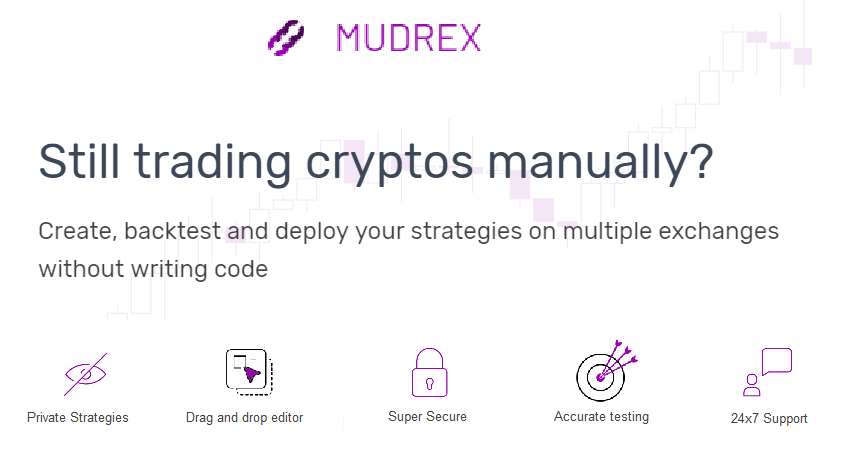

Mudrex helps crypto traders to automate their trading

It is much of a similar automation platform available for traditional trading

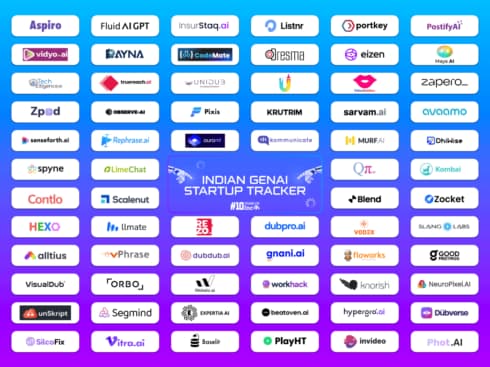

The platform is touted as the first-of-a-kind from India’s crypto ecosystem

The US-and Bengaluru-based fintech startup — Mudrex — has developed an operation-as-a-platform that automates the process of cryptocurrency trading. The startup, which shut down its crypto exchange even before its launch due to RBI’s stance against crypto trading, has revamped the platform and is now solving the ‘pain point’ of crypto traders.

“A cryptocurrency trader understands algorithms. They know how the market works. They can write condition and say, if this goes above this then I’d invest. Their pain point is that they don’t know how to convert their trading ideas into algorithms. He requires to do research, code, and needs a scalable infrastructure to be able to trade properly — these are essentially the things we are solving,” Mudrex cofounder Edul Patel told Inc42.

Interestingly, Mudrex’s technology doesn’t use blockchain. The core tech for the platform has been built using computer programming languages, Python and Java.

“We have built Mudrex in such a way so that, if required, we can port it to work in the decentralised ledger at any point of time in the future,” Patel said.

Since its launch in February 2019, Mudrex has already on-boarded more than 1K users. Of which, 20%-30% are from India and rest are spread across the US and Southeast Asian markets. The startup claims to be witnessing 25% week-over-week growth in trading volume.

The Rise Of Mudrex After RBI’s Ban On Crypto Trade

The idea of Mudrex was originally conceived as a crypto exchange. In fact, Mudrex was set to launch its exchange platform on April 15, 2018; but just 10 days before, the RBI issued circular restricting banks and regulated payments to refrain from extending any services to crypto exchanges.

“It was a massive shock for us. I still remember one of our investor saying: “ab toh crypto bandh ho gaya, kya karoge? (now that the crypto has been shut, what do you plan on doing about it?).”

Mudrex obviously decided not to launch the crypto exchange, though the startup had put in years of hard work into the project. In the absence of a supportive regime towards cryptocurrency, it didn’t find it feasible to scale its exchange platform which could entail mass retail participation in cryptocurrency trading. However, even RBI’s blanket ban couldn’t deter the spirit of five IITians.

