DealShare said it has appointed Kamaldeep Singh as the new CEO

In November last year, cofounders Vineet Rao and Sankar Bora parted ways with the startup

The startup said it is in the process of transitioning from an online-only model to a hybrid model

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

All is not well at ecommerce startup DealShare. After the exit of two of its cofounders, Vineet Rao and Sankar Bora, last year, now DealShare’s CEO and cofounder Sourjyendu Medda has quit the startup.

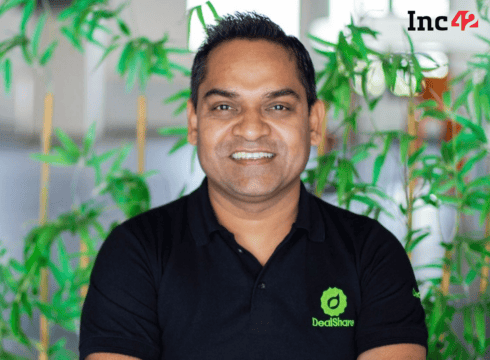

In a statement, DealShare said it has appointed Kamaldeep Singh as the new CEO after an “exhaustive and rigorous selection process” of six months.

“…The firm met both internal and external candidates who were suitable for the role. With over two decades of experience in retail and FMCG, Kamaldeep joined DealShare as President of the company’s retail business in December 2022,” the statement said.

Prior to that, Singh was the CEO of Big Bazaar. He also held various leadership positions in other companies in the past.

DealShare said that Medda will continue to be one of its key shareholders.

The startup said it is in the process of transitioning from an online-only model to a hybrid model combining both online and offline operations. It said Medda’s decision will not have any impact on its operations, headcount strategy and its vision.

The latest development comes over a month after it was reported that two of the four cofounders of the startup stepped down. In the last month of November, it was reported that cofounders Rao and Bora parted ways with the company. Rao resigned from the company in July last year and was initially expected to collaborate with the board for the appointment of a new CEO.

Following Medda’s exit, Rajat Shikhar is the only cofounder associated with DealShare.

The development comes at a time when DealShare is facing a financial crunch. Earlier, Inc42 reported that the startup shut down operations in Maharashtra in June last year. DealShare primarily had warehouses in Mumbai and Pune for B2C and B2B verticals. It shut nearly a dozen warehouses in Pune and also shut operations in Hyderabad.

The Alpha Wave-backed unicorn also shut its B2B business to focus only on the B2C vertical.

In January last year, the startup said it laid off around 6% of its workforce or around 100 employees. However, as per Inc42’s estimates, the startup let go of over 400 employees in the last year alone.

DealShare last raised funding around 21 months ago. The startup has raised over $390 Mn in funding across multiple rounds till date and counts the likes of Tiger Global, WestBridge Capital, and Matrix Partners among its investors. The startup entered the unicorn club two years ago.

DealShare’s net loss widened 543% to INR 431.1 Cr in the financial year 2021-22 (FY22) from INR 67 Cr in FY21 due to its growing business and the associated cash burn. Revenue from operations grew more than 8X to INR 1,932.8 Cr in FY22 from INR 236.7 Cr in FY21. The startup is yet to file FY23 financial statements with the Ministry of Corporate Affairs.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.