SUMMARY

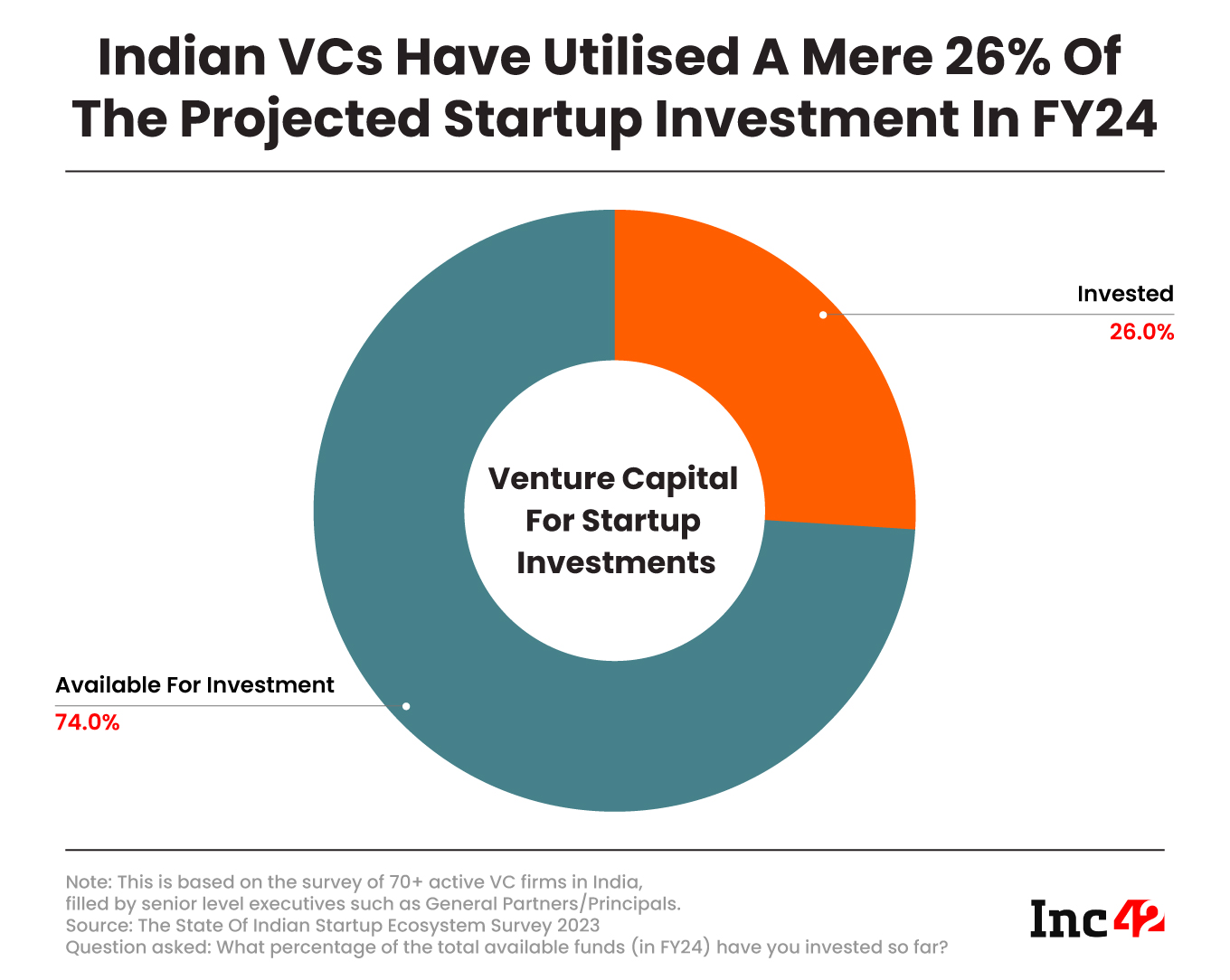

Indian VCs have only invested 26% of the dry powder accumulated and set aside for FY24, per Inc42's latest survey

