Kristal.AI Will Use The Funding To Bolster Its Technology Stack And Expand To More Markets

Kristal.AI, an AI-powered digital asset management platform has raised $1.87 Mn in a Seed funding round led by IDG Ventures India. Angel investors including Shailesh Rao (Senior Advisor -TPG, McKinsey) and Amit Gupta (Founding Partner, Newquest Capital) also participated in this funding round.

Kristal.AI currently focuses on investors (clients) in the Singapore, Hong Kong and India (Bengaluru and Mumbai) markets.

TCM Sundaram, founding partner of IDG Ventures India said, “Kristal.AI’s platform is solving a real gap in the ultra and mass affluent market which is bigger than the equity mutual funds market, with investors seeking sophisticated trading instruments to increase their returns. We are very excited to partner with the Kristal.AI team to scale this new market”.

Kristal.AI: Looking To Democratise Wealth Management For Individuals, Family Offices And Others

Founded by Asheesh Chanda and Vineeth Narasimhan in 2016, Kristal.AI works with an entire spectrum of customers. This includes sophisticated funds and family offices as well as mass affluent clients, who do not receive the service they should from private banks, as shared by the company in an official statement.

It also aims to build a community of independent financial advisors, traders, and portfolio managers, thereby truly democratizing wealth management.

As Asheesh said, “2017 has marked the first steps Kristal.AI has taken towards delivering diversified investment solutions for our clients with clarity, consistency and complete transparency.”

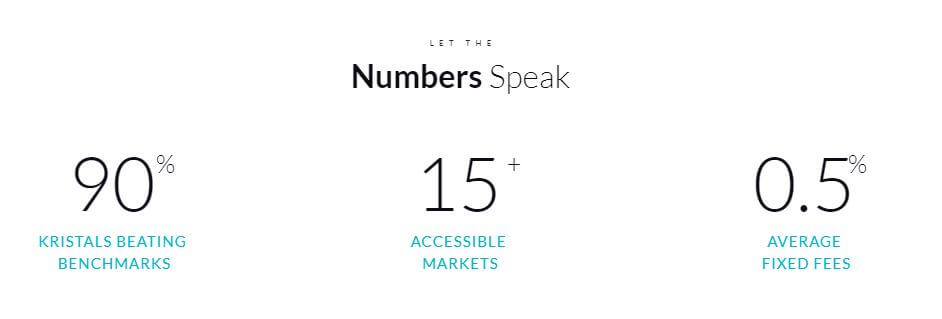

The platform provides investors and advisors with sophisticated curated portfolios (branded as Kristals) created by financial experts on the platform. Each Kristal is based on a theme and is comprised of a wide variety of exchange-traded assets including stocks, ETFs, bonds, options, futures, currencies and alternatives.

The Kristals are rated and ranked based on ivy league criteria used to evaluate mutual funds and hedge funds. Kristal.AI’s proprietary compliance engine and due diligence process ensure trading strategies are vetted and approved before being put to use on client’s money.

With 30+ Team, 150+ Kristals And More, What’s next For Kristal.AI

Currently, there are 150+ Kristals on the platform, allowing investors to invest in global markets such as North America, Europe, Asia-pacific including India, Japan, and China. The startup employs 30+ people in its offices in Singapore, India, and Hong Kong.

“In the past two years, we have brought a simple idea into a live platform providing value to our customers. Our vision is to enable our customers to have a seamless, fully self-serviced and intelligent investment experience via our platform”, added Vineeth.

“In the past two years, we have brought a simple idea into a live platform providing value to our customers. Our vision is to enable our customers to have a seamless, fully self-serviced and intelligent investment experience via our platform”, added Vineeth.

Kristal.AI plans to utilise the raised funding to bolster its technology stack as well as expedite the integration of machine learning capabilities for providing faster and more efficient financial advisory to its clients. It is also looking at expanding its reach beyond the three countries, especially into South-East Asia, Middle-East and the US.

IDG Ventures India: Diversifying Its Startup Portfolio

Bengaluru-based IDG Ventures India is a sector agnostic fund, focussed on the Indian markets. In past, the VC fund has been known for its investments in platforms such as PolicyBazaar, Active.ai, Curefit, and more.

After making around 15 (disclosed) investments in 2017, IDG Ventures India has already started making progress in 2018 as well. So far, the VC fund has invested in four startups (apart from Kristal.AI and as disclosed in media reports) including NestAway, Healthify.me, Axio Biosolutions and EarlySalary.

Earlier, in November 2017, Mumbai-based Unilever Ventures, the PE vertical of Unilever and Amazon Internet Services Pvt. Ltd. (AISPL), also invested $10 Mn (INR 65 Cr) into IDG Venture India Fund. The raised funds were said to be utilised by IDG Ventures India Fund to invest in consumer-technology, innovation, and digital startups.

Ad-lite browsing experience

Ad-lite browsing experience