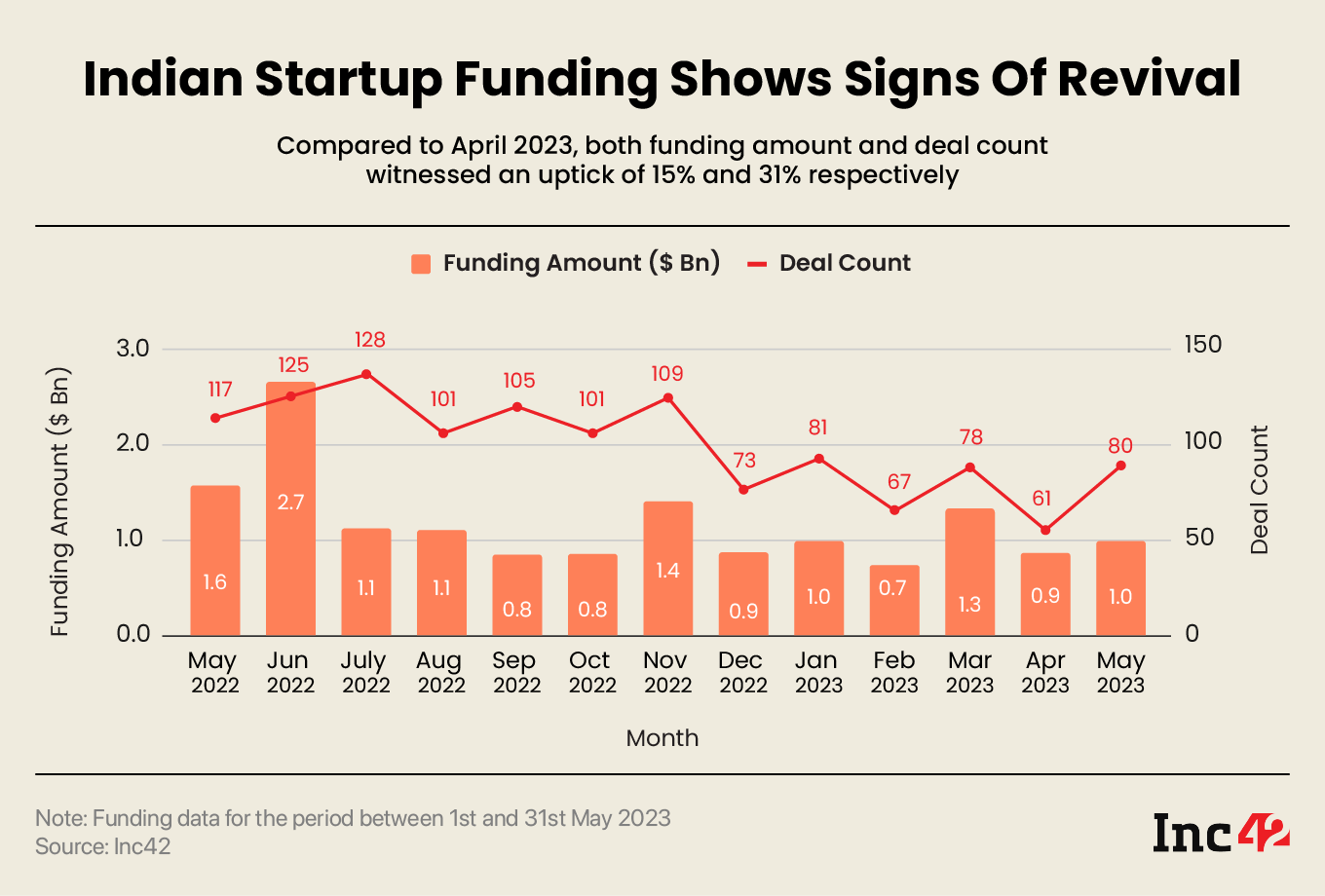

As per Inc42 data, deal count also surged 31% to 80 in May from 61 in April 2023

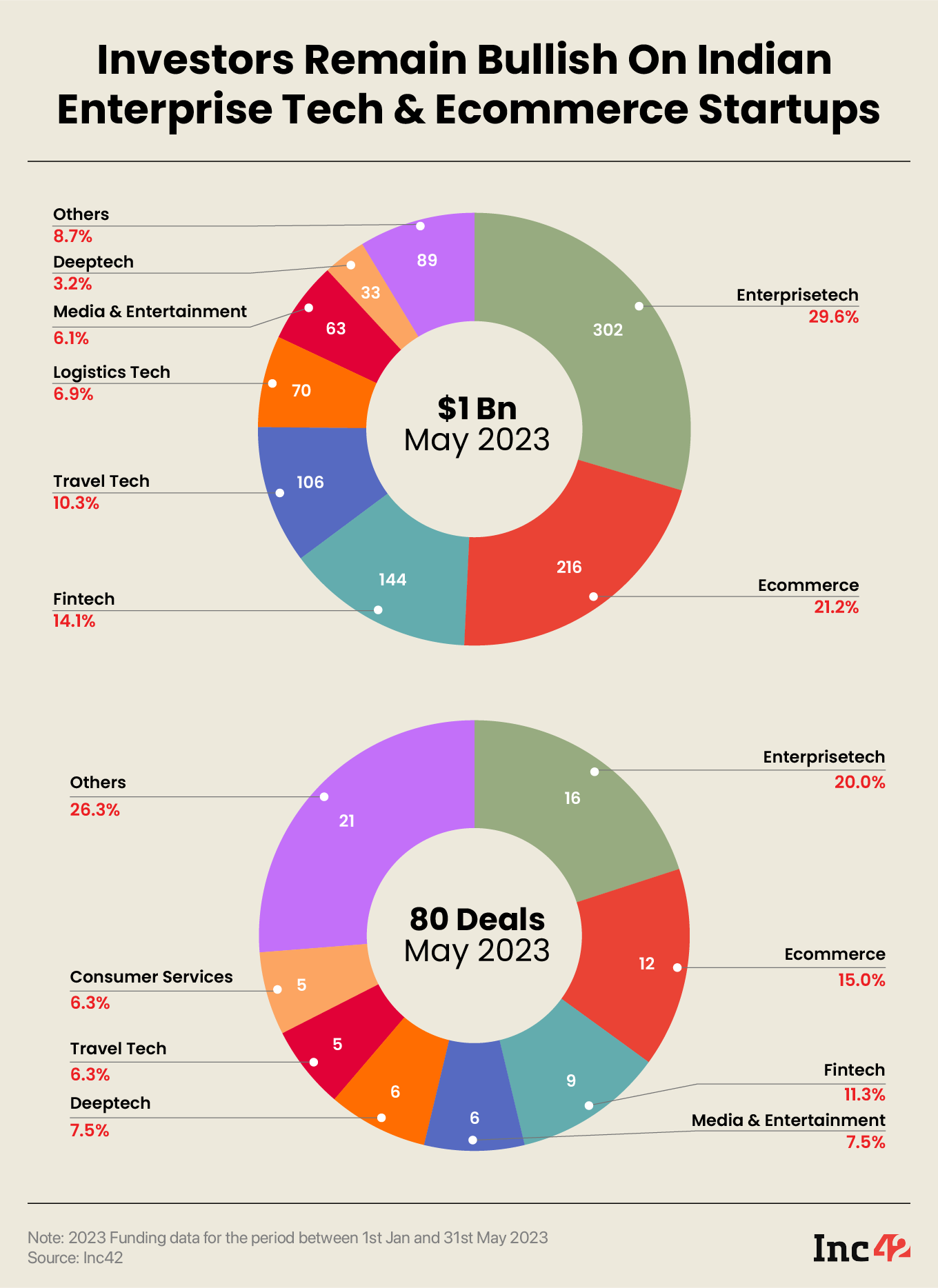

Enterprise tech, ecommerce and fintech continued to be the investor favorite as the three sectors together cornered 66% of the total funding raised in May

While the numbers improved on a MoM basis, the total funding raised by Indian startups tanked 37.5% in May 2023 from $1.6 Bn in May 2022

In what is definitely a silver lining for the Indian startup ecosystem, which has been engulfed by the funding winter, the total capital raised by the country’s startups increased 15% month-on-month (MoM) to $1 Bn in May 2023. In comparison, Indian startups had raised $900 Mn in the month of April.

As per Inc42 data, the deal count also surged 31% to 80 in May 2023 from 61 in April 2023.

