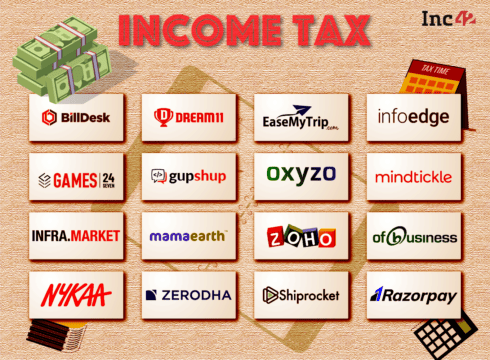

16 Indian unicorns cumulatively paid INR 1,276 Cr as income tax in FY21

Zerodha and Zoho, being the most profitable startups, together paid INR 783.2 Cr as income tax

Dream11 was at the third position and paid INR 166 Cr as income tax

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

India has the third largest startup ecosystem in the world, just behind China and the US. The country’s startup ecosystem is challenging several traditional systems with new age technologies and addressing several pain points.

However, a lot of funding is required to address the problems faced in a country with a population of 1.3 Bn and for innovation. Riding on the government’s focus on promoting startups and fund flow from venture capital and private equity firms, the Indian startups have raised over $100 Bn in funding since 2014 in over 7.5K deals.

The country is home to 107 unicorns currently. 44 unicorns were minted in the last year alone, the highest ever in a calendar year in India. The country’s startup ecosystem has produced 21 unicorns even in 2022 amid negative investor sentiments and a ‘funding winter’.

While the increase in the number of unicorns is a milestone for the startup ecosystem, the lack of profitability of these startups is a matter of concern. A majority of the unicorns, which have raised millions of dollars in funding, are spending more on marketing, expanding product portfolio and global footprint, rather than generating revenue.

Out of the 107 unicorns in the country, only 18-20 unicorns are profitable currently. While a lot has been written about the funding, job creation, and layoffs by these startups, we take a look at the direct income tax paid by these unicorns in the financial year 2020-21 (FY21).

As per the startups’ filings with the Ministry of Corporate Affairs (MCA), 16 profitable unicorns cumulatively paid income tax of INR 1,276.6 Cr in FY21. The combined profit of these unicorns stood at INR 5,529.7 Cr during the year.

It is a no-brainer that the Kamath Brothers-led Zerodha and Sridhar Vembu-led SaaS giant Zoho, two of the most profitable startups in the country, contributed 60% of the total INR 1,275 Cr income tax paid by the unicorns for the year. While Zerodha, which reported a profit of INR 1,122 Cr in FY21, paid INR 356.2 Cr in income tax, Zoho, with a profit of INR 1,971 Cr, paid INR 427 Cr in income tax for the year.

The revenue of Zoho and Zerodha stood at INR 5,442.4 Cr and INR 2,729 Cr, respectively, in FY21.

Online fantasy platform Dream11 paid the third highest income tax among startups at INR 166 Cr. The Falcon Edge-backed gaming platform, run by parent entity Sporta Technologies, posted a profit of INR 328.8 Cr in the financial year ending March 31, 2021.

BillDesk, which was acquired by PayU for $4.7 Bn, paid INR 81.2 Cr in income tax for its profit of INR 271 Cr in FY21.

The ongoing global slowdown has led to tightening of purse strings by investors, which has resulted in funding slowdown. As a result, many startups are trying to cut down their expenses to increase their runway. While some have decided to bring down their marketing expenses and discounts, others have resorted to laying off employees.

Nevertheless, the drying up of liquidity has brought back the focus on profitability. While the job cuts would undoubtedly hurt, a higher focus on profitability can lead to refinement of business models and responsible expansion by these startups. Besides, an increase in the number of profitable startups would also mean more money in the government kitty in the form of income tax from these startups.

Data & Analysis Credits: Mihir Malhotra

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.