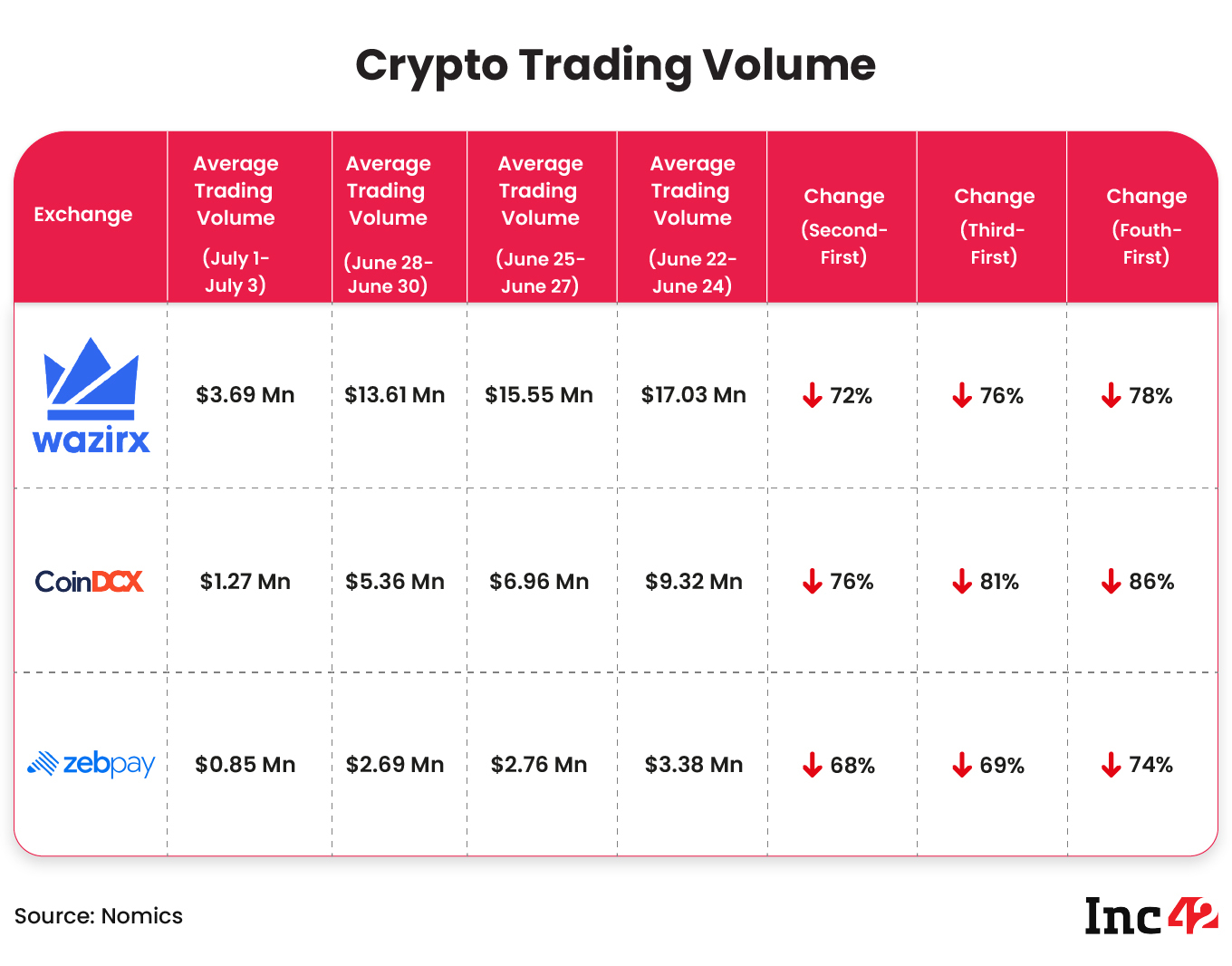

Cryptocurrency exchanges such as CoinDCX, WazirX, and ZebPay have seen around a 70% decline

The 1% TDS rule, which was proposed earlier this year in Budget 2022, has been introduced through a new section 194S in the Income-tax Act

Different experts told Inc42 that the provision would have most impact on retail investors

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Cryptocurrency exchanges such as CoinDCX, WazirX, and ZebPay have seen around a 70% decline in trading volume during July 3-1 period, as compared to previous three-day periods in late June, as per data available on Nomics.

From regulatory ambiguity to new tax rules, Luna crash, Bitcoin price fall, and overall market volatility, multiple issues have troubled the cryptocurrency exchanges in India. Starting from April 2022, the major Indian exchanges have seen a constant decline in trading volume. As the 1% tax deducted at sources (TDS) rule for virtual digital asset (VDA) transactions has come into effect, the volumes have dipped further.

Decline In Volume

The 1% TDS rule, which was proposed earlier this year in Budget 2022, has been introduced through a new section 194S in the Income-tax Act. “According to section 194S of the Act, any person who is responsible for paying to any resident any sum by way of consideration for transfer of VDA is required to deduct tax,” the income tax department said in a circular.

From the time when the TDS was proposed, stakeholders and industry experts highlighted that the tax slab is very high and it will hurt the growth of the industry. Even the industry also urged the government to reduce the TDS rate for crypto transactions, but to no avail yet.

Impact On Retail Investors

Earlier in April, when the 30% tax rule for transactions from cryptos was implemented, the exchanges saw over a 60% decline in trading volume. At that time, various experts told Inc42 that the real impact would be noticeable following the TDS implementation.

“If 1% TDS had to be imposed on them, then the small revenue traders were making would be affected. In such a situation, it will not be viable for them to act as a market maker on exchanges,” Praveen Kumar, founder and CEO of Belfrics Group told Inc42 in April.

Industry experts also said that the TDS provision would impact the liquidity in the crypto market and the TDS would impact retail investors who trade with low margins, locking up their capital.

However, while there were ambiguities around the implementation, the income tax department issued a circular last month clarifying the rules. When the transaction is being conducted through an exchange and it plays the role of an intermediary, it will have to deduct the tax before transferring the payment to the seller of the VDA.

“According to section 194S of the Act, any person who is responsible for paying to any resident any sum by way of consideration for transfer of VDA is required to deduct tax,” the circular added.

More Clarity Needed On TDS Guidelines

While the guidelines provide clarity on many aspects, certain doubts still persist, Sunil Badala, partner and head of Financial Services, Tax, KPMG in India, said while the guidelines were released.

“It is not clear how the buyer who is buying VDA on the exchange will get to know whether the exchange is the owner of the VDA or someone else. Potentially, exchanges may find it convenient to hold the inventory and agree with the buyer that they will discharge the tax obligation on a quarterly basis,” Badala said.

“As regards the clarification that TDS needs to be done on net consideration (excluding GST and charges), there appears to be an error as the guidelines mention GST / charges ‘levied by the deductor’ shall be excluded – the fact is GST / charges are ‘levied by the exchange/brokers,” he added.

Key Highlights

Funding Highlights

Investment Highlights

Acquisition Highlights

Financial Highlights

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.