The uptick in funding will provide a much-needed respite to the startup ecosystem, which has been pummelled by the funding winter. Besides the funding crunch, many major Indian startups have also seen their investors cutting their valuations amid the global economic slowdown and eroding valuations of tech startups worldwide.

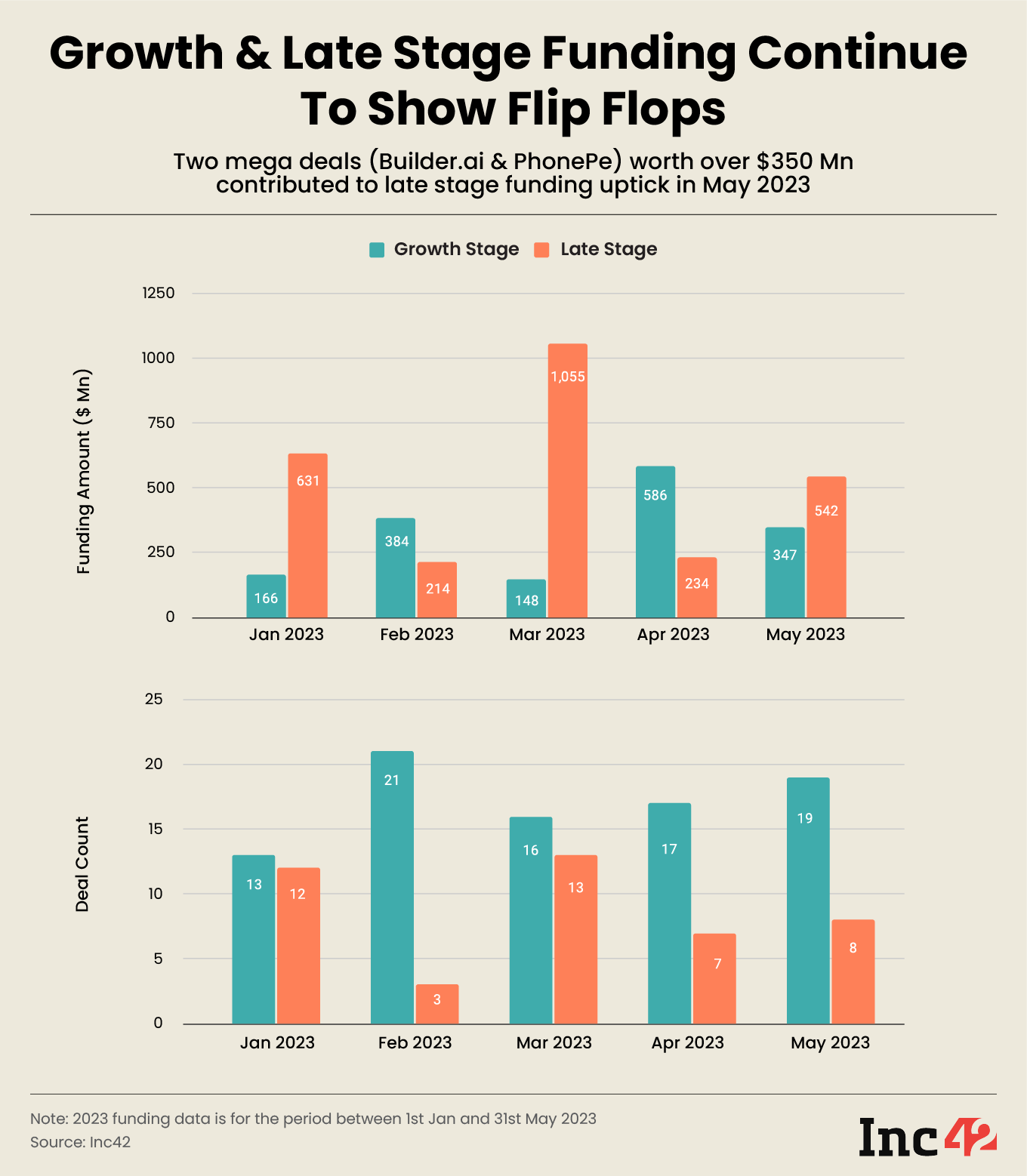

The month of May saw two mega funding deals (those above $100 Mn or above). While Builder.ai raised $250 Mn, fintech giant PhonePe bagged $100 Mn, as part of its ongoing $1 Bn funding round. Home appliance startup Atomberg’s $86 Mn funding round was among the other major investment deals during the month. The top ten deals accounted for $710+ Mn (71%) of funding in May 2023.

