Over 90% of startups fail, with many of them failing because of one-off circumstances or poor risk management: Mahindra

Startups with potentially viable models and good tech are a fertile field for large companies to plough, the Mahindra Group chairman said

While India has more than 72K startups, only about 5.2K of them are funded, as per Inc42 data

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

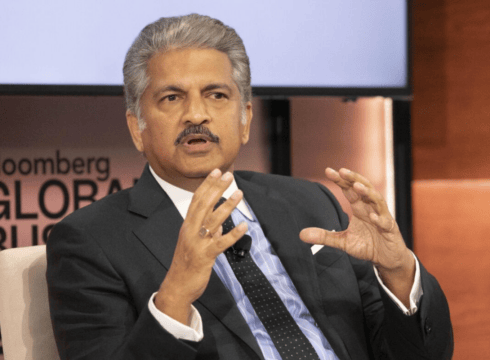

Poor risk management and one-off circumstances are the reasons for the failure of many startups, according to Mahindra Group Chairman Anand Mahindra.

“Over 90% of all startups fail. Many had no chance of survival in the first place. But many fail because of one-off circumstances or because of poor risk management. Yet they had potentially viable models & good tech. That grey zone is a fertile field for large companies to plough,” said Mahindra in a tweet on Tuesday (October 4).

Mahindra’s comments came after Mahindra Logistics announced the acquisition of logistics startup Rivigo’s B2B business for INR 225 Cr.

Tweeting on the same, Anand Mahindra said, “I was an admirer of Rivigo’s startup business model. Unfortunate that it encountered challenges. We’re buying just the Express business, but happy to keep its legacy alive. This is also evidence that enormous value lies in the synergy between new-age startups and large companies.”

The ‘grey zone’ Mahindra talked about belongs to the startups who fail to raise funding despite having ‘potentially viable’ business models, talking in the context of the Rivigo purchase.

According to the Mahindra Group chairman, the area could be an opportunity for large companies, with adequate funding, to experiment with the said business models.

It is prudent to mention here that while India has more than 72K startups, only about 5.2K, or around 7%, of them are funded startups, according to Inc42 data. Further, of the 5.2K funded startups, more than 95% have raised $10 Mn or less in funding.

The Indian startup ecosystem is currently going through the worst funding drought since the start of 2021. According to Inc42’s recent report, Indian startups only managed to raise around $3 Bn in funding in Q3 2022, a drop of 82% year-on-year.

While overall funding in Indian startups crossed $134 Bn in Q3 2022, the quarterly funding amount returned to 2020 levels, indicating that Indian startup funding is undergoing a major correction after the quarterly funding peak achieved in Q3 2021.

The Mahindra Group chief has talked about India’s startup ecosystem a lot in the past as well – sometimes being critical while sometimes being supportive of the various business models and practices followed by Indian startups.

In April this year, Mahindra shared his thoughts on the quick commerce model. When Pramesh CS, a director of Tata Memorial Hospital, shared the view that the model was ‘inhuman’, Mahindra shared his tweet saying that he agreed.

Zepto founder Aadit Palicha reacted to Mahindra’s tweet, stating that Zepto’s 10-minute delivery is only possible when the distance to the user is less than two kilometres. Mahindra shared his tweet as well, showing the other side of the story.

Last November, he welcomed newcomers to the EV segment from the country’s startup ecosystem. In a tweet, he said, “Well, the more the merrier, and the greener our planet,” in the context of the increasing EV startups in the country.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.