“So we went back to our drawing board. And as we were also doing some crypto trading, we realised that it is too difficult to trade stress-free in crypto. Then we decided to build a platform where everyone can be a trader — that’s how Mudrex came into being,” Patel said.

To Inc42’s query on what makes cryptocurrency trading stressful? Patel explains, because crypto trading is 24*7, the market keeps on moving. Secondly, it is global with at least 300-400 different exchanges operating in one country trading the same assets. Thus making the process of manually trading cryptocurrency very difficult.

“You just can’t simply trade even one asset across five exchanges. You constantly need to monitor,” Patel said.

Sometime in May, the founders came up with a eureka moment — automate crypto trading.

“Then we started building a platform that can automate trading and we were able to do it because we know how to code,” Patel said.

At the time, the startup was largely bootstrapped. The IITians had previously raised small funding from a clutch of investors but the larger part of investments, around $25K precisely, came from their own pockets, for product development and hiring few engineers. It recently raised $150K in seed-stage funding from YCombinator, which is yet to be deposited in their bank account, Patel told Inc42.

U-Turn Moment For Mudrex: Building From The Scratch

Patel asserted that access to data in the trading world is largely categorised to ‘Has’ and “Has Not’. He explains while the former has capital, research and the ability to run their algorithm in the sophisticated crypto trading infrastructure, others don’t have the technology to be able to build or execute their trading ideas.

“This, I think, is unfair. We need to level up a playing field i.e., to avail the infrastructure to all,” Patel said.

Six months after the RBI ban, the startup launched the beta version of Mudrex. For the next three-and-a-half months, it continued to test its platform with 10-15 traders and improved the experience accordingly, until its official launch in February, this year.

This new product provides crypto traders with an automated tool and the ability to trade live. It comes with a simple drag-and-drop-based visual editor to create strategies, ability to backtest on historical data and trade live with dummy monies, along with an API key-based integration with Bitmex and Binance to help trade directly without depositing any funds.

Although the company is registered in the US, all the development and operations of the Mudrex technology has been initiated from its office in Bengaluru, the cofounder tells me. It currently has eight members working as a team, including the five founders.

Its monetisation model has a subscription-based setup and collects monthly payments from users. It plans on adding a per-trade fee based on a trading volume. In terms of user growth, it expects to hit about $10 Mn in trading volume by June this year and much larger number by 2019 end.

Mudrex is However Not The First To Automate Crypto Trading

Mudrex is However Not The First To Automate Crypto Trading

There’s nothing new with the automation of crypto trading, however. Even in the traditional stock market, there are a lot of automation platforms that have come into place.

According to cryptocurrency startup WazirX’s founder, Nischal Shetty, there are various platforms that help crypto traders to automation their trading. He gave an example of a trading platform, TradingView:

“TradingView, for instance, has a variety of charts the traders usually follow. Based on the chart, the user understands whether the price of a crypto asset is going up or will fall down. It’s more of reading historical data to understand where the market will go. And based on your understanding, you set your strategy and can automate them instead of manually having to check them every day,” Shetty said.

According to Shetty, this can be done either manually by keeping track of things or can be done by automating it using various platforms which are built on top of exchanges. “However, still you need to know what trading strategy you need to follow to make that happen,” he said.

Patel here argued that “Although TradingView helps in research for traders, users still need to know how to code if they want to trade. Also, there is Quantopian, which provides users with the ability to test their strategies, however, users can’t trade as they still need to know how to code,” Patel said.

Shetty is of the view that usually, hardcore crypto traders will opt for these kinds of automated trading platforms. “It is, however, interesting to note that crypto automation trading platforms are coming out of Indian ecosystem,” Shetty said.

In the recent development in India’s cryptocurrency sector, the Supreme Court of India has asked the centre to introduce the cryptocurrency policy within March, this year. The focus is to bring back the regulatory issues cryptocurrency startups are currently facing in India.

In such an interesting intersection, the six-month-old Mudrex still has miles to go to scale its business opportunities, especially at a time when the Indian cryptocurrency market is bleak and cold and is likely to remain so until the government comes out with something clear.

Ad-lite browsing experience

Ad-lite browsing experience