SUMMARY

Communication Minister Manoj Sinha said that the department has completed studying the Aadhaar verdict

Sinha also added that the ruling will comply with Supreme Court rule and customer safety

Telecom operators are waiting on DoT’s advice on the KYC policy

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

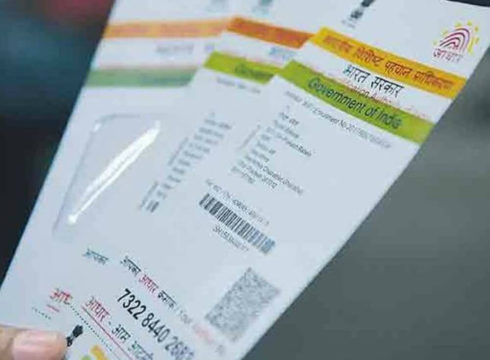

Minister of communication Manoj Sinha announced this week that the Department of Telecom (DoT) has completed analysing the Supreme Court verdict on Aadhaar which prohibited private companies to seek Aadhaar details of the consumer.

The minister also said that the Department of Telecommunications will soon announce its ruling which will both comply with the decision and protect the users.

The decision to the second longest hearing in India’s judicial history on the Aadhaar case stated that Aadhaar is mandatory only for filing income tax returns and for the allotment of PAN. It won’t be essential for opening bank accounts or getting SIM cards from telecom operators.

Along the lines to this ruling, statutory authority, Unique Identification Authority of India (UIDAI) had further asked the telecom companies to submit plans by October 15 to shut down its Aadhaar-based authentication systems.

UIDAI also added that any non-compliance of the ruling may lead to contempt of court proceedings.

This ruling by the Supreme Court was a major challenge to the telecom companies as user could activate new sim connection within an hour by providing their Aadhaar number for instant verification.

According to media report, the telecom companies have said that they are waiting for the DoT ruling especially on the method for complying with the KYC rules and the mandated rule to destroy data collected through the verification process within six months.

Understanding What Is KYC?

Know-Your-Customer or better known by its short form KYC was introduced by the Reserve Bank of India (RBI) in 2002. It is a certain kind of due diligence and regulation under which financial institutions and other regulatory bodies are to identify and collect specific information about their users aimed at combating money laundering.

With the growth of digitisation and fintech companies, the process of KYC went online where customers could record all their details online.

Interestingly, Aadhaar-based KYC had been voluntary. Earlier reports had stated that nearly over 90% of new subscriptions using Aadhaar were made due to certain factors such as convenience, though some avoid it on fears around privacy and data leakage.

Over 500 Mn, or some 50% of India’s mobile phone user base, have linked their Aadhaar to their phone number.

[The development was reported by ET]

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.