SUMMARY

Fintech has significantly changed the clientele of wealth management services

Both affluent and mass market segments now have access to financial advisors

Sector attracted investments of $1.2 Bn in 2018, across 116 funding deals

According to Deloitte India 2019 predictions, wealth management in India will see a continuous and significant shift towards ‘digital investing’, which is investment in through mobile or web applications.

The global consulting company said, “Of every rupee invested in mutual funds and fixed deposits by the end of the next year, at least 21 paise is likely to be invested using a digital channel. Further for every 100 demat accounts investing in equities, over 21 are expected to invest using digital (selfcare) front-end applications.” (Demat Account allows investors to hold shares in electronic form).

There is an unmistakable shift in consumer preference towards digital investment options. Commenting on the same, Deloitte said, “While digital investing may increase at varying rates for different asset classes, the facility of immediate service, better discovery of products, and innovations in providing improved customer experience is likely to cause customers to increasingly gravitate towards these new-age platforms.”

Other reasons cited for the user-growth of digital platforms are superior customer experience and low-to-zero cost for trading in equities coupled with enhanced features like algo-trading, back testing, and free access to research reports.

Over the years, India’s fintech sector has seen massive growth. In terms of funding, the sector attracted an investment of $1.2 Bn in 2018, across 116 funding deals as on December 12, 2018, according to Inc42 DataLabs.

India’s Fintech Growth Trends

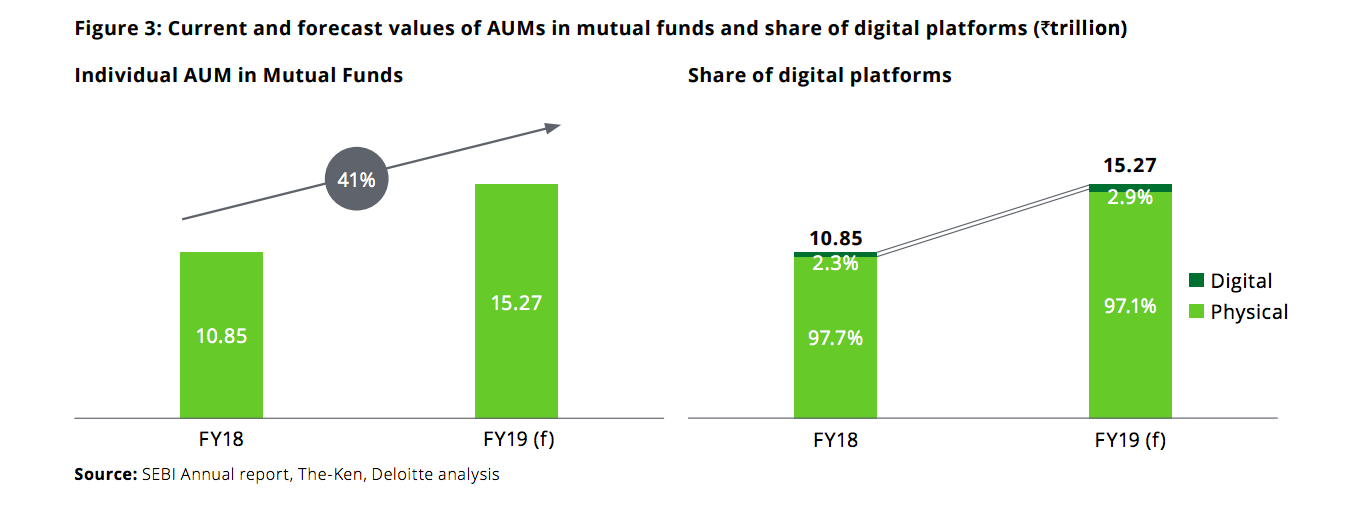

Deloitte India has estimated digital-invested assets under management (AUM) to grow by around 80% from approx INR 250 Bn in 2018 to INR 450 Bn in 2019. In comparison, overall retail AUM is expected to grow by around 37%. In other words, digital investing is expected to grow at more than double the rate of overall investment in mutual funds.

Mutual Funds

Different digital channels for investing in mutual fund accounted for around INR 250 Bn in AUM in FY18; this is still a meagre 2.3% share of the overall AUM of individual investments in mutual funds. Deloitte predicted that such digital channels will see a 75% increase in AUM and account for around INR 450 Bn of AUM by FY19.

