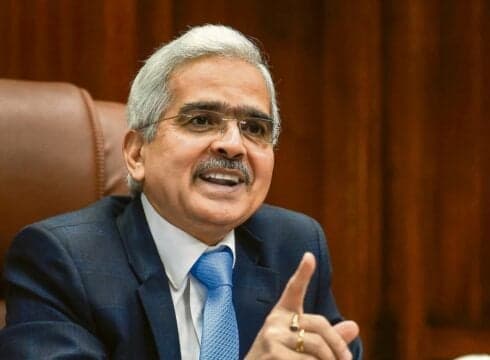

On one hand, we have to support innovation, on the other, we have to maintain financial stability: Shaktikanta Das

He added that the RBI expects licenced entities to operate within the purview and limits of their licence

The RBI had put together a working group to come up with regulations for digital lending platforms in January 2021

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

The central bank will bring guidelines to regulate digital lending soon, said RBI Governor, Shaktikanta Das today.

The RBI governor noted that the situation with digital lending took more time than expected and is more complex than previously assumed, which has prompted the reserve bank to exercise caution.

“It has taken more time than we had initially presumed, but the situation is so complex, you know, we are being very careful and very cautious. On one hand, we have to support innovation, on the other, we have to maintain financial stability,” Das said.

Reiterating RBI’s position on the matter of digital lending, Das said that its responsibility was to ensure financial stability. He added that the RBI expects licenced entities to operate within the purview and limits of their licence.

The RBI governor noted, “If they want to do something over and above that, they need to seek permission from us [RBI]. If they are building anything beyond what their licence permits, then it is not acceptable. We cannot allow a scenario where risk is building up.”

Das informed that the working committee responsible for the norms for digital lending in ironing out the matters related to unregulated digital lending entities as well as licenced entities entering the spaces without a licence to operate in.

This is RBI’s second such regulatory update in just as many months, as the fintech industry waits for the digital lending guidelines. The guidelines are set to have an impact on the $270 Mn digital lending segment.

The RBI established a working group last January to study the problems with the digital lending ecosystem and suggest regulations accordingly. By November 2021, the working group suggested stricter guidelines for digital lending players.

These guidelines include asking digital lending apps to undergo a verification process by a nodal agency, and the setting up of a self-regulatory organisation covering the participants in the digital lending ecosystem.

The move comes against the backdrop of several instances of fake digital lending apps, many times run by Chinese nationals, that either extort money from customers or defraud them or both.

Last month, Shaktikanta Das also urged customers to check whether the app they are borrowing from is registered with RBI or not. “Customers should first check whether the app they are borrowing from is registered with the RBI or not. All details pertaining to the registration of digital money lenders are available on RBI’s website,” Das said.

Last month, RBI sent India’s fintech startups into panic mode after it noted that entities without a banking licence could not load prepaid payment instruments (PPIs) with credit lines.

The move prompted many fintech startups to change their business models in a hurry or stop the PPI service altogether to comply. While Jupiter and KreditBee shut down their prepaid card operations, Slice had to change its business model.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.