In terms of segments, the enterprise tech sector continued to be the favourite of investors, accounting for the highest funding amount and deals in May 2023. Bengaluru continued its reign as the startup hub of the country in May 2023, clinching the highest number of deals and funding amount.

Mirage Or Funding Revival?

The trend for startup funding has been a bumpy one so far this year. The year began positively as Indian startups raised $1 Bn in funding in January, followed by a decline to $0.7 Bn in February.

Afterwards, the funding again saw a surge in March as it inched close to $1.3 Bn, followed by another fall to $0.9 Bn in April 2023.

The increase in funding in May has come at an opportune time. Amid the doom and gloom of the funding winter and layoffs, investors now seem to be slowly getting back into the game.

However, this seems to have been in the making for months. Despite accumulating more than $3 Bn worth of dry powder in the first five months of 2023, India-focused investors have largely stayed out of the picture and have stuck to investing in big names and that too sparsely.

Besides, venture capital (VC) and private equity (PE) firms also raised more than $18 Bn worth of funds to invest in Indian startups in 2022 but remained largely wary of investing. It now seems that the investor confidence is returning and the capital is slowly percolating into the market, bringing some cheer for Indian startups.

However, not everything is hunky-dory. Despite the MoM rise in funding in May, the situation remains grim if seen on a year-on-year (YoY) basis.

The funding raised by Indian startups plunged 37.5% in May 2023 from $1.6 Bn in May 2022. The deal count also tanked 32% from 119 in May 2022.

Enterprise Tech, The Investor Darling

Startups in the enterprise tech sector once again topped the charts. Startups in the sector raised $302 Mn across 16 deals in May 2023, clinching the top spot on both counts.

With a funding of $216 Mn across 12 deals, ecommerce startups took the second spot both in terms of funding amount and deal count in May. Fintech was at the third spot, clinching nine deals worth $144 Mn.

The three sectors accounted for more than 66% of the total funding raised during the month. Other sectors such as traveltech, logistics, and media and entertainment also saw interest from the investors.

In terms of geographic distribution, Bengaluru accounted for a lion’s share of the funding amount at $265 Mn in May 2023. However, Delhi NCR was a close second, with startups in the region bagging $230 Mn in funding. In terms of deal count, Bengaluru and Delhi NCR saw 18 transactions each.

Among other startup hubs, Mumbai, Chennai and Pune saw a capital inflow of $131 Mn, $32 Mn and $19 Mn, respectively, during the month.

