SUMMARY

SuprValue is looking to invest nearly INR 20 Lakh - INR 30 Lakh in startups across sectors

General partner Akshay Bhansali has invested in 14 startups like Yulu Bikes, Kawa Space and Paper.vc

SuprValue is also open to investment and co-investment opportunities in the early-stage startups

Pune-based angel investor Akshay Bhansali has set up a microVC firm called SuprValue to fund seed stage startups. In his personal capacity, Bhansali has been an angel investor in 14 Indian startups, including embolity company Yulu Bikes, spacetech startup Kawa Space and business intelligence company Paper.vc in the last three years.

With SuprValue, he is now looking to invest in 40 startups across sectors in the next two years. So far, the microVC firm has invested in nearly three startups, including kids transportation company Piggy Ride, diagnostic network The Renal Project with 100x.vc’s Sanjay Mehta and an undisclosed spacetech startup.

Currently, the prime focus of the microVC company is to invest in a startup that is working in the “non-trending sectors” and have the opportunity to grow once the startup ecosystem starts healing from the pandemic.

Talking to Inc42, Bhansali added that he believes in the theory of black swan fishing, “Where we bet heavily on a startup which would grow exponentially once change/chance event occurs. The startup needs to have great distribution at scale before such an event happens, to gain maximum benefit from it.”

SuprValue Looks To Enable Investment, Co-Investment

The company is looking to invest nearly INR 20 Lakh-INR 30 Lakh in early-stage startups, with INR 25 Lakh being the “sweet spot”. Besides this, it has a special “Scouts programme” to enable seed funding through referrals.

Scouts programme allows angel investors to refer deals they are investing and get an immediate fee for their referral or a certain carry on exit. “Our program will have a laser focus on educating and training our Scouts on how to develop their own track records as SuprValue.vc aligned investors,” the company’s website read.

Incorporated in February 2020 and backed by two limited partner (LP) including a family fund, the fund is being managed by Bhansali alone, who is also serving as the general partner. It is also looking for additional L=LP to expand the size and the investment opportunities of the fund.

After completing his education from Harvard University in 2013, Bhansali worked as an associate director as Bhansali Group in 2013, which is his family office. He also had a brief sprint at running a startup called Prime Advertising Pune, however, he turned his focus to angel investing in 2016.

Some of his portfolio companies are like Piggy-ride, Dealshare, Dosefm, Tapchief and Kitchen Central. Though he has not got any exits so far, he claims that his aggregate investment portfolio currently values 3x more than the amount he had invested in.

The Fall In Funding Impacts Non-Trending Segments

Meanwhile, the Indian startup ecosystem has been struggling to raise funding. According to Inc42 Plus estimates, the total funding raised by Indian startups saw a massive dip between March and April 2020. The total capital inflow plunged by a whopping 55% from $1.05 Bn in March to just $474 Mn in April and $222 Mn in May. On the contrary, if we look at the investments during the same period in 2019, the funding in March and April had witnessed a surge of 62%.

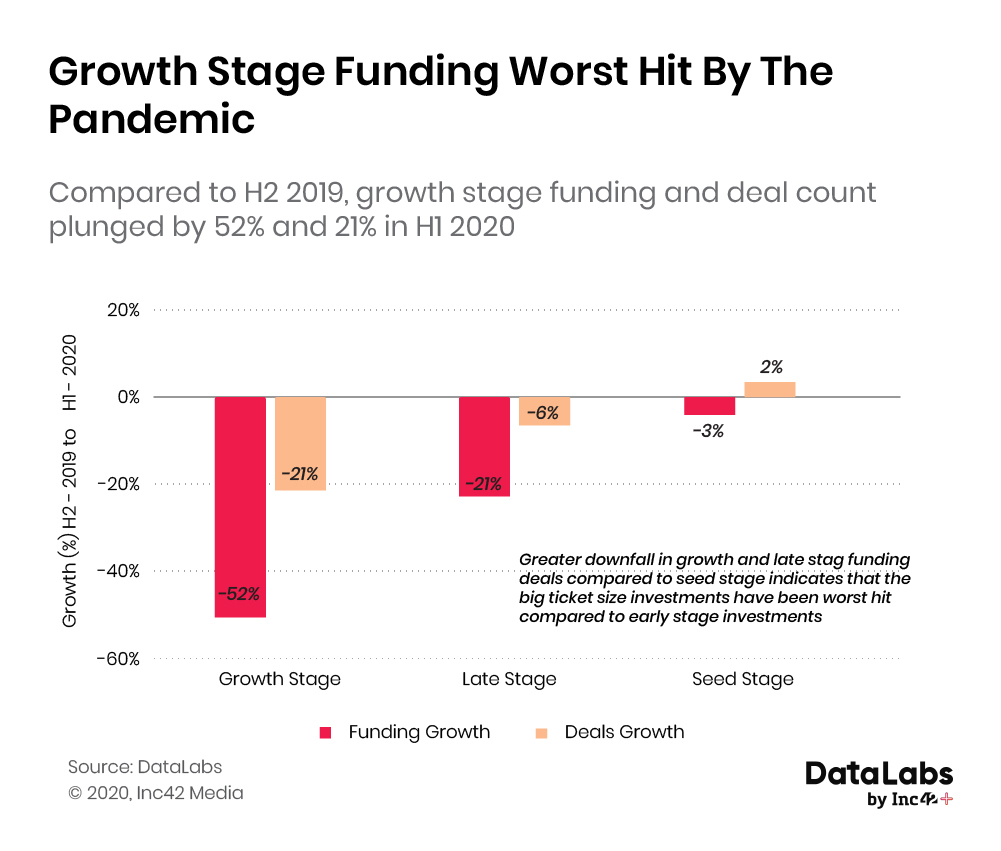

In the first half of 2020, the total capital inflow witnessed a decline of 29% compared to H2 2019 clubbed with all three major stages of funding growth stage, late-stage and seed-stage witnessing a negative growth of -52%, -21% and -3% respectively.