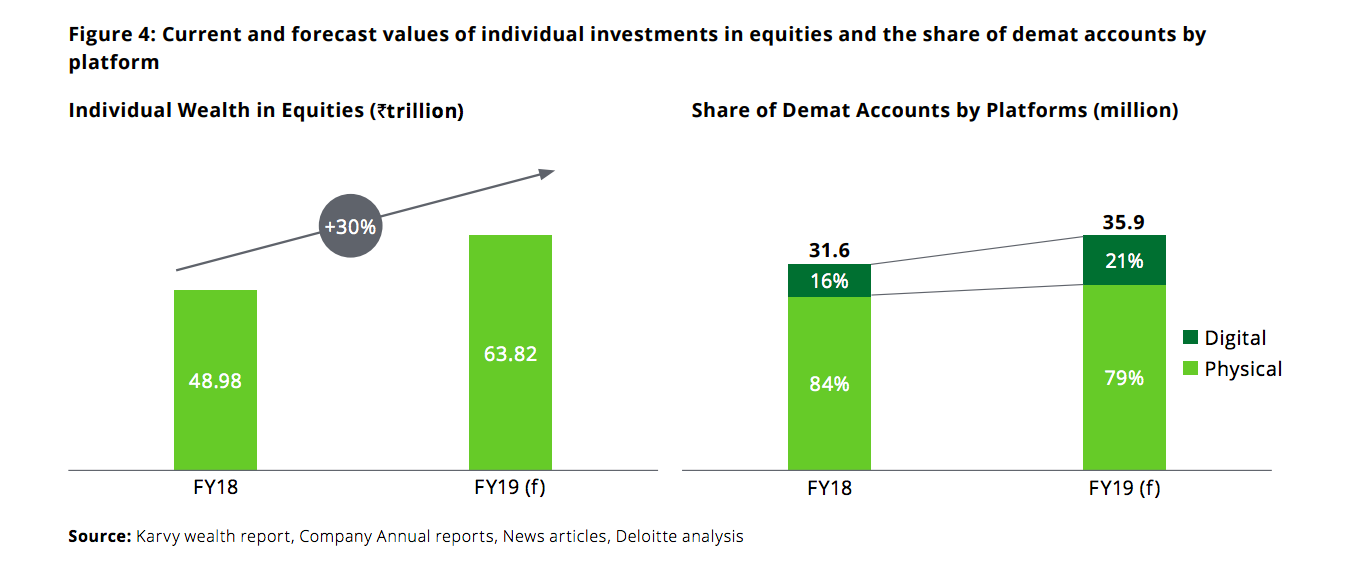

Equities

Digital platforms accounted for an appreciable 16% of all individual user accounts in FY18. Deloitte has predicted this share will increase to 21% in FY19.

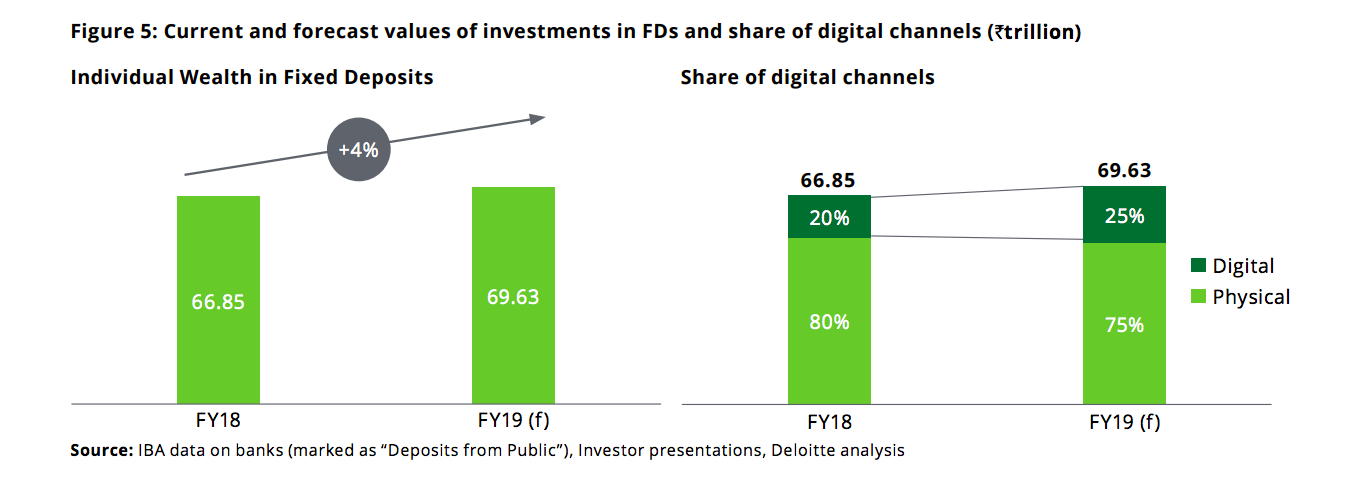

FDs

Deloitte estimated the share of FDs booked through online platforms at 20% for FY18. Further, this share is predicted to increase to 25% in FY19 and translate into over INR 17 Tn of FDs booked through digital channels.

Recently in last month, Bengaluru-based Scripbox, an online mutual fund investment startup, has raised $21.4 Mn (INR 151.2 Cr) in a Series C funding round led by its existing investor Accel Partners, with participation from Omidyar Network and NLI Investment Fund. Mumbai-based fintech startup, Cashcow has raised a seed funding round led by Astarc Ventures, Cashcow cofounder and CTO Gaurav Goyal.

There are startups such as Bengaluru-based Wealthy, Zerodha,Times Internet-backed ETMoney and Paytm Money which offer similar mutual funds-related services.