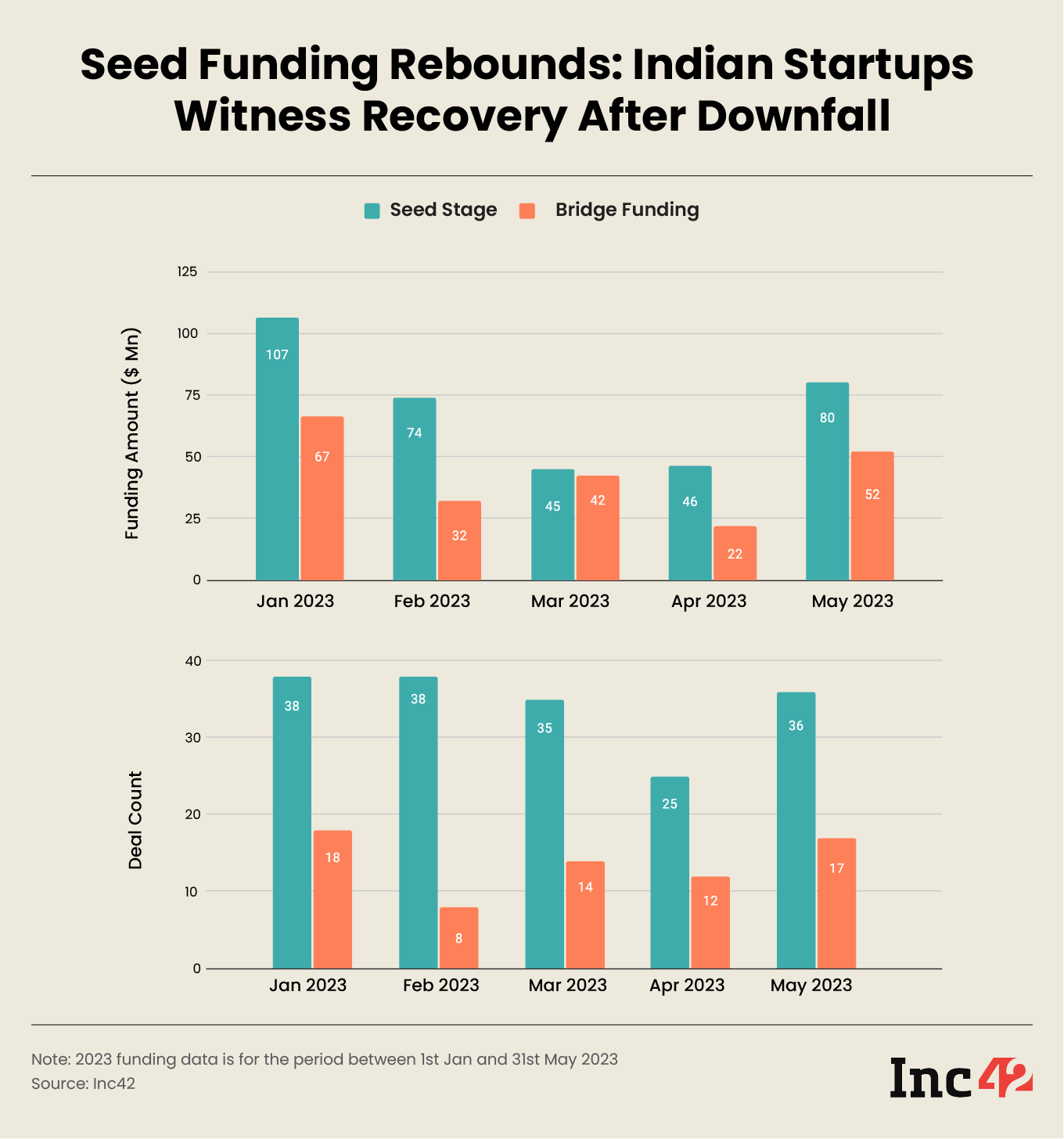

Seed Stage Funding Bounces Back

In terms of stagewise funding trends, the situation continued to be grim for Indian startups across all stages on a YoY basis. While seed stage funding withered 60% YoY to $80 Mn in May 2023, late stage funding declined 34% YoY to $543 Mn during the month. On similar lines, bridge funding fell 18% YoY to $52 Mn in the month, while growth stage funding declined 28% YoY to $347 Mn in May.

However, the situation was different when seen on a MoM basis. Seed and bridge stage funding numbers bounced back strongly in May after a mellow April. Showing signs of recovery, funding raised by seed and bridge stage startups surged 60% and 136% MoM, respectively, in May 2023. This was the second best month for seed and bridge stage startups in 2023 so far.

Meanwhile, growth and late stage funding continued to swing like a pendulum. While growth stage funding declined MoM, late stage funding increased over April in May 2023. Helped by the two mega deals, late stage funding surged 2.3X to $542 Mn during the month under review from $234 Mn in April 2023. However, this number was much lower than $1.05 Bn raised by late stage startups in March 2023.

The funding raised by growth stage startups fell 40% to $347 Mn in May from $586 Mn in April. However, it improved considerably from $148 Mn in March.

As of now, the signs of funding revival has given a sigh of relief to Indian startups that have been hit hard by mounting losses, capital crunch and multiple markdowns, among other things. Be it Swiggy, Ola, BYJU’S or even smaller startups, the adverse market conditions have had no mercy in testing the waters of Indian founders who dared to raise funds.

Further, regulatory concerns shrouding the Indian startup space, which is already down on its knees beseeching to be rescued, have made this ecosystem more vulnerable than ever.

While it remains to be seen whether this growth momentum sustains, the green shoot of funding revival has brought forth the hopes of an upturn, but the question remains: Can this positive momentum sustain in the times to come, especially when the funding climate has been erratic?

Ad-lite browsing experience

Ad-lite browsing experience