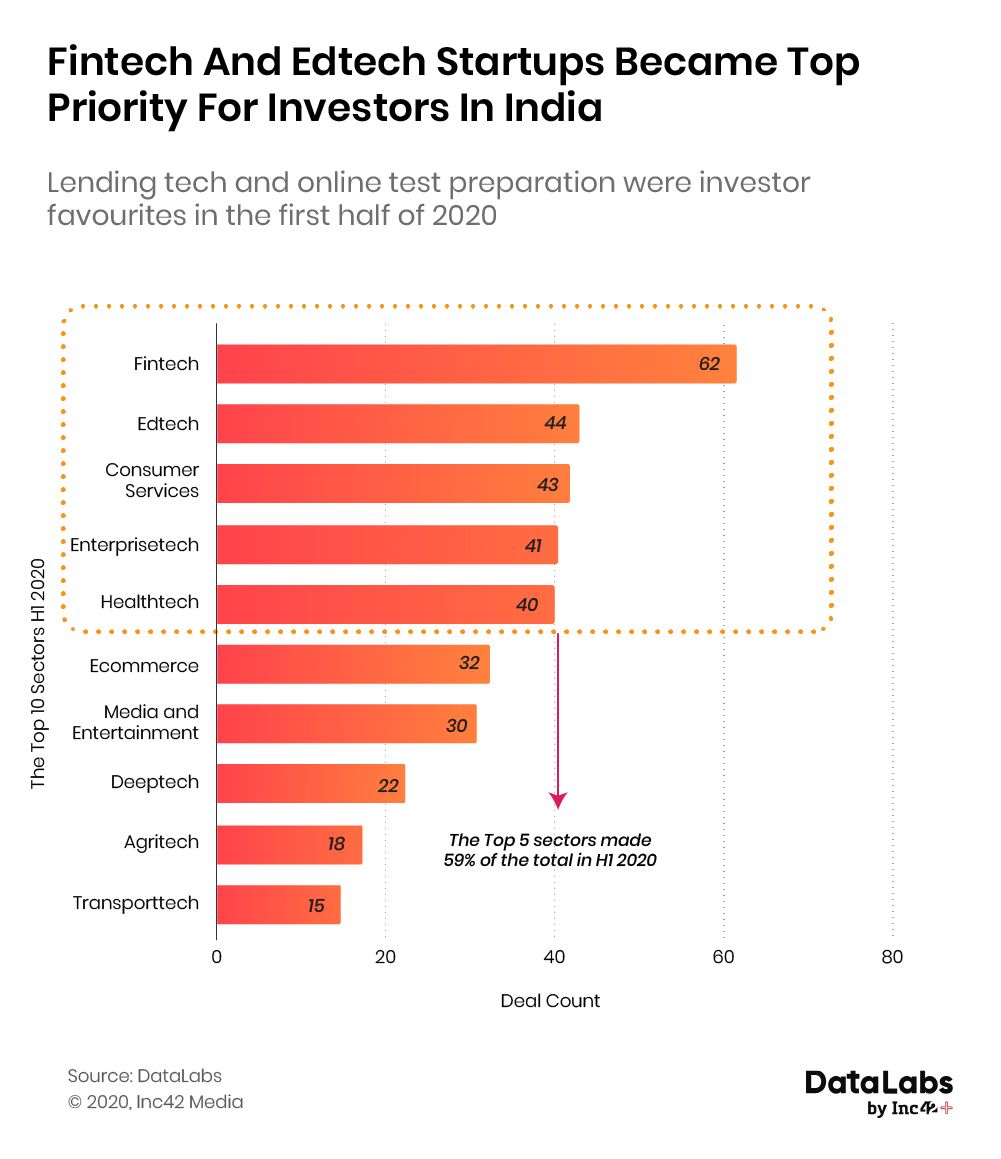

But the drop is not the same in all sectors. Certain sectors like edtech, fintech, consumer services, enterprise tech and healthtech emerged as the top sectors for investors. Even at the seed stage, these three sectors have witnessed a rise in their deal count compared to H2 2019 — edtech (175%), fintech (26%) and consumer services (7%).

You can read more about the funding scenarios and trend in the first half of 2020 in Inc42 Plus’ report: $5.4 Bn Funding, 389 Deals: Indian Startup Funding Dropped By 29% In The First Half Of 2020.

Though big investment firms like Endiya Partners and Unitus Ventures have raised funds this month, their prime focus will majorly be thriving sectors. With microVc funds like SuprValue coming into the picture, which focuses on the non-trending sectors. Early-stage startups severely impacted by the pandemic will get another chance at surviving and creating a more sustainable model.