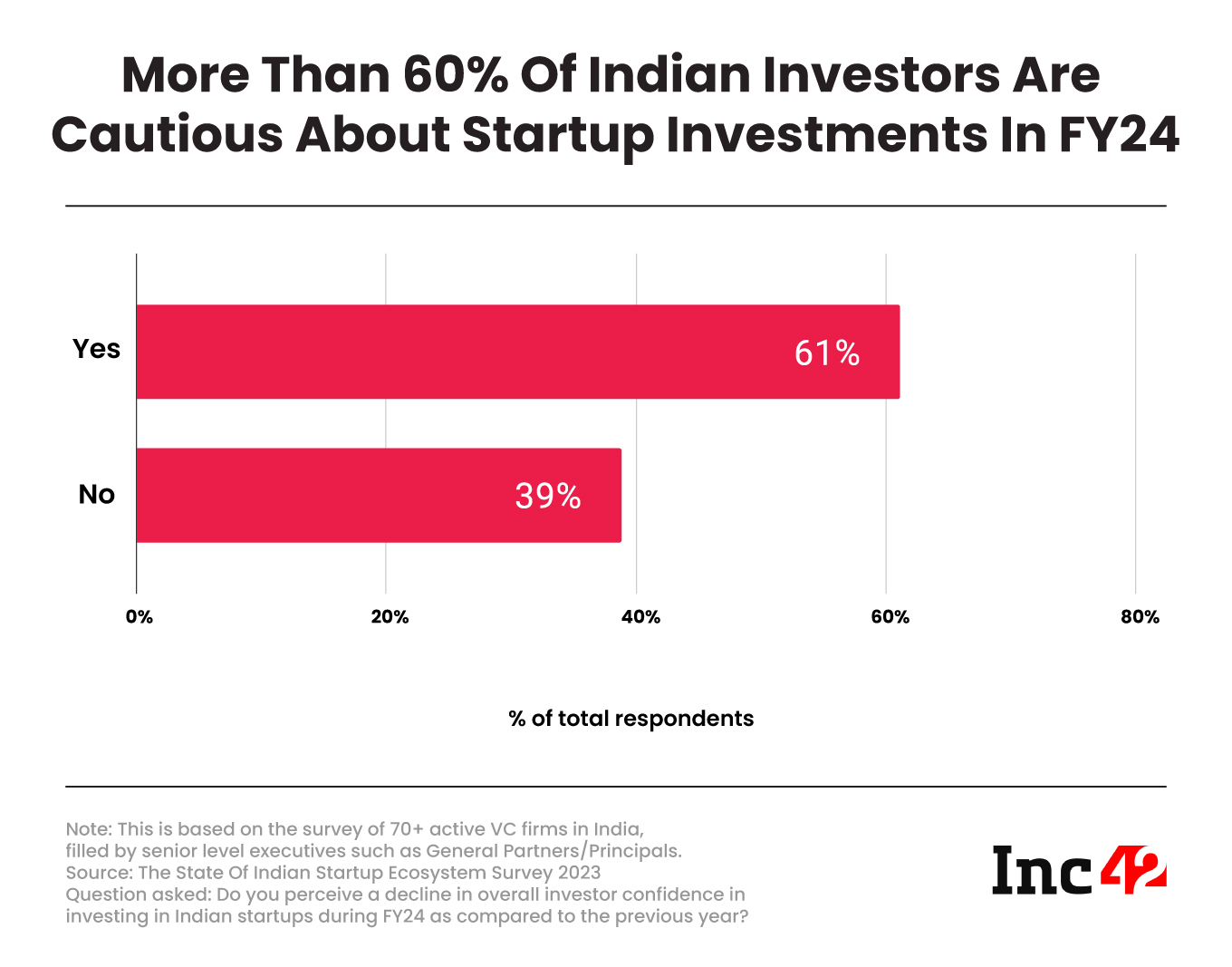

More than 60% of Indian investors are cautious about backing Indian startups

VCs have now started asking difficult questions, and only those with answers will be seen confidently flocking with them

Despite sitting on massive reserves of dry powder, investors are not too keen on jumping headfirst and investing in Indian startups, an industry survey conducted by Inc42 reveals.

According to Inc42’s ‘The State Of Indian Startup Ecosystem Survey 2023’, which surveyed 70-plus active VC firms in India, Indian VCs have only invested 26% of the capital they have accumulated and allocated for FY24, holding on to the rest.

However, what presents a promising investment prospect for both local and global investors is that the Indian economy is poised to achieve a growth rate of 6.1% in FY24, outpacing China’s growth rate of 4.5%.

According to Inc42 data, Indian startups have raised $6.1 Bn in funding across 528 deals this year (as of July 28, 2023), a far cry from the $19 Bn raised across 900 deals in the first half of 2022.

Download The ReportThe funding slowdown has been, for the most part, due to the investors being cautious with their decision, after having been burned during last year. According to Inc42’s survey, more than 60% of Indian investors remain cautious about backing Indian startups.

Over the past few months, multiple issues of egregious corporate governance lapses, massive losses, layoffs, faltering unit economics and other controversies emerging from the Indian startup ecosystem have impacted investors’ sentiments significantly and prompted them to tighten their purse strings.

Investor Confidence: A Sand Castle?

Indian startups enjoyed unprecedented highs in 2021, as startup funding hit an all-time high. In retrospect, coming out of the pandemic, the investors were flush with cash and threw money at everything that looked lucrative.

No wonder Gopal Srinivasan, the chairman and MD of TVS Capital Funds, called the year 2021 an ‘alcohol party’. “We’re coming out of the massive alcohol party of 2021, so some hangover will be there,” Srinivasan said at a media briefing, ahead of the 2023 CK Prahalad Next Practice Entrepreneur Award ceremony.

Not to mention, this ‘hangover’ still persists. With no funding in sight and investor confidence at the lowest, the only startups to survive FY24 will be the ones that have enough runway to smoothly glide through the year — and investors will be on the watch out for such startups.

The irony of the situation, however, is further highlighted when one looks at the amount of dry powder still at the disposal of Indian startups, indicating that the funding winter may be over and investors could exercise caution to invite guests (founders) to the funding buffet.

Rajan Anandan, the MD of Peak XV Partners, declared the end of the funding winter at Inc42’s MoneyX in July. “The funding winter is gone. The Indian startup funding is back to normal, and Peak XV has INR 20,000 Cr to invest,” Anandan said.

Since the beginning of 2022, startup investors have raised nearly $22 Bn to back Indian startups; part of it, over $4 Bn has been announced in 2023 alone.

In the midst of a volatile investment landscape, marked by the highs of 2021 and the lessons learned from it, the Indian startup ecosystem finds itself at a crossroads. Inc42’s survey paints a vivid picture of cautious investors, reluctant to repeat the exuberance of the past.

With the closure of deals becoming a more time-consuming process, and audit cycles growing in duration, it’s evident that investors are being meticulously thorough in their due diligence. The trepidation stemming from past mishaps and uncertainties has led investors to approach the funding arena with a discerning eye. This heightened scrutiny is mirrored in the slowed pace of investments and the accumulation of substantial dry powder reserves.

As the Indian economy readies itself for an ambitious growth rate in FY24, the startup realm stands at an intriguing juncture. Despite the past year’s fervor, it’s clear that investor sentiment has evolved. The startups that navigate this new landscape with sustainable runway and compelling value propositions are more likely to emerge resilient.

Ad-lite browsing experience

Ad-lite browsing experience