Following a robust response to Zomato’s public offering, which was subscribed by over 40 times, many startups such as Paytm, MobiKwik, PolicyBazar, CarTrade and Nykaa are planning to list on the Indian stock markets

SEBI is now exploring the future opportunities of exchange traded funds (ETFs) and trying to increase their liquidity after their growth in recent years

Indian markets reportedly offer the same pool of investors such as those of the US

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

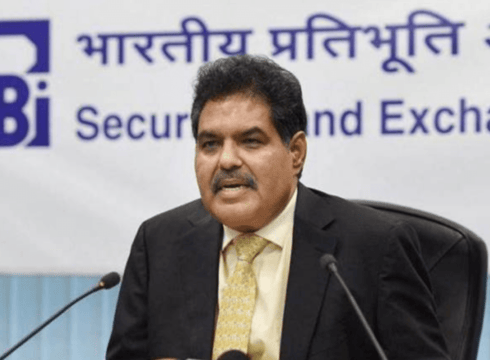

Indian markets are entering a new era with several new-age tech companies preferring to list domestically, said Securities and Exchange Board of India (SEBI) chairman Ajay Tyagi.

Following a robust response to Zomato’s public offering, which was subscribed by over 40 times, many startups such as Paytm, MobiKwik, PolicyBazar, CarTrade and Nykaa are planning to list on the Indian stock markets.

“Our markets offer as attractive a fundraising proposition as any overseas market. Recent filings and public offerings reflect the maturity of our market to accept the business model of new age tech companies, which aren’t amenable to valuation through conventional metrics of profitability. Successful IPOs of such companies are likely to attract more funds in domestic markets; thus creating a new ecosystem of entrepreneurs and investors,” Tyagi said while delivering a speech at a conference organised by the National Institute of Securities Markets (NISM), an educational arm of SEBI.

“From the number of new filings with SEBI, it is expected that the figures (amount mobilised through IPOs) will increase significantly going forward.”

However, initially many thought that most of these companies would opt to list in the US, which was the most common and preferred destination for companies today. The investment bankers on the other hand, said that the Indian markets currently offer the same pool of investors available in the US.

“It also needs to be acknowledged that by the very nature, the markets are forward-looking and the investments take into account future growth prospects. Add to this, the regulator’s effort in terms of continuous dialogue with stakeholders to bring required regulatory changes, rationalizing procedures and maintaining trust in the market,” Tyagi said.

Speaking on the future prospects of the Indian markets and fundraising opportunities, the SEBI chief commented, “The task before us is to sustain growing investors’ interest by maintaining market integrity, simplifying processes, ensuring robust risk management, introducing new products and increasing awareness.”

As per a statement, SEBI is now exploring the future opportunities of exchange traded funds (ETFs) after their growth in recent years.

“Globally, ETFs have emerged as a popular product, and provide liquid exposure to investors on even relatively illiquid underlying assets. SEBI is examining how to increase ETF liquidity on exchange platforms and feasibility of introducing new ETF products such as corporate bond ETFs to increase liquidity in the corporate bond market,” he added.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.