.

Further, upon the achievement of deliverables currently set out, SIL could increase its stake in Spice Money’s share capital to 5%. Sood has also been appointed as a non-executive advisory board member in Spice Capital.

Launched in 2015 by Dilip Modi, Spice Money is a subsidiary company of DiGiSPICE Technologies Limited. It operates a tech-enabled hyperlocal payments network, offering services such as cash deposit, Aadhaar-enabled payments system for cash withdrawal, mini ATMs, insurance, loans, bill payments, cash collection centre for NBFCs and banks as well as ticket bookings and recharge. It also offers PAN card and mPoS related services through the Spice Money App (Adhikari App) and web portal.

According to the terms of the partnership, Spice Money and Sood will collectively ideate to design new initiatives and products that will bridge the divide between rural and urban India. Spice Money will also enable select existing programs developed by Sonu Sood during the lockdown, to be made available on the Spice Money platform.

“I strongly believe that together, we will chart the future for an Aatmanirbhar Bharat (Self-reliant India). Through my experiences over the last few months, I have gained an eye-opening perspective on the needs and struggles of the people in towns and villages of India. My vision is to make my countrymen, socio-economically independent and self-reliant using technology,” said Sood about his association with Spice Money. The actor would be an ambassador for Spice Money for three years.

As a non-executive advisory board member, Sood will contribute to building the network of entrepreneurs, while encouraging financial inclusion and digital empowerment in rural India. Spice Money mentions digital and financial inclusion as one of its aims and claims that up to 90% of its 5 lakh digital entrepreneurs are in semi-urban and rural India. Sood will work with these entrepreneurs to develop an appetite for digital product offerings thus, accelerating their digital journey through technology adoption.

Earlier this month, Sood’s startup Pravasirojgar, a job search platform for migrant and transient workers, raised INR 250 Cr in funding from Temasek Holdings-backed Goodworker.

Lending Set For Boost In India

Of late, a host of digital payments startups have looked to expand credit facilities to tier 2 and 3 cities as well as rural areas, which have remained underserved by the traditional financial system.

In July this year, Google Pay partnered with ZestMoney as part of its plan to add lending to its payments business. Google Pay is expected to partner with more such digital lenders and non-banking finance companies (NBFCs) in the future.

Meanwhile, recently launched payments application WhatsApp Payments has also talked about extending to micro-credit facilities to rural areas.

As per Inc42 Plus estimates, the credit demand in India is projected to be worth $1.41 Tn by 2022. The estimated growth rate in credit demand is 3.73% between FY17 and FY22. However, the Covid-19 crisis is said to be an unprecedented boost to the lending space in India.

Paytm founder Vijay Shekhar Sharma, talking at the ‘Ask Me Anything’ webinar hosted by Inc42, highlighted that lending is one of the biggest opportunities which comes out of these times. “Companies that swing around to the opportunity of distributing unsecured loans and collecting them well, and underwriting them well will become the champions of tomorrow,” he added.

Ad-lite browsing experience

Ad-lite browsing experience