SBI has cited the RBI’s long-standing anti-crypto stance for its warning to users

Earlier this month, ICICI bank and Paytm Payments Bank had stopped transactions to crypto exchanges

“Crypto is more of a fad,” said HDFC Bank’s Treasury Research Team in its latest report

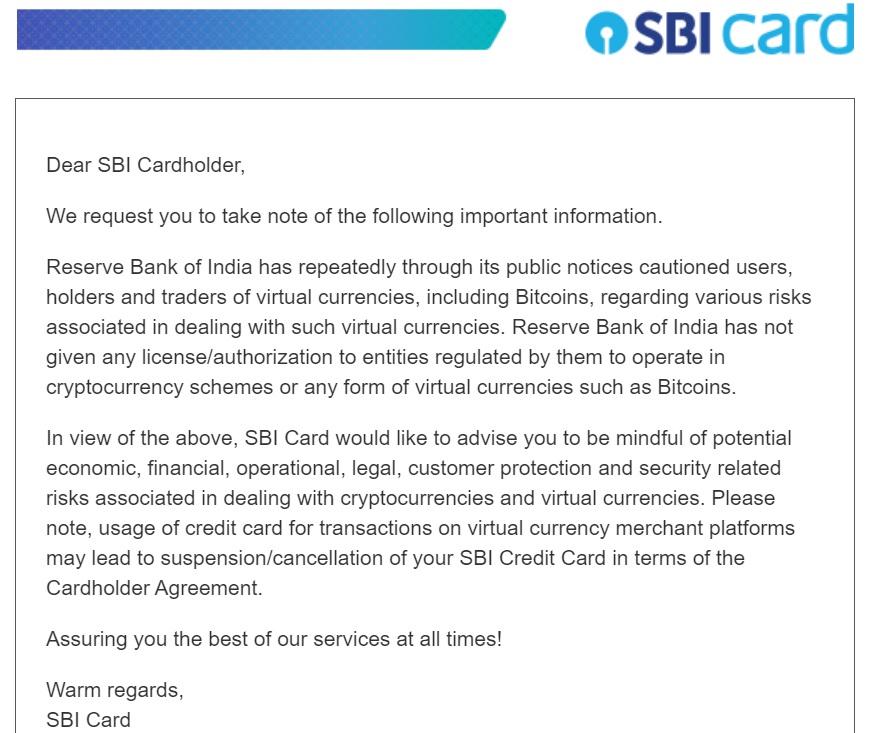

After ICICI Bank and Paytm Payments Bank recently decided to block transactions by users towards crypto exchanges, India’s largest bank State Bank of India has now issued another advisory to its customers. In its email to its credit card customers, the bank has cautioned that any usage of credit cards for crypto transactions may lead to suspension or cancellation of the customers’ SBI credit cards.

As reported in the latest The Outline By Inc42 Plus, the crypto market has been surging amid the pandemic — globally, the crypto market cap has risen 10x, from more than $200 Bn in March 2020 to $2 Tn in mid-May this year. In India, WazirX claims to have achieved 10x growth in just five months, the platform recorded $5.4 Bn in transaction value in April this year, up from $500 Mn in December 2020. In the last month, coinciding with the recent crypto boom in India, the Reserve Bank of India had informally asked banks to curtail growing INR conversions into crypto assets.

Given that the Supreme Court had already cleared the use of banking services for crypto trading and investment, the RBI seems to be risking contempt of court. But a senior RBI officer, on the condition of anonymity, said that the central bank holds the right to control trade in any sector if it impacts the Indian currency in any way.

In the current situation, when the finance ministry has already made it clear that cryptocurrencies do not have any intrinsic value and are not backed by any asset, the RBI has to closely follow INR conversions to cryptocurrencies.

“These are currently not regulated in India. As a result, the RBI is bound to take measures to stop large conversions of INR into cryptos,” an RBI official told Inc42.

What Is SBI’s Advisory Telling Customers

Ignoring the Supreme Court’s verdict from March 2020, the SBI reiterated the RBI’s long-standing stance on cryptocurrencies and said, “Reserve Bank of India has not given any license/authorization to entities regulated by them to operate in cryptocurrency schemes or any form of virtual currencies such as Bitcoins.”

It added, “Usage of credit card for transactions on virtual currency merchant platforms may lead to suspension/cancellation of your SBI Credit Card in terms of the Cardholder Agreement.”

This is not the first time that the bank has issued such an advisory regarding crypto transactions. In April 2018 too, citing the RBI’s crypto notification, the bank had warned its users that adhering to the RBI policies, SBI Card will not allow the purchase or trading of such cryptocurrency or any other virtual currency.

Cryptocurrencies Are More Of A Fad: HDFC

India’s largest private sector bank HDFC Bank has not been offering any crypto-related banking assistance to the exchanges. The bank has also recently sent emails to some of its consumers asking them to comply with the RBI notification.

The company’s treasury research team has recently come up with a report on the recent spike in the cryptocurrency market.

“The fact that there is a strong correlation between bitcoin prices and google searches indicates that it is perhaps more of a fad. The bottom line is that it seems to be highly speculative,” – Treasury Research, HDFC Bank

The bank in its study has also accepted the impeccable return that cryptos have managed to provide. It marked that cryptocurrencies are one of the best-performing assets, with Bitcoins returns at 10869% since 2015 as compared to the returns of 102% of S&P, 184% of NASDAQ, and 59% of gold, in the same time period make a case for Crypto believers that Bitcoin will grow in importance as an asset class.

Furthermore, an increasing appetite for cryptocurrencies as gauged by the number of addresses with non-zero balance might suggest that cryptocurrencies are here to stay and are not going away in a hurry, It added.

Ad-lite browsing experience

Ad-lite browsing experience