The IPO-bound ecommerce unicorn reported a net profit of INR 215.9 Cr in FY21 as against a loss of INR 190.8 Cr in FY20

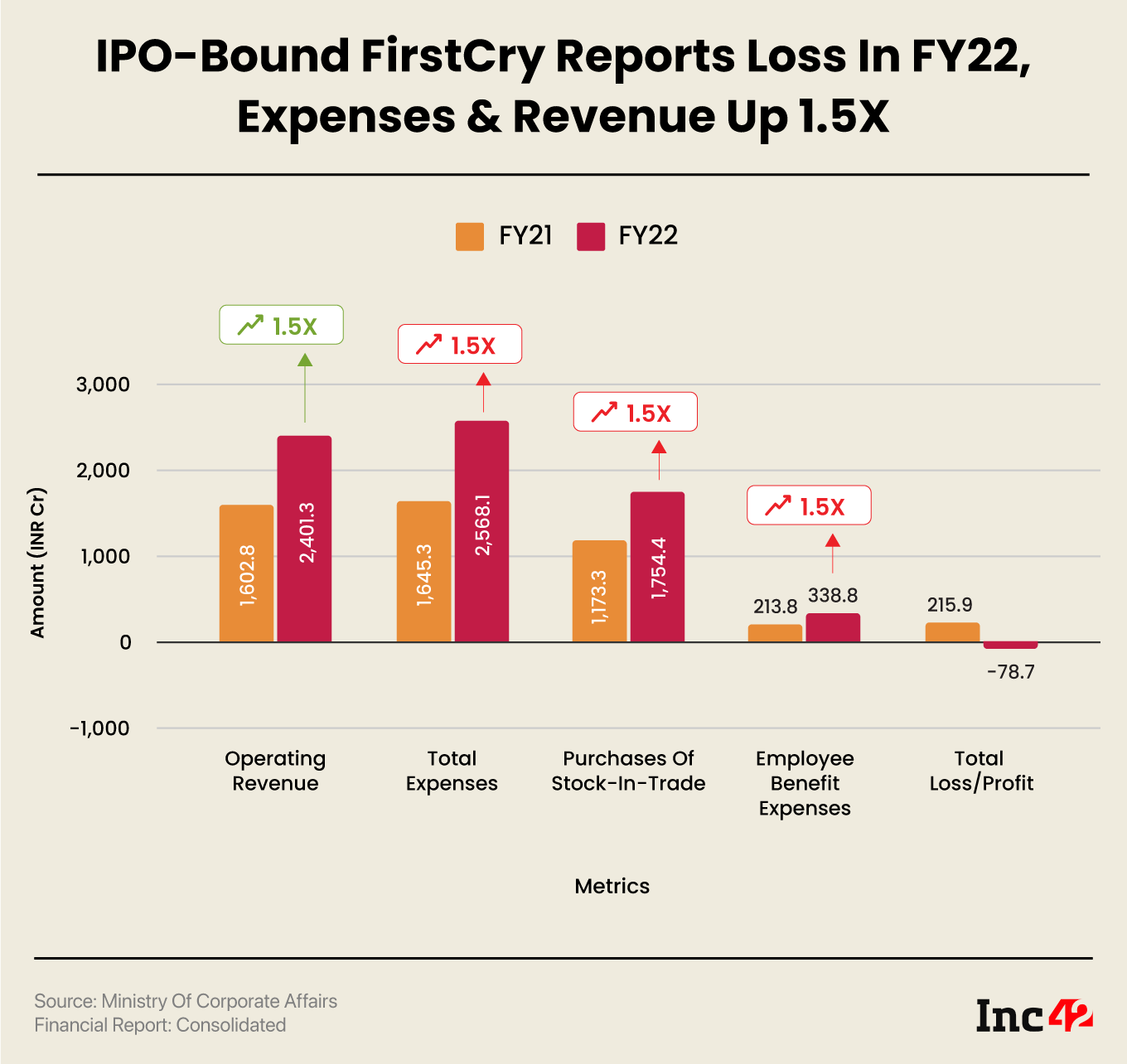

FirstCry’s sales revenue jumped 50% YoY to INR 2,401.3 Cr, but rise in expenses due to increase in purchases of stock in trade and employee benefits hurt the bottomline in FY22

FirstCry’s total expenses zoomed 56% to INR 2,568.1 Cr in FY22 from INR 1,645.3 Cr in FY21

SoftBank-backed omnichannel baby and kids marketplace FirstCry

The IPO-bound Pune-based ecommerce unicorn reported a net profit of INR 215.9 Cr in FY21 as against a loss of INR 190.8 Cr in FY20. Besides lower expenses, tax credits also helped the startup achieve profitability in FY21.

Despite FirstCry reporting a loss in FY22, its sales revenue jumped 50% to INR 2,401.3 Cr from INR 1,602.8 Cr in FY21.

As an ecommerce marketplace for various categories of baby and kids products such as clothing, footwear, and other essentials, FirstCry earns a majority of its revenue from sales of its products.

Besides, the startup also generates revenue from loyalty points programmes, internet display charges, preschool revenue, and more.

FirstCry’s total revenue in FY22 shot up 44.6% year-on-year (YoY) to INR 2,516.9 Cr.

On the expenses front, the startup’s total expenditure zoomed 56% to INR 2,568.1 Cr in FY22 from INR 1,645.3 Cr in FY21, with a majority of the amount spent towards the purchases of stock in trade.

In FY22, FirstCry spent INR 1,754.5 Cr on purchases of stock in trade as against INR 1,173.3 Cr in the previous fiscal year. Similarly, its inventory losses of finished goods, work-in-progress and stock-in-trade grew to INR 405.1 Cr in the reported fiscal from INR 185.2 Cr in FY21.

Meanwhile, employee benefit expenses jumped 58.5% to INR 338.8 Cr from INR 213.8 Cr in FY21. It spent INR 234.6 Cr on salaries and wages, which rose over 1.4X YoY in FY22. Its spending on total employee share-based payments more than doubled to INR 92.1 Cr during the year under review.

Advertising and promotional expenses surged 1.6X to INR 268.6 Cr in FY22 from INR 164 Cr in FY21.

It must be noted that the startup has always been aggressive about its promotional activities. As early as in 2015, FirstCry roped in actor Amitabh Bhachan for its advertisements.

The startup’s courier expenses also went up 1.6X YoY to INR 61 Cr in FY22.

Besides, tax expense during the year under review stood at INR 27.5 Cr as against tax credits of INR 117.6 Cr in FY21.

Founded in 2010 by Supam Maheshwari and Amitava Saha, FirstCry converted into a public company last year. As per reports that emerged around April 2022, the startup was planning to raise $700 Mn through its IPO, seeking a valuation of at least $6 Bn.

FirstCry’s subsidiary GlobalBees also posted a consolidated net loss of INR 40.9 Cr in FY22. On the other hand, logistics unicorn XpressBees, which was spun-off from the ecommerce unicorn in 2015, narrowed its loss by over 57% to INR 27.1 Cr in FY22.

Meanwhile, as per a recent report, FirstCry was looking to facilitate a stake sale of some of its shareholders in the company at a valuation of about $3 Bn. It was said to be a pre-IPO round for the startup.

Ad-lite browsing experience

Ad-lite browsing experience