The company’s board has issued 5,000 Series C debentures at an issue price of INR 1 Lakh each, which translates into a cumulative sum of INR 50 Cr

The proceeds will be utilised for general corporate purposes and to fuel business growth and expansion plans

VerSe reported losses to the tune of INR 1,909.7 Cr in FY23, down by 25% from INR 2,563.3 Cr FY22

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

VerSe Innovation, the parent of Dailyhunt and Josh, has raised debt capital of INR 50 Cr ($6.25 Mn) from Alteria Capital.

As per regulatory filing accessed by Inc42, the company’s board has issued 5,000 Series C debentures at an issue price of INR 1 Lakh each. This translates into a cumulative sum of INR 50 Cr.

The fresh proceeds will be deployed for general corporate purposes and to fuel business growth and expansion plans.

“Resolved that…, consent of the board of the company… is hereby accorded to allot 5,000 Series C… non-convertible debentures with a face value of INR 1,00,000 each, for an aggregate amount of INR 50 Cr to Alteria Capital Fund II-Scheme I,” said the filing.

The development comes at a time when VerSe continues to post hefty losses. The company reported losses to the tune of INR 1,909.7 Cr in the financial year 2022-23 (FY23), albeit down by 25% from INR 2,563.3 Cr in the previous fiscal year. However, operating revenues jumped 51% You to INR 1,456.5 Cr in FY23.

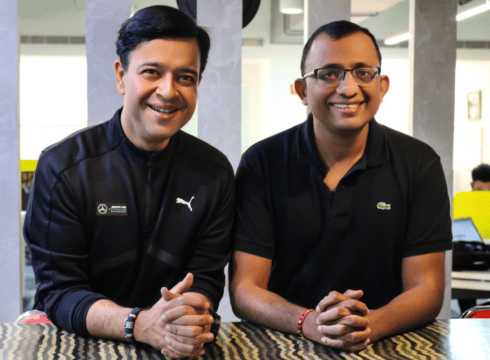

Founded in 2007 by Virendra Gupta and later joined by Umang Bedi, VerSe Innovation runs new aggregator platform DailyHunt and short video platform Josh.

The platform has so far raised more than $1.7 Bn in funding across multiple rounds and counts Google, Microsoft and Sofina as among its investors.

The company’s flagship product, Dailyhunt, claims to have more than 350 Mn monthly active users (MAU) while its short video platform reportedly has 139 Mn MAUs and 68 Mn daily active users or DAUs.

The development was first reported by Entrackr.

The Venture Debt Avenue

The move to raise debt comes more than a year after it raised a mega $805 Mn round led by Canada Pension Plan Investment Board in 2022. As losses continue to hit the company’s bottomline, the raging funding winter has made matters worse.

Right after the $805 Mn fundraise, the company had even fired around 150 employees, or almost 5% of its total workforce, back in 2022.

On the other hand, Indian short video platforms have not had as much success as they anticipated in the aftermath of the TikTok ban. Inc42’s deep dive into the ecosystem last year revealed that Indian startups were far from minting profits and even struggled on operational vanity metrics such as GMV, subscriber base, and engagement.

Amid the downturn, multiple cofounders at many of these short-video platforms have quit including Chingari’s Aditya Kothari and ShareChat’s Farid Ahsan and Bhanu Pratap Singh.

Meanwhile, venture debt firms are having a heyday as investors tighten their purse strings and funding deals plummet. The capital drought has pushed many startups to look for alternatives and debt funding has emerged as an attractive route.

Just this week, ecommerce rollup startup GlobalBees secured INR 140 Cr in a debt funding round from Avendus. Prior to that, construction-focussed marketplace Infra.Market also picked up INR 100 Cr in a debt round from non-banking financial company SK Finance.

In January, fintech juggernaut BharatPe also marked the final close of its $100 Mn debt round. In the same month, fintech unicorn OneCard also secured INR 95 Cr in debt capital from venture debt fund Alteria Capital.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.