SUMMARY

The role of a startup CFO has evolved from bookkeeping to that of creating monetising initiatives for growth as well as directing the expenditure

The new role requires a CFO to collaborate with technology, people, processes and the right banking partner.

Inc42, in partnership with HSBC, brings you a 12-part article series, CFOs in Tech to focus on the journey of such startups and their finance chiefs

In the initial years of a startup, founder’s focus is entirely on the product — finding the right product-market fit, building and optimizing the product, before taking it to market and then reiterating on the feedback, and then as the startup grows in revenue and attracts investors, it needs to dedicate just as much time to financial planning, particularly to accounting compliances and creating basic guardrails on spending.

The conventional norm up until a few years ago was to hire a finance chief with a big funding round looming on the horizon or when a startup achieves quantifiable success in terms of revenue. But today, with businesses undergoing rapid change, the demands of the job have changed from mere record-keeping and managing profit and loss.

With increasing competition in a data-driven economy and real-time environment, a chief financial officer’s role has evolved and increasingly moving from a cost centre to profit centre. Today’s CFO is expected to plan new initiatives for growth, monetise it, collaborate company-wide for execution and optimise resources for the cause.

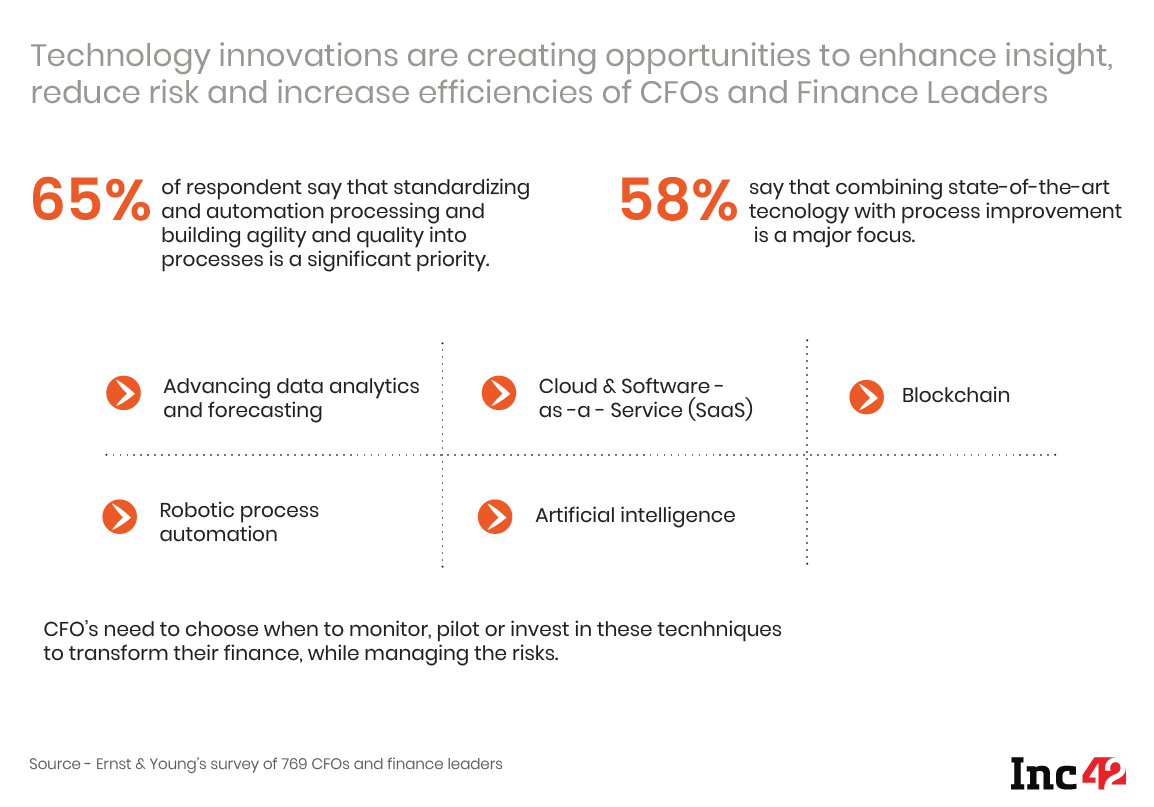

According to a survey of 769 CFOs and finance leaders in 32 countries conducted by E&Y, 58% CFOs are of the view that combining state-of-the-art technology with process improvement will be a major focus for the future of finance function.

Additionally, with unprecedented chaos in the form of Covid-19, businesses have to pivot toward survival and look for newer avenues to sustain and grow. Therefore, a CFO has to rely on technology, people and processes for smoother sailing of the startup and not just M&A activity.

“CFOs today are no longer just the custodians of the accounts & finance side of things, but their role has expanded to a central fulcrum that essentially is responsible for business growth, digital transformation, risk management and are responsible for ensuring that today’s organisations are built to scale and future-ready,” says Prakash Jaiswal, Country Head, Business Banking, HSBC India.

Highlighting the journey of the modern finance chief, Inc42 in collaboration with HSBC brings to you a 12-part article series, CFOs in Tech. Through the series, we will feature CFOs of India’s emerging tech companies and understand their journey of scaling the companies, strategising for growth, and keeping up with the changing norms and expectations.

The series will also bring forth the importance of the collaborative nature of a CFO with their banking partner. Along with the startups, banks’ role in the former’s growth has evolved too. Where traditionally banks involved in financing capital requirements, today they go beyond funding.

“Together with banks and financial market service providers, CFOs can unlock future-ready plans on the longevity of their products & services and utilise banks beyond banking through advisory services and unlocking opportunities hidden within their balance sheets,” says Prakash Jaiswal.

Today, banks also play the role of an enabler, offering advisory services, help with regulatory compliances and overseas expansion. The right banking partner guides the startup on the ease of banking, suggests the right technology for digital finance management and helps in the growth of the startup.

“There’s very little said and written about just how crucial these leaders are in a startup’s journey, the various roles they play, as well as challenges that they are best placed to tackle. Through this series with HSBC, we will shed light on these untold journeys of CFOs and how they are using tech and automation to solve financial challenges,” said Pooja Sareen, cofounder, Inc42.

Stay Tuned!